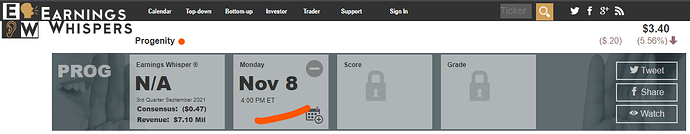

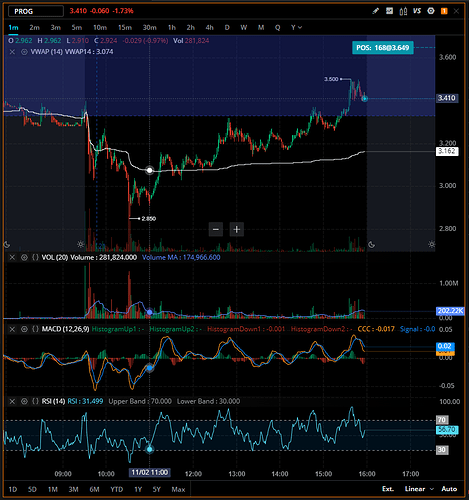

What this is: Update to PROG bullish run after Earnings Report

Read: Swing Trade / Scalp

TLDR:

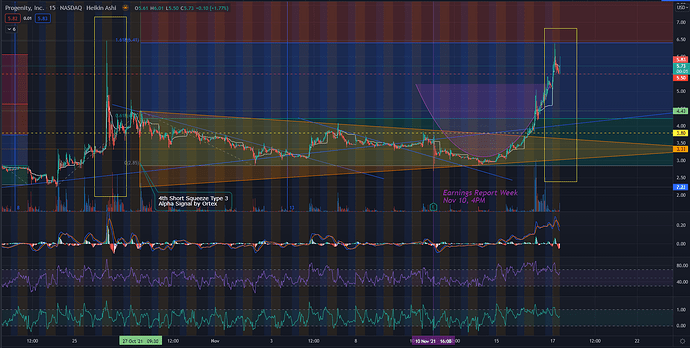

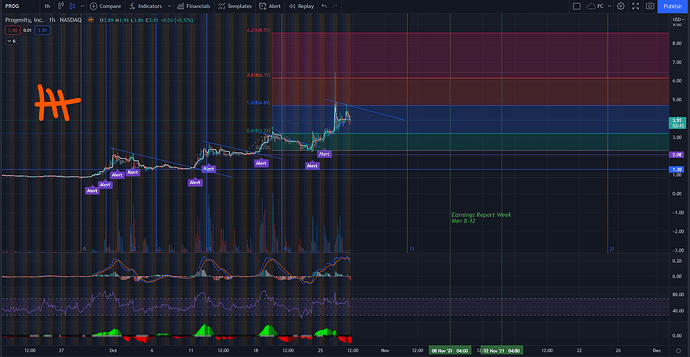

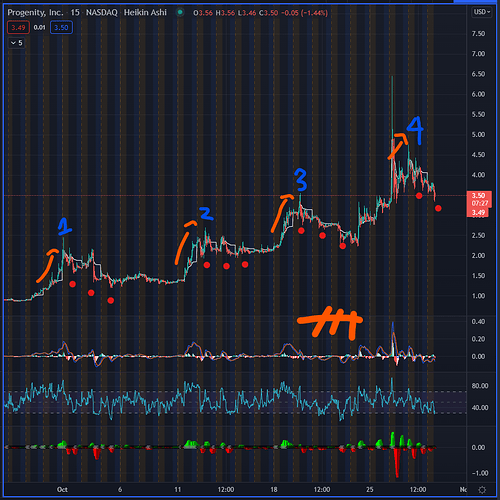

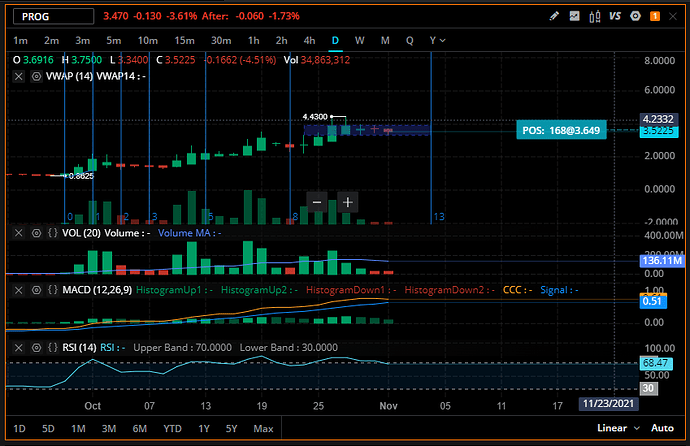

While the Oct 26 Short Squeeze signal was fulfilled somewhat on Nov 4 and 5, PROG is now back on track to a possible Gamma Squeeze.

It’s imperative that you watch out for any negative publicity to help secure your gains, just in case.

Stop Loss and Stop Loss Limits are great tools, utilize them if available.

If possible, watch the 1 min and 5 min charts.

