Of course, I’d recommend reading the full 168 pages yourself: https://messari.io/pdf/messari-report-crypto-theses-for-2022.pdf but, if not, below is my recap of the most personally interesting or educational bits of the report. It’s about 1/10th the word count of the original pdf.

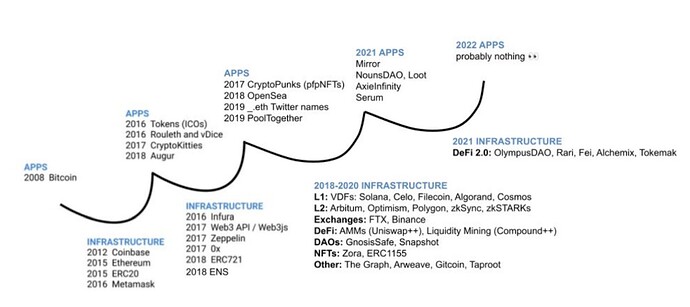

On Web3

- Chris Dixon calls it “the internet owned by the builders and users, orchestrated with tokens.” Eshita describes the Web1 → Web2 → Web3 evolution as Read-Only → Read-Write → Read-Write-Own

- “Web3” is a good all-encompassing term that captures cryptocurrencies (digital gold & stablecoins), smart contract computing (Layer 1-2 platforms), decentralized hardware infrastructure (video, storage, sensors, etc), Non-Fungible Tokens (digital ID & property rights), DeFi (financial services to swap and collateralize web3 assets), the Metaverse (the digital commons built in game-like environments), and community governance (DAOs, or decentralized autonomous organizations).

- Rearchitecting internet services and products so they benefit users rather than gatekeepers is a clear and urgent mission, and Web3 accurately captures the breadth of what we’re attempting to (re)build.

- In Web3, cryptocurrencies and NFTs are the digital goods of the new economy, DeFi is the native financial system, Layer 1 networks are the rails that power everything, and DAOs are how the frontier gets governed.

- I expect growth everywhere across Web3, though three areas are particularly underdeveloped: NFT infrastructure, DAO tooling, and inter-protocol bridges.

- If the future is multi-chain, then those who build better cross-chain connectors and help move assets fluidly across parachains, zones, and rollups will inherit the (virtual) earth.

Cycle Predictions

- Though I waffle on where we are in this particular cycle, the tail winds remain strong and the capital markets flush. So my probabilities are split among three scenarios:

-

- most likely, we experience a blow off top before the end of Q1 2021, followed by a shallower, but still painful multi-year bear market;

-

- we rocket to a $20 trillion bubble that lasts all year, and sits on par with the dotcom boom in real dollars - unlikely, but possible given accommodative monetary policies worldwide, neverending government spending, and crypto’s accelerating narrative momentum;

-

- we march slowly and steadily higher into perpetuity (the “supercycle” thesis).

Capital flooding into crypto

- According to Dove Metrics, we saw $8 billion of private investments across 423 deals in Q3, nearly half of the $17.8 billion invested since the start of the year, which was already more than the previous six years combined. Nearly 90% of the largest deals in crypto’s history have happened this year, and that’s excluding the Coinbase direct listing.

Opportunity in DeFi

- DeFi trades at less than 1% of the global banks’ market cap, which shows how much upside remains long term. Prices have stalled for some of the top DeFi protocols, but if you have conviction that crypto capital markets will displace centralized institutions at an accelerating clip, it may offer better risk-reward opportunities than elsewhere in the market today.

Surviving Winter

- Uwind leverage early, cash out tax obligations when incurred, but for the love of god, do not try to time “the top”.

- And one more thing for the falling knife catchers, who think “wow, this will be great. I can’t wait to buy discounted coins in the next bear market.” Crypto can always go lower than you think, for longer than you think, and it will. Crypto meme trading and reflexivity are a helluva drug. When the music stops, you’ll see the painful withdrawal, and it takes some time to detox.

- The get rich quick crowd will evaporate, but the next cycle’s unicorns will get built during the doldrums of winter.

- The time to go all in with crypto on your balance sheet was last year. I’d be more cautious here: 10 year and 10 hour thinking only.

On Bitcoin

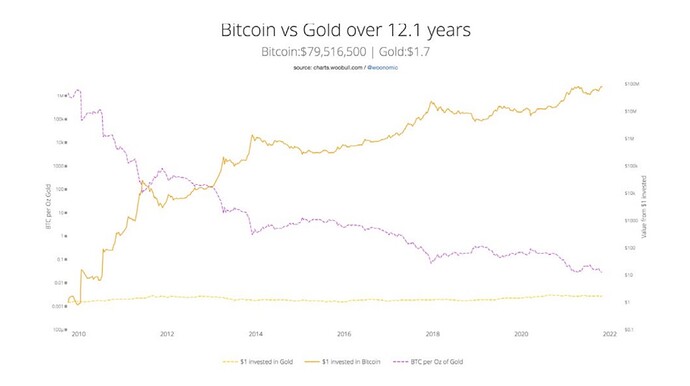

- Investing $100 in gold 10 years ago, would have yielded…$102 today, underperforming inflation. Meanwhile, investing $100 in BTC over that time period would have yielded $1.7 million

- …the “institutions are coming” has flipped to “the institutions are here.”

- Development on bitcoin is like building a rocket, while development on Ethereum has historically been more similar to building a Silicon Valley startup. The stakes are higher in bitcoin, and you need rocket science level security to build a reliable cryptographic alternative to Fedwire.

- Blockstream’s efforts to shoot bitcoin satellites into space, sounds quirky, but it also guarantees network access anywhere society (and the internet) breaks down.

- It won’t be the only winning crypto asset, but it will continue to pull up the rest of the asset class, as crypto rapidly replaces debt in diversified portfolios.

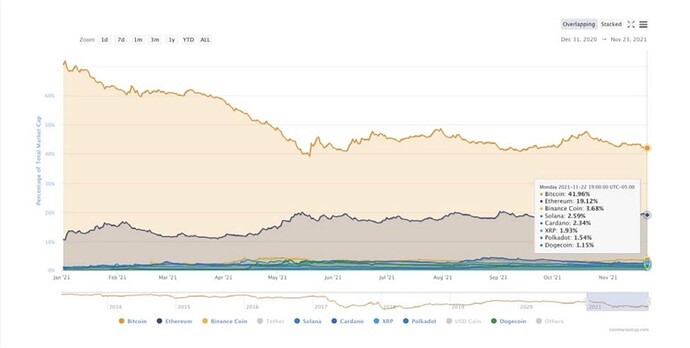

- I’d put the probability of a “flippening” next year at maybe 20%… That said, it’s possible to hold the view that “crypto” as a whole will outperform “bitcoin” (i.e. BTC dominance will decline), while bitcoin retains its spot atop the global leaderboard.

