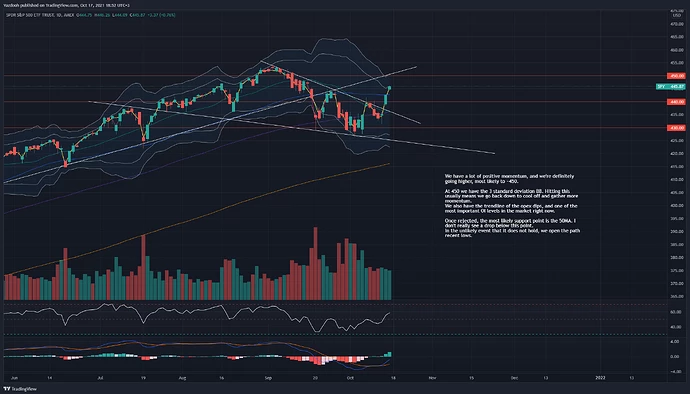

I'm eager for trading next week now that we have removed the gamma pins from the market. Meaning... We should see some more volatility to capitalize on trades at the top of next week. We're in bull mode, but I'm getting a bit carried away. We'll probably go to 450 and then go back down for more consolidation.*

I hope you all enjoyed your weekend and did something that makes future you happy… Please use your free time wisely, don’t waste it! I will see you all bright and early Monday.

#Trading Week 10/11/2021 Market Recap: #Key Points, Week Recap, Macro Context & Random Thoughts

* Earnings could decide the fate of the mid-October market rally, as dozens of companies report in the week ahead.

*Some analysts believe this October could be less volatile than expected

*Upcoming week filled with high-profile earnings releases

*Tesla shares currently behaving like traditional, value stock automobile companies

* Traders will have a better idea once we get through all these earnings reports coming up next week,” said one strategist. “That’s going to be the big tell. So far the initial reactions haven’t been too bad, especially given all the concerns people have had over the headwinds.

* The companies reporting range from Tesla and Netflix to blue chips Procter & Gamble, Johnson & Johnson, American Express, Intel and Honeywell.

* For the 26 S&P 500 members that have reported Q3 results through Wednesday, October 13th, total earnings and revenues are up +32.6% and +17.6%, respectively from the same period last year, with 80.8% beating EPS estimates and 65.4% beating revenue estimates. The proportion of these 26 index members beating both EPS and revenue estimates is 53.8%.

* This is a solid start to the Q3 earnings season, with the EPS beats percentage tracking in-line with historical trends while a relatively smaller proportion of the companies have been able to beat revenue estimates.

* Looking at Q3 as a whole, total S&P 500 earnings are expected to be up +27.0% from the same period last year on +14.0% higher revenues. This would follow the +95.0% earnings growth on +25.3% higher revenues in Q2.

* Rising cost pressures amid supply-chain disruptions and labor/material shortages will keep the spotlight on margins, which are expected to be up year-over-year as well as sequentially in Q3. The margins trajectory over the coming periods is a key source of uncertainty in the earnings outlook given the lack of visibility with respect to the duration of inflationary pressures.

* Looking at the calendar-year picture for the S&P 500 index, earnings are projected to climb +42.8% on +13.5% higher revenues in 2021 and increase +9.4% on +6.6% higher revenues in 2022. This would follow the -13.0% earnings decline on -1.7% lower revenues in 2020.

* For the small-cap S&P 600 index, total Q3 earnings are expected to be up +43.5% on +15.6% higher revenues, which would follow the +281.5% earnings growth on +34.5% higher revenues in 2021 Q2.

* The implied ‘EPS’ for the S&P 500 index, calculated using the current 2021 P/E of 22.5X and index close, as of October 12th, is $193.70, up from $135.66 in 2020. Using the same methodology, the index ‘EPS’ works out to $211.92 for 2022 (P/E of 20.5X) and $233.23 in 2023 (P/E of 18.7X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

Global stocks rally as US earnings push back stagflation concerns

Q3 earnings season has just begun. So far, 38 (8%) of the companies in the S&P 500 have already reported Q3 results.

From a growth standpoint, Q3 earnings are +38.5% y/o/y so far versus the +29.6% estimate when the quarter ended. Q3 revenue is +12.4% y/o/y versus the +14.9% estimate when the quarter ended. This compares to +92.0% and +25.3% respectively in all of Q2. This week, 20 S&P 500 companies reported earnings and 18 of them beat expectations.

> Overall Global Markets have been able to shake off early selling pressure and have mostly positive risk tone during last Trading Week. With the help of better than expected earnings from Charles Schwab and Goldman Sachs, the market has a more risk-reward appetites. Bitcoin climbed past $60,000 which also gave a boost to the global market risk sentiment. US equity markets were bale to build an early strength and extended the recovery move while holding moderate gains.

