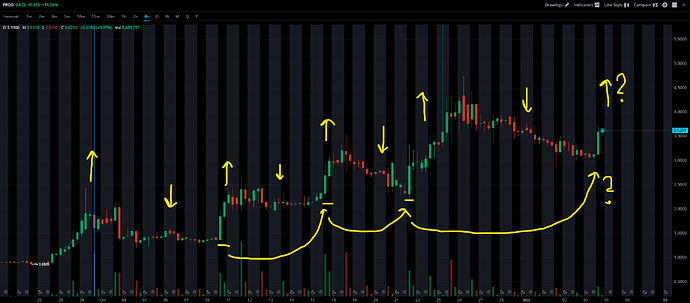

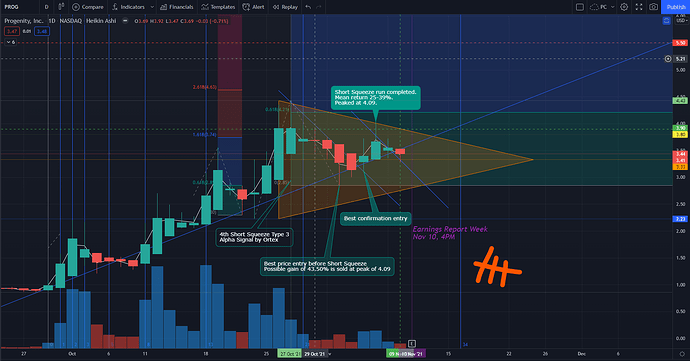

I’ve notice a bit of a pattern on the 4h

So PROG dropped an 8k today naming Jill Howe to their BOD she used to work for Amplyx Pharmacuticals which is now owned by Phizer. Ive heard rumors phizer needs proginity’s drug delivery system due to new fda rules regarding JAK inhibitors. Well crazy coincidence Amplyx has a oral once-daily Janus kinase 1 (JAK1) inhibitor for people with moderate to severe atopic dermatitis from the article I found on this drug in 2020 it was phase 3 I do not know if it was cleared or not yet.

Could the rumors be true or is it all just complete coincidence?

Links to resources for this info.

8k:

https://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=116229793&type=HTML&symbol=PROG&companyName=Progenity+Inc.&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15(d)&dateFiled=2021-11-04&CK=1580063

Info on the JAK1 inhibitor:

Edit: I did go ahead and take profit this morning when it ran to $4 Ill be looking for a re entry back around 3.3 or less. Ive taken profit every Friday for the last few weeks and Ill be looking to do it again next week.

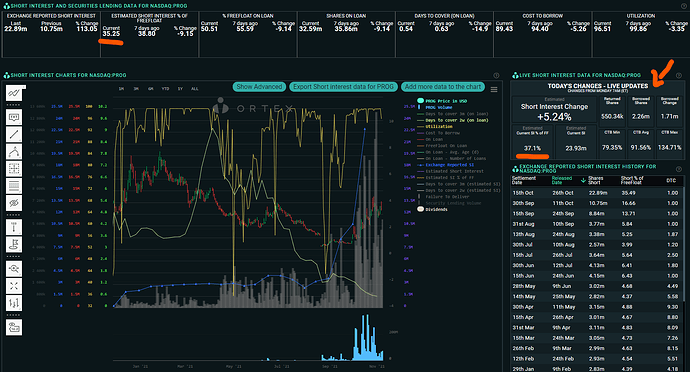

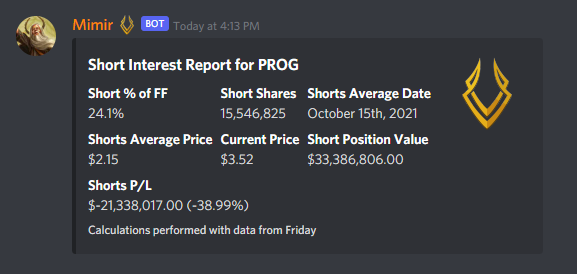

Providing an update on this given the new SI numbers:

It would seem as though the liquidity was a bit too high and shorts have been able to exit a substantial amount of open positions with ease. There is no reason to suspect this won’t continue to be the case, so the short squeeze element is likely removed.

I say that with only one asterisk, sometimes, historically this sort of clearing has been a catalyst for more movement. I would be surprised if that were the case here though as PROG has lost a decent amount of it’s positive sentiment and I think other plays are now drawing the attention needed to give it that same “#It’sHappening” boost.

I closed my position today.

