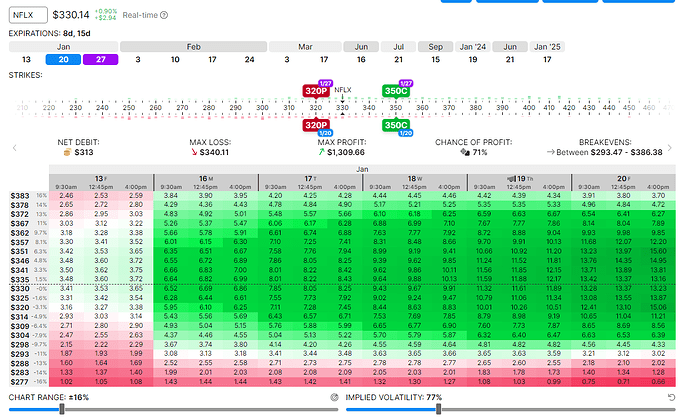

Recently I’ve been dabbling more into multi-leg option strategies and I think there might be a different way to profit from the IV rush that is sometimes observed before earnings, the original post about this sort of play by @Ryndir is here.

A known issue with the delta-neutral long strangles (LS) was theta decay. If the stock traded sideways all day before earnings then these plays were much more likely to result in a loss. If it were possible to be long vega, long theta, and delta-neutral then we could still profit in this scenario. The greeks of calendar spreads (CS) seem to allow this.

Using $DAL as an example:

Delta Air Lines, Inc. is expected to report earnings before market open on Friday, January 13th.

If we STO the Jan 13 36p and BTO the Jan 20 36p for a CS then we get this:

![]()

Compared to a LS:

![]()

(BTO Jan 13 35p + BTO Jan 13 37c) which looks to be the closest we can get to delta-neutral. It is important to note that although we have a delta close to 0, we also have a somewhat significant gamma risk.

All of the greeks of the CS are more favourable with the exception of vega but this is where we look at the net debit cost of entering these positions.

Net debit for the 35p/37c LS = 1.01

Net debit for the Jan13 36/Jan 20 36p CS = 0.19

We can enter 5 CS for the price of one LS so really the greeks of the CS position are:

![]()

This is an improvement on every single metric when compared to the LS. One obvious downside is commission cost as the CS requires 5x more contracts to obtain the same vega.

Even if all my reasonings work out then we still run into the issues that the old strategy faced in that not ALL stocks experience an IV rush so this play cannot be consistently profitable. As @The_Ni said in the original thread, it might be useful to look at IV rank, stock beta, and VIX levels in order to isolate when these plays have a better chance of working.

Another issue I can foresee is that the greeks are inaccurate since they only exist as a theoretical projection. From what I understand about the BSM model, IV is the variable that maintains the integrity of the greeks by being backsolved. The ebb and flow of the market is interpreted as a changing IV when in reality, options are priced via buyer/seller pressure. I wonder maybe if, because of this, there could be a greater IV on the shorter-dated leg, in which case the vega is incorrect and in actuality, we would be short vega with this position. I’m honestly not too experienced with these so I can’t be certain.

Also CPI on Thursday is not a negligible event.

Thank you for reading, please do tell me if I have gone full retard ![]() .

.