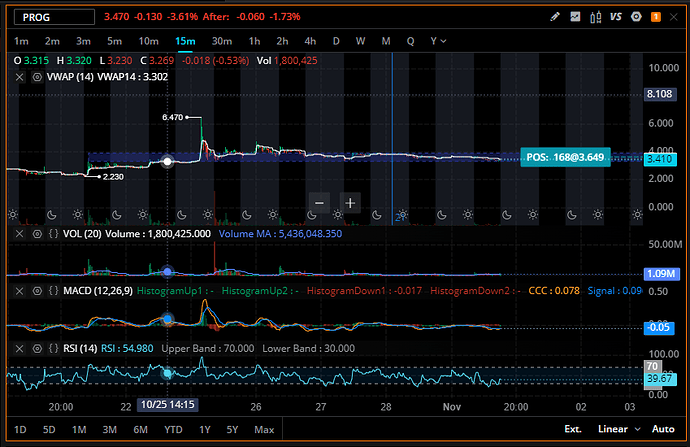

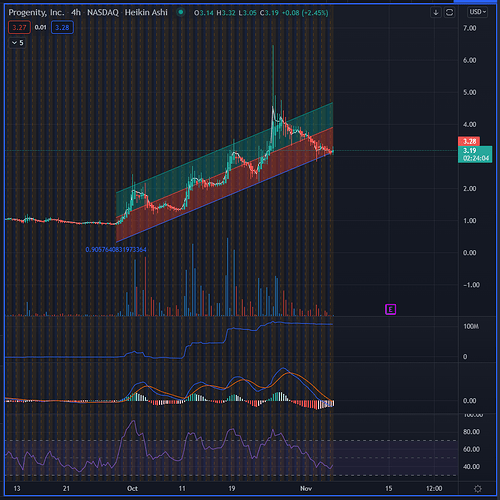

Compared to the Oct 26 PreM run, PROG is holding up real well this time…

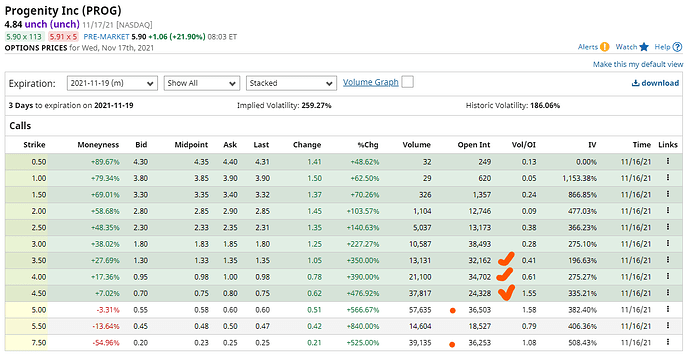

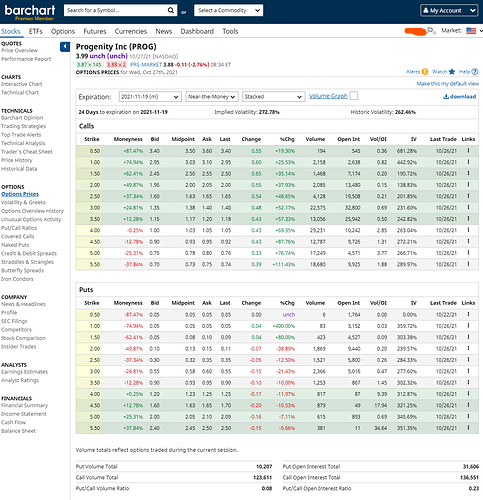

