Macy’s ($M), despite its insane price increase the past year (300%+), is still undervalued and has potential catalysts lined up to unlock the true value of the company. Active investors have recently urged executive management to accelerate the digital transformation of the company via E-Commerce spinoffs and unique partnerships that would push a market cap of at least $15 billion (~$55 per share) based on their projections. Additionally, market sentiment and short interest add greater confidence to why these values could be hit.

Macy’s (M) Overview and Fundamentals

Macy’s, Inc., an omnichannel retail organization, operates stores, websites, and mobile applications under the Macy’s, Bloomingdale’s, and Bluemercury brands. It sells a range of merchandise, including apparel and accessories for men, women, and kids; cosmetics; home furnishings; and other consumer goods. It operates in the US and Dubai, UAE, and Al Zahra. Important Fundamentals below (Pulled from Yahoo! Finance, Fidelity, and Zack’s Research):

Sector: Multiline Retail (In parentheses for sector median comparisons)

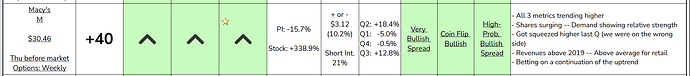

P/E (TTM): 18.98 (18.94)

Price to Cash Flow (TTM): 6.57 (14.2)

Price/Book: 3.58 (11.28)

Price/Sales (TTM): 0.43 (1.43)

PEG Ratio: 0.68 (0.94)

In bold I have what I find as the confidence in the company from a fundamental standpoint that the price will be rising significantly and support why it is undervalued despite being at a 52-Week high. Also, I’m a big proponent of using Price to Cash Flow for evaluation compared to P/E, although P/E is still useful and reign supreme for non-tech in my opinion.

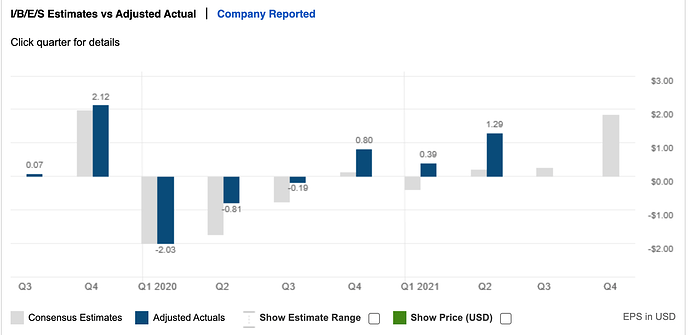

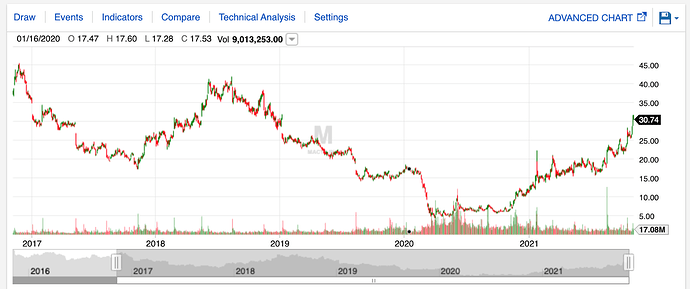

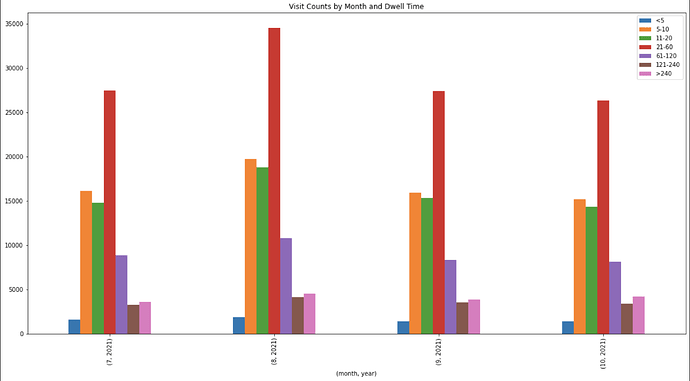

You can see the EPS and 5-Year chart below, using 5-Years because I’m more interested in pre-pandemic price range.

The most striking thing in my mind is that they got wrecked by COVID like many other retail stores despite solid EPS prior, to the point that they may have already been undervalued. Notice though that the past 5 quarters not only have they beaten the estimated EPS, they’ve blown past it especially 2Q of 2021 showing an exceptional recovery. How could this be? Anyone who followed GME knows what E-Commerce and a legacy consumer base can do for you. Overall, the fundamentals look to me like it has significant growth metrics that aren’t being factored into its price despite being at a 52-week high.

