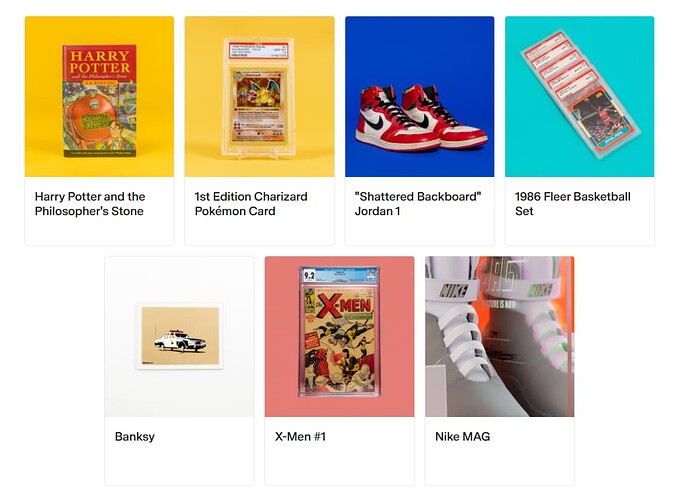

Otis (https://www.withotis.com/) is a company that allows users to buy fractional shares of items that have cultural significance. This includes trading cards, shoes, books, art, NFTs, etc.

How it works:

While it’s not exactly stocks, it functions in a similar way. There’s an underlying item that has an IPO at a certain price per share and a certain number of shares available. That establishes the market cap or value of the item. Usually this is based on recent sales of similar items (if available). Otis authenticates the item itself and interfaces directly with the current owner. Presumably they hold 51%+ of the shares, but I’m not 100% sure how that side of the process works.

After 30-60 days the item shows up in the Otis app for trading. From there, users can submit Bids to buy shares and Asks to sell shares. Just like stocks, when they match, a sale is made and depending on which is accepted, the price moves accordingly.

There are several differences between trading on Otis vs. traditional stocks:

- Obviously, you’re investing in a physical thing not a company.

- Liquidity is low and thus volatility is high (especially at IPOs).

- There is an expectation that the item will get purchased at some point in the future - somewhat true for companies, but less common.

- That means these are more for long term holds versus scalps

- There are no options/warrants.

Regarding IPOs, generally for more highly desirable items there are limits on how many shares you can buy at one time (I guess you could make multiple accounts if you really wanted to). It varies, but I’ve seen it as low as 100 shares (usually $1/share) up to 1000 shares. I believe after the drop happens you could then buy as many as you wanted though. Drops occur in chunks usually and there haven’t been any in a month or two.

Strategy:

Planning to do a follow-up/edit to discuss strategy around these investments, if there is interest.

Full Disclosure:

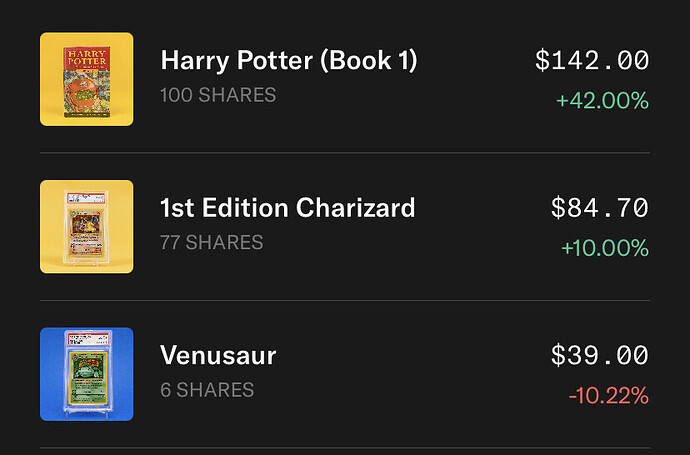

Current investments (unrealized):

Closed investments:

1987 Fleer Michael Jordan Card: Purchased at $10/share ($100), sold at $55 (-$45/-45%)

Meebit #12536 NFT: Purchased at $1/share ($54), sold at $76 (+$24 / +44%)