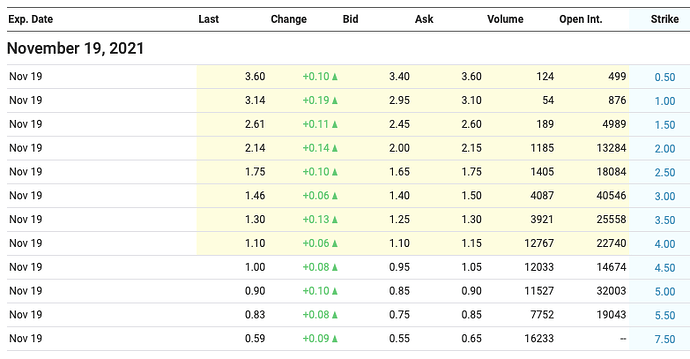

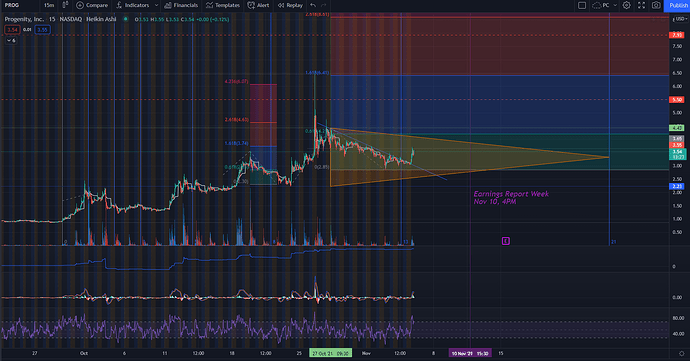

This week’s Options Chain…

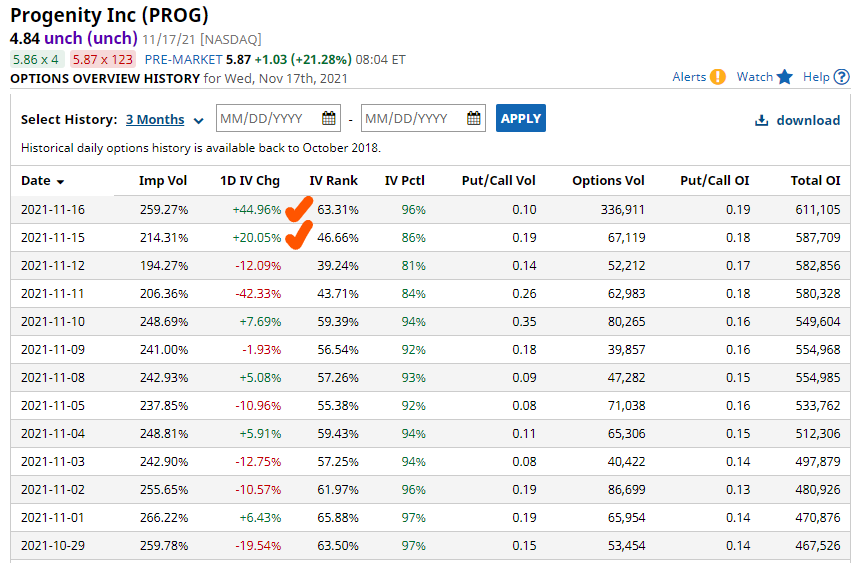

Options Chain history, if we get 3 more greens this week, PROG leaps to the moon next week…

