What: Short DD based on available Objective data

Read: Scalp / Swing Trade

TLDR:

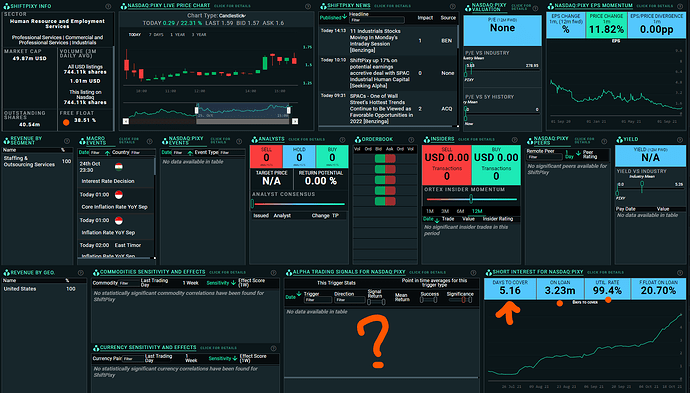

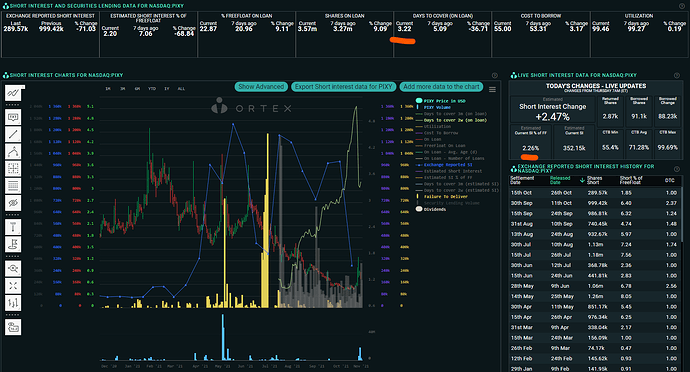

Free Float - 12.62M (trading volume at time of write up is 17.55M)

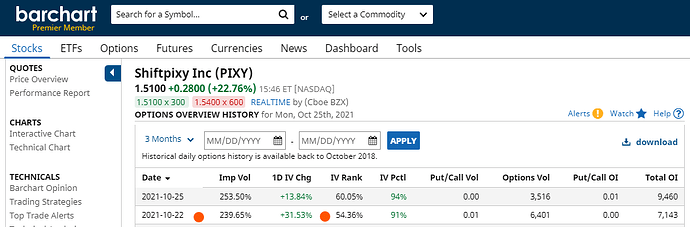

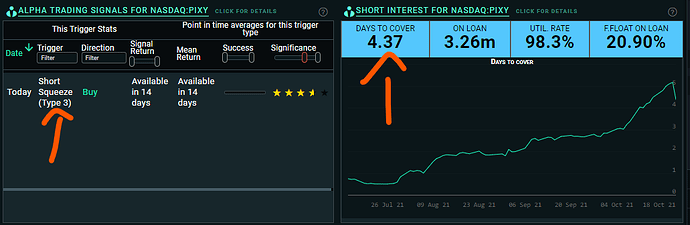

Options History from October 22 is primed to boost.