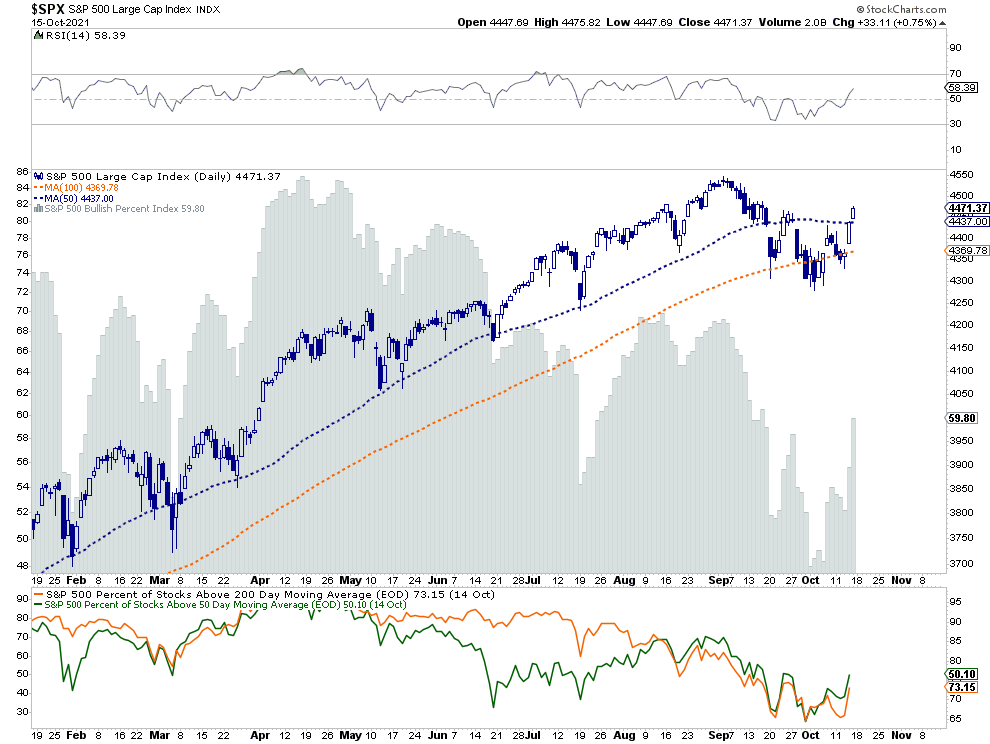

Correction Is Over For Now

~After nearly a month of selling pressure, the rally over the last couple of days came on cue and supported the recommendation to increase exposure to equities.

Two factors are driving the rebound. Earnings, so far, are coming in above estimates. Such isn’t surprising as analysts suppressed estimates going into reporting season. Secondly, bond yields declined.

Most companies haven’t reported earnings yet, and macroeconomic challenges still exist. So far, large banks beat estimates on reduced loan loss reserves, but they don’t deal with supply-chain limitations. We are about to see earnings from companies directly impacted by, and don’t benefit from, higher inflation, labor costs, and supply line disruptions.