- Bitcoin dominance slid from 71% to 42% this year. Bad. But ETH’s smart contract platform dominance also slid from 80% to 60%, and might bleed additional value to its new Layer 2 rollup “allies” that come to market in early 2022.

Bitcoin ETFs

- The Bitcoin Futures ETFs are state-sponsored pieces of sh*t

- Raoul Pal put it best: “Issuing the BTC futures ETF is a good step but it’s basically handing hedge funds a massive arbitrage opportunity as the futures will trade at a large premium in bull phases and they get to capture those returns. This is the old financial market trick - you now have to add multiple new intermediaries who all make profits - the ETF provider, clearing house, futures broker, administrator, auditor, law firm, CME and hedge fund arbs. Wall street gets richer. Retail investors lose. Again.”

- …eight years of SEC foot dragging limited the bitcoin float in ETF-like vehicles to just 5%. An earlier approval could have created centralization risks in bitcoin’s money supply - risk that is minor today, reducing the odds Wall Street can ever manipulate the bitcoin markets.

- …my bet is that total BTC locked in ETFlike vehicles will remain less than 10% of outstanding bitcoin supply in the next five years. As other large institutions build positions, the smart ones will go for direct exposure, and lower fees.

The Great Fall of China(’s Bitcoin Industry)

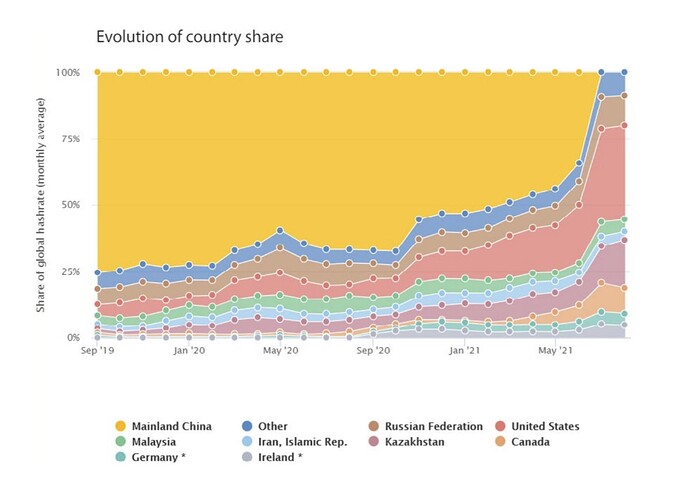

- For years, Chinese miners accounted for over 70% of bitcoin’s hashrate. Then the CCP turned hostile last year, and implemented an outright mining ban this spring, leading to a multi-billion reversal of fortune for the West, and the most incredible chart I’ve seen in eight years:

- It’s such a senseless strategic blunder that it’s hard to imagine the CCP failing to undo the mining ban at least, even if they continue to keep a close eye on trading and capital controls in 2022. It sounds like these policies are already being reconsidered, for good reason. I predict mining is back in the mainland by mid-year (70% confidence).

Proof-of-Stake Works because Proof-of-Work Worked

- Proof-of-work’s success paved the way for proof-of-stake research to be taken seriously. That doesn’t mean PoS will overtake PoW as a superior security model. Nor does it mean PoW will prove infallible. It means PoW was first, and probably still best, for stateless money apps.

- The real PoS decentralization comes from the thousands of interoperable PoS blockchains, which will each offer their own unique token incentives, emissions schedules, governance rules, target applications, etc. over the long-term.

CeFi vs. TradFi

- Banks, legacy trading desks, major asset managers… they can all enter crypto, and probably will sooner rather than later with a variety of offerings. But the game is basically over.

- …there will be corporate innovation groups, crypto executive officers, and press releases (god wait until you see the press releases!), but crypto companies are simply bigger, faster, more aggressive, and unshackled by the distractions of maintaining 50 year old parallel TradFi infrastructure. The talent pool only moves one direction, too…into crypto, where we’re still early in the multi-decade migration of financial, technical, and creative talent to crypto.

CEX Ed

- Today, there are basically three tiers. The top 3 “God tier” exchanges are Coinbase, Binance, and FTX, where primacy will likely come down to new products and regulatory wins. Then there’s Kraken, Huobi, Kucoin, Gemini, OKEx, and Bitfinex in the “behind in volumes” camp, but “could still dominate” if any of the top 3 fall or stall. There will likely be a healthy dynamic among this group where market share ebbs and flows.

- If you want to know where the puck is heading, though, I’ll highlight FTX. A lot of ink has been spilt writing about Sam Bankman-Fried this year. Chaotic good. Wealthiest person under 30. Effective altruist. Sizechad impersonator. To be honest it’s well-deserved. FTX moves at an otherworldly speed and has built a $25 billion business in less than three years with under 100 employees. They’re the fastest growing company of all time, ahead of Coinbase, Stripe, and even Binance, and they did it in the ruthlessly competitive crypto exchange market.

- By 2030, we’ll see a trillion dollar crypto exchange.

- The risks of concentrated custody are lower than they may appear at first glance. Coinbase holds 10% of all outstanding bitcoin, but half of that is due to its role as Grayscale’s Bitcoin Trust custodian. By comparison, Ledger is estimated to “hold” 15% of all crypto. So the assets under self-custody via one company’s hardware wallets, eclipses the largest centralized exchange’s assets under custody by a fair margin. At scale, I guess we’ll probably see a 50-50 split, where savers keep large investments in custodial or semi-custodial (multi-sig) accounts, and retain ownership over their more dynamic liquid holdings in something resembling a checking account.

