Hold up. PUTS might actually be the play. Someone in the Discord fortunately pointed out the Temporary, Limited Trading Window for Restricted Shares taking place from November 30 to December 17. Source

Currently, approximately 365 million of the Company’s outstanding common shares remain subject to various transfer restrictions contained in Newegg’s Amended and Restated Shareholders Agreement dated October 23, 2020 (the “Shareholders Agreement”) or its 2005 Incentive Award Plan. In addition, all of the shares issuable under the 2005 Incentive Award Plan and the 2021 Equity Incentive Plan are also subject to various transfer restrictions set forth in those plans.

Over the next three weeks, beginning Tuesday, November 30, 2021 and ending Friday, December 17, 2021, inclusive of those dates (the “Trading Window”), the Company will allow a strictly controlled, temporary waiver of these transfer restrictions to enable limited trading of common shares by its employees, former employees, officers, directors, and stockholders who received restricted common shares of the Company as part of the merger between Newegg Inc. and Lianluo Smart Limited (the Company’s predecessor). Each such employee, former employee, officer, director, or stockholder, together with their respective affiliates, is referred to below as a “Restricted Holders.”

As of November 26, 2021, there were approximately 96 Restricted Holders, who will be limited to selling an aggregate of 1,575,463 shares during the Trading Window. The two largest Restricted Holders, Hangzhou Liaison Interactive Information Technology Co., Ltd., and Mr. Fred Faching Chang, will be limited to selling 408,750 and 245,250 shares, respectively, with daily sales limits of not more than the lesser of 5% of daily volume or 27,250 for Hangzhou Liaison Interactive Information Technology Co., Ltd., and the lesser of 3% of daily volume or 16,350 for Mr. Fred Faching Chang during the Trading Window. All other Restricted Holders will be limited to selling 921,463 shares in total, with daily sales limits from zero to 5,500 common shares per Restricted Holder per trading day, during the Trading Window. Newegg may decide to further limit, but not expand, the volume limitations imposed on such Restricted Holders in its sole discretion during the Trading Window based on prevailing market conditions and other factors. No sales would be allowed by the Restricted Holders when the NASDAQ stock market is closed ( i.e., in after-hours trading). Based on recent historical trading volumes, the Company expects that aggregate sales by the Restricted Holders could comprise a material portion of the trading volume during the Trading Window; however, the actual number of common shares offered for sale by Restricted Holders is subject to their own discretion, within the limits described above, and could vary from the Company’s expectations.

The Trading Window provides Restricted Holders with the opportunity to obtain some liquidity for their common shares and vested stock options, while also gradually increasing the size of the public float for Newegg common shares.

So basically there are 96 unique Restricted Holders who will be permitted to unload a limited number of shares onto the float from November 30 to December 17.

Each Holder is limited to max 5,500 shares per day, with the two largest holders limited to 27,250 and 16,350 shares per day. This equates to ((94 x 5,500) + 27,250 + 16,350) = 560,600 shares per day, maximum, if everyone maximizes their selling every day during the Trading Window.

