What this is: Short DD based on available Objective data, specifically from Ortex and charts.

Who is this for: Those who asked about it in Trading Floor, if you weren’t already interested, resist FOMO.

Read: Scalp / Swing Trade

TLDR:

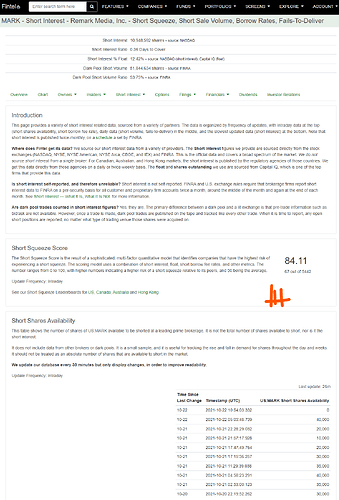

Free Float - 89.56M

Ortex Short Squeeze Type 3 BUY + RSI signals, look for good entry and hold for 1-3 day for gains.

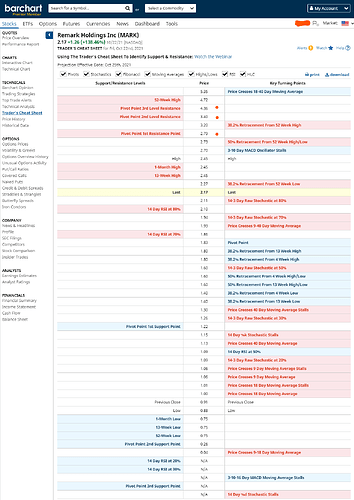

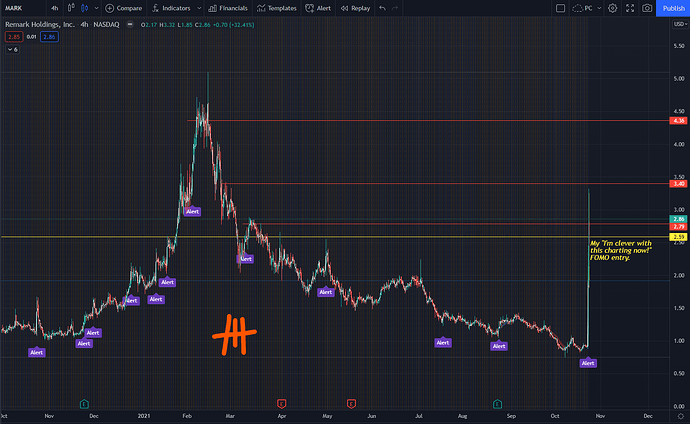

Resistances:

a) 2.79

b) 3.4

c) 4.36

Long Version

MARK, Remark Holdings

Link: http://ir.remarkholdings.com/

About them: Remark Holdings primarily focuses on the development and deployment of artificial-intelligence-based solutions for businesses and software developers in many industries. Additionally, the company owns and operates digital media properties that deliver relevant, dynamic content. The company is headquartered in Las Vegas, Nevada, with additional operations in Los Angeles, California and in Beijing, Shanghai, Chengdu and Hangzhou, China.

*Check their Corporate Governance page if you’re interested in more about the company. I personally am not.

