Obviously I’ve fallen off the diligent reporting that I’d started out with but I wanted to take a second and provide a simply update to the progress of the challenge account. Below is the performance up until this point, the account was started on February 7th and two months have now passed us by:

It’s been a wild two months since we kicked off the challenge with SENS and ASTR. The account had a meteoric climb and a pretty abrupt fall over the course of the first month and while that can be disheartening, things happen. As I said in my RSX reflection post, it’s not a loss that anyone can really blame themselves for and I mirror that sentiment in how I view my own challenge account. But, what I am proud of reflecting on my progress thus far is something that is kinda easy to miss; I haven’t blown up the account and I’m still considerably farther than when I started. Here’s some quick facts about the challenge performance thus far (amounts are adjusted for the 2k debit I made and put back):

Highest Closing Amount: $14,635.79 +1,363%

March 7th, 2022

Just before the halt of RSX, the account hit it’s peak at just under 15K. It’s unfortunate because I was very focused on and excited to activate margin and start day trading for real and it was seemingly stolen from us, but alas, I’m incredible proud of this gain since it occurred entirely on stream and alongside all of you. While the overall challenge has the very lofty goal of turning 1K into 1M, I’m still incredibly proud of this feat on its own.

Lowest Closing Amount: $4,334.69 +333%

March 21st, 2022

And fittingly our lowest close has come after the removal of both RSX & OZON options contracts from the account. If I’m being honest, I’m potentially even prouder of this statistic than I am of the “account high”. One of the things that I harp on most in trading is the ability to “hover” and how important it is to not only be able to make gains, but to be able to stave off losses as well and I feel as though I have demonstrated that throughout the challenge thus far. While debate can be had over position sizing, at the end of the day, the account has remained through the entirety of the challenge thus far up and whole. If I hadn’t recovered a dime past this figure, I’d still be overjoyed with the progress of this account and the fact that we’re on our way up again is just icing on the cake.

Highest Single Day Gain on Account: +85%

From $4,648.79 to $8,516.34 on March 28th, 2022

Meme stocks baby.

Largest Loss on Account from ATH: -70%

From $14,635.79 to $4,334.69 between March 7th, 2022 and March 21st, 2022

Fuck CBOE & VanEck.

Average Dollar Amount Made Per Week: $820

We’ve averaged an impressive $820 per week in profit thus far meaning our average weekly gain on initial investment is about 82%.

Time to Completion at Current Performance

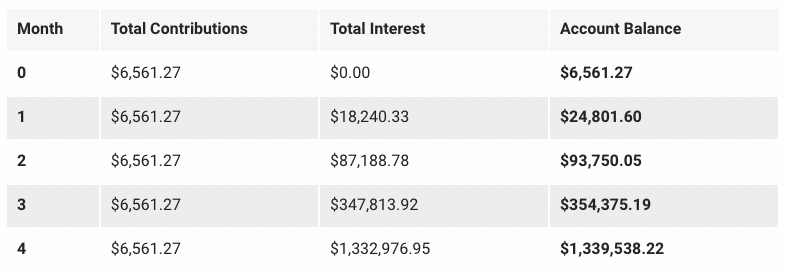

I’m going to preface with what should be obvious… this is purely for fun lol. However, if we take a look at the table below:

If the current performance of the challenge account at this point in time is maintained, the account would theoretically hit goal between 3-4 months from now around July 19th, 2022.

Taking a look at this challenge, despite the ups and downs, I’m still incredibly proud that we chose to take this on. I’m proud of the account, the performance and of the community for all the positivity and help that has been shown and given over these past two months. After a little bit of a reset I’m getting excited about this challenge again and I’m excited to resume our push to goal. I think as we’re in this stage of gearing back up to push again, everyone should take a look at their own accounts and see what has gone right and what has gone wrong. I think I’ll make a post about my own assessment soon as well.

Thanks to everyone again especially for the patience as I’ve dealt with the hits I’ve taken and some of the my personal stuff that has made me a little less active than normal. Here’s to another 550% two months from now! ![]()