This one still has my curiosity, but since I missed safe entry I will watch it this week and may enter if it drops or wait till OPEX then enter. Also based on volume from past jumps it could mean this will run out of steam in the next few days but finally read all this dd and seems like a decent play. GL all.

My calls are all at least 1expo away. From my pov, anything under 7 is cheap af right now.

I don’t expect this to be a short term play, but who knows.

Buyback programs sometimes takes longer than ideal, but Opfi has cash to spare atm.

Shares are better accumulated here, with longer call opex as the safest big gambles.

Just finished reading this DD.

- So no target date set for buyback but thoughts are it’ll happen sooner than later since price is low

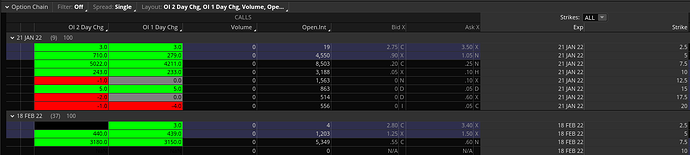

- The option chain is pretty light. January expiry seems a little risky.

- Theta on Feb 7.5c’s is about 1% on ask right now. If this pop’s soon it could be nice but you’ll definitely feel that burn on any large position

- January 7.5c’s is even higher

Think ima scoop some Feb 7.5c’s and go from there

Thanks for this DD I got in Monday and out yesterday about +60%

I appreciate you all!

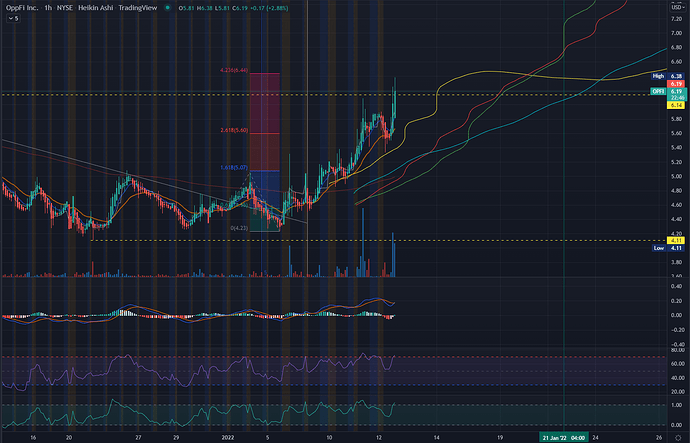

Watch that 5.50 support here. Again rejection off 6. Could see 5.25 or 5 if it falls below.

It is trending nicely today in an ascending triangle with that 5.50 support, resistance was at 5.60. Small area I know. I did get some fills on some Feb calls to try this play even at this level. Not really a large positions but why not. I am bored.

I am still pretty sick so let me clarify my bad punctuation. I did not trust OPFI enough to make an entry at these higher prices. Lower entry I mentioned above was why. It held around that 5.50 and I bought support. Most on this server have now made 50% to over 100% on this play so I owe a thanks to @magician but as always don’t buy peaks and play smart. Entry points matter.

So far, this is outperforming all the ideas I posted…

Should it hold above this 6.14 resistance line for a day or two, it can only be more bullish.

There will be dips here and there, so no need to chase positions.

Really good play and I wish we would have gotten in even earlier but who can complain with the profits already from this play. Very well done and thanks all above that added to this. Another win for the server for those that got in and it could run some more. I just like profits. GL all!

OPFI has been gaining all week, with little pull-back.

There’s usually profit taking after 3-4day run-ups, so there should be no need to fomo into this play.

Watch out for Friday’s dip, if you’re still wanting to start a position or add.