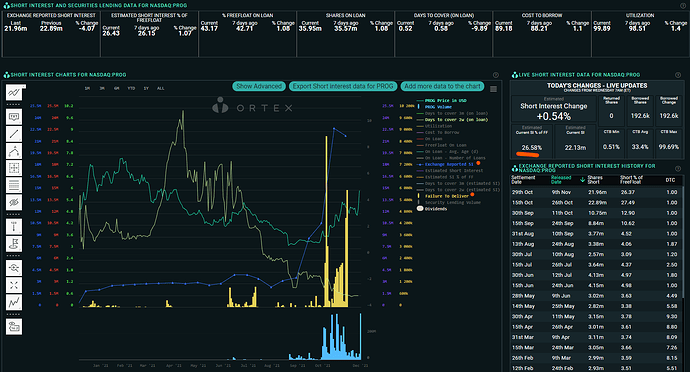

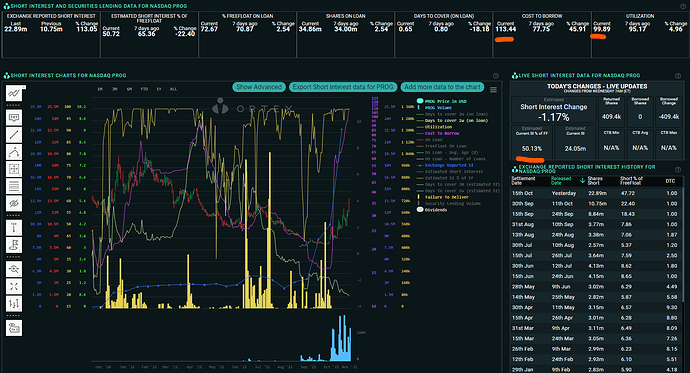

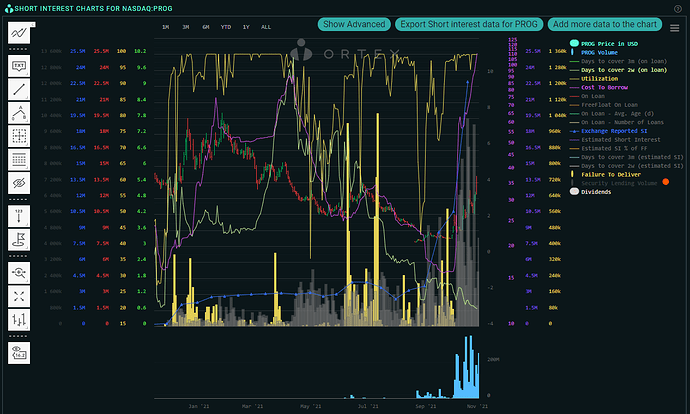

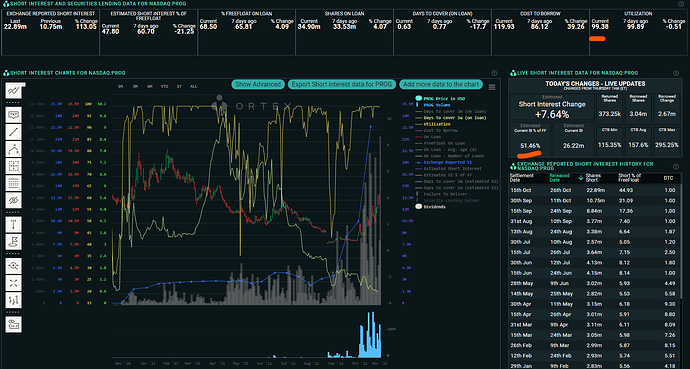

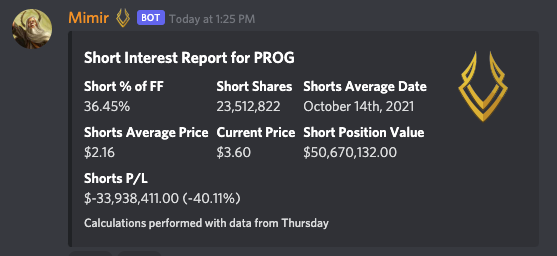

Ortex shows that we may still have a good chunk of Shorts to Squeeze as well…

Consider T+2 with Ortex data.

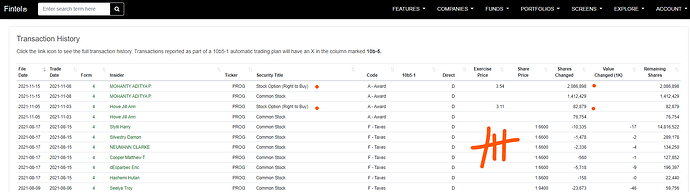

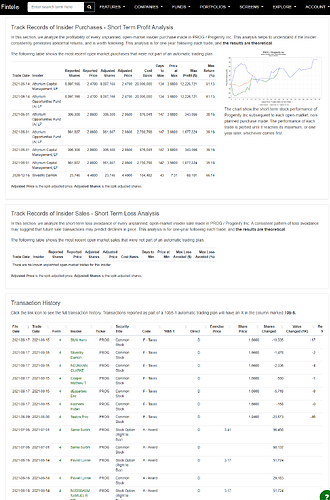