Coinlist and ICOs

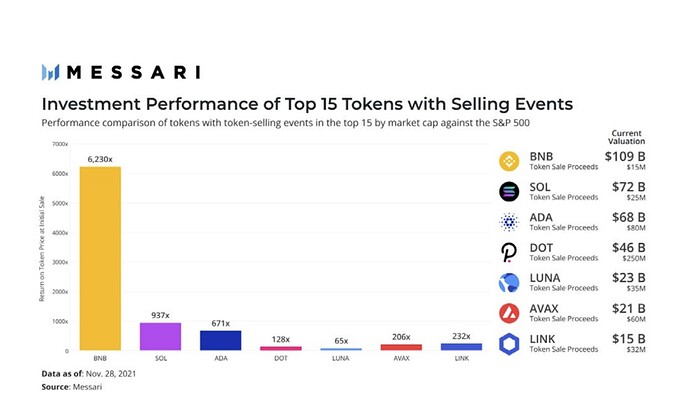

- Token sales have raised about $20 billion all time. Binance (BNB) alone has delivered a 5x on that entire initial investment.

- That’s $350 billion of value creation on just $500mm of invested capital…more than enough to offset all the losers nearly 20x over by themselves. And that excludes Ethereum’s $550 billion of market value created on just $18mm in crowdsale proceeds in 2014.

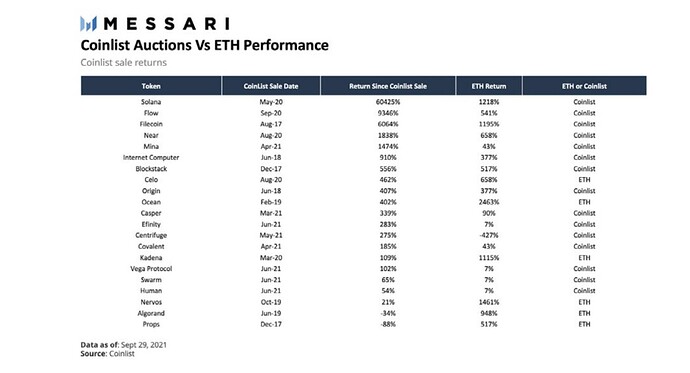

- …here’s how $100 invested across each of their first 20 sales would have actually performed:

- If you had invested blindly with $100 across each Coinlist sale, you’d have deployed $2,000 and returned $150,000 with a 100% hit rate aside from the SEC-sanctioned project.

Payments Innovation

- …all the unique upgrades we’ve seen so far this year: in payroll integrations, “superfluid” streaming payments, quadratic payouts, and integrations with new customers like charities, etc.

- Coinbase announced a partnership with Visa and rolled out its Coinbase Card. BlockFi announced a bitcoin rewards credit card. Stripe is hiring a crypto team and added Paradigm co-founder Matt Huang to its board. Mastercard partnered with Bakkt. Visa leaned into the punk rock ethos by buying a Punk. Ramp raised at $300 million. Moonpay raised at $3.4bn+.

The National Security Case for Crypto Dollars

- Why should policymakers embrace responsibly regulated stablecoins? a16z put it best: “The existing, thriving ecosystem of private USD-denominated stablecoins can help the U.S. act quickly to win the emerging geopolitical arms race in financial innovation. The United States should condemn the surveillance authoritarianism embodied in China’s digital renminbi project–not attempt to imitate it. American policymakers should be cautious about building massive, centralized payments infrastructure. Doing so would impose unprecedented demands on the government’s limited capacity to stand up critical technology platforms, present significant privacy risks, and create an immensely attractive target for attackers.”

- I believe the only path to keeping the USD as the world’s preferred reserve currency is for the US to embrace crypto. The game theory here is for the US to ban its alternative, or buy in as a liferaft.

USDC and Paxos

- There’s a lot to like about USDC. It’s already multi-chain, accessible on Ethereum (and its Layer 2s), Solana, Algorand and more. It’s the most liquid stablecoin in DeFi. Circle releases monthly audited reports of USDC reserves from top five auditor Grant Thornton. USDC’s creators (Circle and Coinbase) have street cred, having worked feverishly on building compliant crypto payments infrastructure since 2012. Circle may also benefit from the public company halo effect once it lists via SPAC, and adds nearly $500 million in additional cash to its balance sheet.

- Paxos has emerged as the backbone for institutional entrance into the stablecoin market. If regulators think Circle is playing too fast and loose in DeFi, there’s always an alternative. This year, Paxos deepened its partnership with PayPal by integrating with Venmo, they teamed up with Mastercard, they began powering crypto trading on Interactive Brokers. And then there was the real prize: the Guatemalan pilot launch with Facebook’s Novi wallet.

- If you still doubt that regulated stablecoins are our future, then you have a homework assignment: send one wire and one stablecoin transaction this week.

NFTs: Digital Goods on a Global Ledger

- NFTs are cool because they represent verifiably scarce, portable, and programmable pieces of digital property. An NFT could be a share of stock, a virtual sword in a MMORPG, a profile picture on social media, a new digital art piece, a plot of land in the metaverse, or your data record on Facebook.

- The “real world” version of an NFT might be something like the deed to my house (verifiably scarce), if I could prove ownership to my insurance company by signing a transaction in a wallet that holds the receipt of my deed (digital representation of property). I could grant access to the house for Airbnb guests with the NFT (programmable), or I could take out a home equity line of credit and pledge the NFT as collateral on a peer-to-peer lending platform (portable).

- It’s not about individual assets, bruh. Almost all of the smart folks in crypto agree that most NFTs will go the way of most 2017 ICOs…to zero. But some early projects will succeed at tremendous scale, and the asset class as a whole will explode over the next decade.

- I predict that the digital art / NFT market crash will eventually be even more nauseating than the 2015 bitcoin bear market (because these are highly illiquid assets by definition), but the 10 year trajectory of the overall market will be the same: 100x+.

The Play-to-Earn Revolution

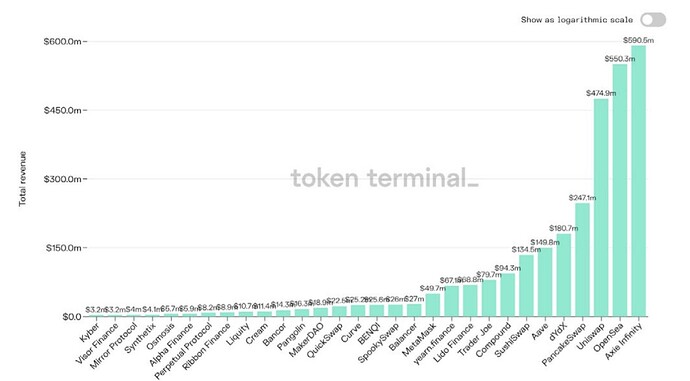

- Consider the economics to Ethereum’s top three revenue producing apps in the past quarter: Axie, OpenSea, and Uniswap. Axie and OpenSea generated more than $500 million in revenue in the past three months. Uniswap was next with about $475 million. After that, both Axie and OpenSea were each larger than the next five Ethereum applications combined.

