Starting a placeholder for the #trading-floor discussion on portfolio hedging with ETFs like HYG, HYGH, SPY, etc.

Was going to write up a few things given the discussion around bonds on the TF, but then found this great writeup from Kyla Scanlon: The Blaring Horn of Bonds - by kyla scanlon. (She has this great ability to explain really complex things simply, without making them so simple they stop resembling the real thing.)

Corporate Bond ETFs

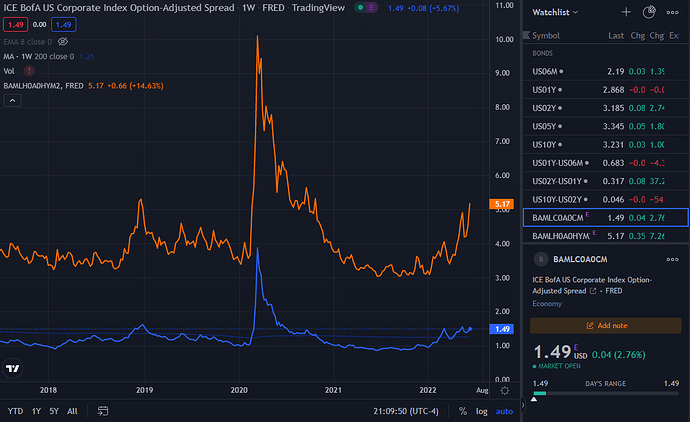

Two symbols on the list to track spreads are BAMLC0A0CM and BAMLH0A0HYM2:

For folks who don’t want to trade bonds directly, there’s an ETF for that. A couple, actually.

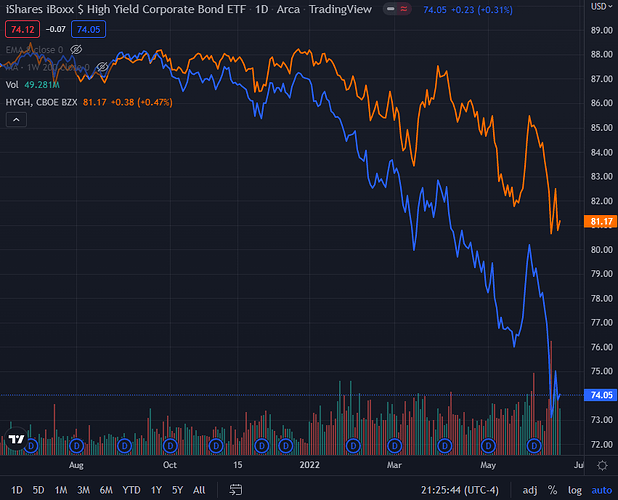

For high yield bonds, there’s HYG and HYGF. HYG tracks the bonds themselves, while HYGH adjusts for the changes in underlying rates through swap contracts.

The distinction is important in there here and now as rates are still increasing. If rates increase even without any change in the credit risk, the value of HYG will fall, but the value of HYGH will now. So it depends on whether we want to bet on (or hedge against) credit risk along, or the cumulative effect of corporate credit risk and underlying interest rate changes.

The answer may not end up being based on this at all, but rather more on the the liquidity of the ETF’s options, as @Sven noted in TF. HYG has much better liquidity compared to HYGH’s nonexistent option chains, and between rate change decisions, the two should track closely enough.

LQD and LQDH have similar considerations.

Treasury Bond ETFs

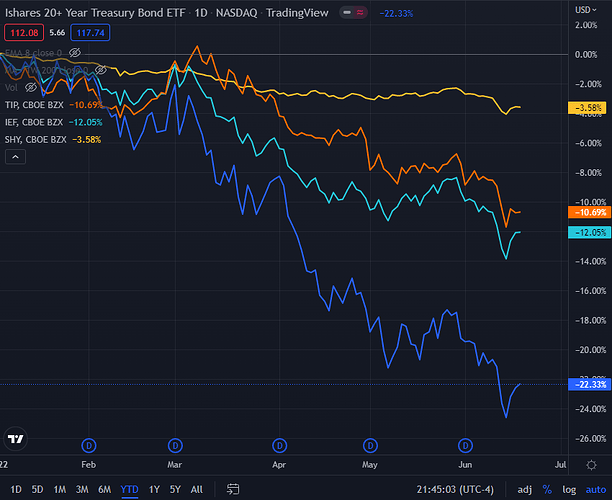

There are tons of these, but TLT seems to be the most popular, and has good liquidity. A few more popped up that have decent option liquidity, but I am not familiar with them so leaving these more as follow-up stubs: TIP to nullify out inflation effects, SHY for shorted term treasuries and IEF for medium term ones.

-

iShares 20+ Year Treasury Bond ETF (TLT): The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. (Options)

-

iShares TIPS Bond ETF (TIP): The iShares TIPS Bond ETF seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds. (Options)

-

iShares 1-3 Year Treasury Bond ETF (SHY): The iShares 1-3 Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years. (Options)

-

iShares 7-10 Year Treasury Bond ETF (IEF): The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years. (Options)

These should allow us to take bets or hedge over different time horizons, including taking out inflation risk. They all have pretty low IV, so work well as hedges. YTD for all four below:

For prior discussions on bonds, please see this thread. @juangomez053 thanks for starting this thread.

I don’t want to make this another bonds thread, but I’ve found success playing with TLT and TBF (an inverse) at the same time.

I’m playing longer time-frame call options on TBF and I buy TLT shares on retracements.

This way I’m generating gains from the natural movement of both and they’re relatively less volatile than stocks.

One more ETF to keep an eye on - TTT. It’s a 3x leveraged fund on 20Y performance. The fall is sharp, but there is a chance of reversion if it turns out this drop in the long end was premature. Not anytime soon since the market is in a “pause/pivot” mindset, but for a time if the mood goes the other way again.

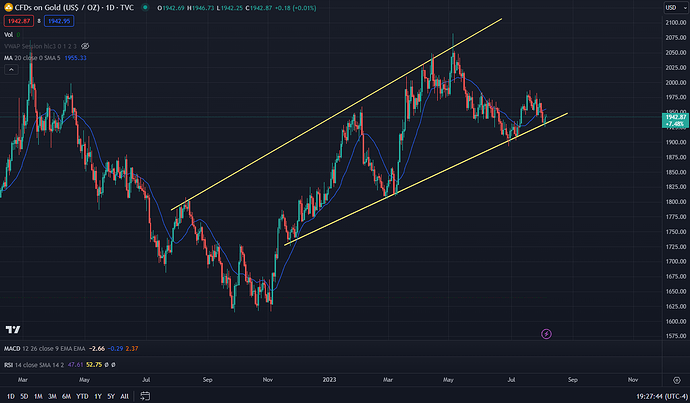

We don’t quite have a gold thread, so parking this here as a potential hedge against rising inflation concerns. Sitting nicely on that trendline, too. Could be played throug GLD.

Have been accumulating TTT as am expecting long yields to keep going up. About 50% upside still, if 10Y yields cross 5%, I think.