I’ve been watching the Puts the last few days and not much has changed. Still 2.2-2.4. When the floor dropped last week, it hit almost $8 fairly quickly, however it almost seems too easy for that to happen again. Would the options essentially be trading 1 for 1 at that price? That’s a hefty gamble that it’ll drop $2 IMO, but is it worth it? And we won’t know redemption numbers until this weekend, but if the vote is Monday when do we lose NAV floor?

Since the vote is on Feb 1, and they need redemption notices to come in 2 days before, the floor is likely to fall away tomorrow. Although could be today too, depending on how the arb funds respond.

Because the commons have not even moved over $10, and the 10P seems to be priced at $2-$2.4, as you note, the market is pricing in a decent fall. So I’m still confident in the original thesis that prices will drop.

The other encouraging data point is that its closest peers, CGC and TLRY, have fallen in 25% in the last month. Part of the whole market “feeling like it needs a joint” situation. To the extent that the market does not have a reason to assign MCMJ a premium to those two - and I couldn’t find one - prices should adjust downward to arrive at comparable multiples.

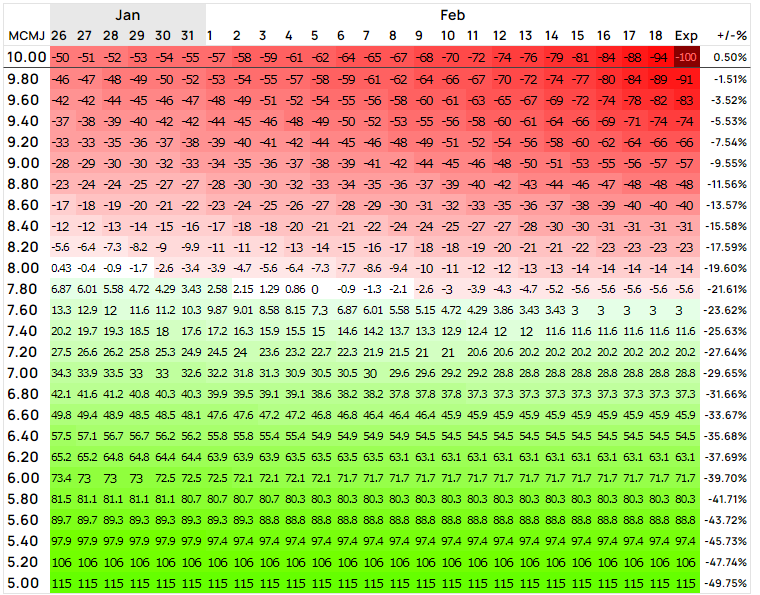

Having said that, I am not sure if prices will drop enough, fast enough, given current prices. One risk is we have 2 weeks till the 2/18 opex, and if prices drift down but not plummet, options might not be profitable.

For example, at current prices and a IV drop of 50%, this is the P/L envelope: | Options Profit Calculator

It’s markedly better for folks who for the 10P around $1.5-$1.75.

Last time it dumped to $8.15 first day when the spac floor gave out 3 days before merger. I’m expecting an even quicker drop to low 7’s now that the risk of the merger being delayed is much lower from the last time.

I’m in feb 18 7.5 P

Good call out picked up some 7.5p as well yesterday and looks like it’s taking a dive in PM as of now

Folks, quick note to say that prices have fallen 23% to $7.62, and still falling, as expected.

Personally, if prices get close enough to $7, will exit. These things do tend have a dead cat bounce when they crash this much, and depending on redemption rates, might even spike a little, so may not be advisable to hold over the weekend, but rather seek a comfortable exit today or tomorrow.

I just closed my 10p for 3.30.

~$7.50 was my PT and it went to $7.40.

Thanks for the great play as always!

Cheers, @Kevin !

I just closed mine also, for $3.50. Need to step away for a bit and didn’t want to come back to an oopsie.

Can anyone find redemptions numbers yet? I haven’t been able to. I have noticed large movements on small volume the last 24 hours, so I’m guessing they’re high.

I couldn’t either - no info in the SEC filing from yesterday:

https://www.sec.gov/Archives/edgar/data/1785592/000121390022004816/ea154790-8k425_merida1.htm

OI for 7.5C is pretty wild today.

They have to release the 8-K by tomorrow, and we’ll know the redemption numbers then.

The 7.5C folks are probably betting on the fact that redemption numbers will be high because :deSpac:. I think it’s a little unlikely that redemptions are 90%+ because Leafly is a real company, has real income, the sector has hype, and there are other online weed marketplaces that area creating a bit of a buzz. It just happens to be overvalued compared to peers.

On the other hand, a rational actor should sell at $10 and then buy back at sub $7 if they expect prices to stay low for a while.

Let’s see what tomorrow brings!

https://newsfilter.io/a/3679cf54ca0b3999e9f96afd2d6f3bde

I haven’t read yet, but Someone mentioned 8.8 million redeemed. We’ll have to look through and verify

8,869,483 were redeemed I total from what I read

Cool! That leaves a 2.7M float, I believe, given that they had 11.6m going in.

Not super small, but perhaps small enough to be buffeted around a bit for the next few days.

What does this news mean for the play? What kind of position are you looking to take?

What does this news mean for the play? What kind of position are you looking to take?

I’ll sit this round out.

With IV between 200-400%, the stock would need to make massive moves for options to be worth it. The redemption figures are not atrocious, so while we are seeing a small AH spike, not sure it will sustain. And LFLY has just about enough of a following to make it glide up or down, but not crash because no one cares (like many other SPACs) or go sky high because it is a meme stock, so I don’t expect large movements in the near future either.

I think this play is over for now. Decent company though, so if it ever gets to the low single digits, might be worth a look as a long term hold.

Also, someone had mentioned 4 million backstop shares. So I don’t know if that means a float of 4 million or 6.7 million. Would love some insight there. And I agree with the play, if you’re in already, tomorrow might be the spike you need on the call side to sell. Otherwise, pretty risky at the moment. I’m hoping for the spike to close my 7.5C and then I’ll sit on the sidelines for awhile.

In regards to long term hold on this one once it dumps I’m going to dig in a bit deeper, have personal experience using them with several dispensaries and it’s always been a positive experience.

The spike is here. If there’s hedging/fomo…this could get very interesting

I sold earlier for a good profit, however, I did not expect it to hold the 7.5 range. I need input from SPAC/option chain/hedging gurus. If this holds at or above $7.5, would the ITM OI need to be hedged considering it hasn’t been above that level in 2 weeks and there are roughly 6,000 contracts that will be ITM?