Hello friends,

I’ll keep this short because Nike earnings is right after close this very day.

Thesis + Bear Case

Most retailers have been hit very hard because of supply chain issues this past fall. Nike competitor Adidas missed earnings by 50% and stock dropped about 6% the next morning. NKE has also been hit hard by supply chain issues which have only gotten worse and are set to progress further into 2022. After last earnings, where we saw an eps beat but revenue was down by 223 million dollars, a huge selloff also occured dropping the ticker almost 7%. Eps is lowered heavily for this earnings, from 1.12 to .63, so we could see a selloff if beats earnings anyway because of revenue factor. Also, with the rising cost of… well… everything, Americans (Nike’s CORE market!) are not splurging on high end shoes or retail for Christmas this year. Lastly, for the fall season we saw nearly no insider buying and mostly selling, further strengthening the bear case.

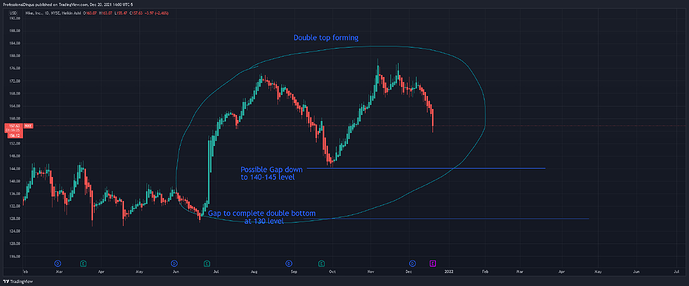

Charting

These will be pretty crude, time constraints

Nike is currently bear-flagging

Gaps to fill

*Text should say “Gap to complete double TOP” my bad on that

Current positions:

none

Thanks for reading this, if you have any suggestions please let me know! Also please note that I am not a financial advisor and this is not financial advice.

!Please take extreme caution with ER plays because they are often a complete gamble!

Put holders! IV is very high for this earnings so watch out for IV crush and watch your breakeven