The Polaris Strategy and Active Investor Pressure

As mentioned previously, GME was able to fall back in favor with the street by laying the groundwork for transition to E-Commerce via digital transformation (even if by accident prior to Cohen). The Polaris Strategy was filed in February of 2020 (right before politicians pulled out their stock as the market was priming to flash crash) so Macy’s C-Suite already knew transition into E-Commerce was a must. The Polaris strategy has a bunch of other initiatives, but see the excerpt below for their E-Commerce and digitization goals:

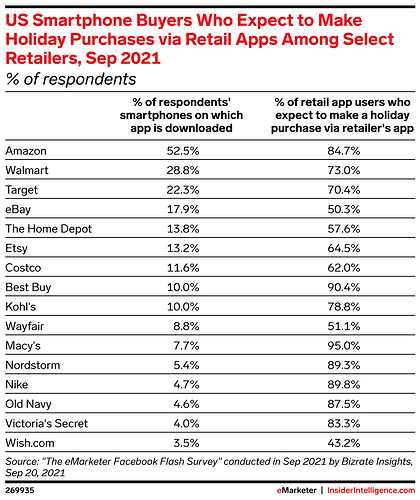

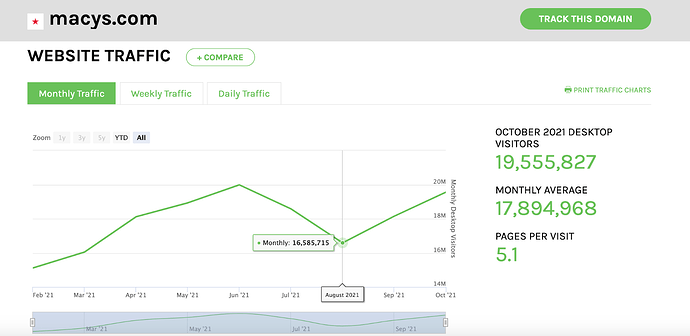

“The company has a scaled and growing digital business across its brands that generates more than $6 billion per year in sales. Macys.com contributes to overall operating profit, and the company will continue to invest in its websites and mobile apps to deliver a superior fashion experience, accelerate growth and further strengthen profitability.”

Along with this, Macy’s is planning and still implementing the consolidation of lower-tier stores in malls to generate additional cash in their move to E-Commerce. There’s tons of promising info in the Polaris strategy which if you’re curious you can delve into here (https://www.macysinc.com/investors/news-events/press-releases/detail/1608/macys-inc-announces-three-year-polaris-strategy-to).