- My bet is that a top five gaming studio enters crypto in a meaningful way next year, most likely via M&A of other Web3 games. The benefits to being early on a ten year trend will prove too compelling (capitalize on the NFT craze while things are hot and get an edge on the imminent talent war) for all of the market leaders to sit on their hands… It’s not just opportunism that will drive them. The threats posed by inaction are real, too.

- Today’s gaming giants generate $120 billion in annual sales with a 100% default take rate. Compare that to Axie, a meh game not even available in app stores. Its play-to-earn model reduced customer acquisition costs to zero, attracted millions of users and a $10 billion market cap in less than a year.

OpeanSea & Friends

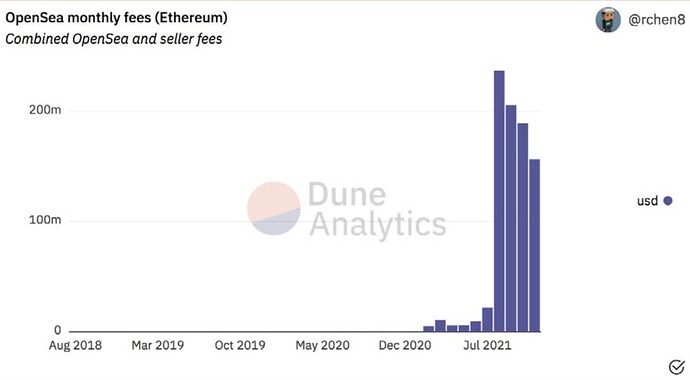

- Over the past 18 months, OpenSea* has enjoyed one of the fastest revenue ramps of any business in history. They’ve gone from a seed-stage startup to a potential decacorn, and I think they could eventually be a $100 billion company (or network) if they continue to execute. This chart highlights their massive run-rate P&L.

- Numbers like this are why Coinbase plans to enter the market. FTX is already there. Same with Gemini. Legacy companies like GameStop are salivating looking at those numbers. Sotheby’s might even go direct.

Non-Fungible Credentials: Your Modular Identity

- …I think NFTs will also be the technical backbone that ports your real world credentials and identifiers to the new world. You won’t need to enter your driver’s license every time you need to prove your identity - your digital signature will unlock access to the NFT of your license, or your health record, or your insurance, etc. We’re talking about a 1000x improvement in the portability of our identities, and the consistency and comparability of our credentials.

- One of the biggest trends we’ll see in 2022 is the move towards meritocratic, earned NFTs. If your crypto wallets become universal digital identification, then NFTs will represent all of the subcomponents of your identity. Composable membership, earned semitransferable NFTs, and yes, TCRs will come back.

Namespaces & Data Sharing

- Crypto domain services (vitalik.eth, ksam.sol) are an obvious killer app for managing Web3 identities. One of the building blocks of internet infrastructure has been domain name registration. Web domains made IP addresses human readable, and the same will be true for many blockchain-based addresses. If PFPs make digital wallets more visual, registries like ENS and Handshake make them more interoperable, and trustworthy.

- Neary half a million ENS names were registered before the protocol’s billion dollar airdrop to its early users last month, and it’s conceivable that the network could rival or surpass centralized DNS maintainers like Verisign ($27 billion market cap) one day.

DeSo Lotteries

- What happens when you combine PFPs, permanent .eth identifiers, data composability, and data marketplaces that price data packets with AI? You get a Decentralized Social Network and potential lotterylike rewards for early and viral user-generated content.

- Decentralized Social raised $200 million from a16z after raking in a small fortune in sales from its “Clout” (rebranded to $DESO) token, and is paying that forward with a $50 million fund of its own to spark community development.

- Naval put it best when he said, “DeSo is waiting for its satoshi moment.” Right now, the field is wide open, and I’ll be spending a lot of time on the up and coming platforms in 2022.

to be contd.

The Physically Decentralized (Permanent) Web

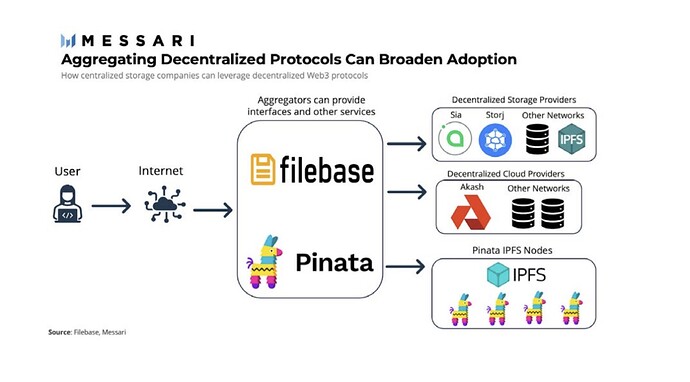

- Of the various components in the Web3 hardware stack, decentralized storage is arguably the most robust. Unlike its predecessor BitTorrent, which relied on required content to be hosted on local servers, IPFS offers a novel decentralized system which allows any node to store data. But these nodes must empty the content they “pin” (cache) eventually, which led to the introduction of Filecoin, an incentivized storage network built on IPFS that verifies the network is storing the data it says it will. As the first blockchain project dedicated to file storage, Filecoin creator Protocol Labs garnered a massive treasury, which it used to fund a laundry list of other projects, accelerators, and developers. Filecoin leads its pack of competitors in terms of data stored on its network for now, though they are hardly alone.

- Even though data stored on Arweave comes with a premium (since the user has to pay for lifetime storage), the protocol has gained traction in the NFT landscape as a permanent solution for storing NFTs and their metadata. Arweave has become the preferred storage layer for Solana NFT projects in particular, which led to a spike in Arweave’s network growth over the past two quarters.

- Decentralized storage is a key layer of Web3 infrastructure that will steadily gnaw at the margins of existing internet infrastructure providers, particularly with the rise of Decentralized Storage Aggregators like Filebase* and Pinata, which provide the interfaces, optimizations, and service layer needed to offer custom storage solutions to new customers. (CeDeWeb3?)

Physical Network Scaling

- A truly decentralized internet also requires permissionless and censorship-resistant hardware networks that support computation and networking.

