Disclaimer first: I am retarded. Am not a financial advisor.

What do they do? Streaming service

How do they make money? Time based subscription

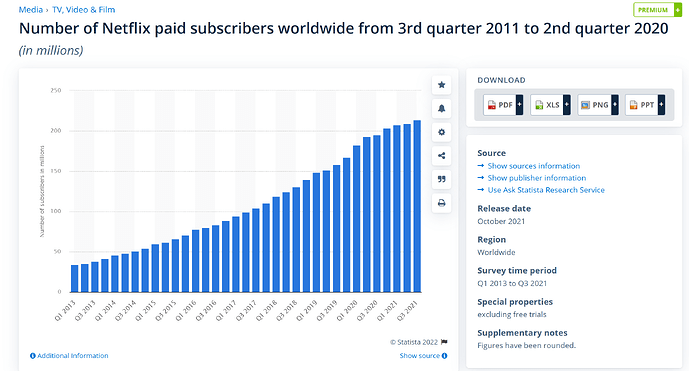

Why are they important? The first big stream based provider with largest user base (+200m)

What are their products? Select choice of digital media old and new, originals and exclusives

Pro’s:

Strengths? The first to market advantage, +200m subscribers and growing

STATISTA.

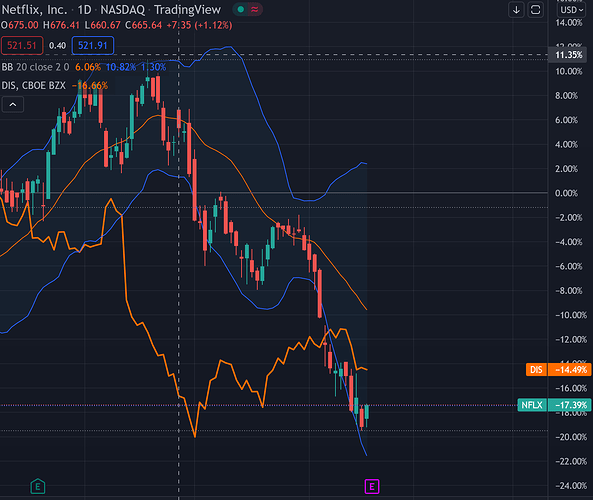

Moat? Better subscriber growth than Disney. Disney makes the trend clear: Growth is slowing for streaming services

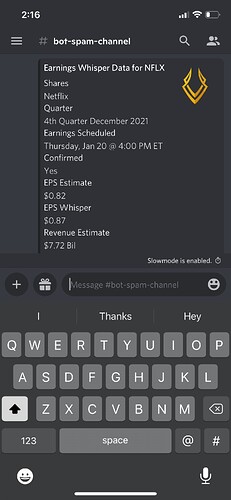

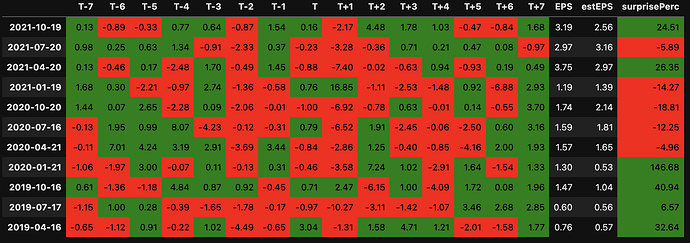

Much better profit per share (3.19 vs 0.09 DIS)

Valuation: EV/EBITDA

NFLX - 15.10

DIS - 34.63

Advantages?

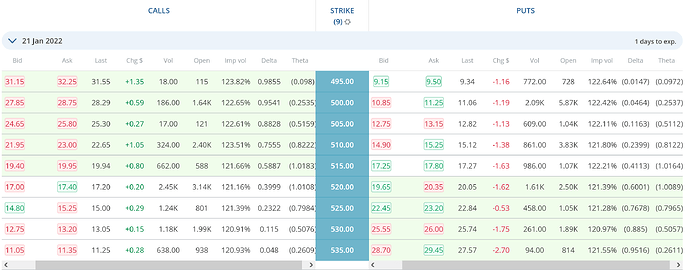

Opportunities? Netflix is currently at a bottom of a swing since the last ER. It seems a lot of hopium died down after the push to $700. This could be a very good opportunity for a value play catalyzed by earnings.

Growth?

" Netflix’s North American subscriber base is over 73 million (Netflix, 2021). The streaming giant managed to bring in 37 million new memberships in 2020 despite facing more competition. Thanks to its string of top-shelf programs like Queen’s Gambit and Emily in Paris , it received 8.2 million new subscribers in the fourth quarter of 2020 to bring its subscriber count to over 200 million, fending off competitors like Disney Plus and HBO Max."

Likely to go over 210m next quarter.

Catalysts? Value-play / Earnings

Con’s:

Downside?

Netflix raised monthly subscription price.

"The standard plan — which allows for two streams at the same time and HD streaming — went up from $13.99 to $15.49 per month in the United States.

The price of Netflix’s premium plan, which allows for four streams at a time and streaming in ultra HD, was increased from $17.99 to $19.99 per month."

This will likely put a downward pressure on number of subscribers. Netflix may be confident that raising price will still retain subscribers and raise the profits.

Negatives? TBA

Concerns? TBA

Weaknesses? TBA

Threats? TBA (worth mentioning NFLX has many competitors)

Risks? TBA

I welcome any bull/bear case from others to add onto this earnings DD.

As always, this isn’t financial advice, play at your own risk.