One project that I’ve had in the back of my mind for a bit is developing tools to optimize the selection of options on potential plays. There are tools which do something like this already, mainly Options Trade Optimizer - Maximize ROI or Chance of Profit | OptionStrat. However, I don’t think it really offers enough features to make it reliable.

So here’s the goal, this thread isn’t so much about creating the tool, I can do that in Mimir easily, however, it’s about the calculations and determining the formula/conditions that we’re after to select “the right option” in a situation. Obviously there will be an element of choice, but we want to know if there are things that maybe should impact our decision.

So here’s what I’m thinking, two main features:

1. Option Optimization Tool

We have our own internal process for selecting “the right strike” and I’d basically like to turn that into an automated tool.

This tool should be capable of taking in a ticker input and outputting the optimum strikes and expirations to take. I would imagine a combination of analyzing greeks and OI/volume should be included. In addition to this, I’d like to build in warnings against taking an FD on the same week of expiration and other helpful hints to help everyone make a little better choices.

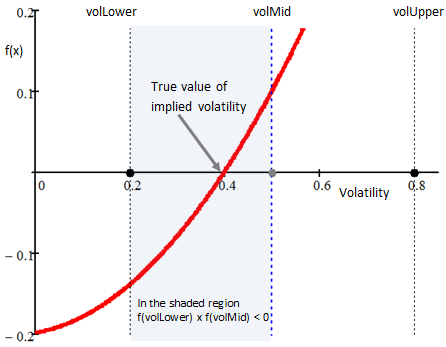

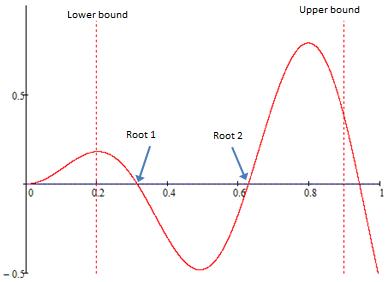

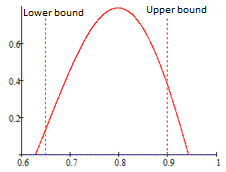

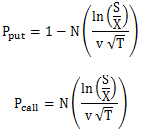

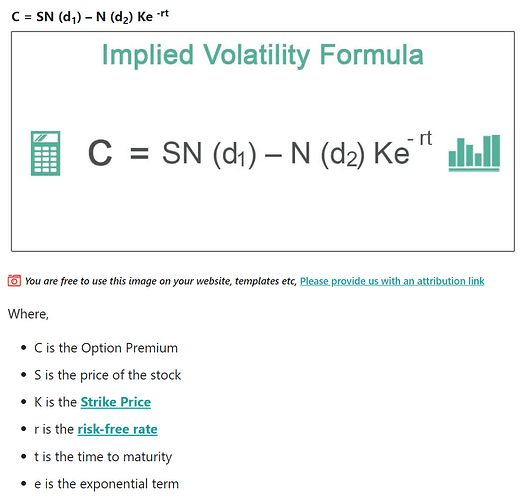

2. IV Crush/Spike Projection Tool

This is something that I’ve wanted for a bit. This tool should be capable of taking an option contract input and predicting IV movement to the bullish and bearish direction. There are methodologies for doing this, however, I’m not an expert in this field so I’m going to have to lean on your guys to accomplish it.

With these features combined, I think we could move towards taking some of guesswork out of options and help boost the profitability of the server by reducing “wrong choices” because we missed a certain variable.

I’m open for input on what we should be looking at and how it should be implemented.