@juangomez053 (Scalpy_Boi) first brought this up on trading floor but it’s been a very profitable trade with some room to still take advantage of. The House and The_Ni have also provided valuable input on this in the Stagflation thread but I thought it might deserve it’s own as it doesn’t necessarily have to do with US economic growth. I don’t trade FX but have been doing it indirectly through ETFs that short the Yen.

Also, I don’t know shit compared to Juan, House, and Ni. If you need a better explanation then the mess I’m gonna type just scroll to the bottom for the Bloomberg article. For those that want a deeper dig to the economic theory of why the Bank of Japan is attempting the impossible, there’s an Investopedia article (I half understood).

https://twitter.com/biancoresearch/status/1516429170229886977?s=21&t=HnIGMzSOPz-O34MOcd64Yg

Unfortunately, life is getting busier for me and looks to be getting busier in the near future. Unfortunate, because I’ve been learning so much from Valhalla and I’ve started to find my groove - especially through Conqueror’s Challenge (love you, Conq!). But I am going to try and be more active on the forums and also try for more slow-moving swing trades. The caveat being in this volatile market, I still have to be diligent in monitoring my positions and not get stopped out.

The Set-Up

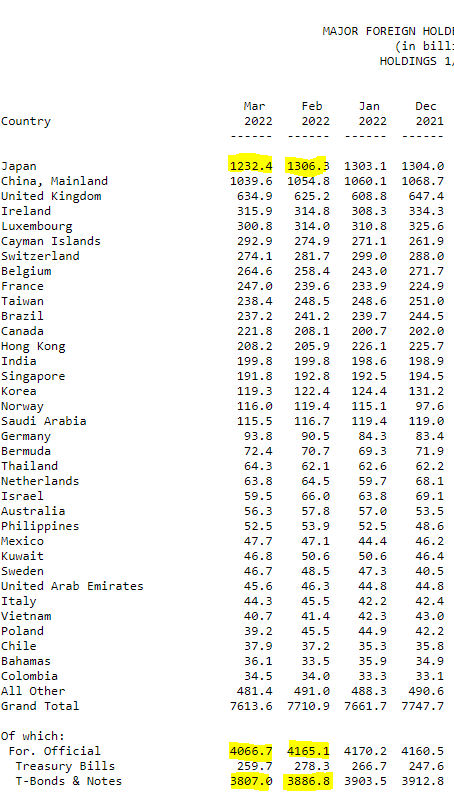

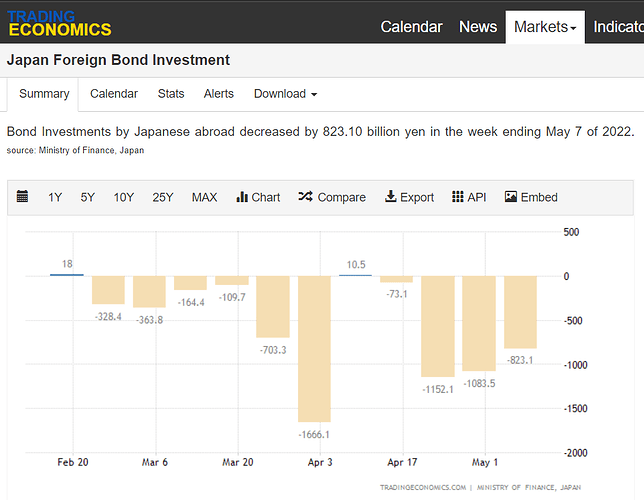

- Japan is the biggest purchaser of US 10-Yr Treasuries, even more than China.

