Chart:

[MGI]

About the Company:

MoneyGram International, Inc. is a provider of cross-border peer-to-peer (P2P) payments and money transfer services. The Company operates through two segments, Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfer services and bill payment services principally as an alternative to banking services. It offers services through third-party agents, including retail chains, independent retailers, post offices, banks, and other financial institutions. It also provides digital solutions such as moneygram.com, mobile app solutions, account deposit and kiosk-based services.

In short, MoneyGram is a way to transfer money without going through your bank. This is very helpful for international remittance and for underbanked domestic transfers.

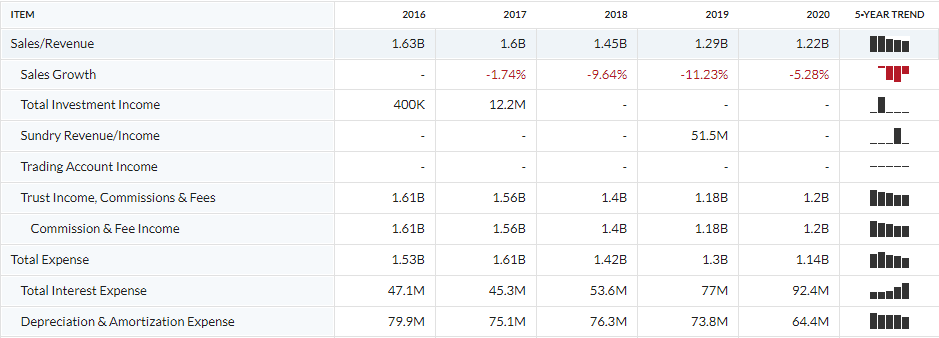

Financials:

Nothing that great to report here, looks like a middling company who’s working on streamlining their costs to get back to where they were 6 years ago in terms of revenue. MGI is also already up nearly 600% from its COVID low, so why are we looking at it?

Buyout Rumours:

MGI has been a potential buyout target for a number of firms dating back to 2018. This past summer MGI received a buyout offer of $12 per share but then declined the offer sending shares down over 50%. This time things could be different, there is a reported bidding war going on between the original $12 offer firm as well as two other firms. From the previous article we see that “MoneyGram set a Jan. 24 deadline to receive binding acquisition offers, and expects to decide on whether it will sell itself in the coming days, according to the sources.” MGI’s CEO struck down the original offer but this could have just been playing hardball to get a better offer and now there are 3 reported firms interested in a buyout instead of the lone offer received over the summer.

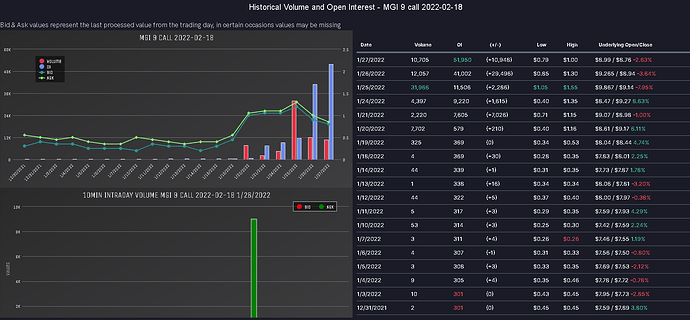

Open Interest:

As you can see OI has exploded since the article came out. The 2/18 $10 call followed a similar pattern with over 55k OI as of this morning. Because the majority of this OI came after the Reuters article release, this is probably large retail traders taking bets.

The Play:

According to the Reuters article, MGI is currently reviewing the 1/24 deadline offers and could make an announcement as early as next week. The tricky part here is that the IV is already sky high on the chain but with a potential $12 floor on buyout offers, it could still be a very profitable trade depending on your entry. Shares could also be a safer route but if this plays out like it did over the summer, you could see a 40% drop if merger talks fizzle out. Overall, I really like these binary outcome plays and will be entering with some 2/18 $9 calls.