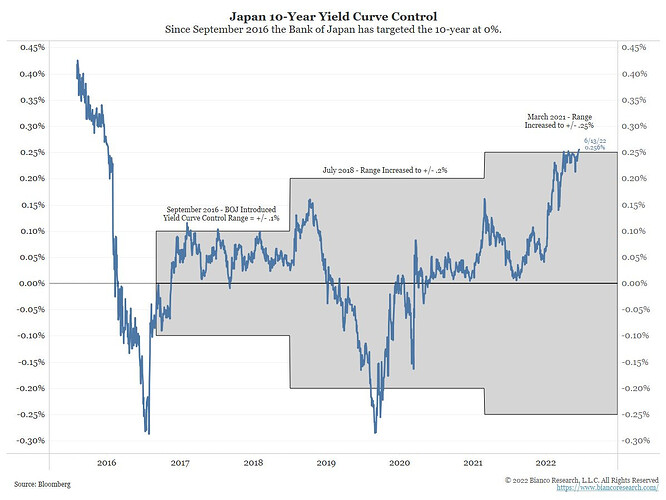

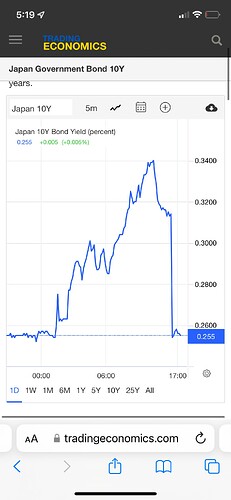

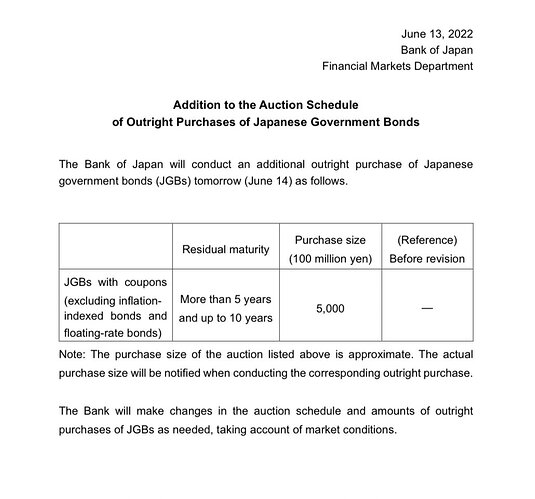

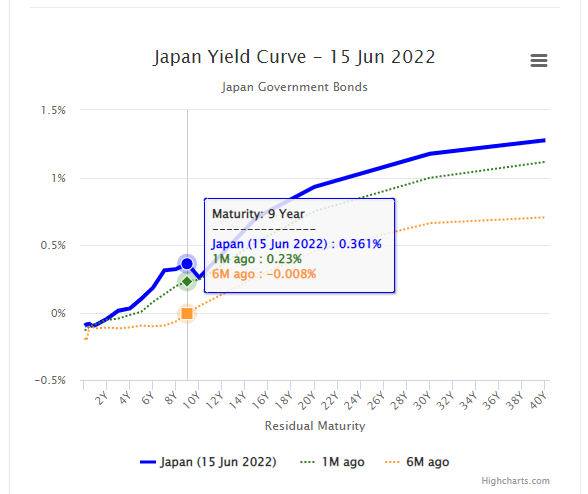

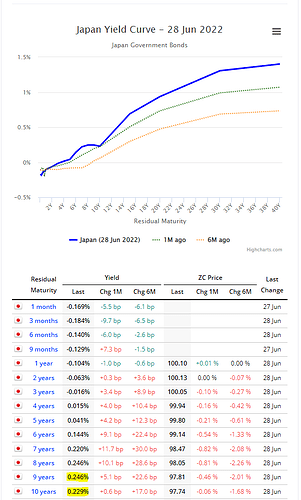

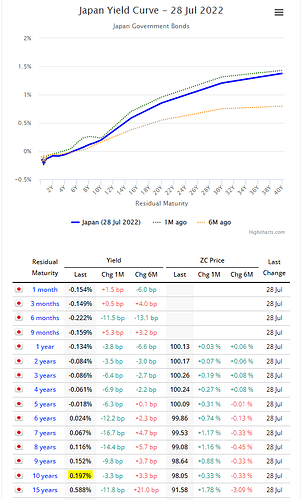

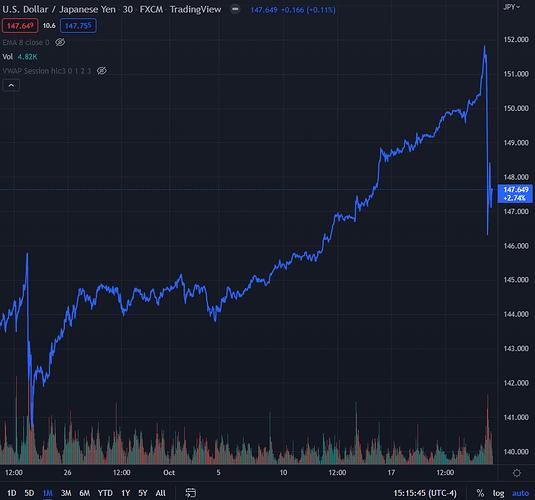

Interestingly enough, the yield curve does not show the stress it was showing even two weeks ago. Unlimited buying seems to be working, for now.