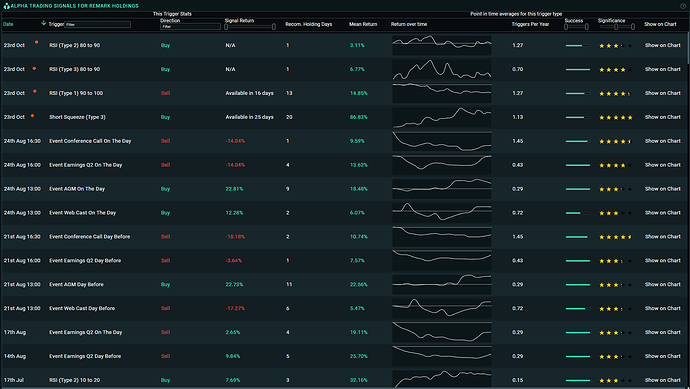

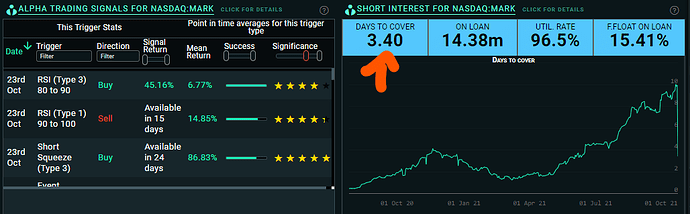

Ortex Trade Signals - Oct 23, 2021

Short Squeeze Type 3 BUY - early in the afternoon.

RSI Type 1 Sell - 1 hour or so after the SST3 signal.

RSI Type 3 BUY - 30min after the RSI Sell signal.

RSI Type 2 BUY - 1 hour after the earlier BUY signal, 30min before Market Close.

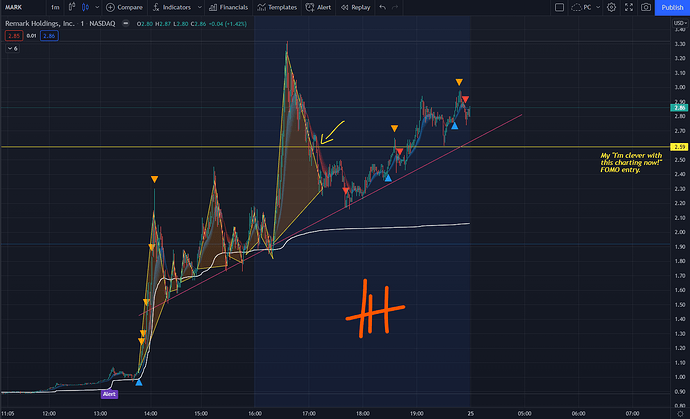

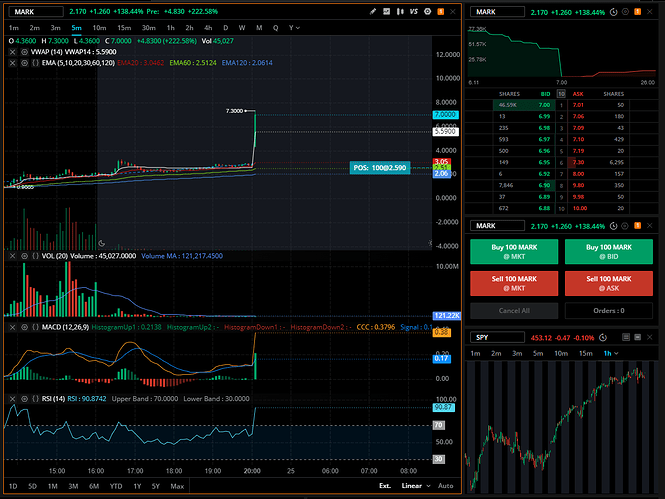

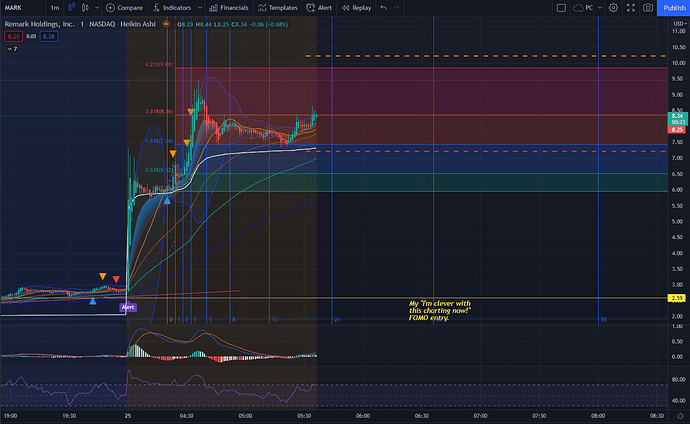

Me watching it on Tradingview, supposedly looking for a bounce confirmation entry, but triggered my FOMO skill anyway…fekkin hell mate…

After this entry, I took a power nap and woke up to my WeBull mobile app realizing the now very obvious Trend Line which I should have followed. Pink trend line added.

