Crazy couple of days at work. So, yeah, let’s talk about trading now.

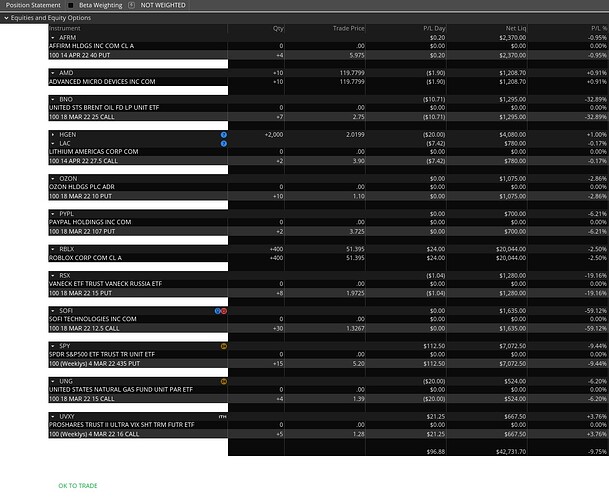

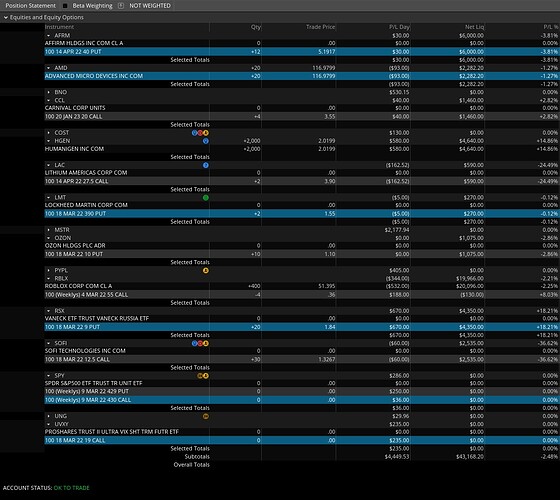

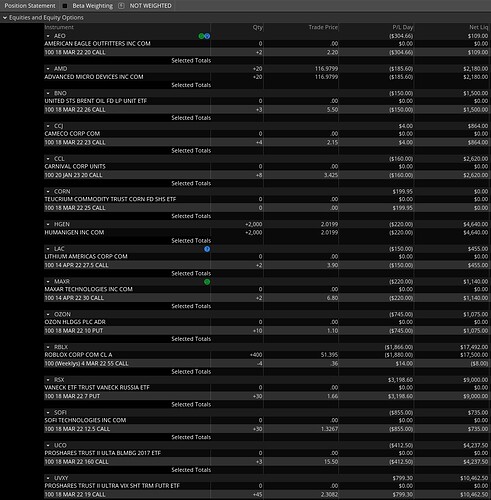

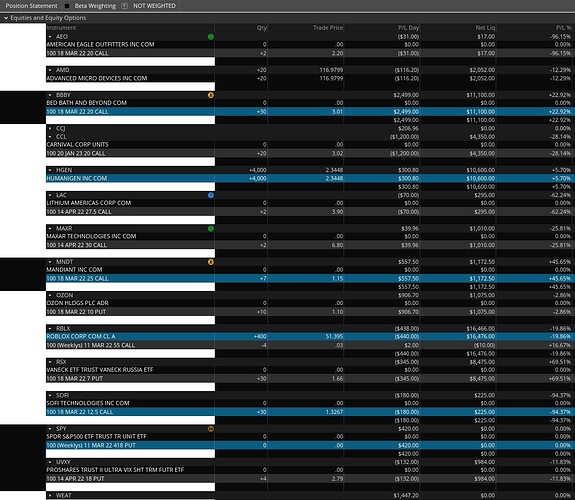

Here are my current positions (excluding RSX, more on that below). Let’s talk about them.

(Potential) Bangers:

UVXY - This is one where I initially took a small position of 5 options and kept averaging down as I saw SPY weaken throughout the day. I eventually got my cost basis to $2.30, which means I’m profitable as long as UVXY is above about $18.40 tomorrow. As of right now, it is at $20.40 so I’m hoping for a good exit on this one tomorrow morning if SPY continues to go down.

OZON - stop suspending trading and die you Russian pile of crap. As you will see below in the RSX discussion, OZON admitted in a press release today (as positive news by the way), that they have lost more than $550 million in the last 2 months because the value of the Ruble has plummeted. This one is going to be fun. I just have to remember to pay attention to it again when the suspension ends.

