An ETF to capture the “Night Effect”

NightShares, a new entrant to the ETF space led by a highly experienced team that has built and grown multiple successful ETF brands, is today launching its first two ETFs: the NightShares 500 ETF (NSPY) and the NightShares 2000 ETF (NIWM).

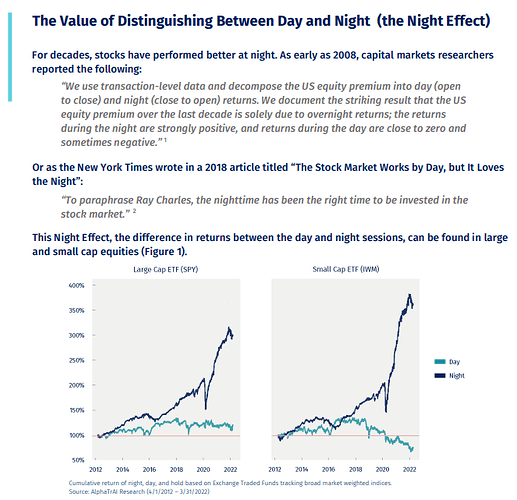

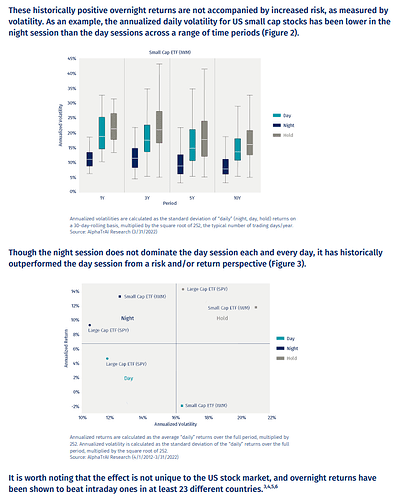

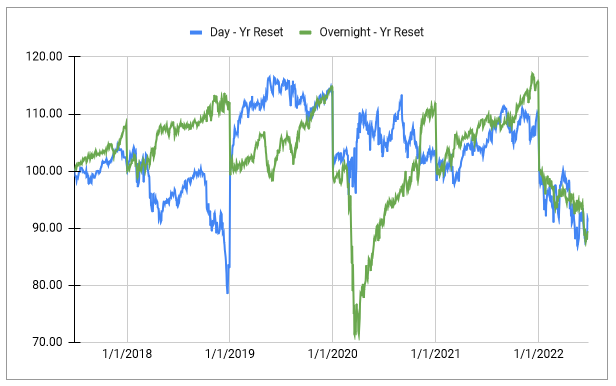

These ETFs seek to capture value from the “Night Effect,” a persistent phenomenon whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis.

The strategy is based on academic research dating back to 2008 and these ETFs are designed for investors to efficiently capture this potentially better investor experience than a simple buy and hold approach that has heretofore dominated the industry. The NightShares 500 ETF seeks to return the night performance of a portfolio of 500 large cap U.S. companies. The NightShares 2000 ETF seeks to return the night performance of a portfolio of 2000 small cap U.S. companies.

(Source: Press Release)

Some additional information from their three-pager:

The Rationale Behind the ETF

It’s not 100% clear why this “night effect” happens, though there are some good hypotheses. Like most interesting things in life, it’s likely a combination of a bunch of things. The FT did a piece on it six months ago:

“Quant” funds that use algorithmic or systemic strategies take advantage of the bigger impact that trades can have when markets are closed and liquidity is thinner. They aggressively buy shares they already own, driving their price higher.

Then, as markets open and trading conditions improve, they can gradually ditch the purchases without undoing all of their earlier impact. By the end of the day, Knuteson says they should be left with a slightly higher-valued portfolio. Systematically doing this, day-in-day-out, would produce the pattern of overnight gains and gentle intraday declines, he argues.

Given his DE Shaw background, Knuteson’s theory is certainly more intriguing than the usual conspiracy theories that clog up the internet. DE Shaw declined to comment. But how plausible is it? Not very.

