Covid accelerated the move away from cash payments — both in stores and via the push to online shopping. We do not see that reverting anytime soon. As a result, we believe fintech to be a crucial space for investors to be familiar with.

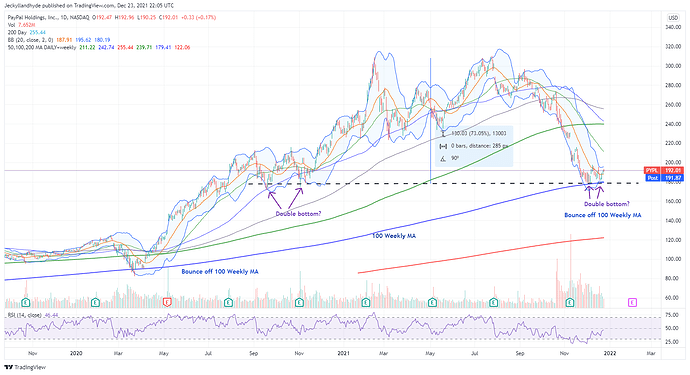

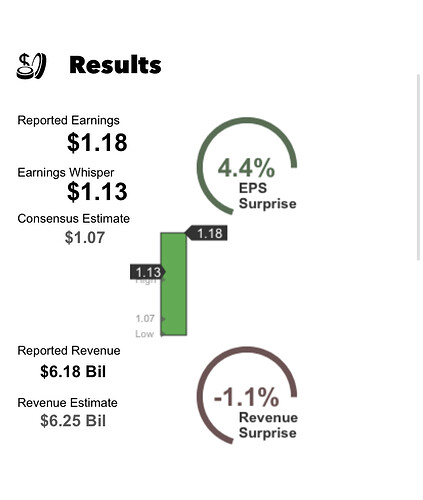

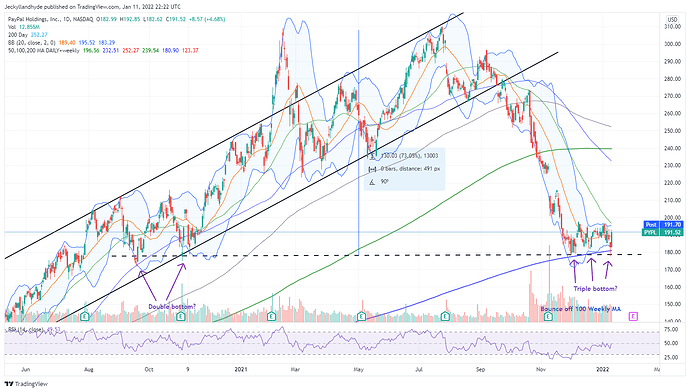

While a slew of fintechs have come public over the past year, not all of them are equal. Against a backdrop of tightening Federal Reserve monetary policy, we believe it’s no longer prudent to pay for growth at any cost. Instead, we prefer PayPal (PYPL), a name that we believe offers “growth at a reasonable price,” a.k.a. GARP.

Why PayPal

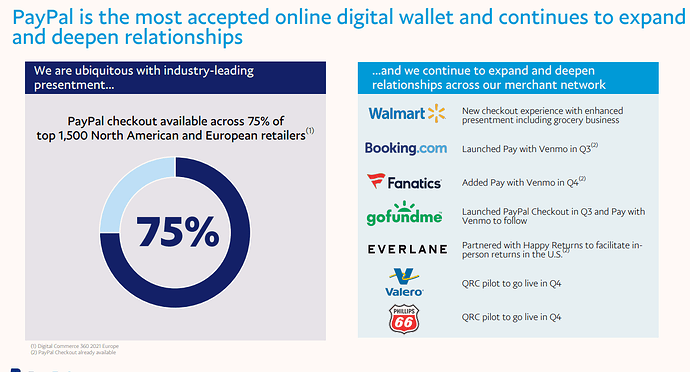

PayPal is one of the most widely accepted digital wallets in the world. Furthermore, after acknowledging the issue of there being too many apps on smartphones — which adds significant friction to the user experience as it requires jumping between them, and the fact that very few of those apps are used on a daily basis — management has invested significantly in recent years to build out a PayPal super app.

CEO Dan Schulman previously described his vision for the super app as being able to “turn all of those separate apps into a connected ecosystem, where you can streamline and control data and information between those apps — between the act of shopping [and] the act of paying for that.” He added, “All of your financial services can [also] all come together where you create a simple way, through this super app, to enable, to pay, and to track transactions across all touch points. Then you have this common platform and common data that allows machine learning and artificial intelligence to kick in and give personalized recommendations to those consumers.”

While many investors may be more focused on traditional financials such as the big banks — and we certainly acknowledge the attractiveness of owning them against the current backdrop of rising rates, after all we own Wells Fargo (WFC) and Morgan Stanley (MS) in the Charitable Trust — we believe that investors looking out more than a year must acknowledge that PayPal, which has traditionally only played in the payments space, is quickly encroaching on traditional bank revenue streams.

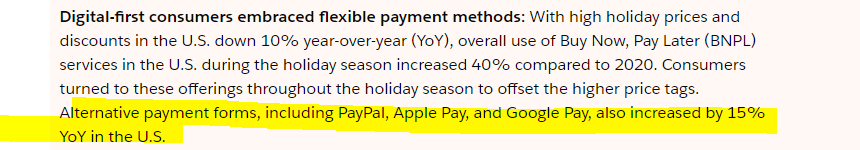

In addition to processing payments, PayPal also offers debit and credit solutions, as well as the ability to buy and sell cryptocurrencies. PayPal Savings is in the works and people can already sign up. We also expect to see an equities trading platform in the future. Ultimately, while PayPal may not be a bank, the offerings it already has and will have down the road put it in increasingly direct competition with traditional financials.