- Helium is one of the strongest performers (+3,000%) within the Web3 sector year-to-date as its global wireless hotspot network continues to attract huge partners like DISH, who announced that they would begin to deploy Helium’s new line of 5G hotspots.

- Similarly, decentralized video transcoding protocol, Livepeer continues to gain traction and accrue fees as a result from its rapidly growing video network. Within the Cosmos ecosystem, application-specific blockchains like Akash continue to expand and produce early signs of sustainable network revenue as they match developers who deploy their Docker containers at a significantly reduced cost to cloud providers like AWS or Google, and data centers who can rent excess capacity similar to an Airbnb for data. Other hardware networks like Andrena and Althea (pre-tokens!) are tackling the internet service provider layer by enabling communities to set up hotspots and antennas that bring internet access to nearby towns.

The USDT Bridge

- Much to the chagrin of Bitfinex’ed (RIP) and short-sellers everywhere, it’s unlikely that Tether will fail or put an end to this crypto bull market. If that were to happen, the death of Tether’s USDT would much more likely come at the hands of a US Government seizure than a bank run from the company’s depositors.

- Tether is the ultimate digital eurodollar, and a lot of people trust USDT not because they have done business with Tether at scale (though many have), or because they believe the USDT reserves are fully backed (at times, they haven’t been), or because they are comfortable being complicit in a global conspiracy (nobody’s got time for that), but rather because at the end of the day they have to trust Tether, and the system has worked so far.

- It’s inaccurate to call Tether a fraud… There’s a lot of legit companies that work with them at scale. USDT remains the reserve trading currency for most of the world’s largest exchanges and trading pairs, and it’s not particularly close - USDT is an order of magnitude more liquid than USDC or BUSD. Even Coinbase added support once it got out the door for its IPO this spring, and they’re a co-creator of USDC!

- I know it sounds like I’m making excuses for bad behavior, but that’s not it. My point is that we all hold our noses and accept crypto’s cowboy for what it is - a bridge to mainstream adoption.

- CoinDesk’s Marc Hochstein nailed it with his parable “A Bridge Called Tether.” Tether is the most convenient, but rickety, rope bridge that spans the mountaintops of the legacy finance world and the crypto finance world. It’s Shady-as-a-Service by design - less exposed to seizure risks due to the jurisdictional arbitrage it relies upon. It’s also likely to get replaced at some point even if the terminal date remains unclear. I think of Tether as the Omar Little of crypto. Everyone knows Omar breaks the rules, but the man lives by a code, everyone in the game respects him (even if they fear him), and regulators should know by now that when they come at the king, they best not miss. (RIP Omar.)

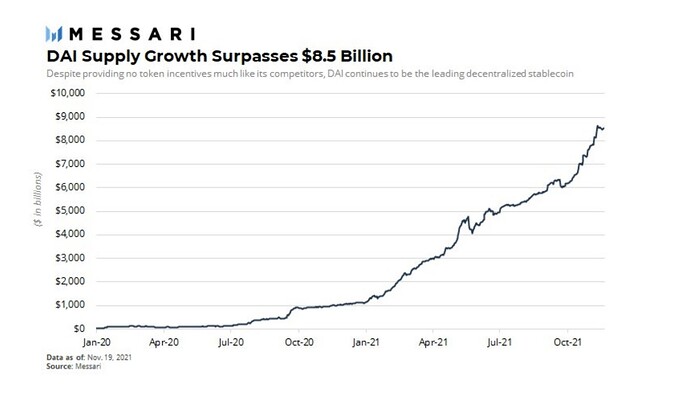

DAI vs UST

- Following a set of upgrades and top tier integrations, Terra’s UST - the fastest growing decentralized stablecoin of 2021 - is positioned to give DAI its strongest challenge yet.

- On September 30, Terra underwent its highly anticipated Columbus-5 upgrade, which spawned dozens of new applications and enabled Terra to expand its reach cross-chain through Cosmos’s Inter-Blockchain Communication Protocol (IBC). A new insurance protocol on Terra (Ozone) helped add the $3 billion of UST (via LUNA burns) to its community treasury within mere weeks. In addition, the cross-blockchain bridge, Wormhole V2, launched support for Terra, bringing Terra UST to Ethereum and Solana. Momentum for UST is accelerating, as it is now positioned to become the de facto inter-chain stablecoin.

- Despite its new competitors, DAI is still the most widely integrated decentralized stablecoin in the industry and the preferred decentralized stablecoin of Ethereum’s DeFi ecosystem. That’s thanks in large part to its four year track record of stability. If the most important attribute of a stablecoin is survival, DAI stands in a league of its own. It’s survived multiple brutal drawdowns and proven its resilience, something competitors can’t replicate so easily.

- Dai vs. UST comes down to Ethereum’s DeFi dominance. One thing UST has in its favor is that it’s not even trying to compete with DAI on its home turf. Instead, UST is building its own ecosystem on Terra and aggressively expanding multichain. If crypto continues evolving to a multichain future, the winning decentralized stablecoin may be the one that proliferates across the broadest ecosystem of blockchains. Terra is marching in this direction while DAI continues to serve primarily as an Ethereum reserve.

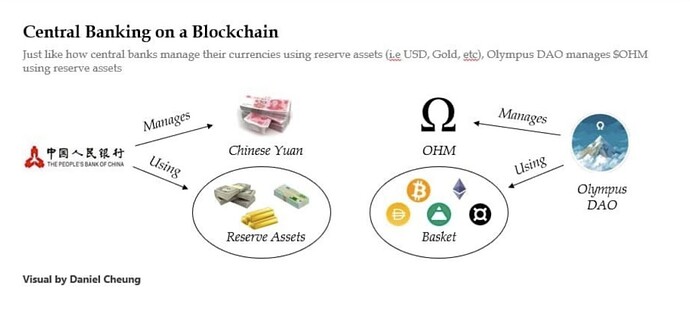

The Emergence of Non Pegged Stablecoins

- …stablecoins have dollarized our blockchains, and have put the entire crypto-economy at systemic risk in the process. A currency ultimately pegged to and controlled by the Fed and Treasury, limits our ability to build a truly sovereign monetary system.

- That’s what led to the launch of a new wave of projects this year, aimed at creating free-floating stablecoins which are unpegged to fiat currencies. Non-pegged stablecoins offer an opportunity for the crypto economy to achieve stability while eliminating its dollar dependence.

