Placeholder for now as I’ll be growing this page some, but I want to take a moment to write about some of the Greeks, how they interact with various market variables, and how these Greeks can aide in the decision making process of what strike to get, what expiry, how much to expect, etc etc.

[size=6]The Greeks and You[/size]

There are a few first and second order greeks that some of us understand, some of us hear and pretend to understand, and some of us don’t even pretend to understand at all. I’d like to try to take some Greeks conversation and turn them into digestible words, and some use cases for how we can weaponize them in our favor. I’ll include screenshots from Robinhood’s UI because that’s one place I’ve found them to be easily digestible. Fair warning, while I will try to make this as understandable as possible there will be a little bit of math

The Greeks tend to be an after-thought when we’re positioning on the fly. They’re actually very important and can help you identify optimal strikes based on anticipated movements.

[size=5]A List of Greeks[/size]

First order Greeks are directly related to some element of the underlying or the option itself. These include:

- Delta - An option’s sensitivity to changes in the underlying price

- Vega - An option’s sensitivity to changes in the volatility of the option

- Rho - An option’s sensitivity to changes in interest rate

- Theta - An option’s sensitivity to changes in time until expiration

- Lambda/Omega - An option’s sensitivity to the percentage change in the underlying price

Second order Greeks are similar, but they measure the sensitivity of the First Order Greeks. These include:

- Charm - Delta decay, measures the sensitivity of the option price to small changes in underlying price and passage of time, the effect of theta given small changes in the underlying price, or the sensitivity of delta to the passage of time

- Gamma - The sensitivity of Delta to changes in the underlying price

- Vanna - The sensitivity of Vega to changes in the underlying price and the sensitivity of delta to changes in volatility

- Vera (Rhova) - The sensitivity of rho to changes in volatility and the sensitivity of vega to changes in interest rates

- Veta - The sensitivity of vega to the passage of time and the changes of theta to changes in volatility

- Vomma - The sensitivity of vega to changes in volatility

Quick Analogy

First order greeks change at a rate of the second order greeks. Straightforward, right? Think of first order Greeks as the speed of your car right now, and second order Greeks as the rate at which you are accelerating. If you were getting on the highway and were traveling at 45 mph, that may not matter right now when in a few seconds you’ll be up to 65mph (or 80, 90…). The rate at which you’re accelerating is also very important because it’s how quickly you’ll reach your target speed. Think of First Order as your Speed, and Second Order as your Acceleration (this is not a perfect metaphor).

[size=4]Delta and Gamma[/size]

Special Note

Options Delta for Puts are expressed as negative numbers, and Delta for Calls are expressed as positive numbers. Gamma is always expressed as positive regardless of position type. For the purposes of formulas I will express Delta as |D|, meaning the absolute value of Delta.

Options Premiums

Delta and Gamma are two of the easier Greeks to explain. Quite simply it describes how much an options premium will move given a $1 change in the underlying security (a stock’s price). Delta says “add D to your option’s premium O1 for every Δ move in the stock price resulting in new option’s premium O2” and Gamma says “add Y to Delta for every Δ move”. This results in something that looks like this, expressed algebraically:

O2 = O1 + Δ(|D| + G)

Moving past the esoteric symbols and letters, basically Gamma is added to or subtracted from Delta for every $1 change in the underlying, and Delta is added to or subtracted from the premium of your option. This is also evaluated at fractional dollars, giving us a grid that may look like this assuming Gamma is constant (spoiler alert - it isn’t):

| Price | Options Premium | Delta | Gamma |

|---|---|---|---|

| $13.09 | $1.78 | -0.3551 | 0.0658 |

| $13.00 | $1.81 | -0.3610 | 0.0658 |

| $12.90 | $1.84 | -0.3676 | 0.0658 |

| $12.80 | $1.87 | -0.3742 | 0.0658 |

| $12.70 | $1.90 | -0.3808 | 0.0658 |

| $12.60 | $1.93 | -0.3873 | 0.0658 |

| $12.50 | $1.96 | -0.3939 | 0.0658 |

| $12.40 | $1.99 | -0.4005 | 0.0658 |

| $12.30 | $2.03 | -0.4071 | 0.0658 |

| $12.20 | $2.06 | -0.4137 | 0.0658 |

| $12.10 | $2.10 | -0.4202 | 0.0658 |

| $12.00 | $2.13 | -0.4268 | 0.0658 |

An Oversimplified Example

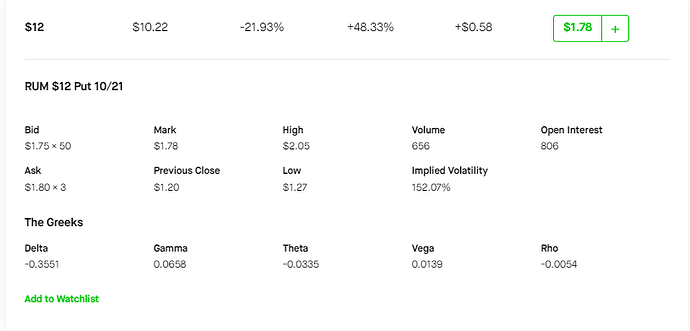

Given a real life example but oversimplifying it by not reevaluating Delta at every penny change of the underlying, let’s look at a $12 put for $RUM (screenshot taken at 6:25PM EDT September 20, 2022).

Current Stock Price (at close): $13.09

Current Options Premium: $1.78

Current Options Delta: -0.3551

Current Options Gamma: 0.0658

In layman’s terms, if $RUM were to drop a dollar from here to $12.09, the options premium would be increased by $0.3551 and the Delta would then increase to 0.4209, making it that much more sensitive to changes in the underlying as it moves deeper in the money. Solely with regards to options premium, this $1 move would result in a premium of $2.14 assuming an environment where Gamma and Delta are the only variables. With the change in Delta, if it were to decrease another $1 to $11.09, the options premium would then increase by $0.42, giving a total premium of $2.56, and the Delta would again increase to 0.49.

Inversely, the same applies in the opposite direction. If $RUM were to raise to $14.09, the options premium would be reduced by the Delta, and the Delta would be reduced by the Gamma (making it less sensitive to price changes). In this example your premium would be reduced by $0.35, and the delta would also be reduced by .06, giving your option a new value of $1.43.