I listen to hedge fund manager Erik Townsend’s MacroVoices podcast, mainly following crude oil alongside other macro market trends. In a recent interview, he discussed the ramifications of the economy reopening and the impact on global energy. Here is an outtake of the conversation:

" Well, let me tell you how I look at energy very briefly. You know, for me, there’s really, if I look at the past 20 years, there’s really two different periods, there’s a 2000 to 2015. And then there’s a 2015 to COVID. Basically, you know, 2000 to 2015, the world goes from using 400 exajoules jewels a year to 500 exajoules a year. And out of that 500, 61 comes from China and out of that 61 from China, 51 come from coal. Meanwhile, there’s basically no increase in the consumption of energy from 2000 to 2015, across the OECD. So basically, what happened between 2000 in 2015, to cut a very long story short, is that the world decided, you know what, I still want to consume a lot of these goods. But I’m going to outsource the production to China. And China’s going to produce them, not with expensive natural gas and not with expensive oil or expensive nuclear, but China is going to produce them by using very cheap coal. Because coal is much cheaper than everything, anything else. You know, if it wasn’t so darn polluting, we’d be using nothing but coal. It’s easy to move. It’s cheap, cheap to move, it’s easy to exploit. And there’s so much of it around the world. So what happened between 2000 and 2015 is basically half of the world’s increase in energy supply was done by Chinese coil. And at the cost of just enormous environmental devastation in China, you know, you were spending time there at the time so was I.