Fintel Insider Trades update…

I will update the thread again on Friday the 19th after market close.

What this is: Ortex Alpha Signal - Short Squeeze Type 3 (hold for at least a few days)

Read: Swing Trade

TLDR:

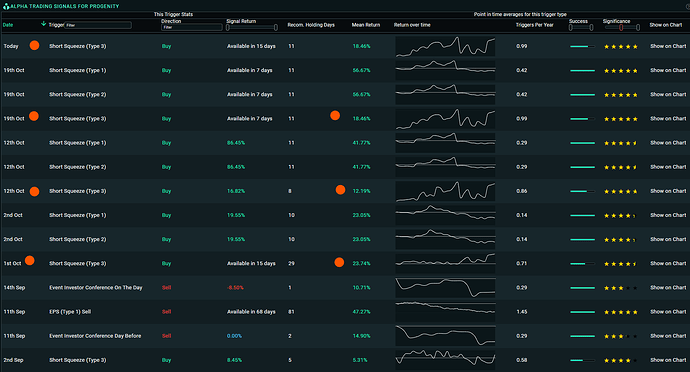

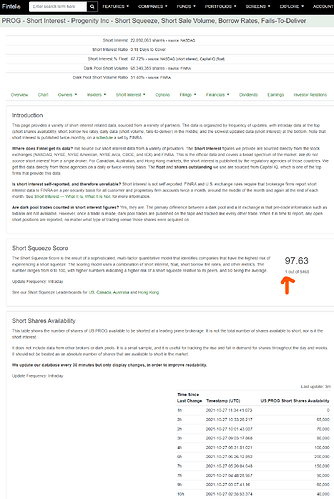

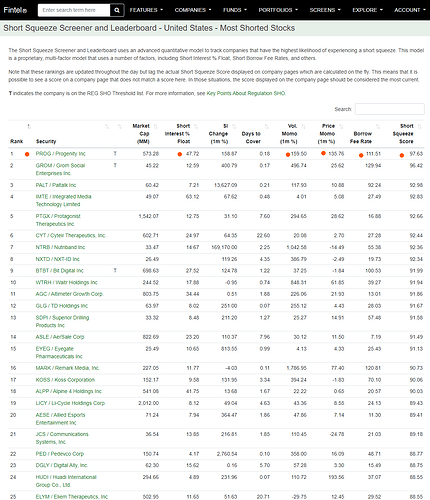

This is the 4th Short Squeeze Type 3 signal for PROG this month.