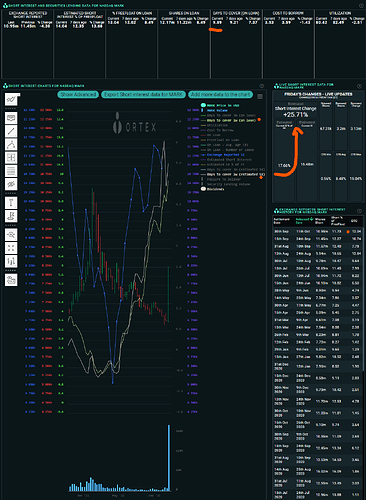

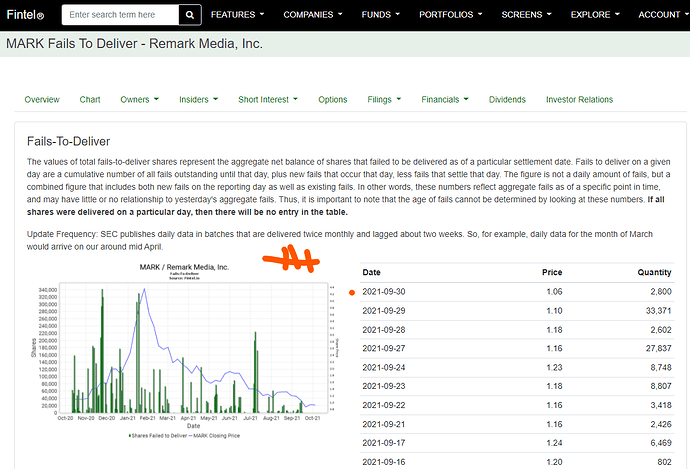

IF you’re interested about Short Interest info, here’s supporting data from Ortex as well…

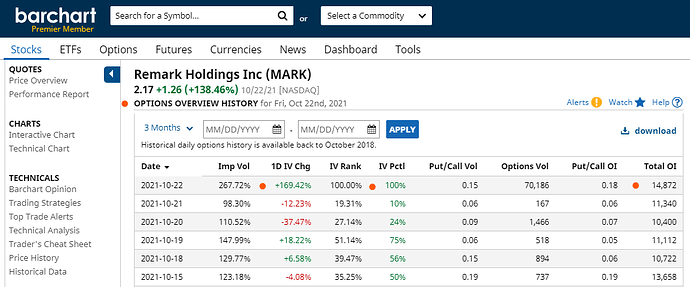

Now for the very important RESISTANCE Price Points, I look at Barchart and compare it to the charts…

4 Hour chart…

Options History - Oct 22, 2021

IF you’re curious in Fintel data…

And that’s all I have.

Position Disclosure: Entered with 100 shares in After Hours.

How I plan to exit:

a) 35% gain overnight trade (from my point of entry), so just above 2nd Resistance Point.

b) will watch momentum (or lack thereof) for a follow up swing.

Possible Entries at Pre-Market for WeBull traders:

a) Support - 2.65 to 2.7

b) Resistance - 2.84

Notes on Ortex Trade signals:

Short Squeeze Type 3 usually means to hold at least 3 days before gains are realized.

RSI signals are based on volatility.

*** Don’t FOMO… Cash is also a position… Keep liquid for the next possible trade!

*** Trading on Technicals give me a healthy 25-35% gain on scalps/swings–even without checking public sentiment.