tl;dr: I think today may be a good time to buy NVDA puts for a day trade, but I came to that conclusion using TA techniques that I’m rather new to, so I’m hoping to get some feedback on if my reasoning makes sense.

I’ve been reading about ATR a bit lately and want to employ it in my trades (along with other indicators, of course) and this is the first such trade idea I have so I want to see if my logic checks out. I’m looking at NVDA on a daily chart for a potential day/swing trade.

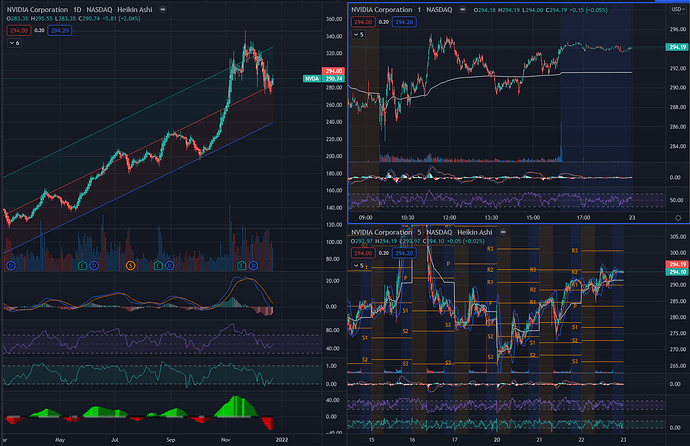

I think NVDA is now on a downtrend looking at MA20 and noticing that the candles have been below the MA20 for about a week now (in conjunction with the fact that there are lower highs and lower lows) and it seems like there’s support in the $271 region that NVDA tested twice in the last 5 days and bounced off two days ago. I think this would normally mean that you wouldn’t enter a bearish trade until the support is broken and becomes the new resistance but perhaps the overall downtrend can be used for day trading if an intra-day support is broken and becomes the new resistance at a smaller timeframe? I’m not sure I’m saying that clearly but I basically think that it may not be the best time to enter a longer term put play on NVDA but looking at the larger timeframe downtrend and finding an intra-day entry seems to make sense to me? Please correct me if I’m missing something big.

Additionally, seems like the ATR (on a daily chart) has been in the 16-18 range for about a month, so if indeed there’s a big swing (and if it’s a downward swing assuming that my downtrend analysis is correct) this may make for a good day trade for puts right?

Is there anything that I’m missing here or does my idea sound like it makes sense?