OPFI

I found this on reddit, but I want some better insight on this since I do not have the skills/knowledge to do it myself.

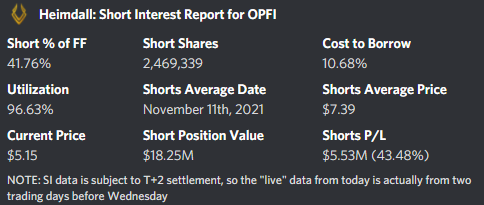

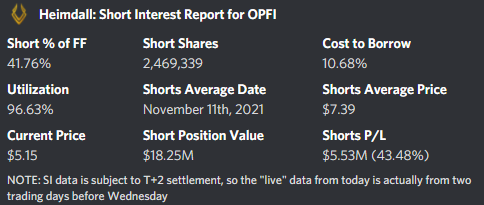

Data from our bot:

OPFI

I found this on reddit, but I want some better insight on this since I do not have the skills/knowledge to do it myself.

Data from our bot:

Thats a pretty broad question, but based on the cursory information I looked into, OppFi ($OPFI) is a severely beaten down Fintech company that targets the customer demographic of ‘subprime’ loans rather than the prime loans that the larger fintech players in this niche target.

That said w/ OPFI they are competing for market share (customers; subprimes) that isn’t all that competitive. It gives them a shot for upside, and I believe it’s not going to be a fundamentally sound eval for this stock to go past ~$13-15, but at its current valuation of ~$5-6 the argument can be made that it is undervalued.

With UPST, PayPal, SOFI, and other fintech plays catching a bit a rising tide so far this week recovering from that tech selloff, I’m looking for sympathy plays w/in Fintech. If the market enters/flips back to risk-off into CPI/Fed talks, it could damp the momentum on this that it was accumulating. That said, I think there is a Bull case at least for a longer term hold or swing for when indexes are more stable and wanting a Pamp.

—————-

Caveat: the stats shared regard Short Interest… well damn that is shorted to a pretty extreme level. Now that could be because the company sucks, sometimes the shorts are right 🤷. If not though, on the Bull case, a lift for fintechs & small-caps generally could give this sympathy tailwinds for the sector, + just some good action from a strong overall market (when we have those conditions align), could end up causing some of those short positions to cover in bursts exerting higher pressure on the buy side as well.

Bear Point(s): With that said though, the SI% is high, yea, but the Cost to Borrow CTB is low relative to other squeeze plays, and the stats that really get me interested in some volatile squeeze plays aren’t at levels that would catch my interest in my personal screeners for things like that. Needs volume to really step in as well, so going into Friday CPI & JPOW/Fed talks early next week, the conditions don’t look awesome for an entry based on my personal criteria, but I’m no expert on short squeeze stocks.

TBH I’ve literally considered going on Reddit on those subs that cycle through ‘squeeze’ tickers, taking notes on the lists that are getting really ridiculous amounts of rockets & other emojis in the DD, with asinine comment threads saying shit like “I hold for YOU, blah blah” and then putting them on a bear watchlist for potential put/short play - BBIG fun ride from 10+ to under $3 comes to mind…  - and then taking puts like many here did with BBIG

- and then taking puts like many here did with BBIG  . I’m not against quick flips when those kinds of plays hit bottom and get some momentum upward, but -

. I’m not against quick flips when those kinds of plays hit bottom and get some momentum upward, but -

If you do start going long on Reddit squeeze plays, just personally I’ve found scalp/quick swings the way to go, I’m not against riding momentum on bad stocks in the shorter time frames like daytrading, but that’s more watching on the 5m/Daily chart.

Closing Thoughts

I’m watchlisting but have not taken entry yet as I see some other quicker intra-day plays lately, like RBLX & ROKU yesterday for example, and was playing intraday calls on the weekly expiry’s. The current market conditions aren’t that conducive to successful swings are high risk assets, as the chop has been really killing those types of plays that I’ve tried in the past month or so.

In an overall bull market/rally, I’d be willing to give this more attention though. What are your thoughts?

Thanks for your input!

You are probably correct about the company sucking but the extreme shorting tend to cause volatility wich could favor us if timed correctly.

Im in for a little share position but not expecting any major action. Taking profits or loss early.

Yea nothing wrong with taking a starter, just have planned out (and set) Stops that you adjust as it moves if you DO get that upside pop you’re looking for so if it turns against you, you get stopped out profitable. Conversely, tight stops if your wrong (esp on the calls), but with a share position if you were personally bullish on this, could hedge directionally and also sell covered calls - how are the premiums on this ticker?

Just curious, what is your PT? Also, Entry Condition/Trigger & Exit strat for it?

If it gets volume stepping in (check the On Balance Volume too - OBV) and you do get some Pamp, there is some potential gapfill on the chart I see, so could fill that with some push to the upside.

I dont use options. Swedish broker & Swedish standard tax (0.375%…) boomer warning!

I dont have any PT, it really depends on the momentum. 10%+ gains would be okay with a small play but if there’s any momentum with short covering I might stick around longer.

About the same with loss.

Again I dont have any big plans and wanted some input if there’s something “bigger” that I didnt see.