Hello Everyone.

I have been following and investing in NIO for about a year and a half now. It’s no secret that NIO has been underperforming compared to it’s American and Chinese Counterparts in Tesla, Lucid, and XPeng to name a few.

I am anticipating a run-up on NIO’s share price until NIO Day which is scheduled for December 18, 2021 in Suzhou, China at the Suzhou Olympics Sports Centre.

Here are some of the scheduled highlights that are anticipated for NIO Day:

https://electricvehicleweb.com/nio-day-2021-updates/

Announcement of New Models

May Unveil 3 new vehicle models -

-

EC - a new luxury multipurpose minivan

-

ES - (ET5) - a 2nd generation sedan to compete with Tesla Model 3, BMW 3 Series I3 models, and the XPeng P5, and Audi models. This will fall in line with Nio’s flagship model - the ET7 which is priced at $69,000 USD. However, the ET5 model is anticipated to be an entry-level model that will be priced b/w 300,000 and 400,000 yuan (46,934 - 62,579 USD).

-

EF9 - possible announcement of a rumored new-model luxury sporrscar. Nio had filed patent for design of the convertible version of it’s EP9 model. It is rumored that the Ef9 may sport ultra-high density solid-state batteries which was announced on Nio Day 2020, compatible with NIO’s battery swap technology.

-

ET7 - this is key, the ET7 is NIO’s flagship luxury sedan model w/ 1000km range. And will be expected to give an update on it’s deliveries schedule

Entry to New Markets

Furthermore, it is anticipated that Nio may announce entry into German Markets, which will begin to ramp up production in 2022.

Previously this past year NIO has built new production facilities in Norway and has ramped production of it’s ES8 model. NIO is also scheduled to get 20 Power Swap Stations done in by Q4 2022. The ET7 model is also scheduled to fill orders in Norway by early 2022. Along with Germany, there may be more news on expansion to Europe.

More Nio Day 2020 Updates

Be prepared for Nio to announce ramping up production of all it’s vehicles in 2022 as well. I anticipate there to be more news about it’s Power Swap Stations and 150 kWh Solid-State Battery.

On NIO day 2020, we saw news of the 50KW/H SOLID STATE BATTERY which

IMPROVES ENERGY DENSITY BY 50%.

360 Wh/kg. ES8 850KM ,

ES6 900KM AND EC6 90KM RANGE. NEW MODEL (SEDAN WILL HAVE 1000KM+ RANGE).

STARTS DELIVERY Q4 NEXT YEAR.

And more importantly updates to the scheduled flagship ET7 deliveries in Q1 2022.

My Positions and anticipation for NIO Day + Long Term Plans

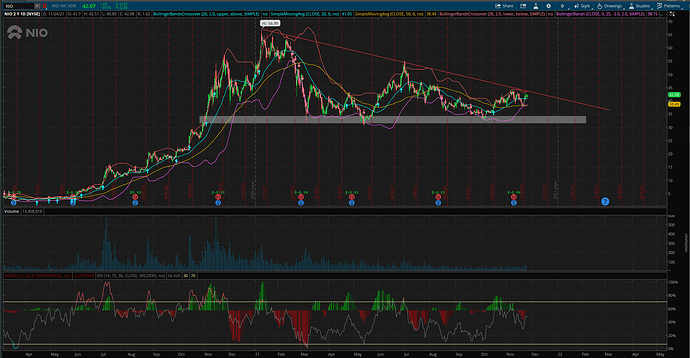

Right now, NIO is trading at $42.04 as of AH 5:00pm on November 23. I expect there to be a run-up to $50 and possibly pass through end of november to December 18th on Nio Day. I expect NIO Day to bring positive sentiment, which historically has boosted the stock price further. I currently have 500 shares(which I don’t plan on selling until nio hits 3-digits) and 2 Nio $50 C Jun 17’ 2022. I also hold a few Jan 19, 2024 calls as well. I have previously just sold my previous calls which I purchased back in September and October for significant profit. I am hoping there is a pullback to below $40 dollars where I will purchase more Jun 17 2022 to be safe. However, if this does not happen then I will probably just buy additional calls leading up to december 18 Nio Day.

I also hold calls on Xpeng and Li Auto, which are 2 other massive EV companies in China. (The CEO’s of NIO, XPeng, and Li Auto) are actually all rivals, and friends who have invested in each other’s EV’s as well. I have noticed that significant price movements in these companies have also driven the each other’s prices up and down as well.

I would sell after Nio Day as I anticipate there will be a massive selloff in the days following NIO Day.

As far as NIO as a company long term, holding long term shares + LEAPS is my plan, I expect NIO to really become prevalent in by 2024 and 2025. I am betting on this company long term and will stick it out. I am confident that the stock will moon when it eventually expands to north american markets + makes a profit, which wont happen in 2021 or 2022. But by 2024 I expect NIO to hit 3 digits. Nio also has significant support from the chinese government, which has injected them with money during the pandemic.

Nio also has price targets significantly higher than it’s current share price.

Edison Yu (Deutsche Bank) - price target increased from $60 → $70.

Nick Lai (JP Morgan) - price target → $70

Bin Wang (Credit Suisse) - price target → $71

Jeff Chung (Citibank) - price target → $87

Ming-Hsun Lee (Bank of America) - price target → 65

Fei Fang (Goldman Sachs) - price target → $56

I also have tremendous confidence in NIO’s CEO, William Bin Li, whom is often considered to be a more-humble Elon-like figure. NIO has also experienced significant pullbacks and drought over the past year. However, this stock just wont go below $30.

This is my first ever DD, so let me know if there’s anything I can improve on in future DD’s. Cheers everyone.