DD from our friend Magician -

Ticker: $OPFI

Exchange: NYSE

Share price: $5.16

Market Cap: 567.4M

Shares Outstanding: 110M

Public Float: 12.47M-13.57M

Institutional Ownership: 6,074,084

OppFi is a fintech player using technology to provide subprime borrowers access to credit and loans. Their mission statement reads “We empower everyday consumers to rebuild financial health through facilitating credit access, enabling savings, and building wealth.”

Disclosure:

OWNERSHIP: The author owns $OPFI shares, warrants, and options.

NOT INVESTMENT ADVICE: This document is provided for informational purposes only, you should not construe any information or other material as legal, tax, investment, financial, or other advice. Nothing contained constitutes a solicitation, recommendation, endorsement, or offer by the author or any third party service provider to buy or sell any securities or other financial instruments. Nothing in this document constitutes professional and/or financial advice, nor does any information displayed constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. The author is not a fiduciary by virtue of any person’s use of or access to this document. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information before making any decisions based on such information. You agree not to hold the author, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information this document.

The view from 30,000 Feet:

OppFi went public in July 2021 via SPAC at a time when people were running from SPACs. The capital structure with heavy private ownership of Class V private shares distorts the market cap calculation. (Many sites report market cap near 60-70M using only class A common shares). And most importantly the nature of their business targeting subprime consumers immediately turns-off many Wall Street and even fiscally responsible individuals who mistake high APRs as predatory, rather than the cheapest option available from a responsible team and partner working with its clients, and that is loved by the borrowers. Profitable and successful before entrance into the public markets, $OPFI has since been aggressively shorted and beaten down to absurd valuations given their revenue and growth numbers.

Why you should listen to me

You shouldn’t. Realistically, I’m not doing much special here. I’m pulling public information, gathered from earnings reports, presentations, SEC filings, etc. You should never make a financial decision based on what anyone on the internet says or writes. Talk to a professional registered financial adviser.

My background

I’m a retail investor with a strong interest in undervalued companies, who spends all his time reading and researching ideas. In July of 2020 I was pitching a stock. I noted it was a misunderstood company and investment, and that the prevailing public, retail, and street sentiment wasn’t based on the fundamentals or the balance sheet. I saw a deep value play where heavy short interest had pushed a company’s share price out of alignment with the reality of their financials. I saw the company as being well positioned with upcoming catalysts, excessively shorted, undervalued, misunderstood, and I believed there was opportunity.

This company was $GME. And my entry was roughly $4 a share.

Notably, $OPFI has some of the same characteristics.

Highlights:

Value:

- Profitable since 2015, a rare feat in fintech

- Trading at a fraction of competitors’ multiples

- Delivered 40% of UPST Q3 Total Revenue, trading at 6% of UPST market cap. (567.4M vs 9.48B)

- Delivered 33% of SOFI Q3 Total Revenue, trading at 5% of SOFI market cap. (567.4M vs 11.09B)

Growth:

- 50% CAGR 5 years preceding public listing

- Q3 had adjusted 17% sequential and 25% YoY revenue growth

- Recently Launched SalaryTap product offering sub 36% APRs

- OppFi card being tested for introduction as a graduation product

- Large TAM, with roughly half of Americans reporting $1000 or less in savings

Timing:

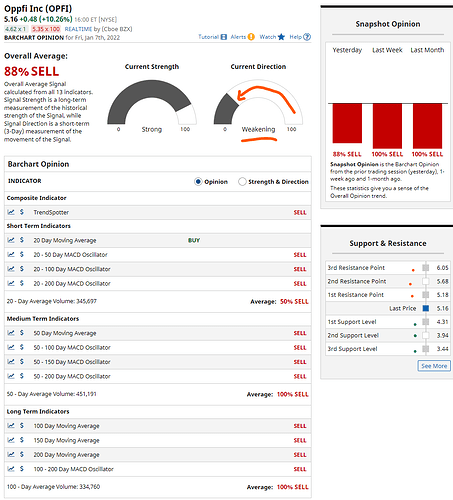

- Shares down 50% from successful SPAC combination

- Stock is trading near 52wk lows, despite recent bump

- New CEO effective Jan 1, 2022 (Neville Crawley)

