Hey guys,

Repos posted an update DD regarding this:

https://reddit.com/r/BigBrainCapital/comments/rn1669/nxtd_holiday_cheer_update/

I decided to take a look myself. Be gentle, I’m new to DD.

Gamma

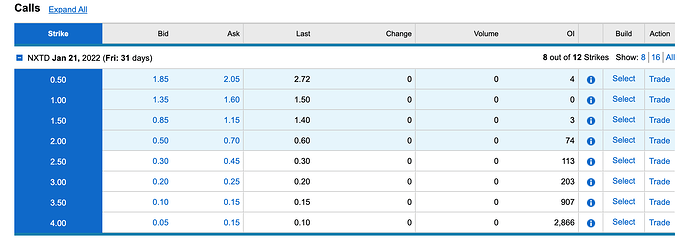

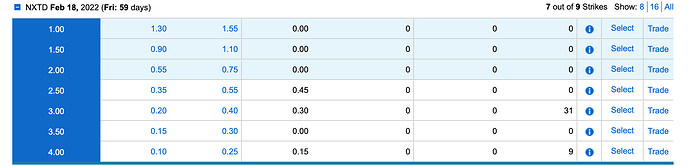

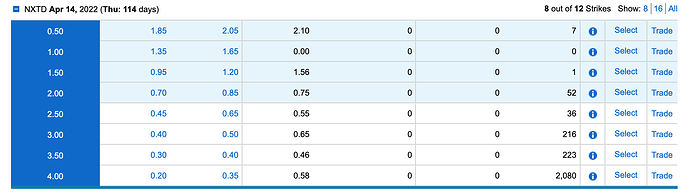

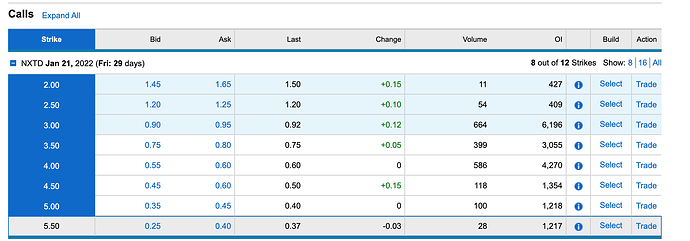

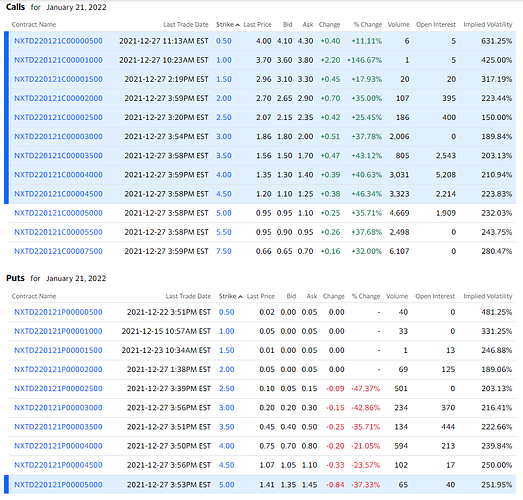

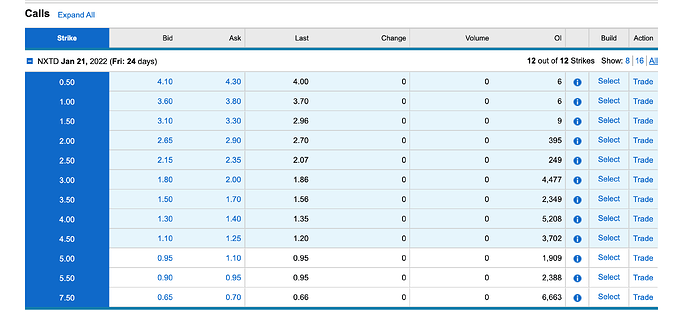

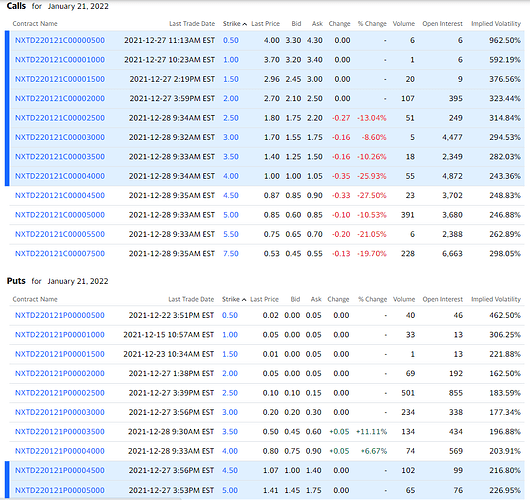

Although my pictures have the same OI as posted above, they also have the updated call volume from yesterday. See below:

The volume on calls is absolutely nutty. Lets say half of the volume on each strike is 50% sells (which it probably isn’t since the run more than likely caused retail FOMO buys). This would leave the OI exactly as is.