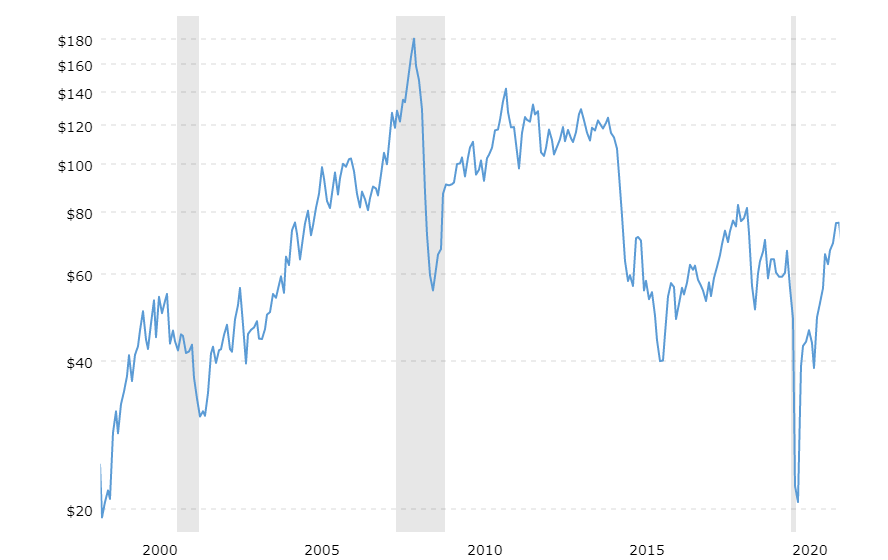

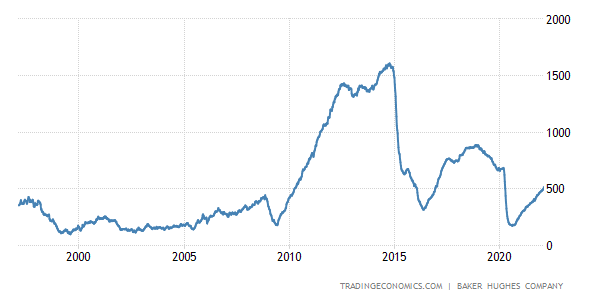

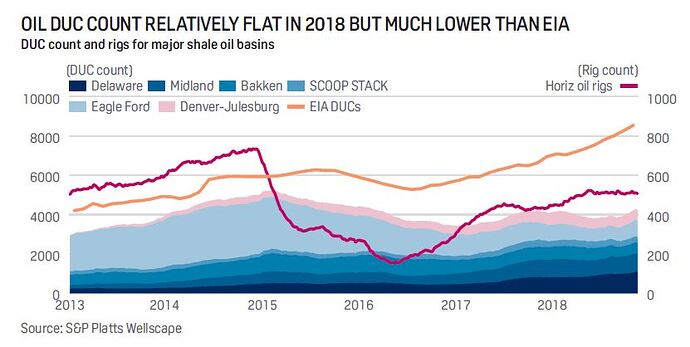

And then in 2015, China basically says, you know, what, I’m done. You know, I’m, you know, I’ve got, I’ve got babies dying of asthma, I, you know, I can’t do this anymore. And since then, coil used in China has flatlined. Now, we were saved because in 2015, the US oil and shale gasboom kicks in. So the US moves from five and a half million barrels per day, to 13 million barrels per day. And instead of using Chinese coal, we use US natural gas and US oil. But that boom is now over, because that boom was massively capital intensive. In fact, it was capital destructive. More than $300 billion were destroyed in the shale oil patch. It was massively destructive. And that brings us to today. Now, you know, COVID has set us back in terms of global energy use. But if we think that by 2022-2023, you know, will be roughly back to normal in terms of global travel in terms of everything else, then basically, that means that between now and the end of 2023, the world will need to produce an additional 50 or 60 exajoules, knowing that it won’t come from Chinese coal, and knowing that it won’t come from the US oil patch. So where’s it gonna come from? The answer is, I don’t know. But I think that’s problematic ."

The full transcript can be found here: https://www.macrovoices.com/guest-content/list-guest-transcripts/4489-2021-12-30-transcript-of-the-podcast-interview-between-erik-townsend-and-louis-vincent-gave/file

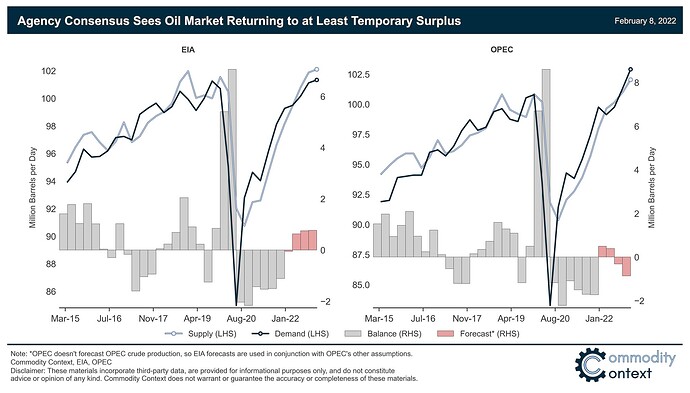

While the consensus is that the final years of the era of oil will be defined by very, very expensive oil (maybe, $150 to $200 per barrel) not by cheap, due to the lack of investment in continued oil exploration and production, coupled with low returns on green energy, agency consensus sees market returning to oversupply this year.

In other words, major monitoring agencies expect oil market pressures to ease over the coming months and conditions to flip, at least temporarily, into surplus through 2022. These agency outlooks for easing oil market pressure rely on 5 common assumptions:

- Rebounding US shale

- Further unwinding of COVID-era OPEC+ cuts

- All-time high production for non-OPEC producers outside the US and Russia

- Unchanged Iranian and Venezuelan oil sanctions

- A complete post-pandemic demand recovery

The SubStack linked below summarises the forecasts of OPEC (the Monthly Oil Market Report (MOMR)) and the EIA (the Short Term Energy Outlook (STEO)).

Oil Bullish on the Streets, Bearish in the Forecast Sheets

Ultimately, what is relevant here is that if you agree that we will see a market surplus shortly, you may consider adjusting your timelines for either entry or expected returns.