My ass grabbed calls last second yesterday tho…

Sven got me fucked top

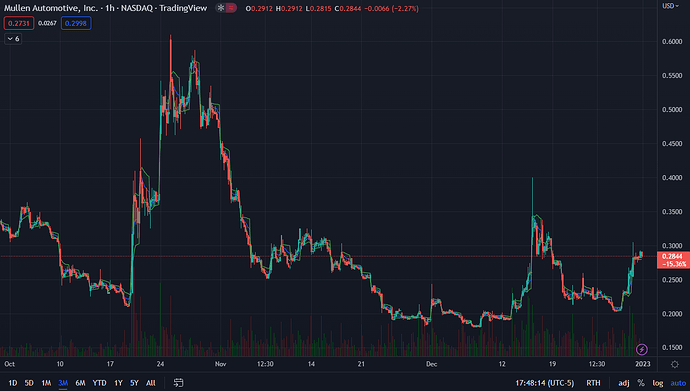

Something is afoot in the land of MULN.

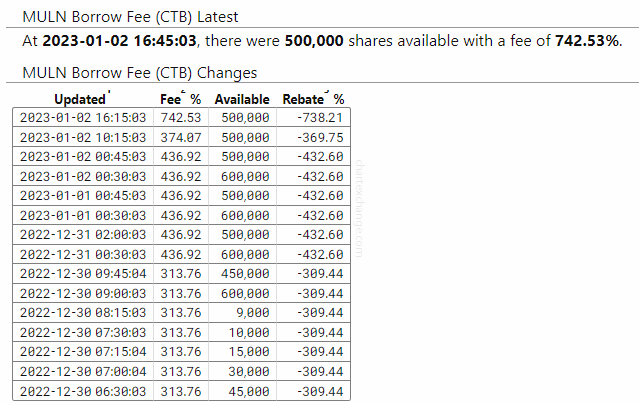

CTB is over 700% right now, spiking from single digits a few days ago.

This is surprising, as SI as % of FF was < 15% on Fri, and there’s a ton of shares floating. It’s particularly surprising as their earnings had to be delayed because they couldn’t figure out how to deal with warrants in the financials - an affliction we have seen with SPACS, which the SEC is coming down hard on. Not to mention, the vote that failed a week ago around RS and an increase in OS.

Muln is no stranger to pump-and-dumps, and there is nothing fundamentally redeeming about it, so it should mean revert.

It has liquid options, and the two catalysts coming up - Q3 filing within 2 weeks, and the RS/OS vote in 3 weeks. There should be movement tomorrow, and probably through this week.

Enjoy ![]()

MULN run streak continues!

MULN back over $0.40

@The_Ni new 10-K

I’m still going through the 10-K. Got distracted with the other two filings. Shared thoughts here, reproducing below:

The filings 14A and 8-K filings from today contain essentially the same information, and it’s troubling.

What happened, so we are all on the same page:

- Muln issued about 1.2B shares in the second half of 2022

- These were based on the authorization of 1.75B shares in July 2022; prior AS was 500M

- In Dec 2022, two class action lawsuits were filed, essentially claiming that the majority of shareholders did NOT vote for the increased authorization

- Muln has asked the Delaware Court of Chancery to validate their July action, including “in its discretion, to ratify and validate potentially defective acts”.

- The court has scheduled a hearing on this on Jan 23, 2023

This puts Muln in a pickle. A very big, bad, rancid pickle. Here’s why:

- They may not be able to move ahead with any of the Proposals in the Jan 19 meeting because the very Certificate of Amendment from July 22 that will be amended again is under scrutiny. So we could have another postponement.

- Muln did ask the court “in its discretion, to ratify and validate potentially defective acts”. This suggests they know there’s a chance they screwed up.

- The Delaware Court of Chancery does not f*ck around. They are pro-business, so Muln might have an edge, but it’s like getting caught with your cookie jar in a SDNY bodega.

- Jan 23 is a hearing only, not judgment day, so this might drag on for a bit.

- Until all this is sorted, Muln will very likely not be able to undertake issuance to raise money. We’ve estimated they are kinda out, after Elms and Bollinger, so they’re basically stuck in the water until they can vote for RS and/or increase in AS.

The best outcome for Muln is if the Court both: a) “forgives” them (as above), and b) throws out the class action lawsuit.

If it does not, though, there will be chaos. Muln has gone ahead and shit out all these 1.2B shares. There are warrants associated with them. The same warrants which are now holding up the 10-K. Until the Court rules, the accountants will not know how many warrants can actually exist, and so what to report on, how.