That’s 20% of the float on ITM contracts and if the whole chain were to become ITM that would be 30.4% of the float needing to be hedged… with OI exactly as it was before the massive volume increase on Friday.

That is for the possible gamma side of things.

Shorts

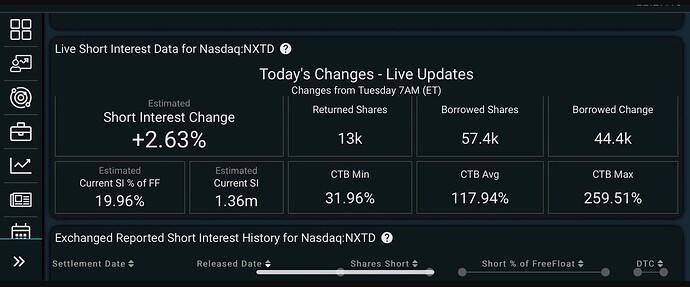

The shorts side is interesting as well.

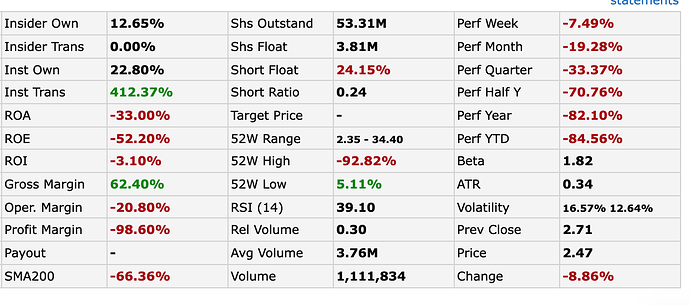

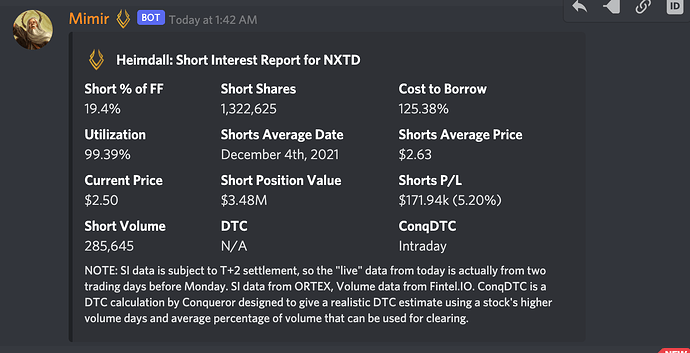

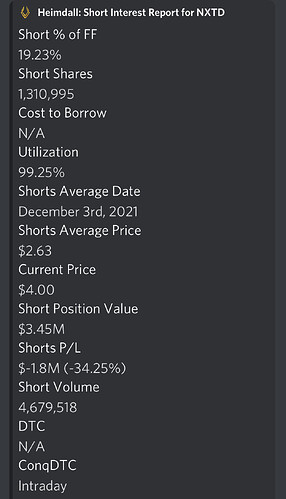

Pictured above is the SI given by Mimir.

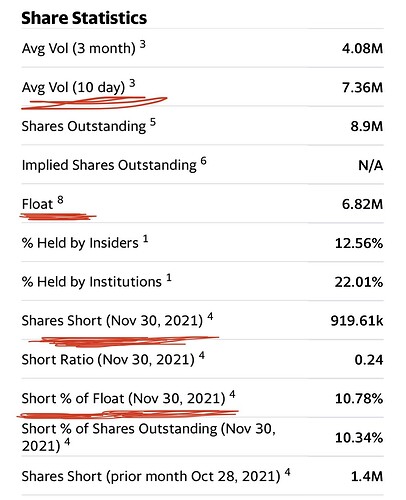

Pictured below is from Yahoo Finance.

As you can see, there is quite a difference. A 400k share difference actually. Yahoo’s numbers are from Nov 30th. Assuming Mimir’s is more up to date since it pulls from Ortex, this shows that there is an almost 45% increase in shorts since November 30th.

Not only that, but with the price being $4 at the time, they were down $1.8mill or 34% with their average price being $2.63. NXTD closed AH with a nice 15% run and is sitting at $4.61.

Things are heating up on both the short and gamma side of things.

HOWEVER, keep in mind that with volume being 12.3M on Friday, over 3x the average and almost 2x the float, it is possible that covering and/or hedging has happened or has begun.

I have no positions but will more than likely look to buy in on Monday at support if possible. The setup, in my opinion, looks great.