This thread is for general discussion about NVDA stock.

Completely speculative but Atrioc (streamer, lead of marketing at Nvidia) said he got approved for a big project and has a track record of doing great things for Nvidia. No other info on what that is though

Relevant for anyone in NVDA: Nvidia Stock Is Downgraded. China and Russia Are Headwinds. | Barron's

This should remove the paywall

I’m holding out hope, NVDA wouldn’t have made that announcement Friday afternoon if they didn’t have big plans for those extra shares. They do seem to split pretty often, but that doesn’t really make sense to do right now, does it? Really hoping we ended up just being a bit too early…

I am hoping for a semiconductor reversing rally sometime between now until july. Seems like a good time length. I could be totally wrong.

Personally, AMD and NVDA going toe to toe right now with new architectures thinking about 3D cache and MLM design chips. seeing the new products in the hands of reviewers and how the market truly reacts to them will be the true turning point for AMD.

if all the rumors about how much power RTX 4000 cards need will be a turn-off to people looking at something similar since they will not need a PSU upgrade. AMD is also focused on taking control of the lower market by releasing many different low-end sku’s of cards that people are not super interested in it seems.

No sources to sight, just my personal opinion from watching NVDA since GTX 900

If I understand this correctly, the inflation numbers at 8.5% are worse than expectations, and that means dollars are worth less and stocks should rise to account for this and maintain value? Is that an explanation of the NVDA green candles starting at 8:30 when the report came out? Seems largely SPY correlated, so I believe this must be related to the inflation report and the market at large rather than something about NVDA.

Not exactly, the hope is that CPI is peaking either now or next CPI (still have to wait for next reports to confirm):

However, core inflation appeared to be ebbing, rising 0.3% for the month, less than the 0.5% estimate.

“The big news in the March report was that core price pressures finally appear to be moderating,” wrote Andrew Hunter, senior U.S. economist at Capital Economics. Hunter said he thinks the March increase will “mark the peak” for inflation as year-over-year comparisons drive the numbers lower and energy prices subside.

“Overall, this report is encouraging, at the margin, though it is far too soon to be sure that the next few core prints will be as low; much depends on the path of used vehicle prices, which is very hard to forecast with confidence,” wrote Ian Shepherdson, chief economist at Pantheon Macroeconomics. “We’re sure they will fall, but the speed of the decline is what matters.”

Keep in mind PPI comes out tomorrow PM, seeing how big of a disconnect between producer and consumer would be useful, too.

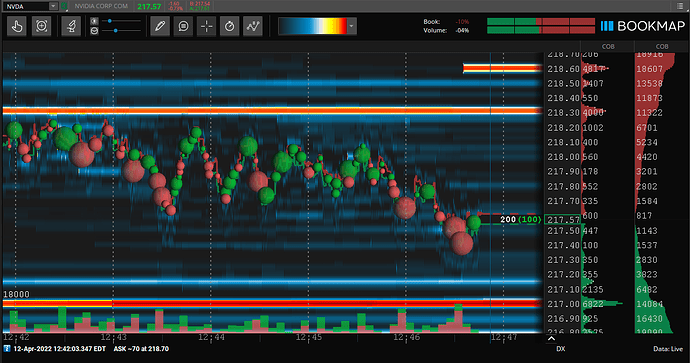

Currently going back and forth on cutting this play in The Challenge. Haven’t really seen the rally that we’d expect from the CPI numbers as of yet. A lot of times when we see this, SPY will either gap up or have a herculean run towards the end of the day, looking at the bookmap for NVDA:

217 is a pretty solid support at this point, it’s bounced a couple times and has for the most part resisted dipping much lower. So with that said, I’ve got a call position worked up on a play that is near solid support with potentially bullish movement coming, the alternative outcome is that I’m wrong about the read of the CPI and SPY drills overnight.

Right now leaning towards giving this one more night to play out. Will update with more thoughts as we get closer to the end of the day.

Historically, it seems as though NVDA has a pattern of splitting its stock two years in a row. With them announcing a split last year, if the pattern continues, they may be on the path for another split.

On the other hand, since they recently lost the ARM deal, they may be authorizing extra shares in order to follow through with an acquisition of another company. Of course, this is all speculative and nothing will be confirmed until NVDA explains the reason behind their news release on Friday, but just wanted to share my thoughts.

Cheers ![]()

perhaps NVDA is looking to acquire a foundry? Intel is committing billions into new fabs. TSMC has geopolitical risks and limited allotment since it is a global fab. NVDA reportedly is paying tens of billions just to secure future allotments, competing with Apple. Why pay that much when you can buyout existing foundries for only a few multiple, and start building towards securing future production? NVDA has one of the best profit margins, it would benefit greatly if it could secure the multiplier it needs. Only foundry company in my mind is GFS https://imgur.com/a/skNDk7a. Even though NVDA has been fabless for so long, the chip shortage lit fire under every hw company. just my 2c.

The reason many companies went fabless was simply due to cost, competition, and technology improvements. While TSMC is typically always headlining the news, make no mistake that Samsung is right there at the cutting edge with them (and in fact also manufactures chips for NVIDIA along with TSMC). Intel is planning new fabs but will be quite a few years before they are online and qualified for regular production.