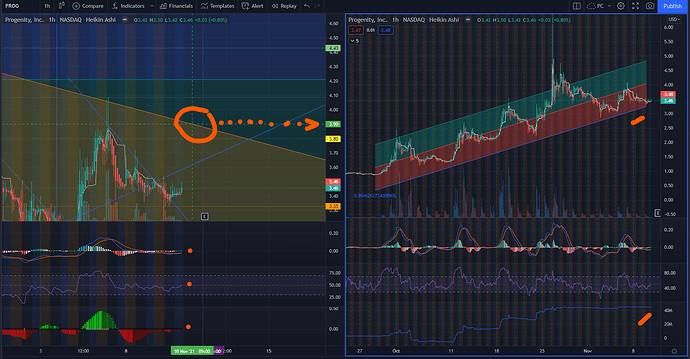

Chart update:

IF you read my chart snapshots above, you would have been prepared to exit at $4, since that was the roof of my ideal pennant.

I always try to draw this pennant regardless of the visible trend and support lines.

Today confirms the end to the Short Squeeze Type 3 Ortex signal that I started this thread on.

Read Conqueror’s note above if you still plan to continue playing PROG next week.

Again, thanks to @Balu and @brandomango for bringing interest to this ticker. It wasn’t a monstrous win, but it did make a few Valhallanos (yes that ancient word was originally American-Hispanic) happy.

- rexxxar out

PS - I forgot to mention, full disclosure: after selling for profit, I did reEnter. This time around starting with 300 shares, and some Calls. Again, emphasis on this no longer a short squeeze play imho.

I have nothing valuable to add except…shit.

I’m holding long. My avg is in the 2s so I’m letting this ride up till the 18th at least.

Curious if those SI numbers are accurate.

Their new board member did receive 80k in shares this week as well.

@bestbagholder You may not want to hold longer than the 16th.

Since share dilution news might come out on the 17th.

Link:

https://fintel.io/doc/sec-progenity-inc-1580063-424b5-2021-october-05-18905-1169

And I quote,

“In connection with our August 2021 underwritten public offering, we agreed with the underwriter not to issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or securities convertible into or exchangeable for shares of common stock or file any registration statement or amendment or supplement thereto, other than this prospectus supplement or a registration statement on Form S-8 in connection with any employee benefit plan until November 17, 2021, without the prior written consent of H.C. Wainwright & Co., LLC.”, end quote.

@bestbagholder wait a minute… you didn’t sell at 6 or above 4 ???

Nope…I am a moron but I also fundamentally believe in the company (I was sleeping when it hit 6 lol).

I’m more concerned about my calls than my shares.

They’re predicted to blast through earnings (Wednesday AH) but like you said they can dilute again soon (I thought it was 11/19 for dilution).

Technicals still look bullish but I’m starting to stress a bit.

I’m actually preparing for more of a dip on Monday with some recovery Tuesday afternoon and some FOMO Wednesday prior to earnings.

But I’m the guy that didn’t sell at 6 so wtf do I know.

Nah. You’re good and in great profits too. Plenty of time and upward room to sell even higher.

Yeah, after this final play, I’ll keep tabs and most likely add them for long term.

Do I smell puts? Or is that jumping the gun?

TBD. yeah let’s not jump the gun.

So Friday Mimir was showing SI roughly around 25% now its showing 35% Benzinga posted their standard top 5 list today but said Fintel data wont be up to date till tomorrow for PROG. But the data for them is also 35% as of this morning when the article was posted.

So does anyone have fresh SI data or is Mimir now correct and was just being buggy on Friday? Even without the SI its a tempting play again this week for earnings but if SI is still really high it may be worth the gamble to hold past earnings.

Thanks in advanced to anyone that can get this info.

Benzinga Fintel Top 5 Article:

Mimir, afaik gets data from Ortex.

Now, please always consider T+2 when acquiring data from Ortex.

Here’s the current stat with the “Live” updates from NASDAQ…

Thanks and thanks again for the t+2 info I wasnt aware of that. Still pretty new to all this but this group has been amazing up 40% going into my 3rd month. I doubt Id be here with these gains without all the tips and educational resources posted yall are amazing.

So guess I wait for Mimir tomorrow and see if the price comes down just a bit more to see if Ill play PROG one last week. Im def not sticking around for a possible share dilution.

For those of you who are still playing this, I wanted to assist on managing your expectations this Wednesday–before the Earnings Report at 4PM…

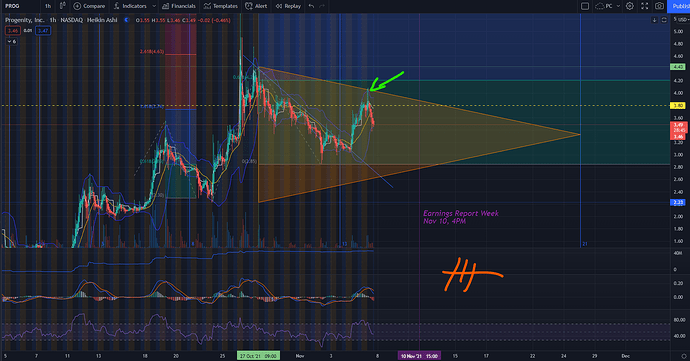

Chart:

1 Hour Candles…

-

Last Friday, Nov 5, PROG ran at the beginning of the day and peaked right at the edge of my pennant at 4.09.