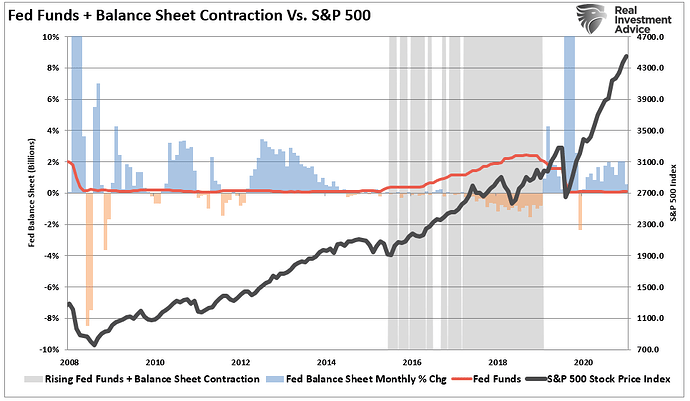

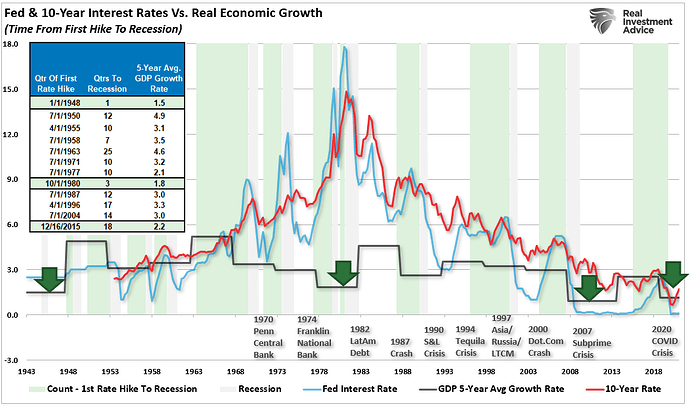

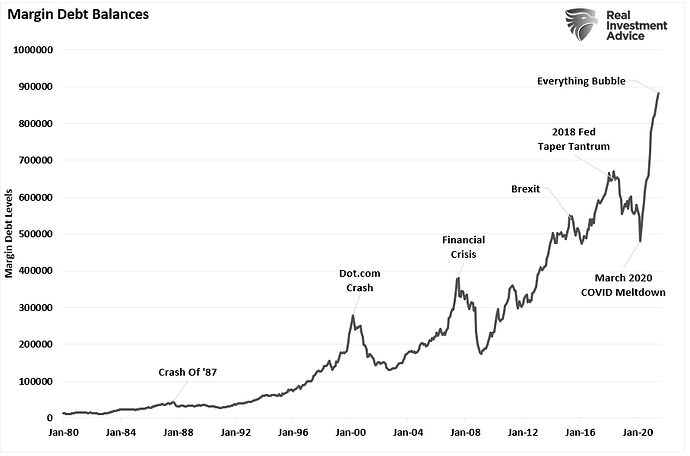

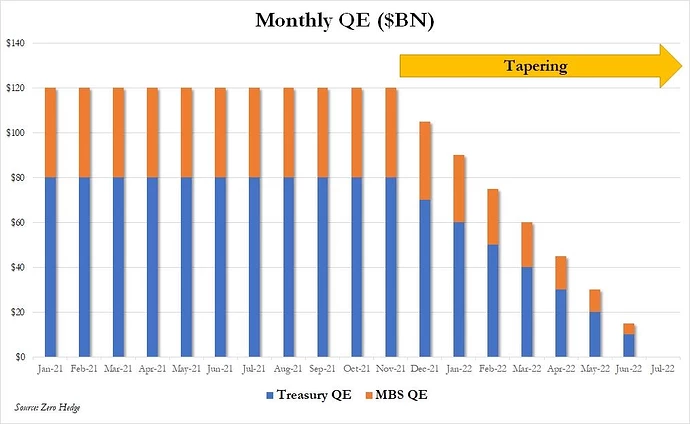

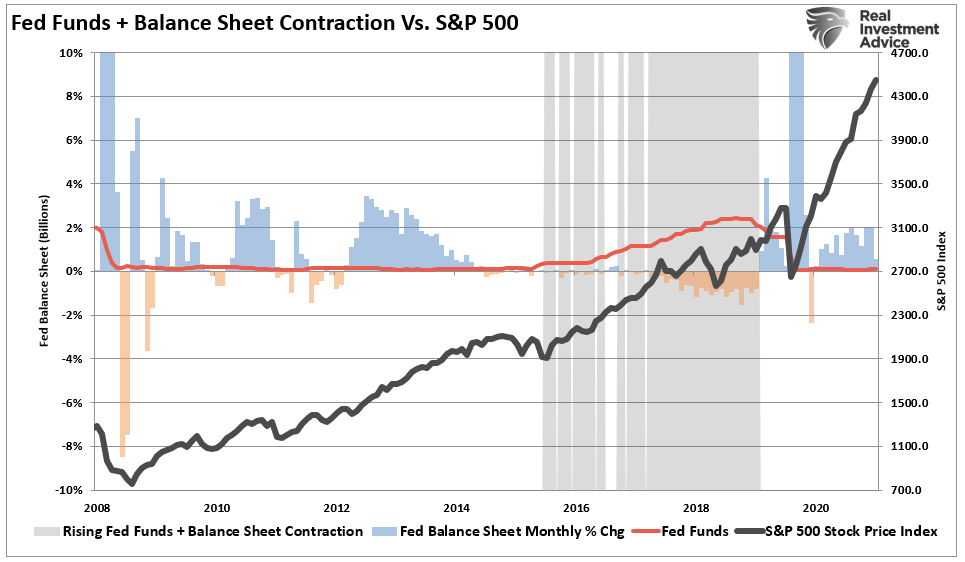

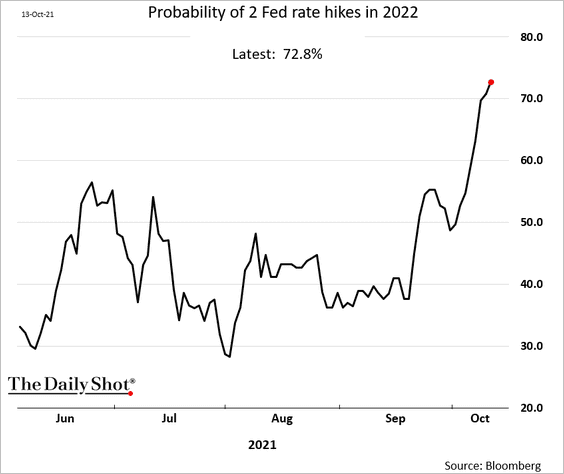

~Technically, If the current rally is going to push back to all-time highs, the market’s underlying strength must begin to improve markedly over the next couple of weeks. Bull markets lure investors into believing ‘this time is different.’ When the topping process begins, that slow, arduous affair gets met with continued reasons why the ‘bull market will continue.’ The problem comes when it eventually doesn’t. As noted, ‘bear markets” are swift and brutal attacks on investor capital.’” Pay attention to these indicators. The Fed is discussing taper. The yield curve is flattening, and there is a risk the Fed will hike rates next year. These are all actions very reminiscent of previous market topping processes.