- $20M share repurchase program announced Jan 6 '22

- Aggressively sold and shorted post Q3 ER

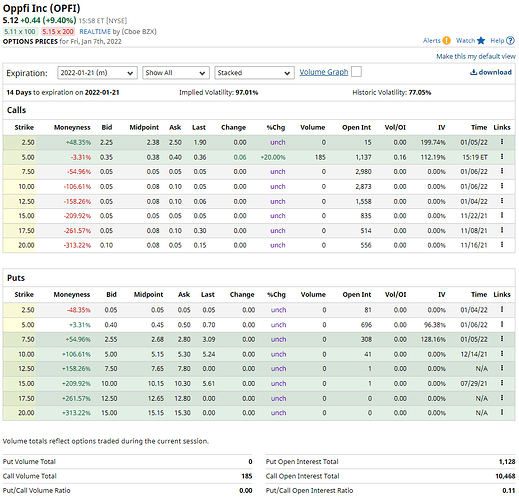

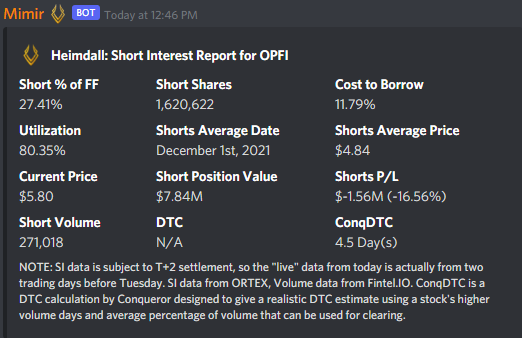

- Ortex estimated SI% of Float @ 26%

- Latest Exchange Reported Short Interest (settlement Dec. 15): 1,278,628 shares

- Exchange Reported SI% of Float: 21.62%

- Next release of Exchange Reported Short Interest: Jan 11th(settlement Dec. 31)

Full 2021 Guidance per Q3:

- Revenue: 350-360M

- Adj. EBITDA: 120-125M

- Adj. Income: 122-126M

Industry & Competition:

What does OPFI’s industry look like? Who are they competing with? And who are they competing for?

$OPFI is in a unique spot here. They are similar to $SOFI in ways, but targeting the subprime market entails more risk.

$OPFI is among a new breed of digital lenders. While most of $OPFI’s mainstream competitors target the prime market, $OPFI has positioned to help subprime borrowers get access to credit and loans, while simultaneously offering them resources to grow their financial health and further engage with the company’s products and services.

Given $OPFI’s revenue and growth, I am comparing them to two well known and prominent names in the sector, SOFI, and Upstart. While these company’s have more public mindshare, $OPFI’s numbers should put them in the conversation given similarities in business approach and sector.

Competitor Fundamentals

OPFI

- Market cap: 567.4M

- Q3 2021 Revenue: $72.89 million - up 62.42% YoY

- Q3 Adjusted EBITDA: $31,779M

- Net Operating Cash Flow: 168.78M

UPST

- Market cap: 9.6B

- Q3 2021 Revenue: $228 million - up 50% YoY

- Q3 Adjusted EBITDA: $59,139M

- Net Operating Cash Flow: 248.01M

SOFI

- Market cap: 11.09B

- Q3 2021 Revenue: $277 million - up 28% YoY

- Q3 Adjusted EBITDA: $10,256M

- Net Operating Cash Flow: -108.75M

Valuation with Peer Multiples:

As seen in peer comparisons, $OPFI did between 33% and 40% of the total revenue of $UPST and $SOFI respectively in Q3. Normally I would pull far more ratios for comparison, including PE, PEG, price to sales, etc. However given OPFI is less than a year on the public markets, and accounting for gaap / non-gaap on several of these companies becomes challenging, I find it easiest for a broad picture view to simply compare market cap, revenue, and EBITDA.There are others I’m sure who can investigate more fully and find all the metrics for a more detailed breakdown.