-

The edge of my ideal pennant marks 3.9 as the possible peak limit for the day.

-

You can choose to sell here if you see weakness in the 1min and 5min candles.

-

You can of course choose to hold longer IF it breaks past that target and holds it longer than 3 min.

-

MACD has crossed along with green volume bars, signaling a possible continuation of buying pressure.

-

RSI is hooked onto the upper band, showing intent of continued bullish trend.

-

Squeeze indicator shows compression on volume.

-

Right picture with the Regression Trend tool, shows ample room to move upwards and that yesterday could have been another best entry for bulls.

-

Price + Volume Trend, remains high and strong.

Daily Candles…

Strong Support is 3.33

- IF PROG moves but doesn’t break past 3.9 today, I expect it to just fall back down to the Support line.

- IF PROG moves and breaks out of 3.9, expect resistances at 4.43, 5.5, and 6.5.

For Shareholders, remember that PROG has a history of reaching new highs at Pre-Market hours.

The recent high price of 6.46 was reached at 6:29 AM, on Oct 26–which was great for WeBull users.

For Options, remember to check the chain via Barchart.com or your other preferred site/broker.

If you see profit, I wager it best you take it–holding options past Earnings Report is very risky.

Note that this is an Earnings Report play with a possible News/Announcement catalyst.

It can go either way.

Manage your risks, Do Not Fomo, and Secure Your Gains.

This is a phenomenal breakdown. Thank you!

I have posted updates on the main body above.

Will be watching this until Friday, and post updates here below, after market close on the 19th.

If you’re bullish on this, watch out for negative publicity, and if possible, keep an eye on the 1min and 5min charts.

God speed.

This has been the move I’ve been waiting for and the reason I didn’t sell in premarket a couple weeks ago when it hit 6. The option chain looks sexy as fuck and I think it’s gonna go nuts.

The ONLY thing that can stop it in my opinion is if they do an offering which is on the table starting tomorrow I believe. However their cash flow is excellent and insiders have bought more shares recently so it’s very unlikely.

Prog is THE PLAY!

i’m playing PROG in the short term for the gamma/short squeeze play. besides the short-term, Progenity as a company is a solid mid/long term play. they have partnerships with major pharm companies. they just haven’t named the 2 big ones yet. in the earnings call, the ceo said they were waiting on data before making the announcement. my guess is they’re waiting for trial data to verify that Progenity’s drug delivery system works with their partners drugs.

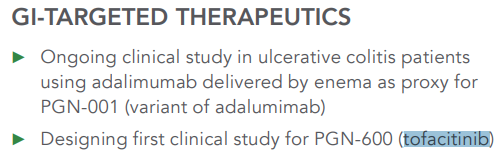

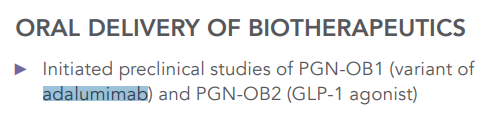

in an earlier press release from Oct, Progenity said they had partnerships with 2 other pharm companies:

in their earnings presentation slides, they listed clinical study for PGN-600 (tofacitinib). tofacitinib is the generic drug name. the brand names include Zeljanz, which owned by Pfizer. there are rumors that Pfizer is one of their partners.

in the same presentation slide, they have listed preclinical studies for PGN-OB1 (variant of adalumimab). adalumimab is the generic name for Humira, which is owned by AbbVie. the speculation is this is the other partner.

regardless of who the actual partnering pharm companies are, once they make the announcement, the price is going to run.

i took profit on my Nov calls and rolled to Dec, still playing the gamma. i have Jan calls and shares to give me cushion to wait for the partnership announcement.

good luck everyone!

How do we know that insiders have bought more? Sorry if my question is stupid. I’m pretty new to this.

My thoughts on today after following PROG since its second bounce weeks ago. I liked PROG as a meme stock because of its strong trend and the huge OI. Its typical pattern is a strong bounce off the bottom support, ascend to the top, form descending wedges back down again.

I got out at the yellow dot in the graph because volume was down, it didn’t reach the top of the trend, the choice to add a 7.5 strike without allowing for a ramp with 6 and 6.5 strikes, two previous dilutions, and the DD on the stock is all speculation.

This morning, PROG hit its upper resistance of its trend. If PROG follows the same pattern as the last hits, it will bounce once more today/tomorrow then trend down for a couple weeks. This does not account for the meme possibility and the huge OI in the options chain.

Note: A lot of people say PROG can’t have an offering until the 19th, but it is possible for insiders to sell starting today. (sorry don’t have screenshot).

Wanted to add this in to contribute to the bigger picture among this period of FOMO