Growth Concerns

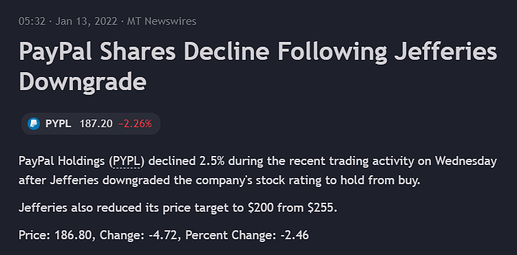

In recent quarters, shares have seen an incredible amount of selling pressure due to growth concerns.

- First, there is the eBay dynamic. eBay has been migrating payments on the platform away from PayPal in recent years. However, the timing for when this move would be complete has been difficult to forecast and taken longer than expected, resulting in a headwind to reported growth rates in recent quarters.

- Second, fears of net new active accounts growth concern were further exasperated following news that PayPal was considering an acquisition of Pinterest, which was taken by the market as a sign that PayPal is now in a position where it needs to acquire growth. While PayPal ultimately chose not to move forward on Pinterest, the growth concerns have since lingered over the stock.

Argument for Growth

While time will tell on both of these fronts, we are inclined to believe the reaction to these concerns are overdone.

- For starters, in the third quarter of 2021, while reported revenue growth came in at +13% YoY, the growth ex-eBay Marketplaces was +25% YoY, indicating just how impactful that eBay migration is to reported growth rates and perhaps providing some insight into the growth rates we could be looking at in the year ahead — once we get through the first quarter, which management previously said it anticipates will be the slowest growth quarter of the year due to difficult comps.

- As for the interest in Pinterest, we are not surprised that management is on the hunt for acquisitions that fit with their vision for the new app and at a high level think that were the price right, Pinterest could have been an interesting addition to the platform. While we understand the concerns, we think it is too soon to write-off the company’s ability to grow net new active accounts in coming quarters without acquisitions. In fact, management previously called out that their medium-term growth outlook does not rely acquisitions.

- Speaking of internal growth optionality, we would be remiss if we didn’t call out Venmo, the company’s person-to-person (P2P) payments platform that has thus far gone largely unmonetized and provides for an already highly engaged growth lever. While many stores, including Cub name Walmart (WMT), already accept Venmo as an in-store payment option, we will also see ecommerce kingpin Amazon (AMZN), also a Club holding, add the platform as a payment option this year as well.

Catalysts

While PayPal is more of a secular growth story than it is a catalyst driven one, we are looking for the eBay migration to get behind us as it will remove the growth headwind noted above and refocus investors on the underlying dynamics that we believe remain robust.

- The addition of Venmo to Amazon checkout options represents another potential catalyst.

- The easing of supply chain bottlenecks represents another catalyst as it will provide for an unlock of pent up demand and therefore spending activity that benefits PayPal.

- Finally, we are looking to additional services that bring new recurring revenue streams (a savings account, for example, should provide and steady stream of interest based income) as additional catalysts for investors to start factoring into valuations.

Risks

- Competition is the key risk, especially given the slew of fintech players that came to market over the past year.

- A slowdown in demand represents another risk given PayPal’s business model of taking a percentage of sales.

- Finally, execution on the Super App roadmap is critical as competition to create an all inclusive financial app is as cutthroat as ever.

Bottom Line

Ultimately, we believe that consumer financial services are rapidly transitioning away from brick-and-mortar branches to digital mediums. As a result, investors must be on the hunt for digitally native fintech companies.

While there are many names attempting to gain market share — and several appear to have sustainable business models that are intriguing — we believe that PayPal, the company, brings the scale needed to outcompete its rivals while the stock offers a more attractive earnings based valuation than others. Thinking through the valuation versus others, we maintain that in this market, characterized by rising rates, companies that generate actual profits must be prioritized over those currently losing money in the name of growth.

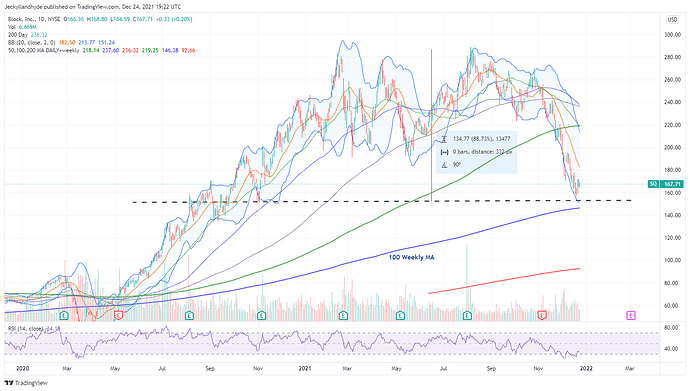

Furthermore, while the decline in PayPal’s most direct competitor Block, formerly Square, has resulted in Block trading at a lower growth adjusted valuation. Based on the PEG ratio (which divides the price-to-earnings multiple by the expected growth rate), we believe PayPal to be more attractive as the market is no longer willing to pay the same multiple for growth that it did a year ago, given expectations for rising rates. We therefore believe it more prudent to focus on the fact that Block trades more than two times PayPal’s valuation (~65x FY2022 earnings for Block versus ~31x FY2022 earnings estimates for PayPal) than it is to focus on the growth adjust valuation.