Hey friends, Tedro here. I want to discuss stop orders and more specifically trailing stop orders. I know this topic has been done a few times including Holi’s great write up. When looking back at some of the recent plays, “candle paralysis” and mitigating losses always seems to be a topic of discussion.

I want to define what each stop order means, then I will give some examples of how I set these types of stop orders from Fidelity ATP (this is the broker I use). If anyone uses a different broker and would be willing to add how stop losses are configured for that specific broker, I would appreciate that.

Sell Stop Order

Use this one if you want to protect yourself from a possible declining price. If your ticker is declining in price, a sell stop order will ensure you get out before the price drops too low. This is probably the most popular sell order and highly recommended for new traders.

This is a “sell stop market order”. This means that when you put in your stop trigger price, and the ticker trades at that price, this order will trigger a market order to sell your position. Think of it this way “the stop price, is the trigger price”.

If BEKE is currently trading at $19.83, my stop trigger is $19. So, if BEKE drops to $19 or below, it triggers a market order to get me out.

Buy To Cover Stop

If you’re short a stock, you profit when the price declines, meaning the protection is on the upside. So, if the price is going up, you want to get out at some price, which is a ‘Buy to Cover’ Stop order.

If SCHW is currently trading at $34, I would trigger my stop at $36 because I am short and I want the stock to go down, however it went up to $36 and I want to get out without more loss.

Short Stop Limit

Short Stop limit are a little more complicated but can offer you higher degrees of protection based on their nuances. With a Stop Limit order, there’s two configurations. The Stop Price, is the trigger price, let’s use $36, same as the example above. Now, you can also set a Limit Price that you want to get out. There’s more risk here because there is no guarantee that your Stop price is triggered, and you get out at $36. So, your Stop price and your Limit price do not need to be the same.

Let’s make the Limit price $35.50. When SCHW goes to $36, I think it will go back to $35.50 and I can save some money by getting out lower.

For a stop limit order, the ticker must get to $36 in order to trigger my Stop, then the $35.50 Limit order to cover my position is sent to the market and I’m waiting for that $35.50 price to get out of my position.

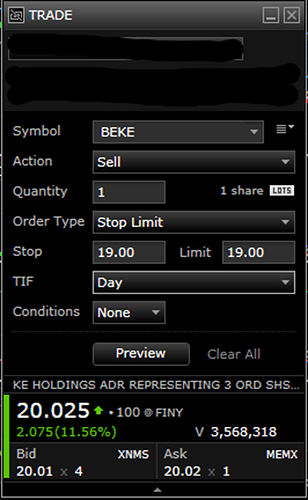

Sell Stop Limit

Same as above, we have a Stop price first. I want to trigger the order if BEKE trades at $19 and I want to get out. A Stop order means, I’m hitting that trade price and I just want to get out.

I can then set my Limit to whatever I want. We can even set the Limit order to be the same as the Stop order. This is risky, and I do not recommend it. Let’s say BEKE has a gap down through my price. So, BEKE gaps down at market open tomorrow and it’s now trading at $17. I won’t get filled because it opened lower than my Stop and Limit prices. This order won’t even get triggered because it opened lower than my set price.

Another thing to keep in mind with Fidelity (not sure on other brokers). Stop orders are only monitored for execution between 9:30am EST to 4:00pm EST. So, you don’t have real protection with this type of order if a ticker is heading into a period of volatility.

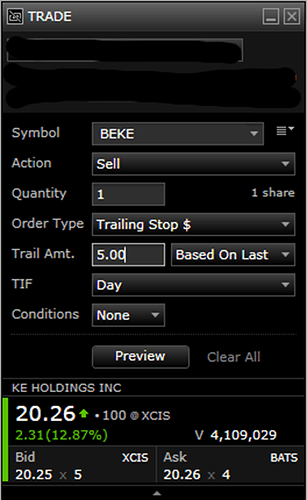

Trailing Stop Order Dollar Amount

This is my favorite type of order and I think this is a valuable type of order for potential squeezes like IRNT and ESSC. You can do a dollar amount Trailing Stop or you can do a percentage Trailing Stop.