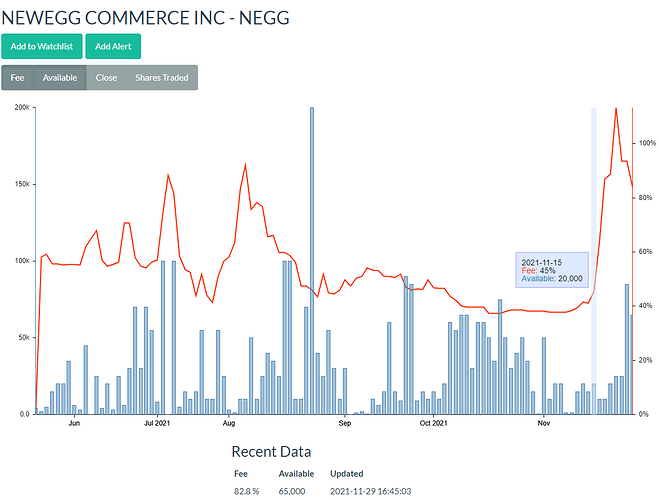

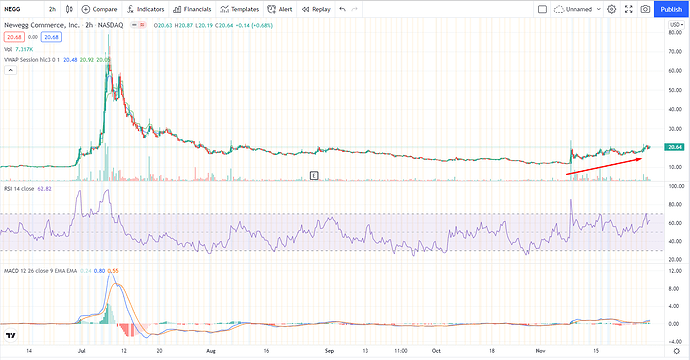

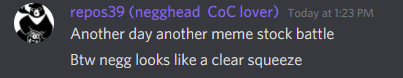

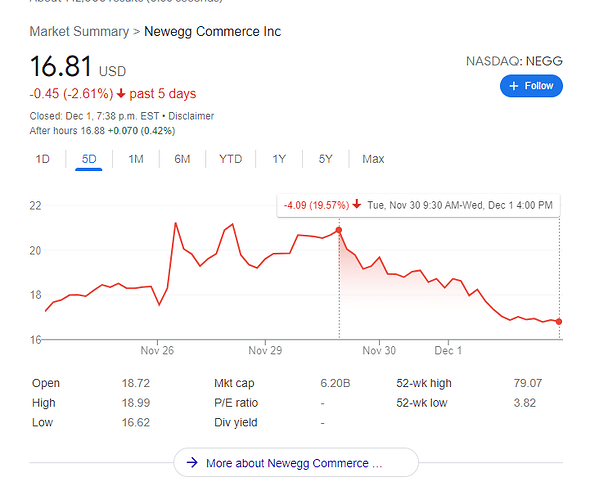

Looks like these days NEGG usually sees a trading of volume of around 500,000 to 2,500,000 per day. Volume

This selling pressure could be enough to break momentum.

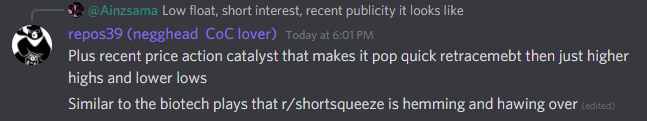

We have one other example of this Trading Window that was opened by NEGG from September 14 to September 24 with similar selling restrictions totalling also around 1.5M shares. Source

Here is what September 14 to 24 looked like in the screenshot below. It looks like NEGG was actually starting to bottom out and reverse but the reversal may have actually been ruined by the Trading Window (either by the insiders selling or by the market perceiving the insiders as selling — more on this at the end of this post). NEGG fell from around $18 to $14.50 in the last trading window. Maybe puts are actually the play until December 17? Or just abstain from any position and find a different play.

Volume from Sept 14 to 24 did appear to be on average higher than their surrounding days:

One thing that I am confused about is that in both Press Releases about the Trading Window, it notes the same number of outstanding shares that remain subject to various transfer restrictions. When I read this statement, intuitively this sounds like nobody sold at the last window. But this seems wrong because why wouldn’t anyone sell a single share? Seems strange.

In the September 13 article:

Currently, approximately 364.7 million of the Company’s outstanding common shares remain subject to various transfer restrictions contained in Newegg’s Amended and Restated Shareholders Agreement dated October 23, 2020 (the “Shareholders Agreement”), the Award Plan, certain standalone lockup agreements entered into with the Company and/or the Company’s insider trading policy. In addition, all of the shares issuable under the Award Plan described above are also subject to various transfer restrictions set forth in the Award Plan, the Shareholders Agreement and/or Newegg’s insider trading policy.

In the November 29 article:

Currently, approximately 365 million of the Company’s outstanding common shares remain subject to various transfer restrictions contained in Newegg’s Amended and Restated Shareholders Agreement dated October 23, 2020 (the “Shareholders Agreement”) or its 2005 Incentive Award Plan. In addition, all of the shares issuable under the 2005 Incentive Award Plan and the 2021 Equity Incentive Plan are also subject to various transfer restrictions set forth in those plans.

However, in the previous window there were 125 Restricted Holders as of August 31, and now there are 96 Restricted Holders as of November 26. But the same number of shares outstanding subject to the transfer restrictions? It’s like some Restricted Holders sold their shares to other Restricted Holders. Can someone else make sense of this?