Weekly Trader's Outlook

At the time of writing this, more S&P 500 companies are beating EPS estimates for the third quarter than average, and beating EPS estimates by a wider margin than average. Due to these positive surprises, the index is reporting higher earnings for the third quarter today relative to the end of last week and relative to the end of the quarter. The index is now reporting the third highest (year-over-year) growth in earnings since Q3 2010. Analysts also expect earnings growth of more than 20% for the fourth quarter and earnings growth of more than 40% for the full year. These above-average growth rates are due to a combination of higher earnings for 2021 and an easier comparison to weaker earnings in 2020 due to the negative impact of COVID-19 on a number of industries.

Overall, 8% of the companies in the S&P 500 have reported actual results for Q3 2021 to date. Of these companies, 80% have reported actual EPS above estimates, which is above the five-year average of 76%. In aggregate, companies are reporting earnings that are 14.7% above estimates, which is also above the five-year average of 8.4%.

Stocks appear to have shaken off the often spooky trading pattern of October for now, and whether that continues could depend on earnings in the week ahead.

Dozens of companies are reporting, from Netflix and Tesla to Intel, Procter & Gamble and American Express. Railroads, airlines, health care, tech, financial firms, energy and consumer products companies are all reporting in the first big wave of reports.

Stocks were higher in the past week, with the NASDAQ leading the charge with a 2.2% gain. Cyclical sectors, like materials, industrial and consumer discretionary were out-performers, and tech held its own with a 2.6% gain. Real estate investment trusts were also among the best sectors up nearly 3.5%.

Market Trends:

- Analyst viewing Overall Market Value is Waning

- Interest Rates appear to be Stalling

- Commodities Cycle is Mixed

- Financial & Energy Sector Carrying Market Strength

- All Eyes On Cryptocurrency as BTC surges

MAJOR US EQUITY INDEX

My Bloomberg Report:

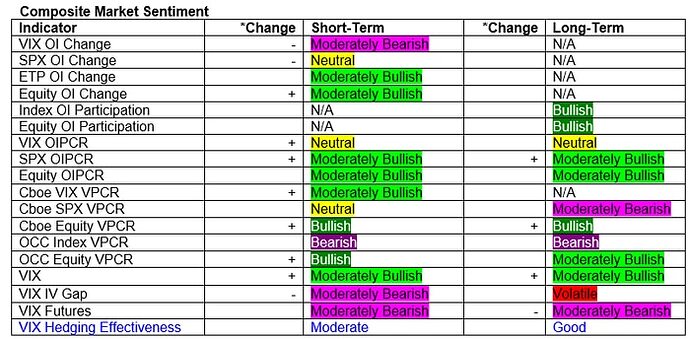

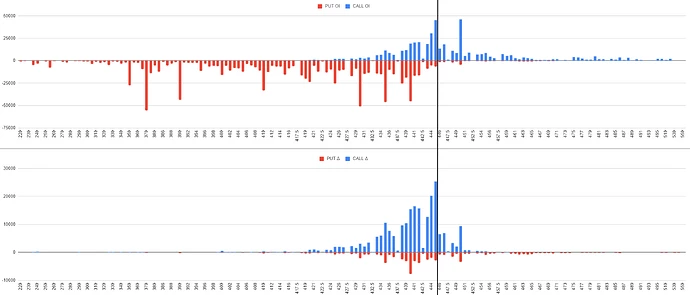

After holding more than $46 billion net long in major equity index futures (SPY) a year ago, my best is smart money is looking for a hedge, almost $60 billion is now net SHORT… Can be seen on the Major Index Combined Hedger Position Chart…

At the same time, the NDX Aggregated Put/Call Ratio chart shows that option traders are betting on a tech correction. The Aggregated put/call ratio for the NASDAQ 100 (QQQ) is the highest its been for awhile. Traders are being insightful and placing betts on a short term bearish term, for a long bull run rally in the Technology Sector. In regards to macro Market Principles; when everyone is in a consensus, something different almost always happens (the bull run might happen sooner rather than latter) so keep a lookout on the Technology Sector as more price action develops. Nonetheless, NASDAQ looks weaker on recent Back-tests. Many analyst will continue to monitor the price after the coming weeks, will give a better judgment on the current trend in Technology Growth.

Winter is coming… Winter is Coming…

Well its here the SPY index seasonality chart shows that the end of the year will perform once more for the holiday seasons… Going off early data the SPY and the Market in general is still in the Chop Zone, ongoing market correction is on the menu for many Analysts… I believe we will se an equal price action for the coming weeks, a lot is happening and I’m going off early data, so It hard for met to tell the direction of the US markets…

The Non-Commercial Net Long Positions chart shows US indices and highlights what non commercial traders are currently net long on, and short positions on the Russel 2000…

Analyst are too believed that the market is in Phase two of a Bull Run. That tells traders that the future performance is going to be relying heavily on forward positive market sentiment from Earning and the Market Cycle itself…

My Final Thoughts on the US equity Markets

Traders are in choppy waters and have been for some time now, but with everything in mind, the ISM Manufacturing Composite vs Regional Surveys Model shows future downtrends following of S&P EPS growth. Compound with market P/E analyst are stating that this potential compression does not bode well for the overall equities market.

