Just start an ongoing thread. Main purpose is to have articles that help explain certain concepts or just provide insight into current market conditions. I just love reading so I’ll just start dumping articles here whenever I feel they’re insightful or I learned something.

https://www.marketwatch.com/story/the-next-financial-crisis-may-already-be-brewing-but-not-where-investors-might-expect-11663170963?link=sfmw_fb&fbclid=IwAR3KnLfKhJh2j1nKcyXGDSfc7pwnphhotZ6JNTwUbEXJptqglhytVwsNKLg&mibextid=li3ck7

Actually I saw this the other day and thought of you.

https://twitter.com/BrianFeroldi/status/1566382865503453185?t=UlmJ4oM2LCvJS5Pee9MTWg&s=19

Lmaooooooooooo learning how to hide shit on balance sheets was the best after lesson class my accounting professor ever gave me

Dropping this here so I can finish watching myself after this David Bowie movie at IMAX - YouTube

So far gonna take notes for my own reference later:

S&P (or the DOW or Russel was hard to follow) being at the 17 multiple is lower than the 5 year average of 18.5. But at the 3900 we’re at the “safe base” we grew up with hide and seek and kick the can. We’re just waiting to see if the Fed is going to continue kicking the can however instead of calling it a day on interest rates for a little bit.

They mentioned multiple people saying that it would make mores sense for the Fed to do a 0.25 rate hike since all the market data is rolling over instead of really trying to force it down. But it’s going to be very telling of where the market will go more so on the Fed’s outlook on interest rates.

Did really like the bit about the inflation rate we shoot for should be a variable range (not a massive one) but to at least allow for a moving target as the market grows and allow for more respect to the fact that the treasury bond yield are considered the risk-free rate of return GLOBALY. so while we may see some immediate benefits from fighting inflation at home we could see blowblack from effects on global markets

Lmao they got to housing as well.

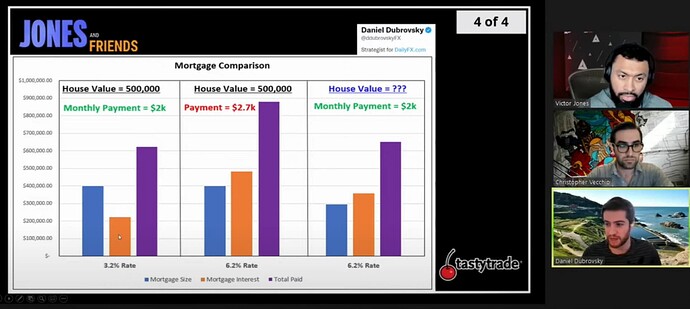

Gonna end this post here. Try to figure out the house value on the right. First winner gets some sloppy toppy (legends and gods not allowed. I know yall can do the reading and maffs)

$370,370.37?

$326,500

hold up, not enough info… down-payment?

other wise 400k

375000

305k but assuming $0 down payment

You got some sloppy toppy

The math doesn’t add up for me on the first two examples. It’s clear the mortgage amount is $400k in each, but assuming 20% down from the $500k purchase price, the monthly payment would be $1729.82 for the first rather than $2k, and $2449.88 rather than $2700, but the interest amount looks correct for both.

Monthly payment is with no money down I believe. Not positive. But feel free to check the math on it. The main point is around the cost of the home on the right tho