Semiconductors in general have been on a wild ride the past few months, more so than the market/tech in general, rising to stratospheric heights only to lawn dart.

So far during earnings, semiconductors have been a mixed bag, though more positive than negative.

Winners so far:

TXN, QCOM, AMD, NXPI, XLNX, KLAC (maybe)

KLAC is a maybe since it had a dive immediately on earnings but recovered quite well, however it may have just been riding a general uptrend.

QCOM likely would have had a stronger uptick, but had earnings the same day as FB.

Misses:

WDC, INTC, TER, LRCX

TER had a surprisingly bad miss, far worse than other semiconductors have reported. WDC and INTC are perennial earnings misses, so nothing surprising there.

To come:

ON, Reports Monday morning half an hour before market open.

The AMD comparison:

When one speaks of NVDA, AMD isn’t far away.

It’s easy to see why: They have significant market overlap. GPUs, data center, and embedded systems make up their largest revenue streams with data center and embedded being the fastest growing for both companies.

So tied together, in fact, NVDA popped on AMD’s latest earnings and had a sympathetic rise with AMD’s previous earnings.

AMD spiked on record revenue growth along with the statement in their call that, simply put, demand exceeds their ability to provide. They answered the ever-present supply-chain issue with a very positive outlook, stating they were investing heavily in their backend to meet their impressive guidance.

Something to consider is that last earnings, AMD had a slight shrinkage in market share and NVDA had an even more significant shrinkage along with reduced shipped units from both. I haven’t been able to find a report on that for their latest earnings, but during the call Lisa Su mentioned they’re expecting total units shipped to remain flat for 2022.

My thought here is they’re simply capturing more revenue through pricing increases.

This lines up with information I’d dug up on NVDA for their last quarter earnings. A report from a german distributor/retailer of computer hardware made mention that NVDA’s shipments to them had decreased, not because of lack of supply, but that NVDA was looking to trickle out their product. Suspicion and conjecture indicates that NVDA is doing this because they’re well aware of scalping and increased prices for their hardware. Going another step further, there’s a supposition that they’re using this to normalize higher prices so when they release a new card at a steeper MSRP, consumers won’t have as much ‘sticker stock.’ This likely flows into the data center world as well.

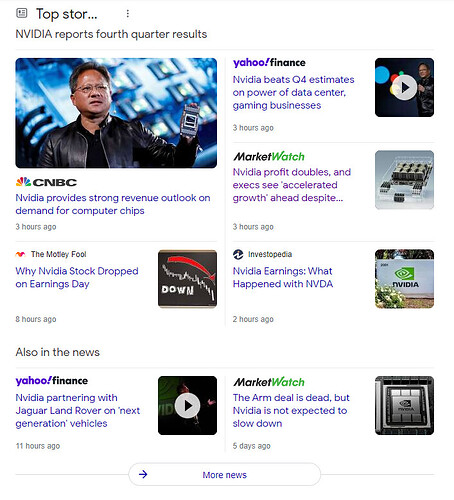

I think it’s fair to anticipate a similar outlook and reporting from NVDA.

Their presence in data center is growing fast, though their embedded–specifically automotive–is their fastest growing division, I believe. They’re also growing their AI division, though it’s still an infant compared to IBM and Google–which, incidentally, they partnered with for AI as well as quantum computing. They tend to release news like this the week before earnings, so keep an eye out for NVDA headlines this coming week.

That said, while I personally expect positive movement from NVDA’s earnings, they could easily have a negative outlook.

- They already have a very high valuation. It wouldn’t take much negative guidance or missed earnings to drop the share price. In fact, I believe NVDA is overvalued at $242. Not that I won’t take a pop to $300 on earnings, but it’s not a figure I imagine will hold over the long-term.

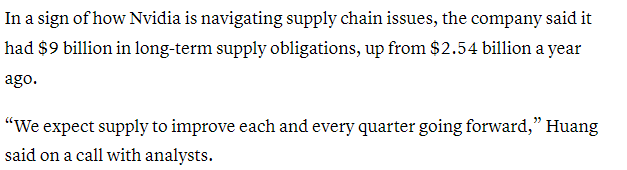

- Like so many other companies, if they don’t have a firm grip on supply chain issues (or at least can blow enough smoke up investor asses to hide the fact they don’t) that’d hurt rather badly–it’s what caused TER’s massive drop.

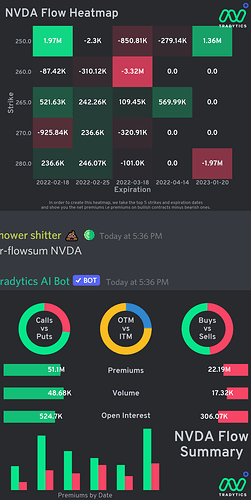

- NVDA doesn’t always pop on earnings. Sometimes it even sags immediately in AH/PM then runs in the following days. Trying to play pre-earnings could result in a nasty IV crush even with a good report. This is exacerbated by the fact NVDA options already command a high premium and running into earnings is going to make them that much more expensive.

- Lastly, there’s the crypto connection. While I’m unsure of the impact, I believe the fall of AMD and NVDA compared to other tech/semiconductors–and their higher volatilities–stems from expectations about demand from the crypto side of things. If BTC continues to flag and stumble, it may hurt sentiment prior to earnings and even after.

So, plenty of downside potential not even considering their sky-high premiums. At the time of this, with a share price of $243, the Feb 18th $250c is a whopping $10.60.

I’ll be looking to take calls (or call, considering premiums) at some point for earnings, but seeing as how this ticker casually swings $10+ a day and can go up and down $30-50 a week, a ‘safe’ entry may be difficult to find. It’s not totally wrong to say NVDA is a mini-TSLA with its swings.