Takeaway on the US Markets

ONLY time will tell where the ultimate question may lie, giving everything mentioned, will the markets melt up and continue the trend, or will the markets face a deeper than expected correction? Only future data will show what is needed. So take a look at the OPEX and figure in the key price levels being tested by analyst on all US indexes (Major). I truly only see Text Book Short Term Bearish Patterns, I’m expecting a long term bull run, but first traders will most likely be battling side-way trading days instead of seeing a rapid price action or valuation on the market cycles in regard to US equities. Overall COVID was BS and this year we have had more and more money flowing into the Markets.

*Market Recap Pictures*

Earnings Calendar // Report

Earnings To Watch This Week (IBM, INTC, NFLX, TSLA)

Third-quarter earnings season begins in earnest during the second full week of October, led by banking giants JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC).

Analysts at US financial data group FactSet estimate an earnings growth rate of 27.6% for S&P 500 companies, which would mark the third highest (year-over-year) earnings growth rate reported by the index since 2010.

The calendar below, which I try to update throughout, shows the US companies most held and actively traded by interactive investor customers that report results in the period.

Earnings Spotlight: Johnson & Johnson

Johnson & Johnson (JNJ), $161.65) peaked in the third quarter but has since turned lower amid broad-market headwinds. To wit, while shares are up a modest 2% for the year-to-date, they’re down more than 10% from their late-August record peak just shy of $180.

~Analysts are still bullish toward this beaten-down stock. Of the 18 following JNJ that are tracked by S&P Global Market Intelligence, eight call it a Strong Buy, two say Buy and another eight believe it’s a Hold. Plus, the pros’ average price target of $185.93 implies expected upside of 15.4% over the next 12 months or so. Wall Street will also be looking for updates on the company’s COVID-19 vaccine, after a Food and Drug Administration (FDA) advisory committee on Oct. 15 unanimously agreed the agency should authorize boosters of Johnson & Johnson’s single-dose shot to the roughly 15 million people in the U.S. who received an initial jab.

Earnings Spotlight: Netflix

Netflix (NFLX), $629.76 has been red-hot on the charts in recent months, up about 25% since its early August lows near $500 – and fresh off a record high around $647 from earlier this month.

~“NFLX stock has emerged from its slump,” a team of analysts at Jefferies (Buy) say. They’re optimistic about the streaming giant’s future, too. Following its recent acquisition of indie game developer Night School Studio, “we are growing more confident in the direction Netflix is taking … and we like it.”

And the group believes Netflix’s third-quarter earnings report – due out after the Oct. 19 close – is “an important one to watch for longer-term sentiment.” In particular, they’ll be looking for paid net additions, which they believe will arrive at 3.5 million. This is in line with what NFLX is projecting, but slightly below the 3.75 million the Street is expecting.

The consensus among the pros is for revenues to jump 12.4% year-over-year (YoY) to $23.7 billion. This will fuel a 7.3% improvement in earnings per share (EPS) to $2.36. Consensus estimates for EPS of $2.56 (+47.1% YoY) and revenue of $7.48 billion – a 17.3% increase from the year-ago period.

Earnings Spotlight: Tesla

Tesla (TSLA), $832.48 put in a solid performance on the charts from July through September – and this upside is continuing into October. Since its early June lows near $570, TSLA stock is up roughly 46% to trade at levels not seen since mid-February.

Can earnings keep the wind at Tesla’s back?

Jefferies analysts are certainly optimistic ahead of Tesla’s third-quarter earnings report, which is due out after the Oct. 20 close. They recently raised their price target on the electric vehicle (EV) by $100 to $950 – representing implied upside of more than 14% – amid expectations for “higher capacity ramp and sustained demand, following further analysis of third-quarter data and various sources of information on the soon-to-be launched Berlin facility,” they wrote in a note.

Overall, analysts, on average, are calling for earnings of $1.50 per share, which is up 97.4% YoY. As for revenues, the consensus estimate is for $13.5 billion, or a 53.9% improvement from the year prior.

Extra:

After a final attempt to push the price down by the bears, bulls finally established clear dominance and have pushed us above the 430-440 range that we’ve been in for the last 2 weeks.

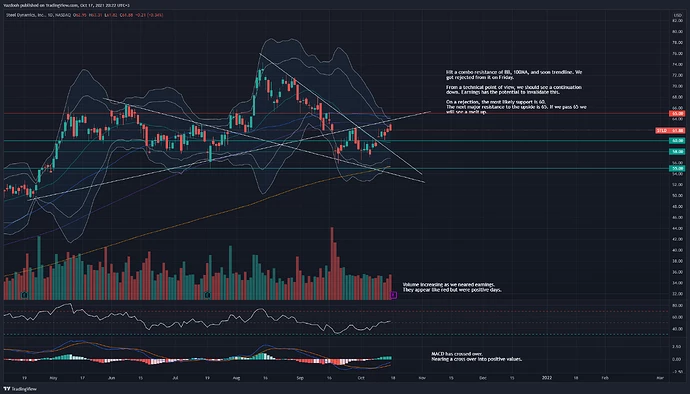

We’ve started earnings season, banks kicking things off with some good results. TSM had good earnings and guidance, that pushed up the entire semiconductor sector. Next week we have some heavy hitters like TSLA & NFLX reporting, as well as Chad steel. This will be a very exciting earnings seasons, that will likely contain a lot of spectacular misses.