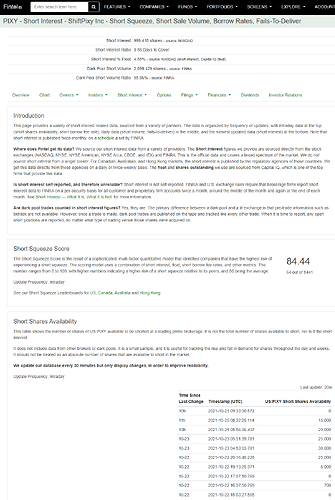

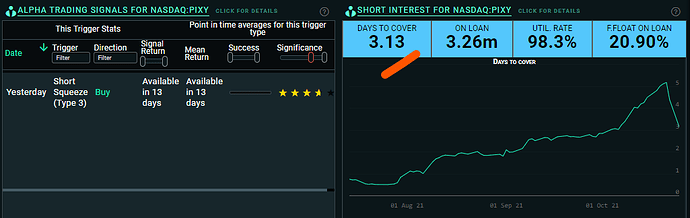

5 Days to Cover the Short Interest, waiting for Ortex to signal a possible Short Squeeze.

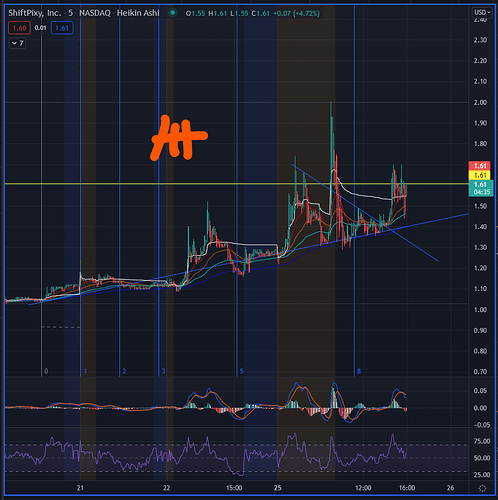

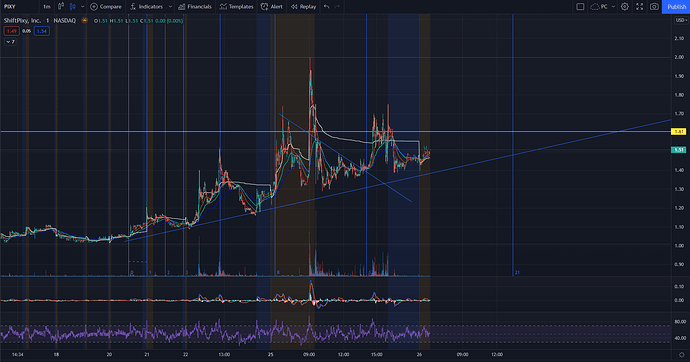

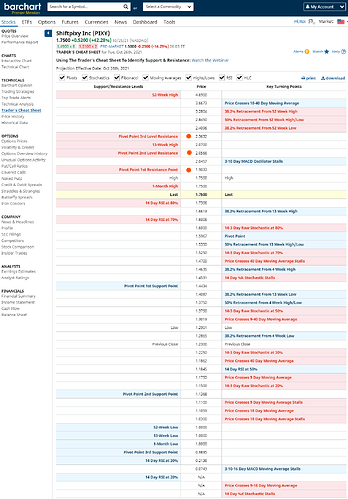

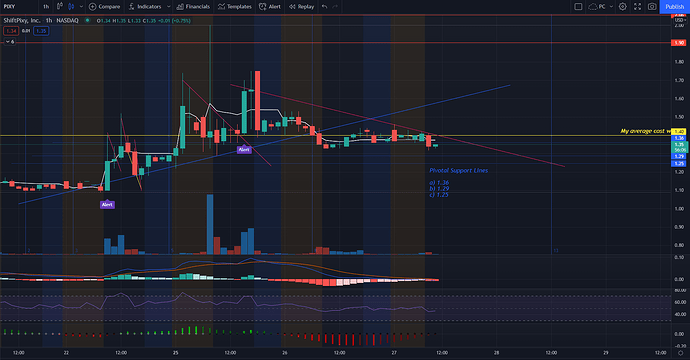

Resistances:

a) 1.4 - already broken

b) 1.7 - poked twice, 1.6 is proving to be the hard one right now…

c) 1.9 - poked once

Long Version (still developing)

PIXY, Shiftpixy

Link: Our Story - ShiftPixy

About them: ShiftPixy combines the modern perks of the gig economy with traditional employment benefits.

Our app serves as an all-in-one workforce management platform for operators (aka, business owners) that rely on contingent employees. But it’s also a dynamic employment resource for shifters (aka, part-time workers) who want the freedom to make their own schedule.

Shifters can receive valuable benefits such as health insurance and workers’ compensation. Meanwhile, operators are able to rest easy knowing that they remain compliant with labor laws and free of time-consuming admin tasks.

ShiftPixy’s gig platform truly represents a new way to work.

*** Need to get my car from maintenance work. Will continue to observe After Hours volume.

*** Ortex usually updates by 7 or 8 AM.

Ortex snapshots… waiting for ALPHA signals…

Options History - October 22, 2021

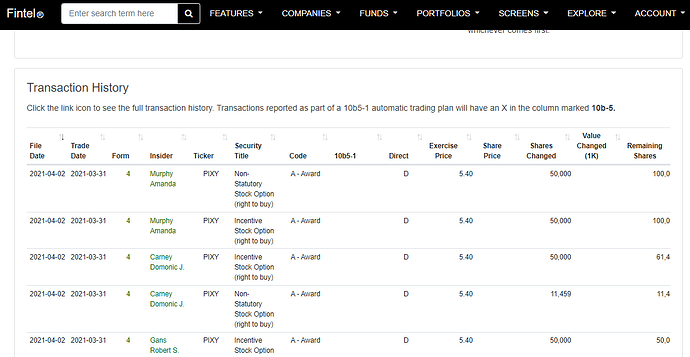

IF you’re curious about Fintel data…

a) Insider Trades? No Sales so far.

b) Short Squeeze rank score

FULL Disclosure:

- I only have minor exposure on this one, 100 shares at the 1.60 mark. LMAO I keep fomoing my own plays. fml

- Once again I plan to exit the trade at 35% gain overnight or more if momentum continues. Never a guarantee.

*** DO NOT, and I repeat, NEVER, with strong emphasis, Do Not FOMO!

*** IF you consider playing this, plan your positioning, find a good entry. So far it’s still a slow moving target.

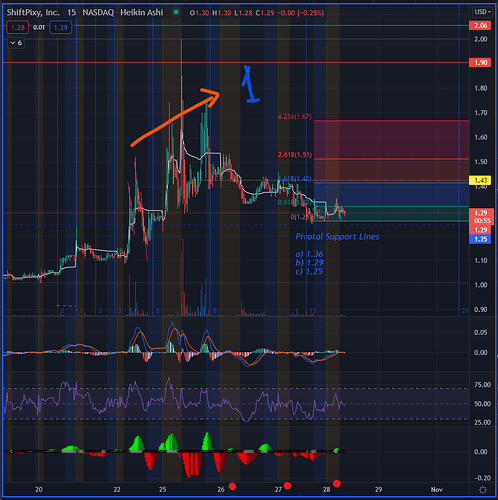

*** For Low Floats, I always use MACD + RSI and VWAP + EMA 20/50/100 or 20/60/120 on other charting tools.

*** I try to enter closer to the VWAP or even under, with RSI at low and MACD crossing up.

*** IF price already went parabolic, waiting for a pullback of 20-30% is a good idea.

Here’s the current 5min chart…