Btw a couple of considerations for why the Japanese govt will allow this to continue. First, they want inflation as they have been stuck in a deflation-low wage spiral for decades. This WSJ piece explains some of these considerations.

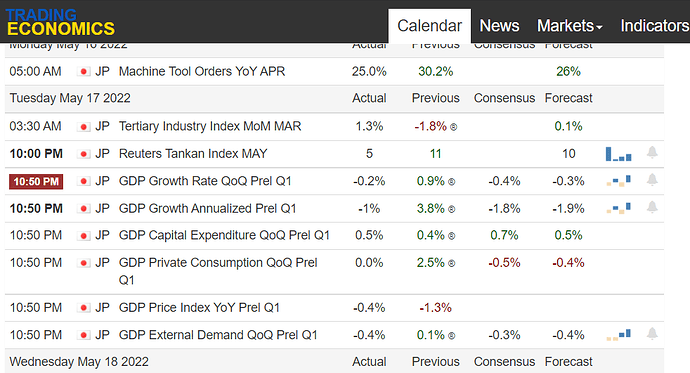

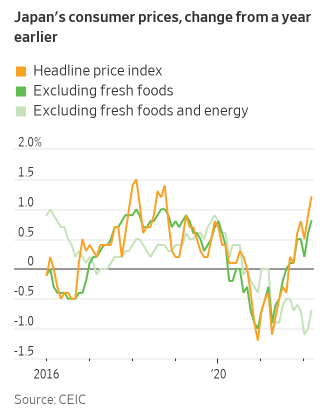

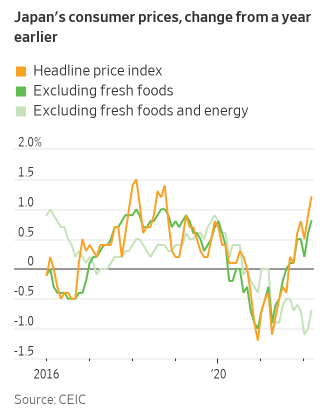

While consumer prices in the U.S. rose 8.5% from a year earlier in March, inflation in Japan is still running lower than the central bank’s 2% target. Japan’s core consumer-price index, which excludes fresh food but includes energy, was up 0.8% from a year earlier in March—the highest in more than two years. Rising energy prices will likely drive it even higher and a tumbling yen could exacerbate that as Japan imports most of its food and energy.

While Japan might finally hit its target, such cost-driven inflation—instead of price increases driven by demand—might not be what the central bank is looking for. Excluding energy and fresh foods, the country is still experiencing deflation. That puts the government in a tough spot, especially with an election coming in a few months: Tightening too early could risk nipping the green shoots of growth, but easing might drive consumer prices higher through an even weaker yen.

More aggressive fiscal policies could help soften the blow for consumers and transfer some money to households, but another key lies in the job market. Japanese wages have been stagnant for nearly three decades and have lagged behind corporate profits. That might be set to change, according to CLSA strategist Nicholas Smith. He says that a shrinking population together with hiring driven by reopening could force companies to compete for workers. The working-age population has been declining in Japan for decades, but more people have joined the workforce—especially women—to fill job vacancies. Around 91% of the working-age population were employed just before the pandemic hit, up from 78% in 2012, according to CLSA.

Second, because this is a supply-driven inflation, and their demand for non-food and non-energy is still weak, they risk leaving an even bigger demand hole when the supply issues are resolved, even if it is a year or two from now. Japan has been stuck here for decades, and it is likely they really don’t want to make this decade long hole deeper.

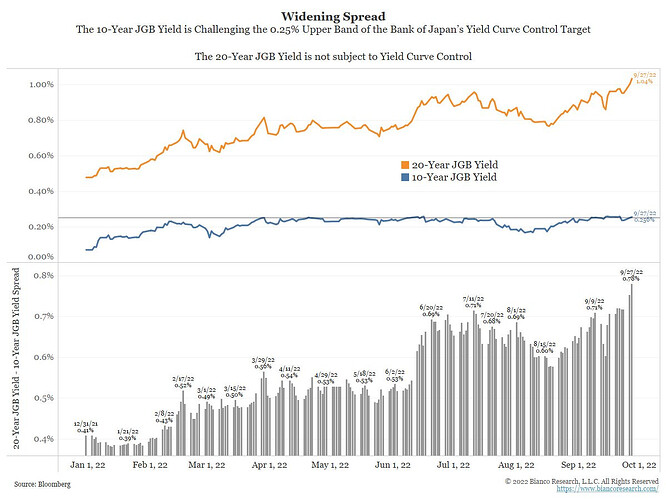

Third, BoJ is pinning at 0.25%. The Fed is halfway along its warpath to 3.5%+. How much can the BoJ raise? Another 0.25%? 0.5%? Any rise for them will have all other kinds of devastating, far-reaching consequences - all the things we’re doing to cool the economy will freeze theirs.

Finally, if JPY weakens enough, some of their export-oriented industries might become more competitive, or competitive again. (Much to China and Korea’s chagrin).

This almost seems like a freebie Japan got to do a historical reset on their macroeconomic fortunes.