- The controversial, but indisputable leader of this movement is Olympus DAO. Launched in March 2021, Olympus incentivizes users to “bond” tokens (Dai, ETH, LP tokens, etc.) to its protocol permanently in exchange for a new token called OHM. The protocol attracts liquidity by offering OHM at a discount to the value of the collateral received, though newly issued OHM can only be redeemed at par value after a vesting period. The game theory has been powerful so far - in eight months since its fair launch, Olympus has accumulated $700 million in treasury assets, and rocketed to $3.5 billion in market cap.

- There are ponzi-like game theory attributes of the protocol that drive interest and participation, and it’s unclear how those will hold up amidst a broader crypto selloff. However, judging by the number of forks it has spawned, OlympusDAO may be the year’s most important new project, and non-pegged stablecoins may be the best bet this industry has when it comes to de-pegging from the US dollar.

DeFi 1.0 to 2.0

- The DeFi boom started 18 months ago with Compound’s yield farming program. Then (and still), a preferred incentive scheme among DeFi projects has been to offer native token incentives for liquidity providers (“LPs”) to the underlying DeFi protocols. This juices early liquidity in these systems, and everyone from market makers in Uniswap’s AMMs, lenders and borrowers in Aave, vault holders in Yearn, etc. have flocked to the protocol’s with the highest risk-adjusted returns, which include protocol revenues, and token-denominated liquidity mining rewards. These capital providers were critical during DeFi’s bootstrapping period, but have diminished in value over time because they’re fickle: the capital they provide is “hot” and they move from project to project. LPs are more like locusts than humble farmers, as they create a perpetual expense for protocol treasuries and relentless selling pressure.

- Some projects saw this and realized yield farming 1.0 was unsustainable. Instead of creating native treasury token yield farms, they began to create “Liquidity-as-a-Service” schemes that “rented liquidity” from other protocols… Instead of creating native treasury token yield farms, they began to create “Liquidity-as-a-Service” schemes that “rented liquidity” from other protocols.

- …liquidity is now being provisioned at the DAO level rather than the liquidity provider level.

- Olympus DAO now has a treasury worth more than $700 million in non-native assets, and is putting those assets to work in DEXs, lending protocols, yield aggregators, and even venture capital. That improves the returns of the DAO (its treasury assets generate yield) and reduces its cost of capital (the DAO doesn’t pay external sources for its liquidity). Higher revenues. Lower costs. This is the biggest unlock of DeFi 2.0.

- Critics will point to subprime mortgages and other derivatives, and note that “DeFi 2.0” will have a significant garbage in, garbage out problem, with cascading failure risks. Others will greedily (and literally) invest in the magic internet money ($5 billion in liquidity in six months). I’ll be honest. I haven’t yet wrapped my head around all of this yet, and whether it’s all moon math or a new sustainable financial model.

Tokenized Funds & Index Co-Op

- …the ETF space itself is less than 30 years old. The number of mutual funds has been declining, while ETFs have ascended to 20% of global AUM in open-ended funds (remainder are mutual funds).

- Despite their track record of success ($6 trillion in total net assets, lower management fees, and higher net returns for their investors), each new ETF application uses an “exemptive application process” that requires SEC permission for each new product.

- That there hasn’t been any innovation in the now $30 trillion fund market since the birth of the internet is fairly alarming, especially for the “financial capital of the world.” It’s also one reason I’m bullish on projects like Index Co-Op, which makes it simple to create a custom index of tokens using smart contracts.

Security & the Dark Forest

- We’re now at $250 billion+ in “total value locked” in smart contracts across various protocols. That’s a lot of cheddar to come after. Ethereum security researchers have had their hands full enough, and now high fees are pushing more at-risk assets to brand new chains with less sophisticated user opsec stacks. Ethereum is down from 98% of TVL to 67% today.

- Three things to keep an eye on this year:

-

- smart contract insurance like Nexus* which became the first crypto insurance unicorn, but not the last I’m sure.

-

- verified secure smart contract libraries and security as-a-service. For example Forta* offers an “enterprise-grade run-time security platform that detects system-wide threats through a network of node operators incentivized to look out for foul play.” In nongobbledygook, it’s a central nervous system for DeFi. Stub your pinky toe or simply feel a chilly breeze and Forta’s network could send that message to the right brains quickly, possibly serving as a circuit breaker in the future.

-

- bullish in perpetuity on smart contract security researchers.

- samczsun found a $350mm bug in SushiSwap, which remember ripped off Paradigm portfolio company Uniswap Labs’ original code, and likely saved the project and its users

ETH Q3

- This summer’s NFT mania pushed the Ethereum network to its breaking point, even as more on-chain capacity migrated to Ethereum’s newly launched Layer 2’s (Optimistic Ethereum launched its Alpha in July, and Arbitrum One’s Mainnet launched in August). As of this writing, there’s now $330mm locked in Optimism (Uniswap and Synthetix), $2.7bn locked in Arbitrum (UNI, SUSHI, Reddit), and $5.1bn locked in Polygon (Aave, Polymarket, Decentraland). DeFi Llama helps track all this locked value in real-time, and that’s before factoring in throughput that migrated to dYdX’s zk-rollup chain built on StarkWare, where liquidity sits around $1bn and volumes at one point eclipsed Coinbase’s.

To EVM or Non-EVM?

- In broad strokes, Ethereum’s competitors are all taking different angles towards solving the “scalability trilemma” which holds that blockchains can only prioritize two out of three priorities between scalability, decentralization, and security. Vitalik and the other Ethereum core developers have already rallied around a “roll-up centric future” which prioritizes the security and decentralization of the base Ethereum blockchain intentionally over its scalability, which will be pushed to other adjacent chains. This model is similar to the preferred path of Polkadot and Cosmos. Solana, on the other hand, wants to go fast, and they’re satisfied with sacrificing some level of decentralization for speed.

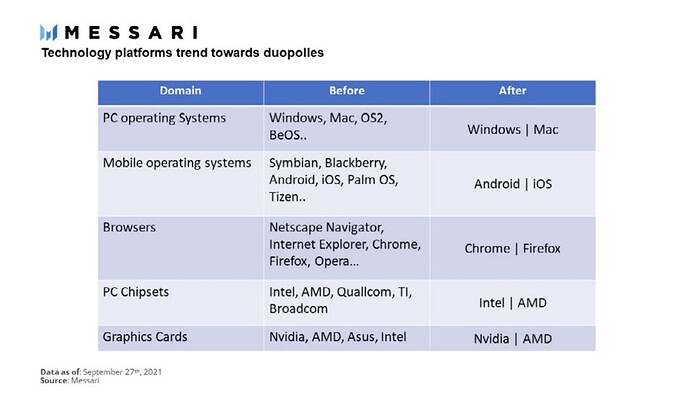

- There’s a window of time where this battle for mindshare will play out (many standards!), but you certainly don’t want to be the one “bag holding the 5th guy for anything more than a trade.” We may have hundreds, or thousands of application-specific “rollups” or “parachains” or “zones”, but we won’t have hundreds of L0/L1/L2 standards. As Ramshreyas wrote in a recent Pro piece, major tech platforms tend to trend towards duopolies.