Free Float - 128.71M

Possible profit range - 12-56%, when trading shares.

*** IF you don’t know how to play this, Do Not Fall into the Fear of Missing Out (fomo)!

*** It already hit the High of 6.46 at Pre-Market yesterday - 10-26-2021.

*** PROG has a history of reaching new highs in Pre-Market, consider that.

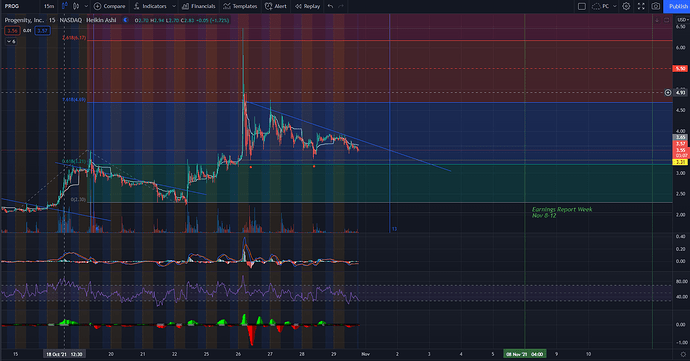

Tradingview chart:

https://www.tradingview.com/chart/PROG/LV1HB0Vk-PROG-confirming-its-trend-of-Bull-Flags-and-Short-Squeezes/

About them:

Sector - Health Care Services

https://www.progenity.com/company/about

“Progenity is an innovative biotech company that was founded in 2010 and went public in 2020.

We aim to improve the diagnosis of disease and improve patient outcomes through localized treatment with targeted therapies.”

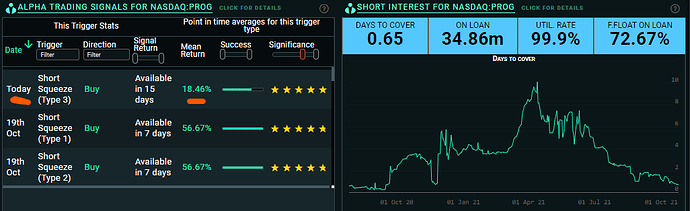

Ortex Alpha Signal

As you can see above, PROG has a healthy history of Short Squeezes for this month of October.

It also squeezed in September and June, so weather your Bullish or Bearish, there are plays to be had in this ticker.

*** PROG’s previous 3 Short Squeeze runs this month were always all Types, with Type 3 being the first.

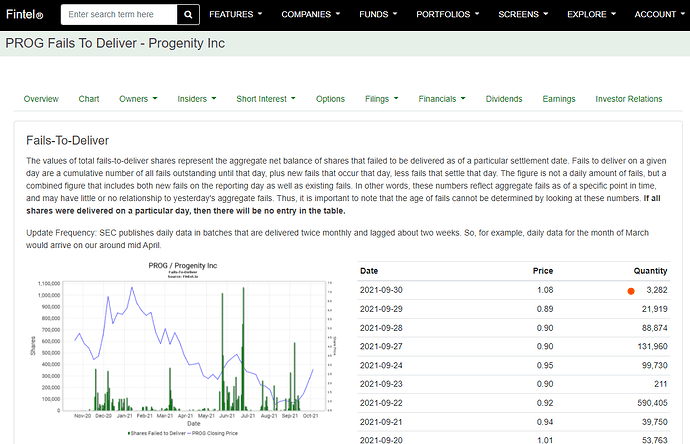

Ortex Short Interest data

- Take note the 0.65 Days to Cover, and compare that with the Estimated SI% of Free Float which is 50.13%.

- This means that Short Shares are becoming more frequently available–liquidity is good (feel free to correct me please).

Evidence of this can be found on the lessening Failure to Deliver ratio.