The insiders who were rug-pulling retail this entire year will also not be happy. Maybe a few figurative knee-caps will be disturbed, to boot. It’s not quite possible to rewind all the money that has gone out, not least because it’s all in illiquid Elms and Bollinger now, so unsure how this will resolve itself.

And I don’t even want to think about what would happen to everyone holding the 1.2B additional shares since July.

Silver lining… because SO much has happened since July, it is unlikely the Chancery Court will consider turning back the clock completely. Toothpaste-tube… and all. That could end up being the saving grace for Muln. And the Court acts fast - weeks, usually. A month or two, at worst. The judges are chosen because they are experts in business law, and they understand businesses need to go on.

What a clusterf*ck…

This, ladies and gents, is what finding out looks like after you’ve f*cked around a little too much.

The worst part is they’ve obviously given that audit company a kickback. There is no way they own that much intangible assets or can even prove that goodwill. That’s where they’re hiding the “unrecoverables” because in a bankruptcy proceeding they’ll do a full audit and valuation and find those numbers are drastically overstated. I just don’t know how tf they’re gonna get away with that (even tho it may just be how it plays out)

Assessment of 10-K: https://www.reddit.com/r/Muln/comments/10bbkq0/review_of_10k_grab_a_stiff_drink_before_diving_in/

I should really be getting paid by MULN fanbois for providing this rite of passage. ![]()

Review of 10-K. Grab a Stiff Drink Before Diving In.

![]()

I was meaning to do a detailed analysis of the 10-K, but it’ll take way too long. Sharing the parts that seemed most important to me. I’ll provide context, but leave you to draw your inferences.

As always, none of this should be construed as financial advice. It’s simply the opinion of someone who has reviewed financials of companies for decades, made investment decisions, and seen a fair few through good times and bad. (That someone is me, just to be clear.)

Note that the 10-K is audited by an actual accounting firm. So this is the closest thing we will get to a “fair and balanced” version of the company.

Brass Tacks - $780M Loss

The Income Statement is a bit surreal. Because they had $0 in Revenue, and also $0 in Cost of Goods Sold, it looks a little weird.

Then there’s the $780M loss to shareholders. Compared to $44M last year.

$607M of that has to do with warrant-related accounting, and we’ve spent a ton of time on warrants in this sub already, so skipping this. Also because this is an accounting treatment, and while “real,” detracts from some of the more material things.

That leaves $133M in losses. Note this is before ELMS and Bollinger - the latter deal was closed, but no actual activity happened before Sep 30. This includes:

- $21.6M in R&D on the Mullen Five

- $75.3M in G&A, more than half of which went to consultants

- $27M in interest expenses

This does not include the $40M that were still paid to Preferred holders (the insider “investors”).

With just the M5 to show for it, do these numbers make sense to you?

If Muln is already spending 21M in “R&D” and 75M in G&A without Elms and Bollinger, where will these numbers end up this year?

What has Muln done in the last year to justify a $780M loss?

2,890 Mullen Five Reservations

Simply calculated from the Restricted Cash section:

Very close to r/Kendalf’s prediction of 2,800.

CEO Compensation

If there is one person who made out very well, it is, of course, DM. Salary of $750K, stock awards of $6.4M.

The kick in shareholder nuts is in the awards. 108M shares were minted and handed to DM, worth $30M. Note that these “performance” awards:

- did not come against $1 in revenue or 1 production vehicle on the road

- included KPIs like sticking a glorified water bottle in vans

- were highly dilutive to shareholders

Do we think $30M worth of stock awards is justified given a $780M loss, and no vehicles or $$$ to show for it either?

Funny Assets

Almost two-thirds of the “Assets” are composed of “Intangible assets” and “Goodwill”.

The breakdown of Intangible Assets is as follows - the IP and Patents come from Bollinger:

The entirety of Goodwill was transferred from Bollinger.

Ladies and gents, almost $190M of “Assets” are either Intangible, or connected with your feels. (Ok I kid a bit about “feels”, but Goodwill isn’t that far off in this case - this isn’t Coke or Nike.)

2/3 of the Assets of a company that has roughly zero track record of doing anything is locked up in things you can’t touch or feel. Since we’re talking about feelings, how real does this $190M feel to you?

Risks

A few additional risks were noted in the 2022 10-K, which were not in the 2021 one from a year ago.

