[Ported verbatim from: The dirty dozen of bloated tech - a short story - #6 by The_Ni]

Earnings: Feb 22, post-market.

Second to be analyzed is the one which has earnings coming up on Tuesday. It’s the largest company on the list, and one that has shown great relative strength compared to its peers. Or QQQ in general:

PANW is a turnaround story, going from mostly hardware to an increasing focus on software based security solutions. They had handily beat earnings last quarter and guided for 50% growth over 2 years.

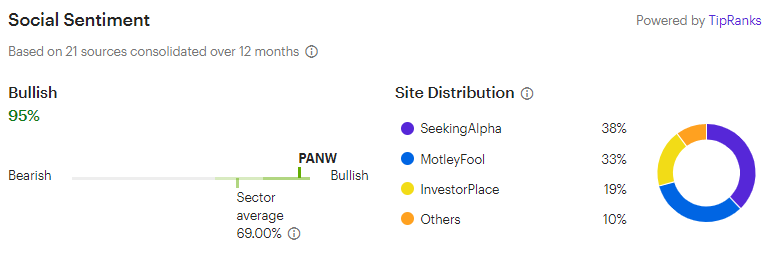

Sentiment continues to be quite bullish:

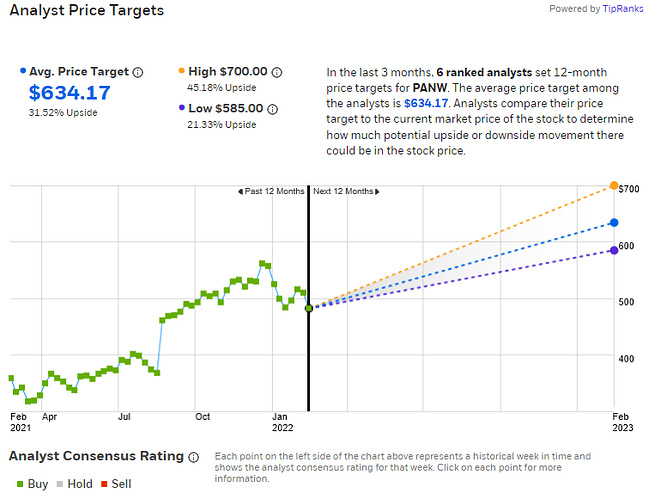

And PTs seem to have significant upside.

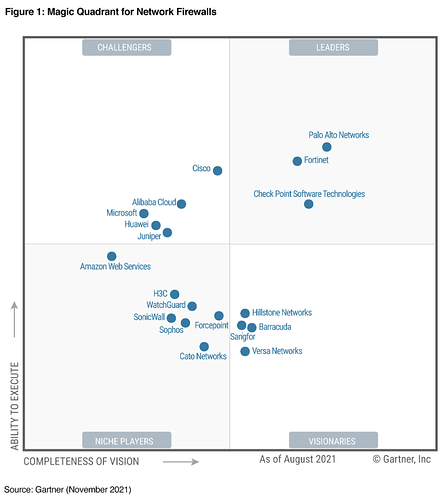

Worth noting though that while they show up at a relatively weaker position compared to ZS on the SSE magic quadrant, they do show up as the leader for Network Firewalls.

A thing about Gartner charts - they create all these niche categories so that they can show as many companies as being leaders in their little (and not so little) corner of the world, so worth discounting for this.

Given PANW’s relatively lower valuation compared to its bloated peers, there is a possibility that their prices might actually go up from an earnings beat, confirmation or improvement of guidance, and … share repurchases. They had already earmarked 676M for this last quarter, and either progress on that repurchase or adding to the repurchase amount might provide tailwind. They certainly seem to have the FCF for it.

In summary, going in with slightly bullish feelings, but not looking to initiate positions pre-earnings.