- Perhaps this time will be different, but I find it unlikely that developers (particularly those working in small teams) will choose to integrate with multiple virtual machines outside of the top 2-3 even in the nearterm, unless they have vastly superior technical capabilities that better suit their applications. (e.g. Serum’s decentralized exchange can only work on Solana, as its central limit order book would be infeasible on Ethereum.) Even then, many upstarts will face a choice in the medium-term between going the “safe” route in building on Ethereum’s EVM, or settling new land on a tech stack that might not survive a bear market.

- Even if Ethereum manages to hold off its largest non-EVM rivals, it will leak value to the rollup chains it leans on for scalability. ETH sits at ~60% market cap dominance among Layer 1s. That will either fall below 50% in 2022, or its Layer 2 rollup tokens will eat into its growth. Maybe both.

Solana Summer Never Ends

- No project - maybe in crypto’s history - has gotten hotter, faster than Solana in 2021. A 100x rally, a legendary challenge from one of its early critical backers, intense VC interest, an exploding infrastructure stack (Syndica!*) and application ecosystem, and a blockchain that is fast, fast, fast, make it the first legitimate challenger to Ethereum’s Layer 1 dominance.

- Solana is really good at the things Ethereum doesn’t even try to be good at. Solana is not trying to out-EVM and out-modularize Ethereum. It’s trying to fit everything it can into its base chain.

- The team is executing at a breakneck pace that was evident this month at their Breakpoint conference: $100 million in investment for decentralized social media with Reddit’s cofounder, $100 million fund with FTX geared towards blockchain gaming, Brave’s migration to Solana as the browser’s default blockchain, Solana’s ascendance as a potentially dominant platform in crypto gaming and NFTs (hello, FTX integration), and the recent 1mm wallet threshold for Solana’s browser wallet, Phantom.

- It hasn’t been a panacea. The network had a major, 17 hour outage (or a “17 hour block” if you ask Solana founder, Anatoly) that could have led to systemic issues in its fledgling DeFi apps had the Solana price cratered. But if we’re calling things fairly, this isn’t dissimilar to the early technical challenges Bitcoin and Ethereum faced.

- Growing pains are inevitable, and it’s normal for networks to discover catastrophic bugs early in their lifecycles.

- We’ll see if the momentum is sustainable long-term, but Multicoin crushed the short-term thesis: “The only blockchain protocol that can [scale to 10s of millions of users] within the next 24 months—is Solana…I’m not saying that scaling via sharding and roll ups can’t work. I’m actually reasonably optimistic that both solutions will, eventually. But, both of these scaling strategies don’t really work today, and will create a lot of secondary and tertiary problems that have to be worked through. It’s hard to see a world in which impartial organizations that demand certainty around scalability will get the certainty they need in the next 24 months because there are just so many intertwined components to scaling Ethereum.”

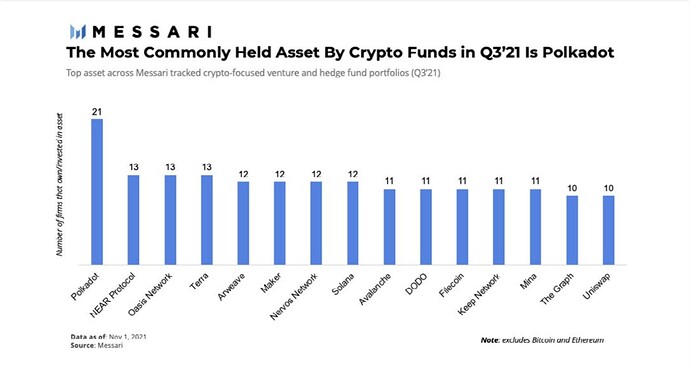

Polkadot’s Slow & Steady Rollout

- Polkadot is interesting for a few reasons, not the least of which is that the rollout is slow, but steady (in contrast to Solana’s pace), and the development team seems to be inverting the ETH 2.0 model - rather than having applications flee the Layer 1 to work on friendlier application specific chains (ETH’s rollup model), Polkadot began with a base layer that had limited execution capabilities but generalized security. The protocol outsources most functionality to customizable execution layers (parachains) at regular intervals (slot auctions), which requires contributors to buy and lockup DOTs on an ongoing basis. Add in staking and parachain bond derivatives (e.g. those on Acala), and you have the makings of a ponzinomic masterpiece.

- Polkadot might be moving a bit slower and steadier than the other projects in this chapter, but I wouldn’t bet against someone who co-founded Ethereum, and followed it up with a second $50 billion network.

Cosmos & IBC Opt-In

- Cosmos was the first to work on a modular network of blockchains, and Ethereum’s rollup-centric scaling plans sealed the deal. The “one chain-to-rule-them-all” thesis is dead, and Cosmos’ Inter-Blockchain Communication protocol (IBC) does something Polkadot and Ethereum don’t, keeps the protocol entirely open and independent of the Cosmos “Hub” and its native token, ATOM.

- The Hub is not enshrined in the Cosmos Ecosystem. It competes on equal footing with other chains that may seek to serve as a central router of data and assets across the Cosmos ecosystem in the future. The Hub’s initial shared security model offers new Cosmos blockchains (“zones”) the option to anchor to the Hub on an opt-in basis. Like Polkadot’s Relay Chain, or Ethereum’s Beacon Chain, but 100% optional. Cosmos treats interoperability as a spectrum, then - zones and their users choose which security risks to take on from connecting to other zones. Fully, uncoupled zones might not connect at all, while fully coupled zones might share a single consensus process.

- Paradigm’s Charlie Noyes puts it even more simply: “If Ethereum is a mainframe computer, Cosmos is a protocol for networking independent servers.” Chain specialization might be the only way to effectively scale on-chain activity, but Cosmos doesn’t seek a premature answer to the question of how blockchains get modularized and which markets will be winner-take-most.