The ballpark estimate gives a general idea of where OPFI is performing in comparison to UPST and SOFI.

If OPFI were valued at a very conservative 20% of the average market cap between the two ($10.345B), $OPFI’s market cap would be $2.069B.

At that valuation, shares would trade at $18.80

While this is just a simple comparative valuation using few metrics, it exposes that presently, $OPFI trades at a significant discount to other players in the space given the revenue and growth they have delivered. Some of this may be attributed to their increased risk profile in dealing with subprime borrowers, and their short history as a public company.

Management and Ownership:

The share structure of this company is another factor that may make Wall Street investors and funds turn away. The total shares outstanding is 110M; however, 96.5M of these shares are Class V voting shares are held by Executive and Chairman Todd G Schwartz.

Share Breakdown:

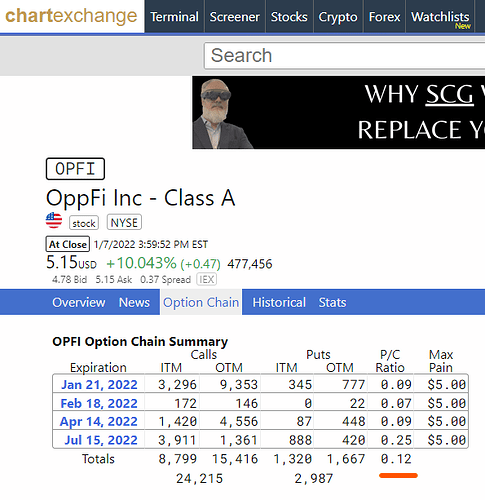

Class A Common Shares: 13,464,542

Class V Voting Shares: 96,500,241

Institutional Ownership: Per Nasdaq.com, there are presently 80 institutional holders with a combined share ownership of 6,074,084. Fintel alternatively shows 60 institutional holders and total ownership of 8,561,054 shares.

Given the difficulty in assessing this number accurately due to trades made between reporting periods, I am assuming the number is at least 6M+ shares held by institutions. This represents 45% of the shares. Thus, the public tradeable float would be reduced to roughly 7,464,542 shares. Other estimates put the free float far lower, at roughly 5.9M shares.

This is an extremely low float stock.

OPFI does have warrants. Presently, they are trading at $0.83. The warrants will expire on July 20 2026. There is a complicated structure from the initial business combination where warrants were issues various as founder warrants, underwriter warrants, private placement warrants, etc. Some of the founder shares warrants were returned before the completion.