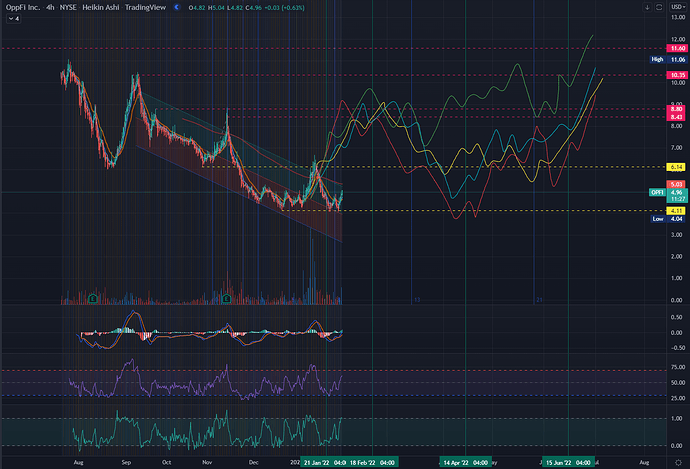

Watch for new support. So far the peak was called out short term. We could continue this as a long term play so don’t take my words so negative. I am often focused on short term gains and when you see 100 to 200% it’s a no brainer for short term. I want to look more into this play and will try to comment later tonight or tomorrow. All in all, lots made profit from this. If long on this. I like a 4.50 to 4.30 entry but I know I’m picky. TBC

What you think JB? Good entry?

After seeing more and more people involved in the pump reddits on this stock, I don’t think this is a great play and believe my initial thought is correct on this play. I am buying nothing long until later in the week. And long for me is maybe 1-2 weeks lol. If you are long and believe this company to be good long term, then this might be a good entry around 4.

10-4 I’m gonna follow your approach, Thanks JB!

I’m going to co-sign this and say that these “buyback plays” are often nonsense. We saw it go down with RKT and countless others where retail thinks “Ok, this is the spot where its going to happen”… anddddd nothing. They give themselves long timeframes for a reason. We were thinking RKT was going to buy back when the stock was at $20… it’s currently at $12.

This company may be worth a look for a long-term hold scenario, but as for the buyback in the immediate future, I’m unsure.

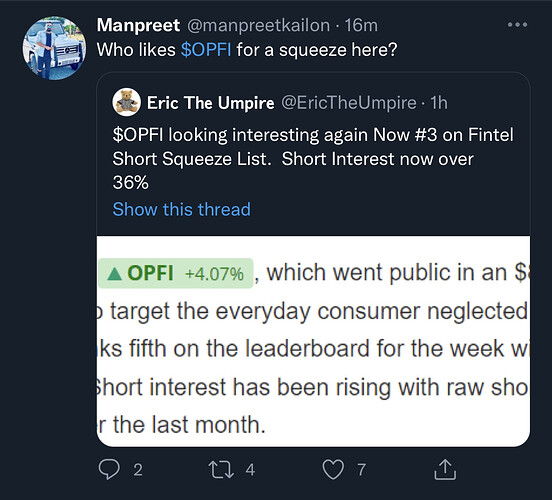

This tweet was posted to TF by @T_Milly:

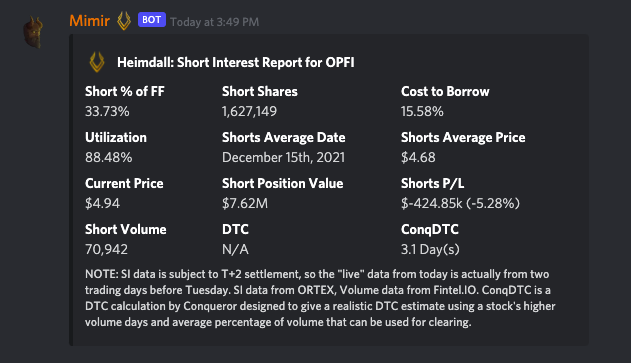

Now if we look at Mimir:

While this position is theoretically “squeezable” as in the SI% of FF is high enough and the average daily volume is low enough to give us a DTC of 3.1 days, you’ll notice the P/L on this one is only -5%, which is nowhere near down enough to initiate covering.

As @thots_and_prayers wisely pointed out, they may claim that the buyback would push this into a short squeeze, but you have to remember that they have years to do that. Also, when they do, they can only buy back so much at once. You’re not going to see a candle rocket the price into the afterlife. They’re going to slowly reacquire as cheaply as they can over time.

Should the shorts P/L get closer to between 30-40% down, sure. But at this price point, definitely not a short squeeze.

I’d listen to Conq’s input on this.

In my portion of the original work above, I mentioned that I wanted to see it get rejected between 6-8–and it did…

The chart shows obvious deviation from my ideas, which required a maintained bullish market even without great retail sentiment.

I now personally think that we will see $3 first, before OPFI tries for 8 again.

Once again, I hope I’m wrong, but in the long run, that’s a longer window of opportunity for this long play.

You can swing trade this stock both ways, but since it’s at a very low price, leap calls may be the safest plays.