Economic data came in mixed but did not seem to have an effect on the market:

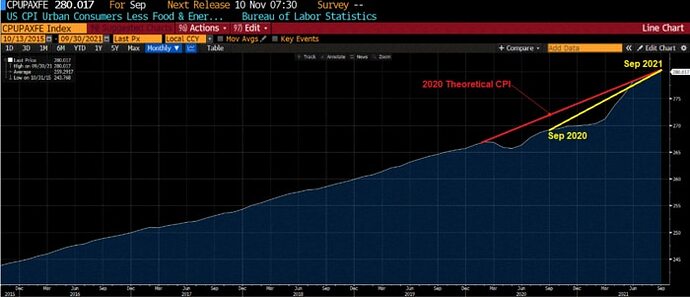

- CPI came in above expectation

- Retail sales came in above expectation - good

- Consumer sentiment dropped slightly compared to September - bad

China

- EG still suspended from trading

- EG failed to sell the HK headquarters

- EG trying to sell Swedish EV unit

- PBOC reassuring the world about EG

- EG will formally enter default on Oct 23rd

My take on this is that EG will eventually have to manage to sell some of their units/assets. PBOC will keep things in check until that happens. Might cause a day or two of moderate turmoil in the market, but that’s about it for now. The real consequence will be the decreasing economic output in china as the real estate sector cools down.

Iron Ore prices remained virtually unchanged.

Both US and EU HRC were virtually flat (slightly up). Both looking like they want to go lower. They will hopefully do this gradually, and at a controlled pace.

TNX 10-Yr yield mostly consolidated this week. Looking like it wants to test 1.7 soon. It surprisingly dropped when CPI came in higher than expected, but recovered on Friday.

The dollar consolidated as well and closed the week slightly lower.

Asian Markets:

- SHCOM on the trend-line, about to break out.

- NIKKEI recovered a lot this week. Sitting just below the 20MA.

EU markets

- DAX bounced of the 200MA/15k level and recovered nicely this week.

- UK100is testing the ATH.

- SXXP on track for a new ATH.

~

Besides earnings, there are a few economic reports to watch, including existing home sales and the Philadelphia Fed manufacturing survey on Thursday. On Friday, Market manufacturing and services PMI data is released. The Federal Reserve’s beige book on the economy is issued Wednesday afternoon.

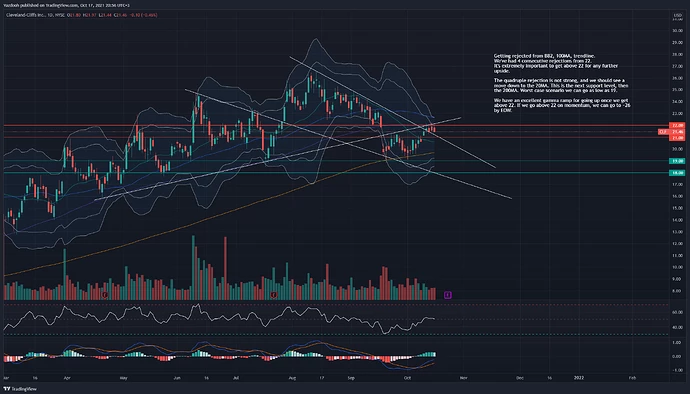

Steel - Earnings Edition

This week I’ll be focusing exclusively on the three earnings bros, STLD, NUE & CLF, and doing more of a deep dive. We also have SCHN but it’s not one of the Chads.

- STLD - Monday after hours

- NUE - Thursday before hours

- SCHN - Thursday before hours

- CLF - Friday before hours

Crypto ETF

The first [bitcoin futures] exchange-traded fund could begin to trade next week, when ProShares Bitcoin Strategy ETF is expected to debut. The Securities and Exchange Commission could still hold up the ETF if it objects to the filing before midnight Monday, but that is not seen as likely, a source told CNBC.

Bitcoin rose above $60,000 for the first time in six months Friday, as investors bet the ProShares and other cryptocurrency-based ETFs would begin to trade soon.

Ethereum lifted into resistance at the .786 Fibonacci retracement level of the second quarter selloff last week, setting up a test at the 4,000 level. Bitcoin just sliced through its .786 retracement like butter, lifting above 60,000. However, Ethereum failed a breakout at this harmonic level in September, adding another layer of resistance. In turn, this suggests a two-sided strategy that buys a rally above 4,025 or sells short a decline through 3,800, whichever comes first.

