XOM has also received a price target of $77 raised from $71 this AM. This is from marketwatch news but couldn’t find a link to a source.

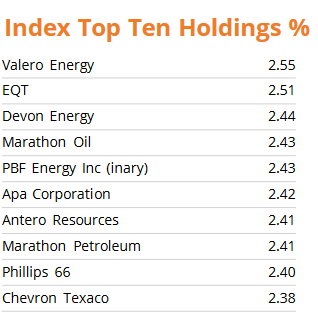

GUSH - ETF 2x Leverage is also doing a bit well. ETF’s are a bit riskier trade rather than hodling a company stock.

The ETF has below as its holdings.

Its worth the ride as it has done well for me.

I have pulled the trigger for the first trade of the year yesterday after biden’s speech.

Should have bought it at 103 but when i finally decided it was at 106.18 and bought 130 shares.

I see alot of talk about Russian natural gas sanction having a positive effect on the LNG Industy. LNG is essentialy natural gas super cooled down to a liquid form 600 times smaller. The problem with this space right now is that LNG inport and export terminals take many years to construct and the early 2020s were not kind to these kinds of projects.

Most of the current export terminals are running at over 90% capactity.

https://www.naturalgasintel.com/lng-export-tracker/

So yes, ideally USA producers of natural gas should be booming and replacing the Russian contribution but in reality there are too few pipelines and export facilities right now and most of it is regionaly gridlocked. Chenerie ticker LNG would be the one to watch for sentiment plays.

Helped me understand Germany’s situation.

Apparently there is LNG port in Poland.

Question for folks who have played oil - how does BNO stack up against USO?

BNO gives more exposure to the spot price movements because that is what it is designed to do, by trading either the near month contract, or the next month contract. USO is the next two futures contracts plus December, and the December is acting as a dampener because it is priced lower than spot prices by a bit. Perhaps because the market is pricing in relief by that timeframe.

The other technical difference is BNO tracks Brent oil while USO seems to track WTI more, but couldn’t find significant differences between the two. Unlike say the Urals which are selling at a 20% discount at the moment.

Note that BNO options are highly illiquid, compared to USO options.

So, with some estimates of oil going to $150-$180 by summer, are there situations where BNO might make more sense than USO?

WTI = West Texas Intermediate = North America pricing

Brent = Brent North Sea = Europe, Middle East, Africa pricing

They are both the same sweet crude classification.

You all are brilliant! And I haven’t even read the entirety of this thread.

I’m keeping XLE close to my heart.

Here’s my watchlist on this market:

What are thoughts on SHEL? It’s European and Recently came under fire for purchasing from Russia, but I know for a fact our government deals with this company because I have a government gas card that works specifically at Shell stations, and has always been specific to shell.

I have actually done okay with NOG, plays into the oil and natural gas movements. Has moved about 6 percent more in last week than XOM and MRO.

My feeling on something like SHEL is id rather choose an OIL play with less variables in play in regards to its sentiments. Theres just alot of competing plays under the same thesis.

There was news the other day about Berkshire buying into OXY (Occidental Petroleum) and their price has been rocketing. Not sure how much more room to run but definitely worth keeping on the radar.

Read the news yesterday. They had OXY shares and now they’re just adding more to it. I already added to my watchlist.

I would be careful being bullish on oil the next few days or possibly weeks. Check out this news. The US is already looking for oil sources to fill the hole Russia left.

I think the Biden administration is just trying to do damage control acting like they are actively seeking oil, I don’t think they will really buy oil from Iran or Venezuela. Both those countries hate us and are pro-russia.

Was going through different conversations and one interesting suggestion was SLB as its an oil services/tech play that is could possibly be acting like a laggard right now.

Venezuela is small fries. They produce 500k bpd and export 70k bpd.

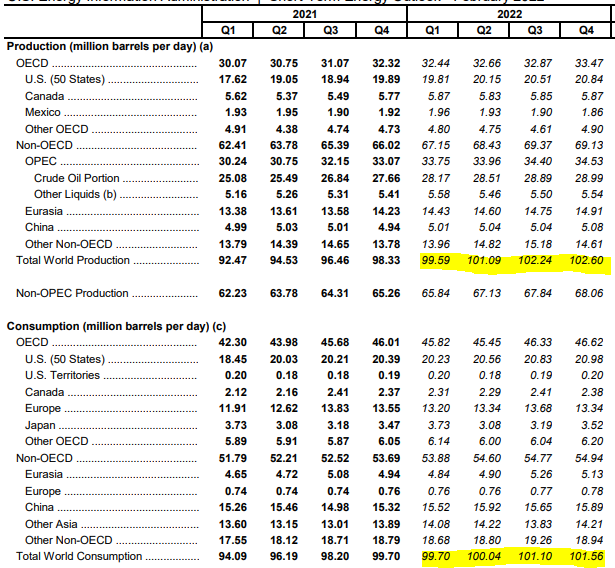

To the extent that global production and consumption are currently even, and we are looking at a ~1mbpd surplus from next quarter, every 0.5mbpd can add up.

Whether Iran and Venezuela will play ball is a whole separate matter, but from the math point of view, it can stave off the price spikes that will otherwise inevitably follow because of demand inelasticity.

(Source)

If that’s the angle you are looking at, you might want to also watch HAL,BKR,LPI,CRK,CLR

Not sure what is going on with TUSK but it really moved Friday and also this PM. Might be worth keeping an eye on.

SHEL saving face, may be worth a watch this morning