Merida Merger Corp I (MCMJ) shareholders will be voting on Jan 14, 2022 on the proposed merger with Leafly Holdings, a cannabis marketplace with some bells and whistles, and trade under ticker LFLY shortly after. LFLY valued at ~$385M. Options available.

Tl;dr - High likelihood of price to drop in the long run. Low likelihood of a spike immediately merger, before price drop begins.

Rationale for Price Drop

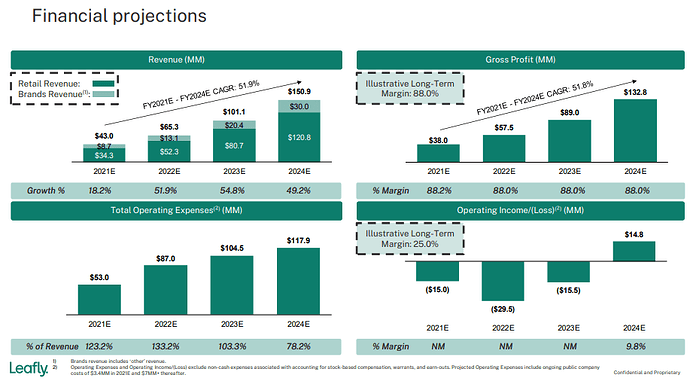

- They do not expect to have positive income until 2024, and do not have parabolic revenue projections like other SPACs that attempt to justify such current unprofitability. Such honesty makes markets frown.

- Weedmaps (MAPS) is considered to be the closest peer, and has a market cap of $340M. This is close to LFLY’s valuation of $385M.

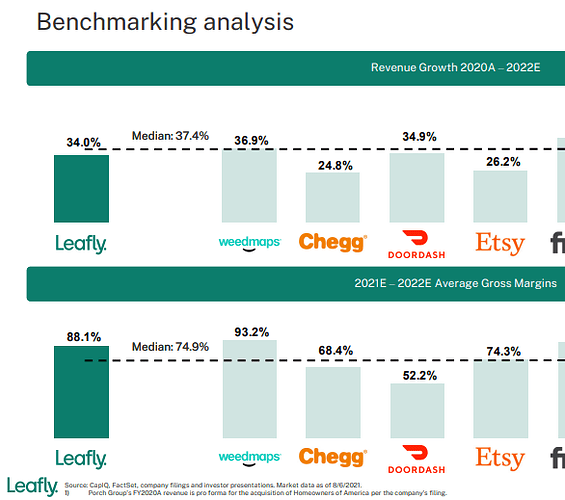

But… MAPS has $51M Q3 revenue alone, and 46% YoY growth. MCMJ/LFLY’s annual revenue projections are $43M for 2021, and $65M for 2022, so a fraction of MAPS’. MCMJ/LFLY confirm they expect very similar growth rates and gross margins (see below).

Given that MCMJ/LFLY has almost the same ascribed valuation as MAPS, but makes in a year what MAPS makes in a quarter, and does not have higher growth or margin as justification, we can consider MCMJ/LFLY to be grossly overvalued compared to its peer.

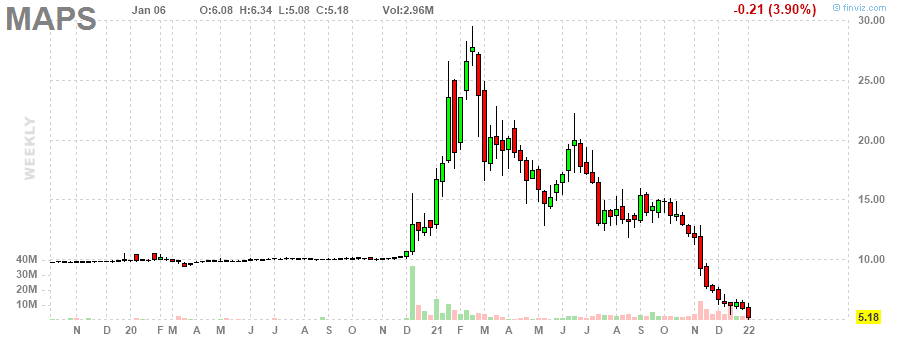

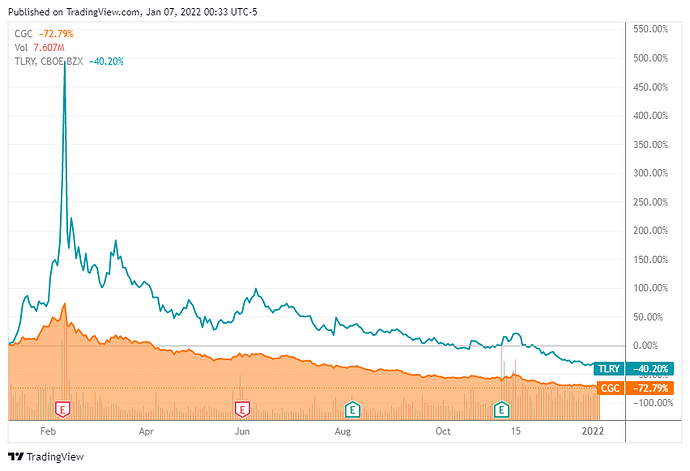

- What possessed them to ascribe such a high valuation when their own comparables show how unrealistic it is? It’s because the deal was announced at the height of the pot-stock euphoria. MAPS was timely - their max price actually rose to $30 before coming back down to $6 now (see below). MCMJ/LFLY, unfortunately, is very late to the game. We can therefore expect the market to assign it a discount because pot stocks are no longer hot. (And neither are SPACs in general.)