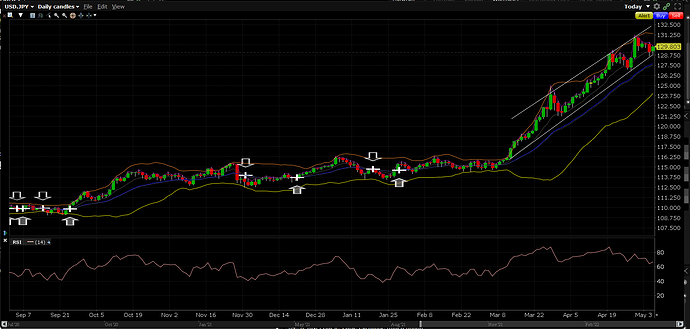

- The Yen has been depreciating against the Dollar, today hitting 10-yr lows as it broke over 130Y to 1USD.

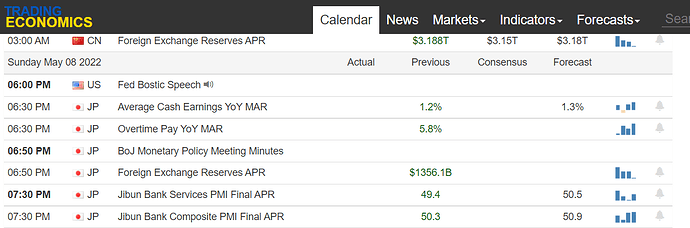

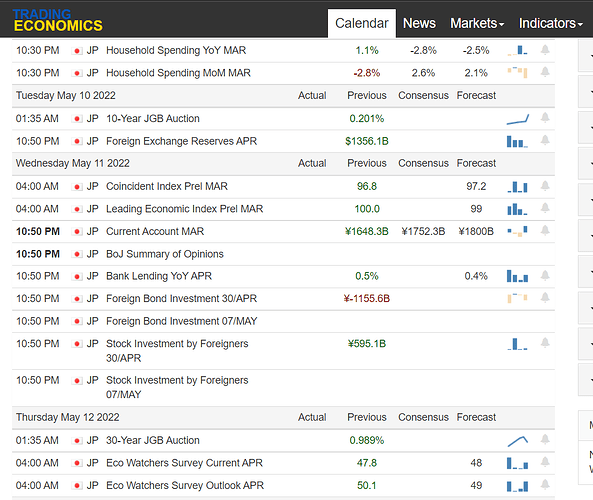

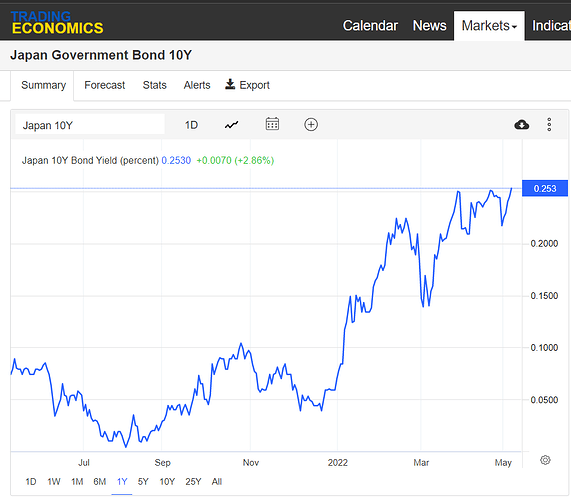

- The Bank of Japan (BoJ) has committed to control the yield curve of Japanese Government Bonds (JGBs) stating that they will purchase unlimited amounts of JGBs to keep rates low (think the Fed’s recent QE and purchasing of treasuries) to stimulate their economy.

- This has created a large spread between JGBs and US treasuries.

The Context

Confusing? Maybe I’m just doing a shitty job explaining. The big takeaway is that BoJ has committed to keeping its interest rates low by trying to buy it’s own JGBs but it’s creating major depreciation of the Yen.

So what? Well most countries communicate and have agreements in place with respect to monetary policy. They’re vague, tacit agreement that say shit like “look towards stability of currency markets”. But it helps to let other countries know what you’re thinking, especially if they’re so closely tied like Japan is to the US, or how Japan is to it’s Asian neighbours.

This is a big deal because right now Japan is going it alone. Think about the entire world right now, who the hell is cutting interest rates or attempting to keep them low? This easy money is having a small bump in the Japanese economy but they also import many resources (like energy) and costs aren’t being passed on to the average person through higher prices - yet.

