Longtime lurker here (since the IRNT days). I’m finally following everyone else’s advice and writing my horrible trades down. This decision came after nuking multiple tiny accounts, but maybe this time is different.

Starting with $100 on 9/29

Today’s bullets:

- BUY: 1 10/7 $SOXL 9.5c @ $0.32 | SOLD @ $0.65

This was purchased this morning around 9:38am mostly because I tried following a WeBull furu’s callout (I know I know). I thought this would be interesting to try since the market seemed to be bouncing up at the time.

- SOLD: 1 10/7 $SPY 370c @ $1.18

Purchased on 9/30 near the end of the day’s breakdown $0.68 because I believe that SPY would go back into the 360/370 channel this week (way oversold). Sold pretty early today at 10:24am for no real reason, even though the market was in a clear uptrend.

- SOLD: 3 10/7 $SPY 370c @ $0.5

Auto-sold by stupid Fidelity at 3pm while SPY was going up. Guess I got lucky because that was also the peak of the day. Still a loss because I purchased it on 9/29 for many centbucks (this is before I changed adjusted my starting balance to $100)

- HOLD: 5 10/7 $C 46c @ $0.10

I was actually trying to unload these for $0.05 at the end of day, but it never executed. It’s the same thesis as SPY going back to the 360/370 channel. $C could follow the same trend back up with the market + the increased trading due to the financial sector earnings next week-although I think I expiration I bought is a bit too early. Will probably sell tomorrow regardless and buy back in.

Day’s ending balance: $198.26 (+98.26%)

I’m probably going to go back into SPY/SOXL tomorrow if they bounce off a major support (365/363). TSLA looks interesting too since it went the opposite way of the market.

4 Likes

Day’s starting balance: $198.26

- BUY: 8 10/7 $SOXL 10p @ $0.24

This was an incredibly stupid purchase for many reasons:

- Bought them before 10am

- Bought right before the high impact numbers came out at 10am

- Thought I could time a reversal (even though I KNOW not to)

- Was occupied all day and couldn’t even exit during the TSLA-induced market dip (which would of had me at green)

Day’s ending balance: $157.93 (+57.33% from start of $100)

Hopefully I didn’t blow up the account, I’ll exit with whatever I can get in the morning and probably sit out Wednesday. Definitely not calling it quits though, this market has been very interesting.

1 Like

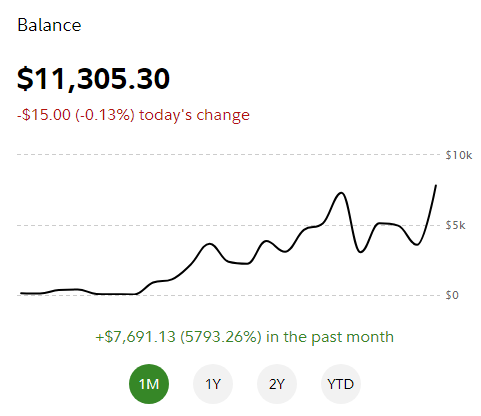

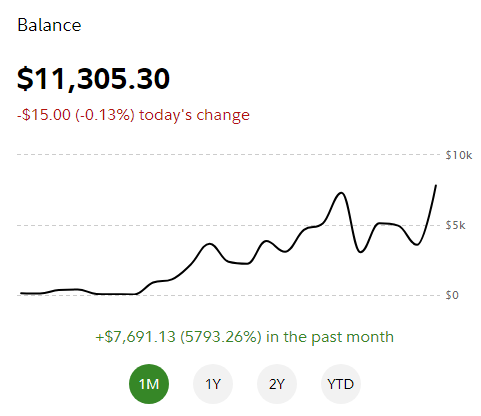

Ah so I completely forgot about this journal. Honestly I almost crashed my account, and then I injected $1k into it on 10/26. Now it’s somehow $11k. I’ll try to break down my trades but honestly the past couple weeks were a blur.

Using 10/26 as a re-start point: Starting Balance of $1,121

11/16 end of day balance: $11,305.30

The best strategy so far is getting my butt out of bed 15 mins before open (I’m on the west coast), look at the earnings/server callouts (thanks JB!) and then put in mid-bids for calls or puts depending on the pre-market action (high/lows), earnings performance, and overall market direction. I also use a relative volume indicator to help me with interpreting both the individual stock and overall market direction.

So far I’ve been green every day for the past two weeks…if I exit before 10am. If I enter trades after 10am I usually have a 40-50% success rate. If I hold overnight I lose a lot.

I’ll try to put a log of my postions from 10/26 to now in the next post and continue the journal at least on a weekly basis

2 Likes

Also to add, I’ve been compounding and doing mostly full port option trades for end of week (if mon-tues) or next week (if wed-fri) expirations. Probably why it grew so fast over 3 weeks

1 Like

Impressive work so far. I’m curious to know what trades you made.

Thanks! I’ll try to put together a day by day list of trades from start til now over the weekend