- We will require substantial additional financing to effectuate our business plan;

- Our stockholders are subject to significant dilution upon the occurrence of certain events which could result in a decrease in our stock price.

- Our commitments to issue shares of Common Stock or securities that are convertible into shares of Common Stock may cause significant dilution to stock holders;

- Our commitment to issue shares of Common Stock pursuant to the terms of the Notes, our preferred stock and the Warrants could encourage short sales by third parties which could contribute to the future decline of stock price;

- We may not be able to maintain compliance with continued listing requirements of the NASDAQ Capital Market;

- The priority of the holders of our debt and preferred stock over the holders of our common stock in the event of liquidation, dissolution or winding up; (“preferred stock” part is new)

Additional risk noted in the “Risks Related to Mullen’s Capital Requirements and Financial Condition” section:

- We may have insufficient authorized and reserved shares.

Additional risk noted in the “Risks Related to Mullen’s Business and Operations” section:

- The concentrated voting control of David Michery, Mullen’s founder; potential conflicts of interest;

Parting Thoughts

There are some other threads to pull on, such as the 9 items of litigation (not including the 2 that are holdings thing up at the Chancery Court), warrant restatements, and IRS liabilities and associated liens, but I’ve written enough. I may add more later, after a break.

I look forward to your observations and feedback.

Finally, my thoughts and prayers for those whose optimism and trust keeps them supporting a company that puts most Chinese P&Ds to shame in terms of greed, incompetence and shamelessness.

Not sure why I get so much joy in analyzing this turd. Perhaps it is the same reason that some people like a slow motion train crash.

https://www.reddit.com/r/Muln/comments/10dx9qu/post_10k_analysis_how_smart_money_is_likely/

The 10-K finally dropped, and it was a bigger dumpster fire than I was expecting. This, on top of storm clouds already brewing. I’ll share some thoughts on what could come next … but first, a thanks.

Yay, Us!

Big props to this community for having an engaging, informative discussion over the long weekend. I kept an eye out on Fintwit and a few other places that are generally accessible, and they don’t hold a candle to this place. Special thanks to /u/Kendalf and newcomer /u/TradeGopher for keeping things real. Apologies to everyone whose feelings were hurt, and doubly so because I’m about to do it again. To everyone asking real questions, please continue doing so! It only makes this place so much better.

For anyone just catching up, or lost in the deluge of posts, you can start with this one that explains how the giant hole in the financials came about (h/t Kendalf), and this one that highlights the key items of interest (imho).

Aight, buckle up - we’re diving in.

Things that may go bump in the night

There is a version of Muln that is doing very well in 2024 and beyond. It is pumping out the vans in volume that generates revenue, and selling some M5s for pride. To get there though, it must pass through the valley of death.

I fear we are looking to a chasm, especially after the release of the 10-K.

I want to put the following items on your radar because you should know how “smart money” will assess things. It is a snapshot of all the risks that are facing Muln at the moment. You choose what to do with this information.

Institutions will have a negative visceral reaction to the 10-K. You don’t get to restate earnings and take a (780M) write-down, along with a (390M) adjustment to prior 10-Qs, and not look completely daft. Especially when you have 0 in revenue. This is quite unprecedented in the startup world. It demonstrates enormous lapses in internal controls, and is doubly damning because predatory issuance in favor of preferred shareholders caused it. Remember, retail got screwed, but so did the tutes - and you can rest assured their reaction will not be, “oh let’s hodl because ‘Marion’ or ‘Newgate’”.

Moreover, you have what looks like a vastly inflated valuation of Bollinger, with 93M in goodwill and 93M in intangible assets booked against 5M in assets. There is no justification provided other than some vague technical hand-waving. And then you have the 108M shares as performance awards to DM worth $30M, against $0 in revenue and 0 vehicles in production. This clusterf*ck of a 10-K casts doubt on any future un-audited submissions too.

All in, this 10-K is likely a massive red flag to any serious investor.

(H/t to Kendalf for flagging this early on.)

Muln can’t raise money at the moment. It seems stuck. Both Proposals 2 and 4 very likely got shut down by shareholders (explanation here), and now they have two class action lawsuits that are questioning the legality of the previous increase of AS from 500M to 1.75B in July. (Details here.) Muln has asked for relief and there is a hearing on Jan 23 - a week from now. For what it is worth, I think Muln will eke out a win here as the Chancery Court is unlikely to attempt to put toothpaste back in the tube. But … if they don’t get a win there, then expect all hell to break loose.