First, the US stock market is only officially open for a fraction of the hours in a day. But you can in practice trade equities around the clock. George Pearkes at Bespoke Investment Group has calculated that if one adjusts for the different lengths of trading windows, then average intraday and overnight returns are not that dissimilar.

Second, a New York Federal Reserve study of S&P 500 futures patterns showed that returns actually spike most notably between 2am and 3am in New York. Tellingly, this is roughly when European traders get to work, and not what Knuteson’s theory would suggest.

Third, a quarter of US corporate earnings releases are published right after the market closes, and another 60 per cent before trading starts in the morning. Most companies tend to beat estimates and therefore enjoy subsequent price spikes in the overnight trading session, helping explain the phenomenon.

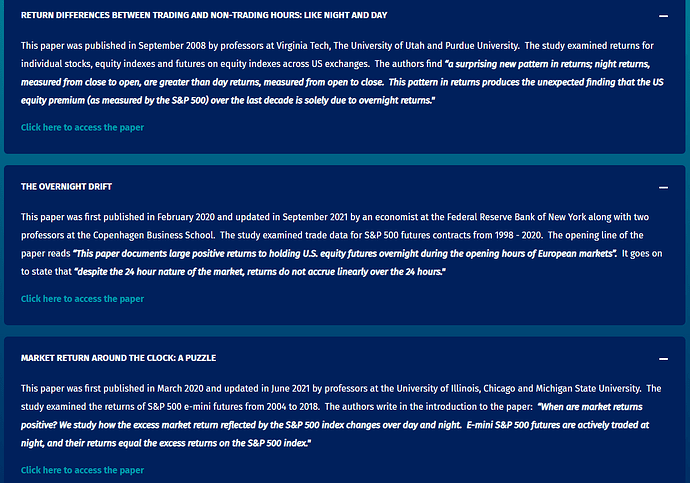

Nightshares itself shares the following papers:

Here’s another piece that was a good read: The Magic of Overnight Stock Market Returns (I) - systematic individual investor

All are very interesting reads.

The Play

The obvious play is to go long this ETF. After all, two of the core reasons for this effect are: a) the Euros are responsible, and b) Option flows are responsible, which, when combined have a certain subjective appeal to it.

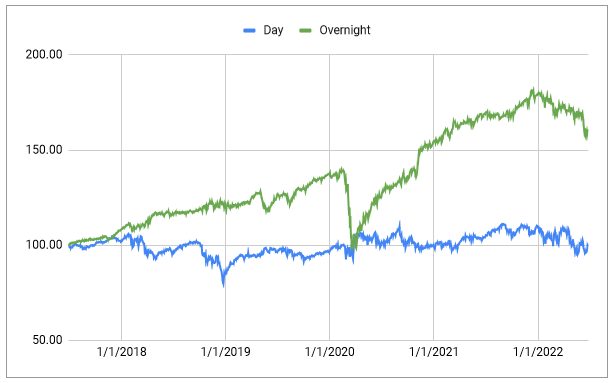

Nevertheless, since we try to go beyond just looks here, it’d be helpful to corroborate some of these findings. Or stress test it somehow. One of the reasons for sharing this is to ask the community to do just that.

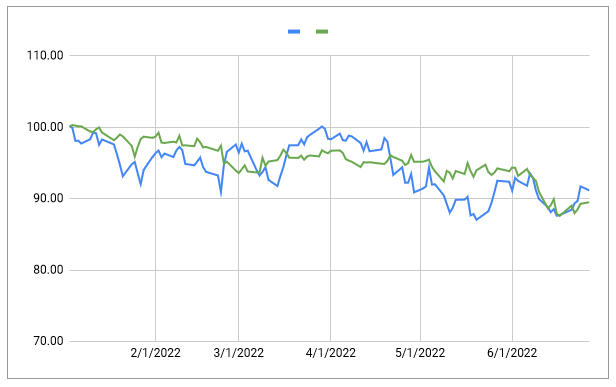

To start off with, one of the reasons I am not sure we will continue to see this effect is: all the papers seem to be from the decade long bull market. We turned a corner six months ago and have gone bearish. So need to see if overnight gains still occur or it’s more overnight losses now.

Any other hypotheses to test?