The equipment necessary for 7nm and below is ridiculously expensive, only made by ASML, and back in 2020 they only made like 30 of them. With all the supply chain issues last year and this year I’m sure production was much lower. Search for my article on ASML that goes over costs and whatnot. Each jump in chip design requires a similar jump in new fab costs.

AMD actually spun off their fabs in 2009 which became GlobalFoundries. GFS doesn’t compete at the bleeding edge and stopped their 7nm development back in 2018 (citing unaffordable costs) and and instead focused more on higher volumes at more affordable and better developed technologies. They currently only produce down to 12nm.

Basically fab companies just keep expanding, running their older machines along with acquiring new ones, while most of the money is made at the cutting edge, there’s still tons of demand for “older” tech / simpler ICs. It’s not really economical for a company like nvidia that only needs the cutting edge to keep trying to swap out equipment every other year because these machines are so huge, so costly, and take so long to setup and dial-in. That’s why so many have gone fabless.

They must be buying an EV company then!

Tangential but pretty scathing report on state of Samsung Samsung Electronics Cultural Issues Are Causing Disasters In Samsung Foundry, LSI, And Even DRAM Memory!

Sunday Barrons news on NVDA

Nvidia is slowing the pace of hiring, the company confirmed on Sunday.

The chip maker joins several other major technology companies that have decided to be more prudent with their operating budgets in recent weeks.

On Friday, The New Indian Express reported the semiconductor company’s management has told its hiring managers to pare down hiring of new recruits.

“We’ve been extremely successful in hiring this year,” a Nvidia spokesperson said in a statement to Barron’s when asked for comment on the report. “We’re slowing for now to integrate these new employees and to focus our budget on taking care of existing employees as inflation persists.”

The technology industry has been cutting back as it struggles to deal with rising inflation and a deteriorating global economic environment.

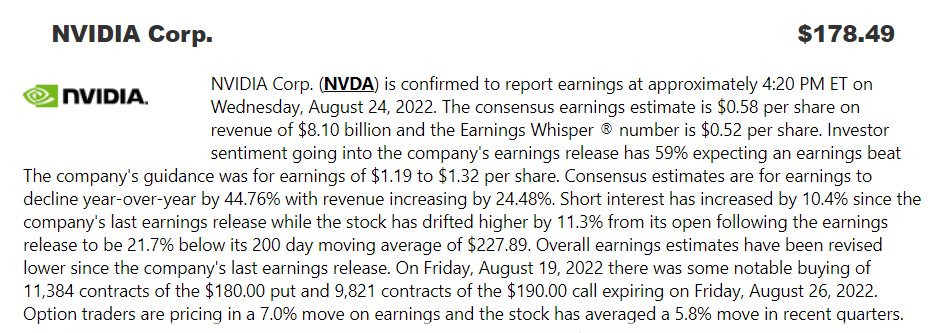

Parking this here for NVDA ER this coming week. Market conditions may impact this given Fridays dip.

Thanks Walter…

This occurred after hours today but basically the US has halted Chip sales to China which has caused both NVDA and AMD to fall about 6.6% and 3.8% respectively. This would hamper both NVDA and AMD’s sales and business in China, hence the bearish moves. SPY took it harshly and fell another 0.5% after hours

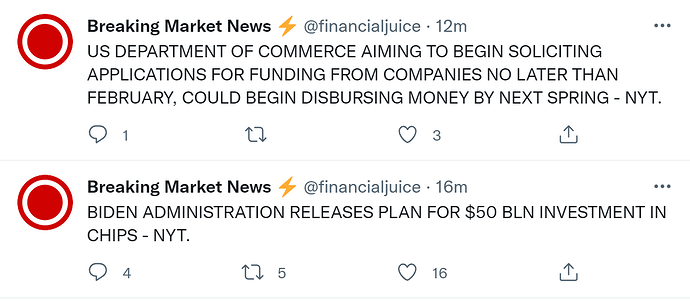

This news from the Biden Admin releasing a plan for $50B investment into chips seems to have given futes a lil rise. This might serve as fuel for semis to bounce a bit.

This could hurt NVDA a bit. (Though NVDA thinks its fine.)

Graphics card manufacturer eVGA has made a name for itself manufacturing and selling Nvidia’s GeForce GPUs for two decades, including some of the more attractively priced options on the market. But according to the YouTubers at Gamers Nexus, analyst Jon Peddie, and an EVGA forum post, EVGA is officially terminating its relationship with Nvidia and will not be manufacturing cards based on the company’s RTX 4000-series GPUs.

EVGA’s graphics cards have exclusively used Nvidia GPUs since its founding in 1999, and according to Gamers Nexus, GeForce sales represent 80 percent of EVGA’s revenue, making this a momentous and arguably company-endangering change.

…

The end of the EVGA-Nvidia relationship could hurt Nvidia—Peddie says that EVGA represents about 40 percent of Nvidia’s GPU market share in North America—but in the medium term the company is unlikely to be fazed much. Nvidia has other partners, and despite differences in cooler design and clock speeds, GPUs in the same series tend to perform similarly regardless of which of Nvidia’s partners actually made them. In other words, an RTX 3070 is an RTX 3070, and people who want one are just going to buy one from another company if EVGA’s products aren’t available.