Even if the Court provides them with relief, they still have to figure out how to get RS done, or AS increased, to raise any more money. By my estimates, they have spent what they had raised from the SPA on ELMS. No Props 2 or 4, no money. And Muln is basically dead in the water.

This would be a darn good time for Muln to apologize to retail who have been extremely loyal to the company, and do a deal - allow one of the Props to pass, and in return they do a direct market issuance. That benefits retail instead of the insiders. Too much to hope for?

That CTB spike to 700%+ and shortage of shares to borrow for a few days… We have no way of knowing-knowing if shorts loaded up because information got leaked, but the timing looks awfully sus, doesn’t it. “Someone always knows something.” If there was a leak - and smart money will find out - it will also point to a lack of internal controls.

Finally… and I kept the best for last … the 10-K vastly increases the possibility that Muln might not remain a going concern for long. I.e. they might be bankrupt within a year. To be fair, the auditors made sure the 10-K said this too (“There is substantial doubt about our ability to continue as a going concern.” - page 24.) Let me tell you possibly why.

Their paid-up capital is about 950M. They have booked (890M) in accumulated losses so far, leaving them a very tiny sliver to play with. What is propping up the balance sheet are two fugazi items - 93M in intangible assets, and 93M in goodwill. These are from Bollinger, which Muln valued at 248M and paid 148M for 60% of, even though they only ever had 5M in assets. (lol…) If there is ever a need to take a markdown on this - and there will be if they ever have to deal with serious people - equity will melt in a hurry.

Moreover, there is the warrant liabilities of 85M. This is marked to market as of now, because they did not have enough shares to issue commons against them. If they have to be repriced if share prices drop more (resulting in increase of multiplier), this swells the liability side, which eats away at equity too. Not even going to get into what happens with a new SPA.

And when equity goes negative … it’s lights out.

There are other concerns too. The extreme degree of incompetence and inefficiencies demonstrated through the 10-K will likely draw a new set of lawsuits. Sure, we’re a litigious society, but it doesn’t help that if the lawsuits have merit. E.g. Ram Hari Khadka v. Mullen Automotive, Inc. To anyone waiting for “good news,” the I-Go seems to be lost somewhere in Europe. Perhaps going the same way Delpack did, and F500 before it. But let me not delve too much into these - the other issues are more serious.

Parting Words

To summarize:

- The 10-K will likely torpedo the confidence institutional investors have in Muln

- Muln can’t raise money in the immediate future - it is kinda stuck

- The balance sheet leaves very little room for error before Muln careens into bankruptcy

Not going to sugar coat it - it doesn’t look good.

As always:

- This is my opinion only, and I’d welcome any feedback.

- Any errors are my own, and you are welcome to correct them.

- I have used publicly available sources only, so might be missing crucial information that invalidates some of these observations.

- None of this is financial advice - just opinion. Do yer dang DD, make your own decisions.

Apologies in advance for any hurt feelings!

Good luck to all.

MULN is likely a dead company walking.

They seem to have done some funny accounting with Bollinger, where about $75M in cash that was paid for the company was also used to inflate the value of the company by that amount. Detailed discussions here.

https://www.reddit.com/r/Muln/comments/10dy4yu/where_did_bollinger_get_75m_in_cash_before_being/

The fun begins when you take out that $75M from both sides of the purchase consideration, assuming that Bollinger didn’t suddenly find a long lost uncle willing to inject that much capital into a business that was winding down, in the 2 months between financial statements.

Muln ends up paying 73.5M for 60% of an effectively bankrupt Bollinger with negative 11.6M in “stuff”.

This gives Goodwill+Intangibles of 134M.

Using this in Muln’s financials gives them stockholder equity of 108M.

108M is less than 134M. Depending on how much of that Goodwill+Intangibles we think is bullshit, Muln could be at negative equity already.

Yes, the B-word. And we haven’t even looked at what happens if warrant liabilities increase.

Bodes well for the April puts I got. ![]()

Looks like Bloomberg picked up some of the stuff @Kendalf and I have been harping on: Meme Stock Mullen Is Drowning Its Investors in Shares

"Retail investor enthusiasm for the clean energy revolution is admirable, and the quality of Redditors’ research into early-stage companies like Mullen is often impressive. "

Quite amusing, and a nice f*ck you to rags like Investor Place and EvEdition.

Did the server get DDOS?

Appropriate thread ![]()

@Conqueror am I crazy or…

MULN weekly pump up 16% dont know whats going on

Index correlation makes memes spike generally.

yeah been working all day just noticed SPY green and pretty much everything today