Note: This involves Risk

You Could Lose Money

I noticed more mentions of Put Credit Spread’s on the TF and I thought I try and make a guide which is mostly copy and pasted.

Please consider discuss any potential Credit Spread’s on the forum or with @TheHouse, @The_Ni , @Kryptek or the other gods before jumping in. - In the past I have seen these break and destroy ports and traders. Always utilize the knowledge and resources we have here, before going in blind. - I am sure some others a bit more familiar could add quite a bit here.

- Sell a put (naked or covered)

- Buy a cheaper put

So for a put credit spread, you are just selling a put while also buying a protective put to limit your downside. You are selling 1 put while also buying 1 cheaper put… and your profit is the difference between these two. The extra premium that is left after buying your cheaper protective put is your maximum profit.

You’d generally sell a put if you think the stock is going to go up, and because the put you are selling is at a higher premium (because of the higher strike price) than the put you are buying, this is a strategy you’d implement if you are bullish.

What makes this so appealing is that—while your upside is obviously lower—your downside is greatly reduced. It goes from being a 100% downside (if selling a cash covered put), to having a limit, and one that you can set depending on how aggressive you want to be for your profit target.

Example - Using Robinhood (this is an example - not a recommendation)

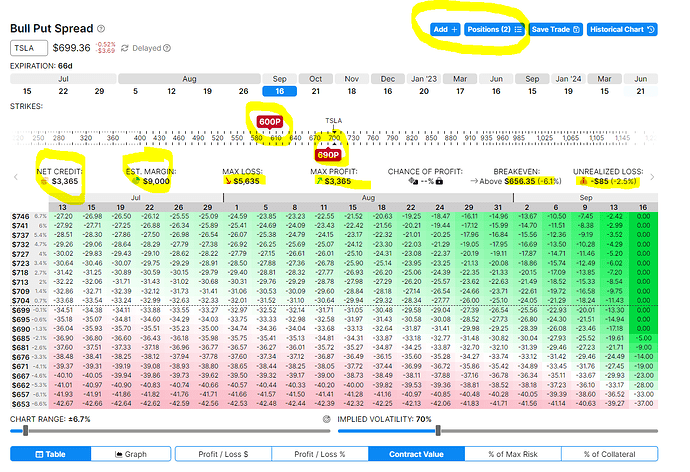

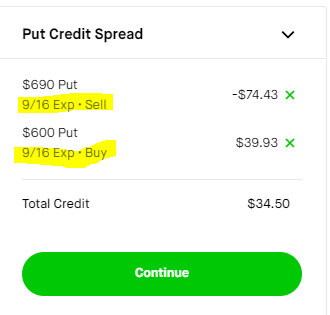

TSLA is trading @ 699.00 - and we want to play 690/600 Puts

To get an idea how this might work out we can use optionstrat.

Potential Mistakes

Here’s some mistakes that could be made with a put credit spread - just some not all:

1. Making the spread too small

If you pick strike prices on the puts that are too close together, you’ll get hardly any profit for the capital you are risking. To avoid this, it is recommend estimating the yield of your credit spread based on how much capital you’re risking AND how long your capital is tied up (the expiry date). If it’s too small a yield, either don’t take the trade, buy a cheaper put, or sell a more expensive put.

2. Setting your protective put too low

If you pick a protective put that is so far out of the money that only a “Covid Lockdown” event would provide you any sort of protection, well you’re risking a lot more downside risk and getting yourself into selling a naked put territory. In fact, some might argue at that point you’re just throwing your money away on the protection (like if the underlying stock needs to drop 20% or something ridiculous). You can be aggressive when it comes to setting your credit spread, but don’t be too greedy.

Just remember the old adage: Bulls make money, bears make money, but pigs get slaughtered…

3. Not setting a profit target

When you have a profit target of say, 5%, you’re able to capitalize on either the swings of the stock and/or time decay—and once that profit is realized you can free up capital for another trade.

4. Not doing Due Diligence on the stock

This should go without saying, should be the 1st step in the analysis. - Some simple things like history, recent news, and earnings call date is a great start.

5. Not checking volume

Liquidity is always something you should consider when trading options, and especially when trading. If you’re setting profit targets but trading options with low volume, then don’t expect your trades to be filled when trying to exit at least not quickly. Option chains post the volume for a contract that day, and so check to make sure that there is decent activity before entering the trade if you’re expecting to get out to take profits off the table later.