- That’s one reason it’s powered two of the top 10 blockchains (Binance Smart Chain and Terra), and may include dozens of others in the future, including Ethereum.

Terraforming La Luna

- Terra’s application ecosystem has exploded this year. Its partnership with South Korean payment app Chai brings Terra to 2.3 million users, Terra’s algorithmic stablecoin UST has gone from $0 to $7.2bn in its first year and may soon overtake Maker’s Dai in market cap. Synthetic stock application Mirror counts $1.5bn in locked value, just shy of Synthetix’s $2.1bn. Terra’s Anchor protocol has locked nearly as much LUNA ($4bn) as Ethereum’s Lido has ETH ($6bn).

- …there’s the reflexivity of UST and its usage of LUNA as a primary source of collateral to worry about. In a full “riskoff” environment, it’s unclear how resilient Terra and UST might be - during the spring dump of LUNA, UST nearly became insolvent as the value of LUNA fell below the total value of UST in circulation. It also took a $70mm capital infusion from Terraform Labs to shore up the stability reserve at Anchor, a systemically important Terra lending protocol. The lender of last resort model works until it doesn’t.

- On the other hand, the protocol’s Columbus-5 upgrade (which among other things connected Terra to all other Cosmos blockchains) and Wormhole v2 integration (bringing LUNA and UST to Ethereum, Solana, and Binance Smart Chain), will derisk some of that reflexivity by extending the protocol to other chains, as well as extend UST’s relevance across the rest of the crypto economy. That’s why I remain bullish on Terra’s long-term potential. Terra’s stablecoin potential alone give the project a massive TAM.

The Best of the Rest (of the L1s)

- Cardano is in the top 10, so this may seem like a slight, but not a single person in my network recommended I replace a section on SOL, DOT, LUNA, or ATOM with ADA.

- If anything, Avalanche was the first bubble team slighted for the big dance, though we’ll be dropping a big report on them soon.

- Algorand has made some moves recently, too, and they got the Mooch on board.

- Fantom has buy-in from Andre Cronje (one of last year’s top 10 people to watch for his work on stablecoin project, Yearn) and coverage from Nansen.

- Near has been aggressive, aggressive on the grants incentives, and expanded its ecosystem through the EVMcompatible Aurora sidechain. Etc.

Polygon Flippens ETH

- Polygon’s rise this year has been remarkable. I’m not talking about the nearly 100x year to date rally in price. I’m talking about how effective the team has been so far in making strides to build a generalizable scaling protocol that allows users application developers to choose between building an Ethereum sidechain, a Plasma chain, or (soon) a rollup chain.

- The fact that Polygon flipped Ethereum in active user addresses, may be the best exhibit A we have that scaling is an existential priority for the Ethereum ecosystem. Were it not for Polygon’s role in processing NFT / gaming transactions, this summer, the migration to alternative L1s like Solana may have been even more rapid.

- Polygon has since ventured into new territory with an array of scaling solutions and complementary tooling. Between May and July, the team introduced the Polygon SDK (a framework for launching new blockchains that could either serve as a rollup or standalone chain) and Avail (a data availability solution for Polygon SDK chains). It has also made a concentrated effort to focus on ZK technology as the long term scaling solution for the Polygon ecosystem. In August, Polygon’s merge with Hermez – an open source ZK Rollup scaling solution – was a step towards integrating ZK into the core Polygon ecosystem. The team also announced a $1B strategic fund to invest in ZK technology and revealed “Miden” an upcoming STARK-based rollup that will be EVM compatible.

Optimistic vs. Zero Knowledge Rollups

- Optimistic rollups, “optimistically” assume all transactions on the rollup blockchain are valid by default. They use an innocent-until-proven-guilty model where transaction confirmations on the L1 chain are subject to a challenge period as a fraud prevention mechanism. This requires some latency between L1 and L2 transactions in order to allow for challenges, but they are EVM-compatible “out of the box”, which allows developers to port existing Solidity contracts from Ethereum’s L1 to Optimistic L2s with minimal alterations.

- Vitalik thinks that ZK Rollups will process the vast majority of Ethereum transactions long-term. They may also upend the thesis for alternative L1s. ZK rollups leverage zero-knowledge proofs (also known as “magic beans” to industry insiders - using this terminology will make you sound really well connected at your next meetup) to near-instantly confirm the state of their L2 chains to the Ethereum L1. Loopring, Immutable X, and dYdX are early adopters, but don’t expect their success to lead to a rush for ZK rollups just yet: they aren’t fully EVM compatible and require some customization to hop between the L1 and other L2s.

- The programmability gap will inevitably close between Optimistic and ZK rollups (StarkWare says its StarkNet is coming soon), but today the tradeoff is about simplicity and compatibility vs. settlement speed.

- My bet is that L1 Ethereum transactions account for <20% of transactions by the end of next year, and Optimistic Rollups account for less than 50% of total L2 usage by the end of 2023.

Build Me a Bridge

- By now, it’s abundantly clear that a multichain world isn’t just the future, it’s the present.

- There are 15 blockchains today that store over $10 billion in assets each, and Bitcoin and Ethereum store nearly $2 trillion by themselves. Growth doesn’t appear to be slowing anytime soon, and it’s likely even more blockchains will rise in the coming years with the launch of Layer 2 rollup chains. In many ways the world of blockchains is quickly starting to resemble our physical world today, defined by nations which each have their own economies, governed by their own rules.

- Today there is still no scalable, decentralized, widely integrated protocol that moves value and data between blockchains without relying on trusted third parties. Instead users mostly rely on centralized intermediaries like exchanges and custodians to move value between blockchains, exposing them to custodial risks and seizure/censorship risks.

- Luckily there are a number of teams acutely aware of this opportunity, and projects like Cosmos that have been building for this world since 2014.

- Cross-chain interoperability is also likely to standardize around a small number of trusted, widely integrated protocols. The immaturity of today’s solutions creates significant user and developer friction, but a bridge that’s credibly decentralized, battle-tested, and well-integrated across Layer 1s would likely emerge as the preferred choice for cross-chain liquidity simply due to its predictability and reliability. As the multichain economy grows, it’s inevitable that cross-chain bridges will facilitate an enormous amount of asset and data transfer volume.

- Prediction: the most popular L1 <> L2 / L1 <> L1 / L2 <> L2 bridge protocols will have higher daily volumes than the most popular centralized exchange within five years.