Greetings fellow Vikings and Shieldmaidens-I offer you the prospect of a medium duration raid with the possibility of riches at the end. I’m advocating that MAXR is a solid mid-term hold that will beat their Q4 2021 earnings for reasons few are probably paying attention to…the specter of war. If that doesn’t get you excited in the forum of Vahalla, then you need to go read the Poetic Edda. This isn’t exactly an earnings play for next quarter, but, based off of this thesis, we will see it exceed its earning due to the actions being taken today. The reason I’m bringing this company up now is because it is within a good buying range.

Before I dive into the background/financials of the company, I’m going to ask you a quick trivia question. What do these articles all have in common (scroll down if you don’t want to click on the links)?

https://www.washingtonpost.com/world/2021/12/08/russia-ukraine-satellite-images/

https://www.politico.com/news/2021/11/01/satellite-russia-ukraine-military-518337

https://www.cnn.com/2021/11/04/europe/russia-ukraine-military-buildup-intl-cmd/index.html

Yea, the last one didn’t fit the same theme but you remember that ship (not a longship) getting stuck…The point is that MAXAR Technologies Inc. is instrumental in the imagery/satellite business (read-they build, deploy, and manage their satellite constellation) and their capabilities are in increasing demand when near-peer nations (read big countries) start maneuvering military assets (as a picture can be a significant indicator of a threat). If you pay attention to foreign affairs or watch the news, you should be aware of the marshaling of Rus forces on the border of Ukraine. If you weren’t aware, stop reading the Poetic Edda and pay attention to the world.

(Seriously though, look at that image quality)

The propensity of the imagery that I can find of this current build up are being captured by MAXAR (they either are cited or have their watermark on the image-see above). MAXAR’s bottom line will benefit as news organizations and other agencies purchase this imagery from MAXAR or buy up satellite time.

We won’t really see the influx of this action until Q4 but MAXAR is currently sub 30 and is in an ideal time to buy.

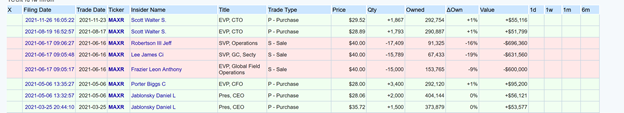

Insider confidence:

There has been insider buying (and some selling). Here is a snapshot of insider purchase/sales from last year.

The biggest takeaway for me is that insiders buy when the price is in the mid to high 20s. That is currently where MAXR is located.

Risk Factors -their financials. They are a tech/growth company and as such the P/E is nonexistent.

Last quarter, they had a revenue of 437M and earnings of 14M, missing their estimate by .01 (.19 vice .20). The estimate for their Q4 earnings is .10. I proffer that analysts aren’t paying attention to the greater macro trends occurring in the international realm. No one likes to bet on conflict or the threat of conflict (unless you are the Rothschilds in the French Revolution) and as such, financial analysts may not be calculating this into their estimates (unless they look at the oil/LNG realm which has a dynamic and sordid relationship to conflict). Though, I must admit, the analyst consensus for MAXR is $43 based off of yahoo finance.

Also, beware! With inflation data soon to be published, the overall market could take a downturn…

Finally, let’s look at the charts:

I’m going to show you a five year chart first because I want to talk about 2018. It is another risk. In 2018, they had a Worldview-4 satellite blow up. This is the danger of space technology (here’s to you Challenger).

I’m nowhere near as good as some of you with respect to TA, but I wanted to show the 1 month as it looks to be coming out of the trough of the most recent market sell off. Granted, the RSI shows that it may bounce off its resistance line and reset (thus providing another buying opportunity).

I know that MACD’s utility diminishes with a 5 day look (so disregard), but I wanted to 1. include this to show it is below its moving average and 2. show some support for yahoo finance as it is a saving grace for those of us who can’t work remotely but want to be able to take a quick peak at a ticker in a more robust fashion.

Author’s note: I have been swing trading MAXAR since October 2020 by primarily buying in the high 20s. Once the stock resets, I usually repurchase. My conviction in the company is continuously increasing through as I have started seeing their name pop up more and more. It is a solid company that is continually locking in new contracts and expanding its capabilities (whether it is imagery, providing SIRIUSXM satellite bandwidth, or by helping out NASA). I’d recommend checking out their website; it buttresses my previous statement. Also, if you care about employee sentiment, it has an average employee ranking of 3.5 on indeed with the majority of rankings in the 3-5 range. (skewed upward).

Let me know if the longship for this raid is taking on water or if it seems ready to sail from your perspective! (Translation-is there a logical flaw in the DD?)

Skal!