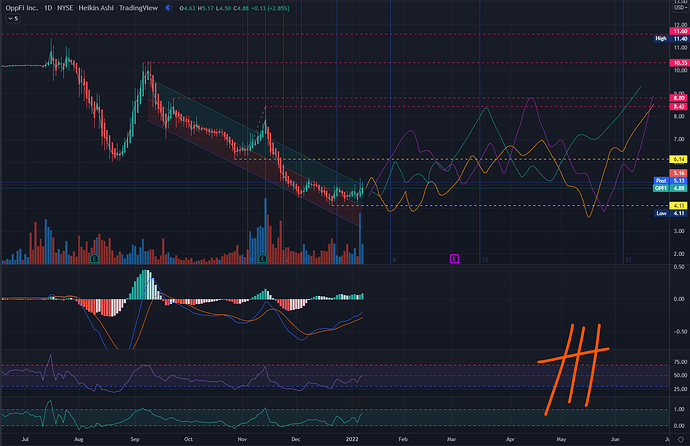

Share Price History

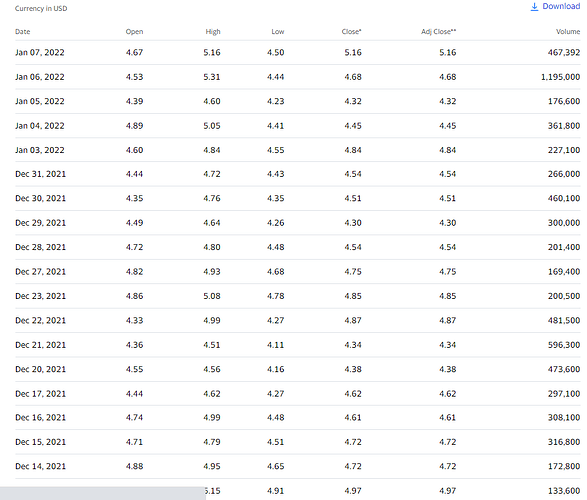

When FGNA completed the merger taking OppFi public in July, the stock was trading near the SPAC NAV. Shares were in the $10 range. Following completion, the share price has gone down dramatically. From September to October 2021 share prices declined from $10 to $6. There was a substantial run prior to Q3 earnings. Shares hit $8.4 as the company released Q3 numbers that beat consensus EPS and revenue. Since then, $OPFI has seen a precipitous decline. Post Q3 2021 earnings, a surge in short selling (Ortex estimated SI% of float nearing 40-45%) accelerated a broader fintech selloff. $OPFI shares fell to the $4-$5 range.

Clearly being a shareholder has been difficult. Those who owned at $10 are now down roughly 50-60%. The whiplash from extreme swings and harsh selloffs is difficult to weather.

However it should be noted that the extreme volatility of this stock caused by the incredibly small public float (13.5M shares before accounting for institutional ownership) can work in both directions. Catalysts, positive earnings, upward revisions, and short exits, may move the share price at an accelerated rate as a result.

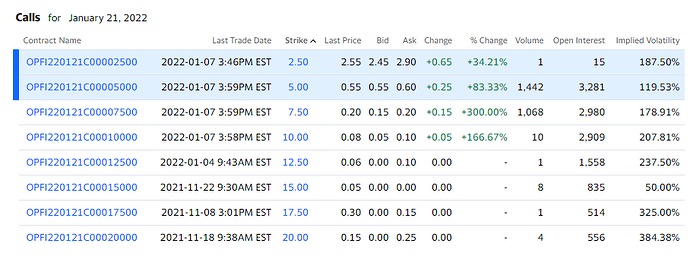

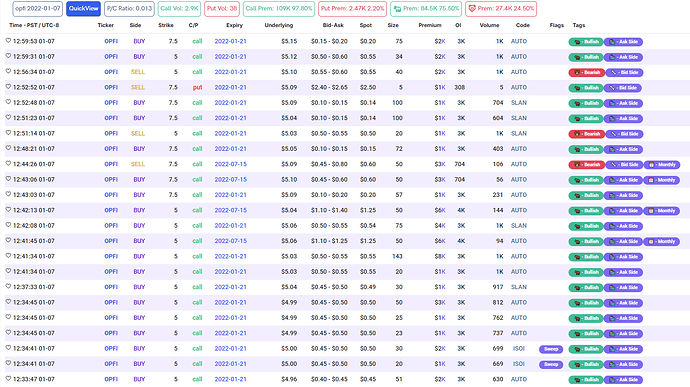

Short-Squeeze Scenario

OPFI has been heavily shorted, especially as noted following their beat on revenue and EPS at Q3 earnings. While Ortex SI% of float estimates have varied, it has reached as high as the low 40s, and currently sits around 25-26%.

With such a small trade-able number of shares (roughly 13.5M class A common shares), a short squeeze is very much a consideration.

In evaluating such a thing it should be noted that the setup here has many of the factors one looks for.

