R/S not be disscussed by the managment and yet I dont see how it’s not coming. Furthermore, I find it odd for a company to make all these aquisition without a stapple product available yet. They really take retail investors like a cookie jar

Shared the following in the sub:

This is interesting.

Aligns with the Bollinger acquisition in that looks like Muln leadership as decided acquisitions are the way to go to deliver.

It is not a bad idea. We know:

- they have failed to get things done on their own.

- there are a whole host of EV companies that are struggling or are bankrupt that have things Muln could use

- most other EVs with cars on the road have a massive head start on Muln

In this context, joining forces and assets could be helpful.

There are two challenges here:

- it takes great skill to pull out synergies from acquisitions. Even big companies struggle. BBIG is a hot mess. On the other hand, SIRC has done a remarkable job 10x-ing through acquisitions.

- it will take a LOT of money to make this work. This means more dilution. That’s the lesser of two evils, as the other evil is bankruptcy.

In short, I think this means Muln will stick around for longer, but has become even more risky, and all this will likely happen at the expense of significant dilution.

To which a prudent Redditor notes that there are not enough authorized shares to get all the things done. They will literally run out of money.

Btw, the science experiment on the covered calls did not work out.

Share price fell below $0.50 at open and has fallen 8% so far to $0.46. 9/23 0.50C ask is $0.05, so no way I’m getting a fill at $0.10 anymore.

Given today’s news, ticker might be on a fast track to much lower numbers. “Experiment CC” is on hold for now.

https://www.sec.gov/edgar/search/#/q=Muln&dateRange=custom&startdt=2022-09-18&enddt=2022-09-19

2 new 8-K fillings and S-3ARS filling

This prospectus of Mullen Automotive Inc. (formerly known as Net Element, Inc.), a Delaware corporation (the “Company” or “Mullen”), relates solely to the resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”) of up to 249,375,003 shares (“Offered Shares”) of our common stock, par value $0.001 per share (“Common Stock”).

On one hand, makes sense - they have to finance their acquisitions and keep running the company somehow.

On the other hand … RIP stock price. Current outstanding is ~500M? Another 250M released into the wild should rip it a new a**hole.

Witch will kill retail cause if no strong catalyst makes the price action go over $1, its R/S time. Dillution is one thing, R/S really fucks you up.

That’s correct. An actual stock that is going to be traded for Krispy Kreme pennie smoothie.

Makes sense to dilute before R/S so then bundle all this into the R/S and do it once, instead of once every year.

-12% today. The Gulag ride is something else man.

Im talking with my lawyer as we speak. Yall going to get all the smoke. ![]()

Im still muted squishy. Its hard in here mayn. Free Rengoku. Westsideeeee

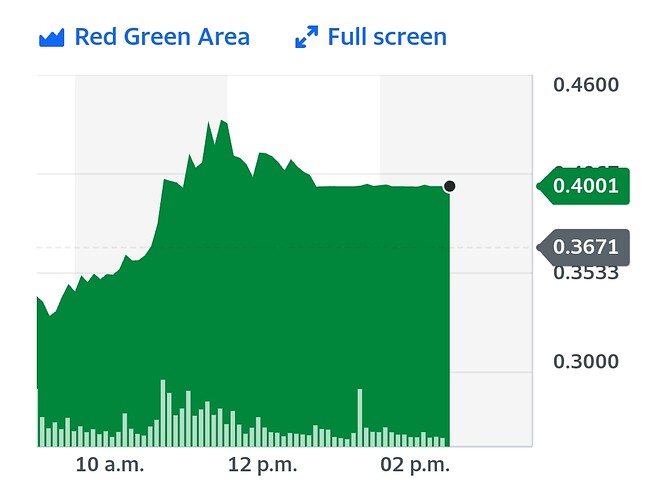

MULN up 9% today. Lets see how it goes.

Notorious pump-and-dump mastro Zack Morris has expressed an interest in Muln:

If anyone is underwater, this could be a great chance to dump into the frenzy. A % trailing stop could work if one is not able to manage this real-time.

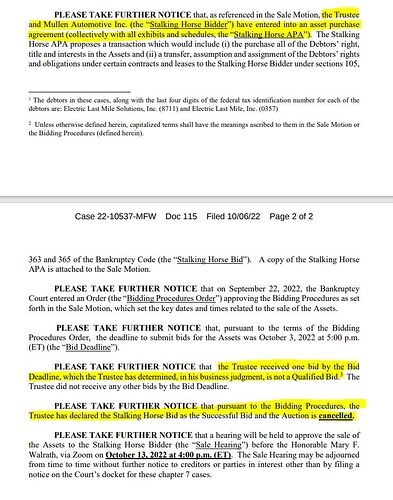

I think they are getting these assets as a Hail Mary because their Chinese connections are not working out. Their own producer (I forget the name) hasn’t delivered anything, so they are hoping that perhaps they can use ELMS’ facilities for that. Which is curious in itself because ELMS never got the certifications needed before it went bankrupt.

Note that this news was known during market hours, and MULN price action does not show a favorable response. It might be months before they manage to salvage anything out of this.

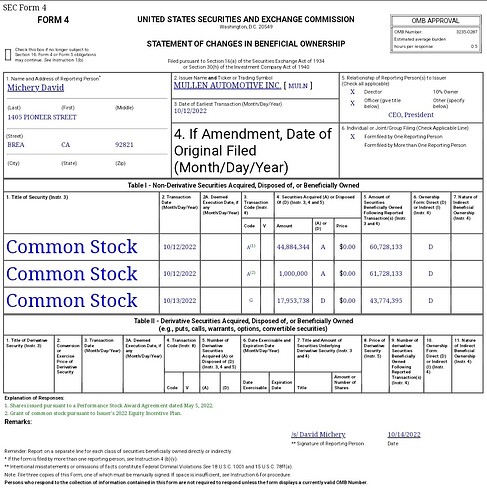

Here’s an 8-K from yesterday regarding Mullen aquiring Bollenger and the ELMS plant! David and some other executive got shares given to them for closing these deals like it was specified in the shares bonus programm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1499961/000110465922108851/tm2228242d1_8k.htm

Here’s the amount they got each

One would think we can expect more upward mouvement in the next weeks now that we have the ELMS plant and that these guys have all these shares lol. Will keep an eye on this!

For transparancy, I’ll detail back my position

@The_Ni @Shadowstars what yall think about this ?

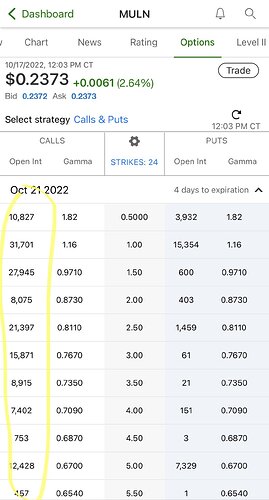

This calls for friday seems unusually loaded. I dont thinks it’s retail.