Another evidence confirming the liquidity of Short Shares is the ever increasing Daily Volume, overlaid here:

This is a good sign for even more price action in the coming days.

Also note that Utilization is still at 99.89 again. I’ve seen it go down to ~80, when Short Shares get returned/covered.

Fintel data…

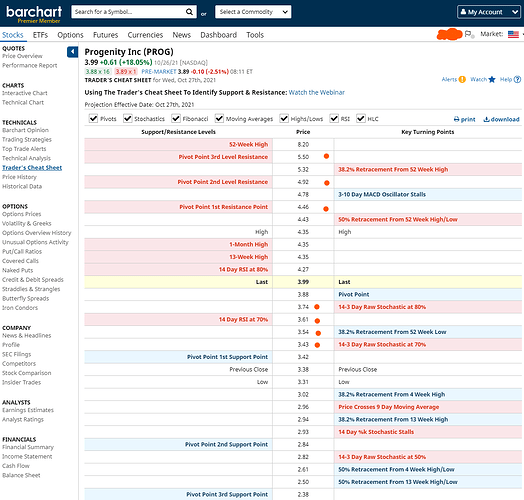

OK, so what about Price Entries to get into the trade??

We look to the support and resistances for that.

Here’s Barchart’s data:

You will want to try and enter somewhere in those 4 support price points marked orange.

Of course, if the price somehow retraces/drops lower than that–I’d stop and watch first.

Depending on the entry position, it may be possible to net over 50% in profits with this ticker in one swing trade.

*** There are NO GUARANTEES of profit here, I am only presenting historical data together with the Alpha Signal.

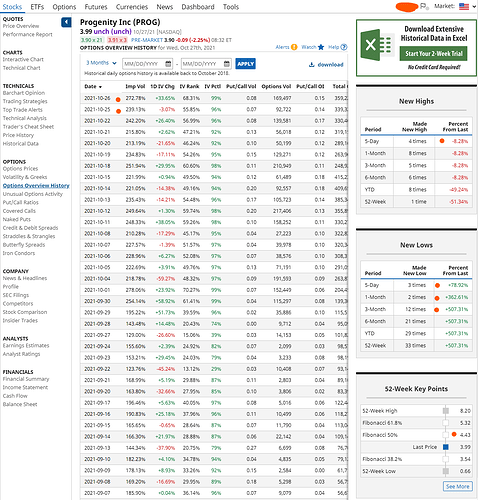

Recent Options History for reference…

IF you’re wondering about the developing Options chain…

Possible Catalysts for Price Movements:

https://investors.progenity.com/news-releases/news-release-details/progenity-participate-crohns-colitis-foundations-fourth-annual

“Progenity’s Vice President of Strategy and Operations, Chris Wahl, MD, MBA, will present as part of a session titled " Novel Drug Delivery Technologies ” on Thursday, November 18, at 2:25 p.m. Eastern. The presentation will be live-streamed and will be available for viewing after the event to registered attendees.

The presentation will focus on Progenity’s novel Drug Delivery System (DDS), currently under development, which is designed to improve patient outcomes in ulcerative colitis by increasing the available dose at the site of disease while reducing systemic toxicity.”

Please feel free to add more relevant News links in the comments. The more eyes and level-headed brains we have on trades, the better.

Full Disclosure: I have been swing trading this ticker the whole month–every time I get the Short Squeeze Type 3 signal.

I have 4.5Cs and 5.5Cs, that are green with IV.

Yesterday, I got lured in again at the FOMO price of $4.07 with 48 shares. If you’ve read my other posts, you’d know it’s a theme. FML

I plan to exit this as soon as I see profit over the price of 4.5.

- PROG was first alerted by Balu, in this server.

- A follow up DD request was created by brandomango.

- I thought it best to create a new thread since this ticker just keeps getting higher price movements and volume.

- I chanced upon it since the first DD posted in r/SqueezePlays/ by u/caddude42069.

Here’s the current 1 Hour chart:

Chime in!