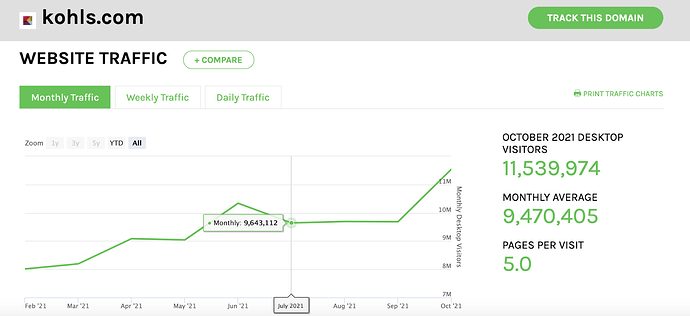

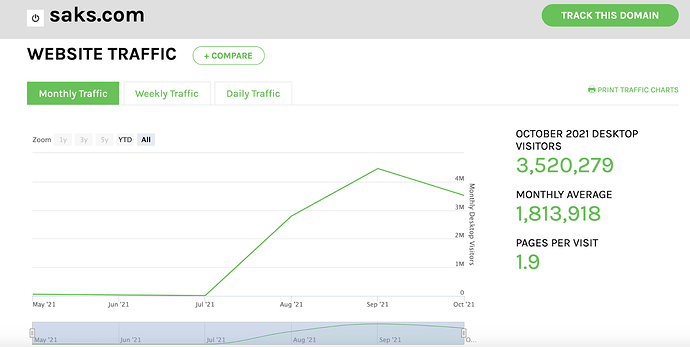

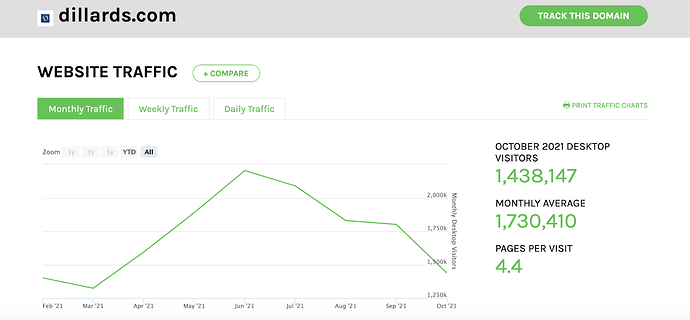

Sounds all well and good, investors should be happy that their company is taking strides for growth and modernization, right? Well, this is where my optimism peaked and I went from watching to going long. Activist Investor Jana Partners recently took a stake in Macy’s and urged them to spin off an individual E-Commerce company (read here:https://www.cnbc.com/2021/10/14/activist-jana-takes-stake-in-macys-urges-digital-biz-spin-report.html). They valued a Macy’s E-Commerce spinoff at $14 billion despite the market cap of the total company back then to be $7 Billion (~$23 at the time) and $9.52 Billion at the time of this writing. Macy’s eventually came out and basically said no we’re good, we’ll stick with the Polaris strategy. Jana Partners is a heavy hitter though, they were able to convince Whole Foods to merge with Amazon, and I’m sure they are not done trying to persuade Macy’s board. This value can be rooted in the recent valuation of Sak’s E-Commerce spinoff which initially was 2X the company sale which was $2 billion; 8 months later, Sak’s E-Commerce spin-off is now valued at $6 billion, triple the perceived initial value which Jana Partners is stressing to the board. Macy’s is expecting sales of $24 billion was likely what struck Jana Partners interest in the untapped value of an E-Commerce spin-off.

This past month, things got even more interesting on the active investor front. NuOrion, who I admittedly have not done much research on but has had a stake in Macy’s for a bit, doubled down on Jana Partners’ call to the board by publishing an open letter regarding on action that needed to be taken immediately regarding the digital transformation and also providing interesting strategies for the companies excess space. NuOrion stressed similar sentiment regarding Sak’s valuation and even brought up that Macy’s is trading around 0.6X its enterprise value. Where NuOrion brings a bit of a unique perspective is that they are pushing to Macy’s to get ahead of the game and start accepting crypto payments, and teaming up with EV companies such as Tesla to model cars on their shop-floors (Especially in NYC) and use their excess parking lot space to act as EV charging stations. NuOrion proposals are bit more daring and possibly can be disregarded, but it seems like investor sentiment in the company is favoring significant changes, see an excerpt from Barron’s (paywall unless you have Fidelity) on one large shareholder’s thoughts:

“At first glance, the recommendations may look like attempts to force Macy’s (M) to cash in on the latest buzz. But one large Macy’s (M) investor Barron’s spoke with notes that the ideas represent the unconventional thinking the department- store chain should consider to navigate a challenging retail landscape.”

Lastly, I will end this section by mentioning that NuOrion believes these changes could bring Macy’s stock price to at least $75 at its current float and link the letter to investors here (https://nuorionadvisorsbusiness.files.wordpress.com/2021/11/letter-to-m-chairman-3.pdf).

Short Interest

Not much to add to say in this section, just info below in the table. Appears that like many of these retail chains, shorts were betting on bankruptcy like JCPenny, but Macy’s withstood the storm and there’s still shorts outstanding. I’m not looking at this play as a short squeeze, but the info is probably more valuable to most of you than it is to me in understanding its potential:

Float

309.06 M

SI%

16.67%

SI% of Float

22.25%

Institutional Ownership

88.85%

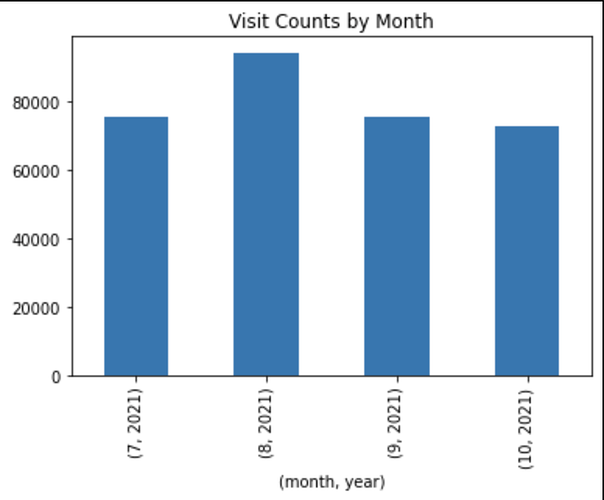

Position and What I’m Keeping an Eye On

Currently, I own 20 call options at a strike of $40 expiring Jan 2023 bought at an average price of $1.21 along with 100 shares at $30.85. I’ve been selling cash secured puts and covered calls weeklies. Moving forward, I’m looking at continued growth in E-Commerce, Jana Partners increasing their position to wield more power to force changes if necessary, holiday sales as they’ve recently took on some of Toys R’ Us’s(?) inventory, and continuation of sticking to the Polaris Strategy, which was actually realized today when they raised their minimum wage to $15.00/hr and are providing educational assistance to their employees.

Note

It was suggested in the forum I do a DD and post it on here regarding a comment I made on Macy’s so that was my motivation. FYI, my first DD ever, criticize away, I appreciate feedback from Value Investors and those who understand Technical Analysis and Fundamentals more than I do. Not financial advice, just for education and discussion purposes. If anyone has TA analysis they’d like to look into that’d be great, I am not savvy at all on that end. I’m having trouble so formatting is off and images aren’t loading, I can update in the following days to include the charts and EPS growth.