ETFs to Watch This Week

US Natural Gas ETF (UNG) remains in a long-term downtrend, even though its nearly tripled in price since January 2021’s all-time low at 8.22. Three reverse splits since 2011 have sapped the life out of the long-term pattern, reducing the technical power of large percentage price moves. More importantly, the rally has just reached major resistance at the 200-week moving average at 23, significantly raising odds for profitable short sales in the fourth quarter.

Week ahead calendar

Monday

Earnings: Albertsons, Zions Bancorp, Steel Dynamics

8:30 a.m. Business leaders survey

9:15 a.m. Industrial production

10:00 a.m. NAHB survey

4:00 p.m. TIC data

Tuesday

Earnings: Netflix, (NFLX) Johnson & Johnson, (JNJ) Procter & Gamble (PG), United Airlines, (UAL) Synchrony Financial, Halliburton, (HAL) Manpower Group, Kansas City Southern, (KSU) Bank of NY Mellon, Fifth Third, Intuitive Surgical

8:30 a.m. Housing starts

11:00 a.m. San Francisco Fed President Mary Daly

1:00 p.m. Atlanta Fed President Raphael Bostic

2:00 p.m. Atlanta Fed’s Bostic

Wednesday

Earnings: Tesla (TSLA), Verizon (VZ), [IBM], Lam Research, CSX, [Baker Hughes, (BKR) Abbott Labs, Biogen, Knight-Swift Transportation, Canadian Pacific Railway, Northern Trust, Tenet Healthcare (THC) PPG Industries, SLM

12:00 p.m. Atlanta Fed’s Bostic

12:00 p.m. Chicago Fed President Charles Evans

1:45 p.m. St. Louis Fed President James Bullard

2:00 p.m. Beige book

8:35 p.m. San Francisco Fed’s Daly

Thursday

Earnings : AT&T (T), [Intel,] (INTC) Blackstone, [Union Pacific], Chipotle Mexican Grill, [Snap] (SNAP), [Whirlpool], Celanese, Southwest Airlines, AutoNation, [American Airlines,] [KeyCorp], Crocs, Marsh and McLennan, Ally Financial, [Freeport-McMoRan,] (FCX) Nucor, Quest Diagnostics, Mattel, [Genuine Parts,] Alaska Air, [Tractor Supply] (TSCO)

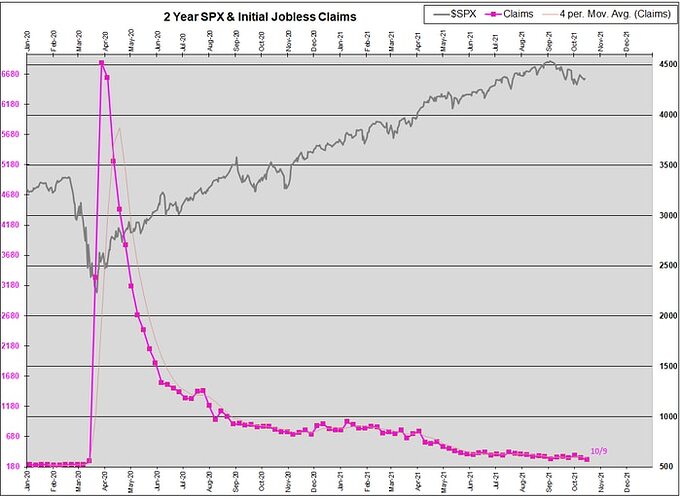

8:30 a.m. Initial jobless claims

8:30 a.m. Philadelphia Fed manufacturing

10:00 a.m. Existing home sales

Friday

Earnings: Honeywell, American Express, [Schlumberger,] (SLB) Regions Financial, Roper, VF Corp, HCA Holdings, Seagate Technology

9:45 a.m. Manufacturing PMI

9:45 a.m. Services PMI

10:00 a.m. San Francisco Fed’s Daly

Global News:

COVID-19

In September, the Centers for Disease Control and Prevention (CDCP) found that among the 3 major vaccine providers, effectiveness against hospitalization from COVID-19 was the highest for Moderna (2 shots), followed by Pfizer (2 shots) and then Johnson & Johnson (1 shot). This week the FDA will consider an Emergency Use Authorization (EUA) request from Johnson & Johnson for a booster shot, which J&J says resulted in 94% efficacy against moderate to severe COVID, compared with 70% for a single dose. Both Pfizer (whose booster was approved in September) and Moderna (whose booster is pending approval now) had about 90% efficacy from their original 2-shot regimen.

Both Bulls And Bears Have Valid Views

Given the potential for a “policy mistake ” and our cautionary views, the following comment I received currently sums up many beginning investors’ views.

“I really am not sure what to do. Should I raise more cash and be defensive with inflationary pressures rising, and the Fed set to taper. Or, should I just stay invested given the market seems to be doing okay?”

For investors, they have gotten caught between logical views.

From the bullish perspective:

- The market just completed a much-needed 5% correction.

- Short-term conditions are oversold.

- ***Bullish sentiment is largely negative. **

- Earnings season should be supportive .

- Stock buybacks are running at a record pace.

- The seasonally strong period of the year tends to be positive for stocks.

However, those views get countered by the bearish perspective discussed last week.