Japan hopes that easy money will stimulate domestic demand, a weaker Yen will make their exports cheaper, and this will create growth. Oh, also, they have elections this August so politically you don’t want the economy to shit the bed before you go and ask for votes.

Something has to give. Either the US helps out the BoJ (not likely) or the BoJ abandons it’s easy money policy (not in the near future).

The Trade

Some say this trade is done:

- The Yen has depreciated 10% against the USD in a month

- The days of looking at the Yen as a safe-haven for investors might be over too, as they take a closer look at the Japanese economy and see cracks

- Japan is also the world’s 2nd largest creditor, meaning they sit on a ton of foreign currency reserves, and could just start selling their piles of USD to bring the Yen back up

But there is still room here, albeit a narrow one. The belief is that the Yen has to depreciate to around 135-140 Yen to 1 USD, for “maximum pain”, before the BoJ would intervene and prop up the Yen. I think we can get there because:

- BoJ is committed to keeping rates low, and continually buying up JGBs, at least in the near future (several months, maybe until the end of year). Politically, even more pressure to do this.

- As more investors keep sniffing at the Japanese economy they’re gonna realize it’s really dogshit sprayed with perfume, and that will cause selling pressure on the Yen.

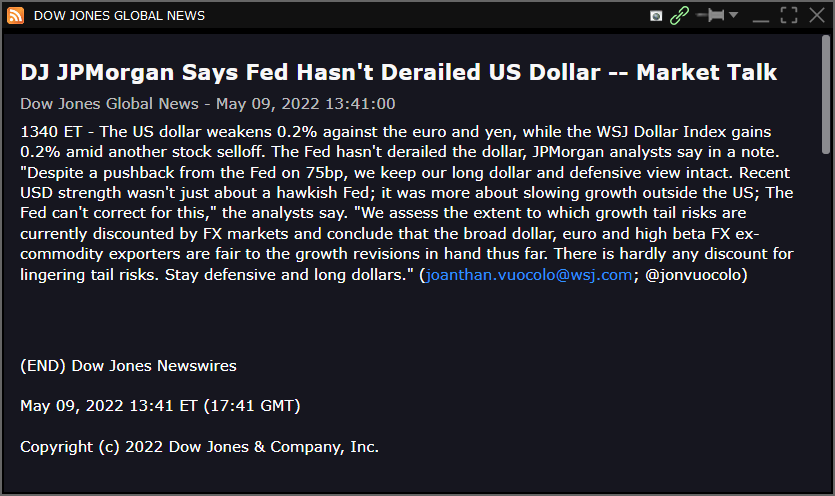

- More importantly, the USD is the most politically stable and strongest asset anyone can own anywhere in the world. So in direct relation to the USD, the Yen has much more room to go down. Namely, the 130-135 range.

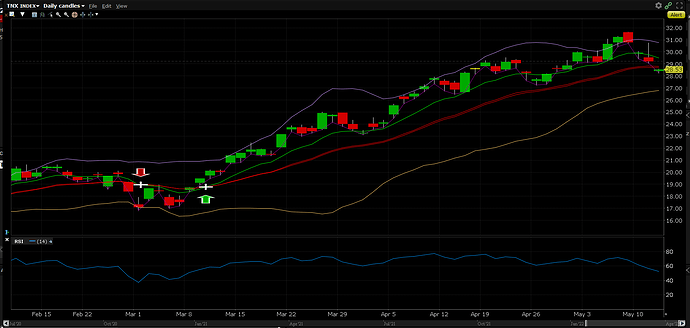

$YCS is the leveraged Short-Yen ETF. In the near term, if FOMC next week raises rates to 50bps, we should expect to see a bump up in 10-Yr Yields creating more pressure on the Yen to depreciate.

Should the Yen start to fall to 103-104** (edited to be more conservative), $YCS 05/20 10c will be ITM.