- Latest Exchange Reported Short Interest (settlement Dec. 15): 1,278,628 shares

- Exchange Reported SI% of Float: roughly 21.5% (using a 6M pubilcly available freefloat number)

- Next release of Exchange Reported Short Interest: Jan 11th(settlement Dec. 31)

- Ortex estimated SI% of Free-Float: 26%

- Days to Cover: 5.6

- Catalyst: $20M in share buybacks.

- Catalyst: Upcoming earnings

Estimations, Expectations, Projections:

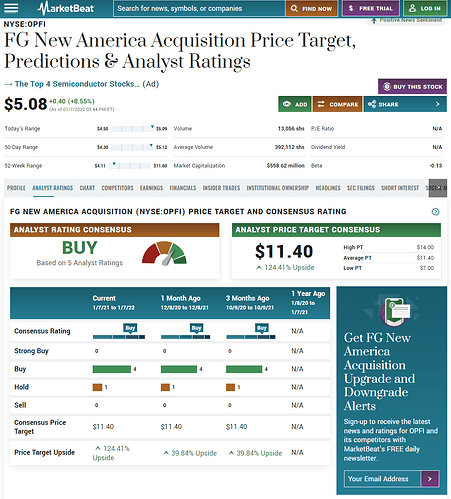

Average Analyst Price Target: $10.5 (Low: 7, High: 14)

This represents analysts’ belief in roughly 100% upside.

$OPFI Full 2021 Guidance per Q3 ER Presentation:

- Revenue: 350-360M

- Adj. EBITDA: 120-125M

- Adj. Income: 122-126M

Risk Factors

Federal Regulation - A 36% Interest Rate Cap

I view this as ‘THE’ primary risk factor for OPFI. This is focused on potential legislation at the federal level to cap interest rates at 36%.

The ‘Veterans and Consumers Fair Credit Act of 2021’ was introduced in Summer 2021, then reintroduced in October. It would install a 36% cap.

The regulatory risk from a bill like this should not be ignored. “Specifically, the bill caps the interest rate on extensions of consumer credit at 36%” - were this to pass, the subprime market would be effectively killed in my estimation. Unless the government took over the task of lending to subprime borrowers, this entire market would be damaged.

I believe politicians see high APRs in the 50-120% range and see malice. But I wonder if they’ve read the data and the details about small dollar loans and lending.

According to a report published by the Federal Reserve on August 12, 2020, break even APRs are quite high for small loan amounts.

According to a research by the US Federal Reserve, a $494.00 loan requires an APR of 103.54% for a lender to break even and a loan amount of $2,530 being necessary for the lender to break even at an APR of 36%.

Meaning essentially, for smaller dollar amount loans, a greater APR is required for lenders to even breakeven. $OPFI has managed to offer sub 36% at times thanks to their savings via automation.

Despite the math here, politics may drive some to push further for this legislation, and in my view it would negatively impact or destroy the entire subprime market, sweeping up $OPFI in the process.

Regulatory Lawsuits

OPFI recently settled a lawsuit in DC. D.C. Attorney General Karl A. Racine’s office sued OppFi rather publicly. $OPFI settled to avoid the expense of protracted litigation, while denying having violated any law or engaging in anything deceptive, and paid 2.2M in refunds / waived interest and a 250K fine to the city.

Economic downturn / rising rate environment

Given the inflation we have seen this is worth considering. In an economic downturn where borrowers have diminished ability to repay their loans, the charge-off rate for $OPFI may increase. Still it’s worth noting that historically, in sudden economic downturns (for example in New Orleans post Katrina), small lenders were hit far less, and their loan repayment didn’t struggle nearly as much as larger lenders. As the company does buyback the loans from their bank lending partners, OPFI would need to carefully manage their balance sheet in such an environment in order to remain profitable.

The Play

Having established $OPFI is fundamentally undervalued, especially using comps to peers in the industry, and is a growth fintech trading like a value stock, I have built a long position. I also want to take advantage of what I perceive to be extraordinary potential for a short squeeze, given the excessively high short interest and the very small public float.