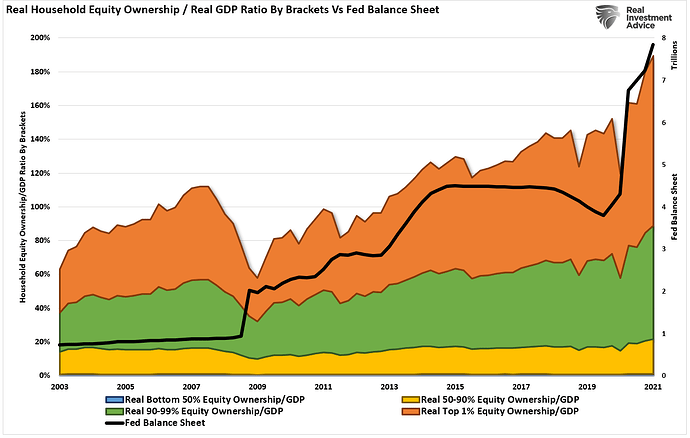

- Valuations remain elevated.

- Inflation is proving to be sticker than expected.

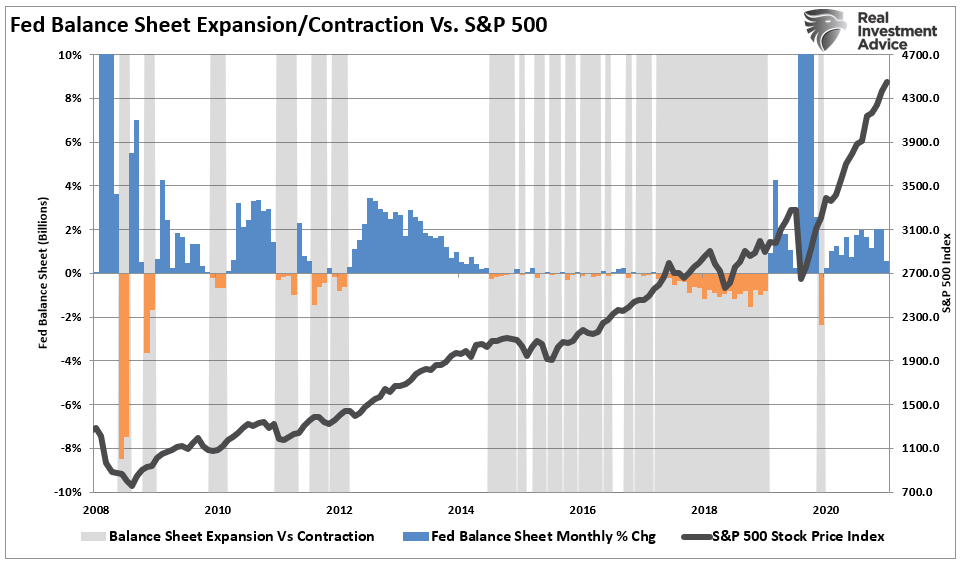

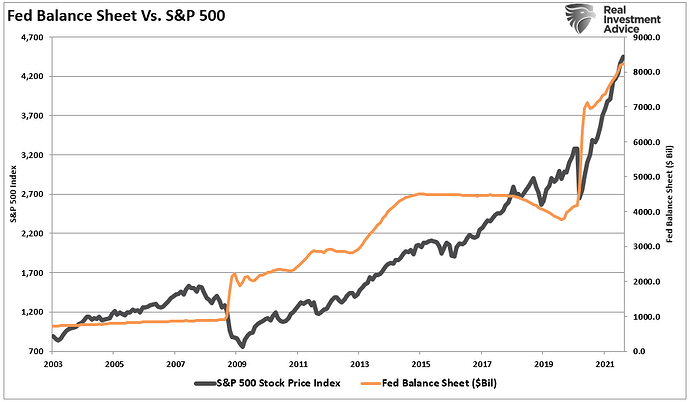

- The Fed confirmed they will likely move forward with “tapering” their balance sheet purchases in November.

- Economic growth continues to wane.

- Technical underpinnings remain weak.

- Corporate profit margins will shrink due to inflationary pressures.

- Earnings estimates will get waywardly revised keeping valuations elevated.

- Liquidity continues to contract on a global scale

- Consumer confidence continues to slide.

Given this backdrop, it is understandable why investors are finding reasons “not” to invest. However, as stated previously, avoiding crashes and downturns can be as costly to investment outcomes as the downturn itself.

“ If you didn’t like the recent decline, you have too much risk in your portfolio. We suggest using any rally to the 50-dma next week to reduce risk and re-balance your portfolio accordingly. “

So here are some guidelines to follow.

- Move slowly. There is no rush in making dramatic changes.

- If you are over-weight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Think logically above where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers.

- Add to sectors, or positions, that are performing with, or outperforming the broader market .

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is foolish.

- Be prepared to sell into the rally and reduce overall portfolio risk. Not every trade will always be a winner. But keeping a loser will make you a loser of both capital and opportunity.

- If none of this makes any sense to you – please consider hiring someone to manage your portfolio for you. It will be worth the additional expense over the long term.

Outlook: