SOLYD.UL / CB.BN / SREHN.S / AIG.N / OTHERS - Aircraft leasing firms are suing dozens of insurers for around $8 billion in a string of lawsuits over the loss of hundreds of aircraft stuck in Russia since Moscow’s invasion of Ukraine.

More than 400 leased planes worth around $10 billion are unable to leave Russia after European Union sanctions forced the termination of their leases.

Lessors argue the aircraft are covered by policies against war or theft, but insurers point out the planes are undamaged and might yet be returned.

HOWEVER, much of the value of an aircraft is in the maintenance records, and with the sanctions, technically Russia should not be able to purchase/obtain replacement parts. This has been confirmed by evidence that Russia has taken an aircraft that is only a few years old and is cannibalizing it to support the other aircraft (of the same type - A350) with the needed parts to keep those aircraft operational. Eventually, it is going to become very unsafe to fly on any Russian airline.

Most lessors have already taken the necessary impairments:

SMBC - 1.6B for 34 aircraft

China Development Bank Aviation - only wrote down $105m so far

Bank of China Aviation - $804m for 17 aircraft

Avolon - $304m for 10 aircraft

Aircastle (AYR) - $252 for 9 aircraft

Carlyle Aviation Partners - $700m for 23 aircraft

Dubai Aerospace Enterprise - $875m for 19 aircraft

Aviator Capital - $147m for 4 aircraft and 3 additional engines

Aercap (AER) - $3.5B for 141 aircraft and 29 additional engines

More are expected to also file suit.

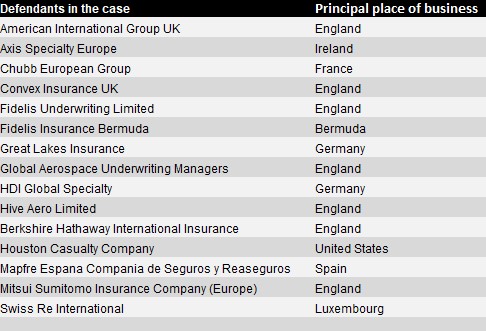

Here are some of the insurers:

Lloyd’s Insurance Company, HDI Global, Swiss Re, Liberty Mutual, Chubb European Group, Fidelis Insurance Ireland, Global Aerospace Underwriting, Great Lakes Insurance, AIG Europe, Scor Europe, Starr Europe, Mitsui Sumitomo Insurance, Abu Dhabi National, Convex Europe, HDI Global Speciality, Swiss Re, Axis, Elseco, Generali, Helvetia Assurances, MMA and SMA.

Litigation settlements and payouts will likely take years, but I’m not sure how harsh of a financial strain this will be for the insurers. It would be significantly larger than the aviation insurance payouts from 9/11 (which were around $5m).

Interestingly enough, a number of insurance brokers are working to develop hull war risk policies for the aviation industry that would allow continued coverage in the event of the detonation of a nuclear weapon.

At present all aviation policies cease cover immediately after the first landing by each aircraft following the hostile detonation of a nuclear device.

I’d love you hear your thoughts on how we can profit off of this.