The great thing with Trailing Stop orders is they never go down. Once I submit the sell order, the trailing stop loss will always adjust based on the current price.

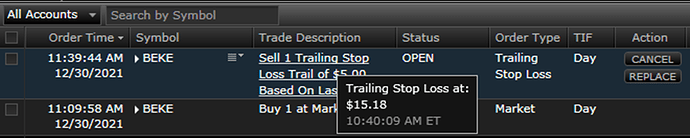

If BEKE drills $5, I want to get out. My sell ticket would like this, and you can see that it will automatically trigger if BEKE gets to $15.18.

Now, let’s say BEKE is starting to squeeze and suddenly it is no longer trading at the $20.18 I bought in at and is now trading at $35. My order will automatically update and instead of selling at the $15.18, it will trigger if BEKE gets drops to $30 (because my Trailing Stop Loss was set to $5).

Using ESSC as a real example, it got up to $26.27. Let’s say I originally bought into ESSC at $17.27. I set my Trailing Stop Loss of $3. This means that when ESSC went to $26 and then plummeted, I would have automatically triggered my position to sell at $23 because a Trailing Stop never goes down.

We can once again use my BEKE as an example. As of writing this, the price went up a few cents and my Trailing Stop Loss has automatically adjusted from the original $15.18, and it is now $15.23.

So, if BEKE keeps going up and up and up, my Trailing Stop Loss will always lag $5 behind the current price but if it draws back, the Trialing Stop Loss will not go down. This protects you from declines in price. It allows you to make more profits, but if it declines $5 from any point in time, this will automatically get me out.

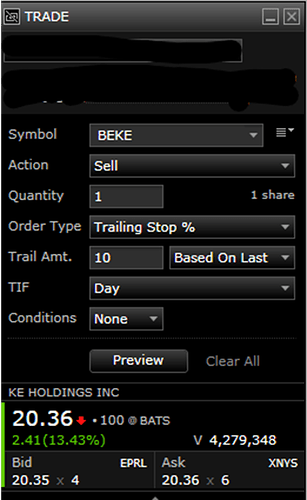

Trailing Stop Order Percentage Amount

A Trailing Stop Percentage Amount order acts the same as a dollar based, just with a percentage :surprised pikachu face:.

What’s interesting about these, is these can only be set between 1% and 30% based on last trade.

If I want to get out of BEKE if it drops 10% at any point, I want to get out.

From my orders window, you can see that now if BEKE drops 10% it will sell and currently, I would get out at $18.33

Buy Stop

This one is pretty basic, and it can be useful if you simply do not have the time to watch a stock closely. Let’s say you’ve done your analysis on BEKE and you think that you want to buy in if it gets to $22 because according to your analysis, $22 means it will break out to $30.

Please note – with Stop Market Orders, the ones that aren’t Limits. The way that Fidelity handles Stop Loss and Stop Limit orders is that Fidelity routes the orders as soon as the orders are placed. In other words, when an order is placed, it is routed to the market specialist and Fidelity is not holding onto that order. I am guessing most brokers do the same method, but you may want to verify with your specific broker.

Fidelity also has something called Trade Armor but that is specific to the Fidelity platform. If you do use Fidelity, I would recommend looking into that as well. It can be a very powerful tool when it comes to scalping.

Conclusion

Now you know most of the important Stop orders. You now know how to do a Stop Market, a Stop Limit, the two ways to do a Trailing Stop (dollar or percentage) as well as Buy Stop Market.

There is a lot of versatility and strategies that you can utilize with these order types. I highly recommend you practice these types of orders with a cheap stock. This way you can see how the different order types work and you can learn to navigate them with your broker. They can be confusing so just try to remember the Stop Price is a Trigger price and all other conditions follow that.

If you have any questions, I will try to answer them and if you are using a different platform and are comfortable showing how to set Stop orders for your platform that would be a great resource for everyone.