BNO, CORN, UCO - Commodities. They fluctuate when sanctions drastically increase or decrease supply. I made sure to buy 3/18 calls to give myself plenty of time to exit when the time is right for each one. I felt like my entries could have been better here, but I’m going to use this as a learning opportunity to potentially have mediocre entries but A-plus exits.

Mistakes:

CCJ, CCL - I held 4 CCL options and averaged down once today. I tried to average down again and accidentally bought CCJ. This was just a dumb mistake. It was me moving too quickly, typing in a ticker, and slamming the bid before I realized what I had done. The lesson here is don’t be dumb. Hey, I’m still learning too.

SOFI - I fucked this up. Badly. I should have set up limit sell orders for market open after earnings. But I was sure I was going to be sitting at my computer at market open and would be able to sell at open. Then I fell asleep and missed it. Just add this to the litany of mistakes that has led to the dumpster fire that is my SOFI play. The only good news from this is that I’ve learned about 5 lessons with this one and I just have to hope they stick. If they do, that alone is worth the money I’m inevitably going to lose on SOFI.

RSX:

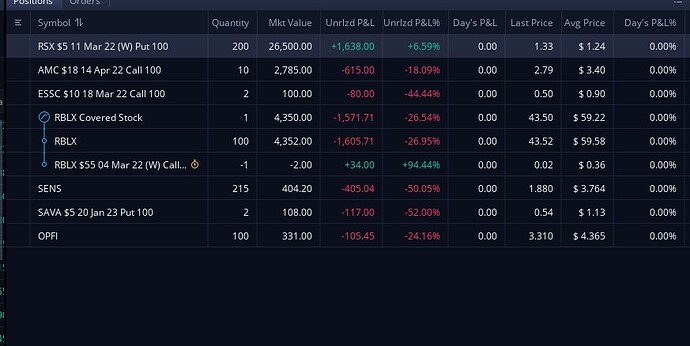

So yeah, RSX. I have 30 of the 3/18 7p in my ToS account. I love ToS. As good as ToS is, TD Ameritrade’s app is complete garbage. Robin Hood may actually be better. Since, I had no time to do anything today except work, I took a substantial portion of my cash position in my WeBull account and made the following purchase:

200 contracts are a lot of contracts. $25,000 is a lot of money. Three things: (1) I purchased these options with cash, not margin. Do not trade on margin. It will end up hurting you. The entire goal of margin trading to give you more leverage than you have any right to have. That goes entirely against the philosophy of reasonable entries and exits, no YOLOs, etc. that make this community great. (2) I will not be hurt in any meaningful way if the $25,000 evaporates into thin air. I will be sad, angry, get ESSC PTSD, etc., but I will be just fine financially. No vehicles will be sold to cover this play if it goes belly up. (3) I believe in this play. Let me explain:

I’ve read all the SEC filings I can on RSX. I’m reading the news just like all of you. Russia’s economy is going to collapse (at least temporarily) as a result of the sanctions being put on Russia by countries throughout the world. We are just now at the very early stages of this. MOEX is not trading this week. Not even trading. Won’t open up until 3/5 at the earliest. OZON, one of the largest holdings of RSX, is suspended from trading. Its 10-day suspension goes away after Monday. In a press release today, OZON said it is financially secure and a strong and stable company. But it also admitted 90% of its business is in Russia. And that it has lost more than $550 million in the last two days because the value of the Ruble plummeted. OZON will gap down significantly when it is no longer suspended. This is just one example.

According to ToS, RSX.IV, which is the chart showing the NAV floor of RSX, is currently at $1.29. RSX closed today at $5.79. I think that floor is optimistic. But let’s say VanEck is right and that NAV is currently $1.29. The delta between the stock price and NAV is $4.50. Said another way, the NAV is 77.72% less than the stock price. So I think the most likely scenario is that RSX will wind down and liquidate. I personally think the announcement yesterday that RSX would no longer issue new creation shares to APs was step 1 of this process.

But even if I didn’t believe that, and just believed that RSX would drop to NAV, that still leaves a delta of $3.71 between the strike price of my puts and NAV. Most ETFs trade within a percent or two of NAV. Look at the average difference between a PIMCO ETFs NAV and its market price and it is usually within 0.20%. But let’s stay crazy conservative. Even if I think RSX will only drop to 10% above NAV, that still leaves a delta of $3.58 between my strike price and a NAV+10% floor. I bought my puts at an average of $1.24. Even if RSX only drops to 10% above NAV, I can exercise my puts and essentially 3x my money. This is one I’m really excited about and my confidence level is quite high. But a lot can happen in times of war, crisis and economic turmoil. Which is why you never invest what you cannot afford to lose.

Cheers and let’s have a great day Friday!