-

MCMJ shareholders have already voted with their feet - 1.4M out of the 13M redeemed their shares on Oct 29, when they voted on an extension for the merger from Nov 7 to Dec 31. The market is also playing this very close to NAV - MCMJ is trading at $9.99, and MCMJW is trading at $0.98. Quite the discount for warrants this close to the merger. Both shareholders and the market therefore seem to be underwhelmed by this union.

-

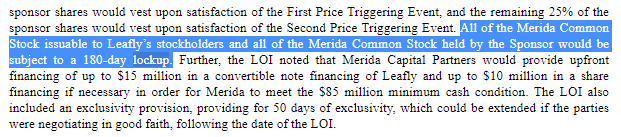

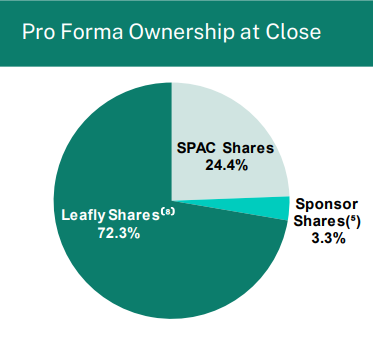

Caveat: Only MCMJ shareholders are free to sell shares after the merger; those held by Leafly and the sponsors are locked up for 180 days. (There is no PIPE in this deal.) This lockup applies to ~75% of the shares in the post-merger company, assuming no redemption.

Based on all this, I therefore expect a price drop, though it may not be as precipitous as some of the other deSPACs because of #5.

Rationale for Spike Immediately After Merger

Given the data presented above, it would not be unreasonable to expect decently high levels of redemptions on the remaining 11.6M MCMJ shares. A 90% redemption would leave us with a tiny 1.2M float. Even a 75% redemption would leave us with a relatively small 2.9M float.

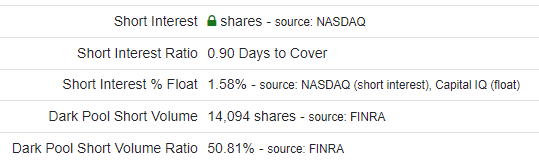

Fintel reports relatively low short interest, but significant redemptions can result in a squeeze from short covering nonetheless, as we saw with HLGN.

If anyone has Ortex data to supplement, that would be lovely.

We see a small rise in CTB, though there seems to be ample shares to short. This may change significantly with high redemption.

https://iborrowdesk.com/report/MCMJ

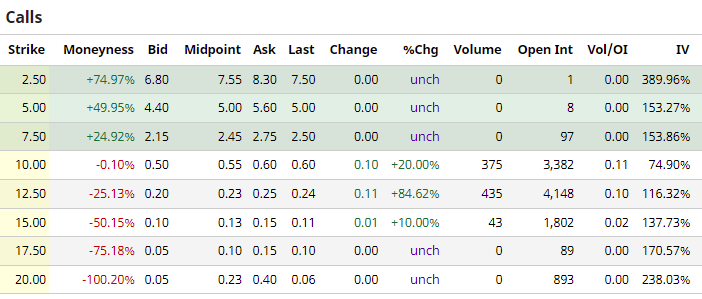

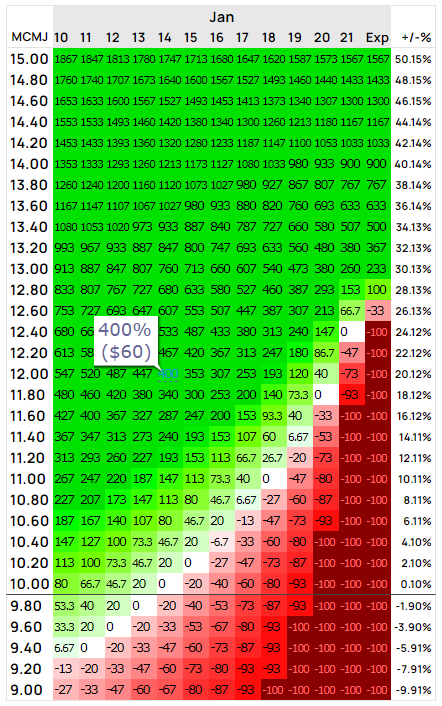

Finally, though not enough for a full blown gamma squeeze, we can expect some gamma tailwind from the call OI chains if redemptions are high enough and prices rise enough to cover the 12.5 strike.

Needless to say, this is extremely speculative, and expectations will need to be revised closer to Jan 14.

Fwiw, at the moment, I am anticipating a mini-spike to $12-$14, mostly based on feels.

How I am Playing This

I got the following:

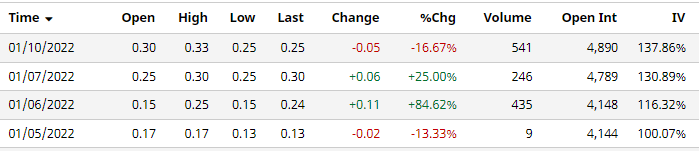

- For the drop: Feb 18, 10P

- For the mini-spike: Jan 21, 12.5C

I’m still holding the Feb ones I got earlier.

I’m still holding the Feb ones I got earlier.