Here is another play I want to try. Typically many companies share price falls after they announce a dividend payout and date. It runs up based on the news, but we are looking for the record date. Cost has a date of Feb 4th on dividend close dates and payable on Feb 18th. KR has a dividend close date of feb 15th and a payout date of March 1st. I need to look more at the history as I believe it drops after close of those dates, but will add to this later today. I probably will also not buy these puts until closer to the date so the market doesn’t effect my entry. If anyone has time please add historical info next.

Going to attempt to contribute here but may need some help if i misunderstand, using just COST for now I can also do KR once I know this is what you want.

COST

Looks like the previous dividend date was on 10/28/21, but it trended upwards after that date:

| Div date | open | close | % change on prev day | open next day | close next day | % change next day |

|---|---|---|---|---|---|---|

| 10/28/21 | 486.96 | 490.53 | +0.29% | 486.78 | 491.54 | +0.21% |

| 07/29/21 | 421.68 | 425.28 | +0.72% | 425.98 | 429.72 | +1.04% |

| 04/29/21 | 368.54 | 373.54 | +1.07% | 372.91 | 372.09 | -0.39% |

| 02/04/21 | 356.71 | 355.85 | +0.18% | 356.55 | 355.17 | -0.19% |

Is this the kind of data you are looking for? let me know if i’m misunderstanding or if you want the same data for the div paid date and div paid date + 1 too.

@TendieMcTenderson thank you for aggregating that data. Does the colum “Div date” represents the date at which you must hold the stock to receive the dividend on the payment date (dividend exp-date, usually 1 day before the div record date)?

This is awesome data and much better than my post. I need to review it more but maybe we are wrong and it doesn’t take the dip that I thought has happened in the past. That is why data always wins. Entry matters a lot with something like this and market how it is trading overall so I need to do more research tonight or others keep adding and see if even worth it. If not, we close this thread and look for something else. Love this community.

No problem!

Yeah that’s right it represents the ex-dividend date. This is where my knowledge is admittidely limited, I didn’t know about record date vs ex-dividend date but I do now which is great so thanks!

From what I can see on COST there has not been a noticeable drop-off the day after the record date on the last 4 dividends either.

Glad I could contribute in a small way!

Looks like I was using the ex-dividend date rather than the record date in my table, though assuming it’s 1 business day prior to the record date the conclusion seems to be the same in that there isn’t a drop off at least for COST.

Would be good to see if this holds true of KR, I can have a look tomorrow.

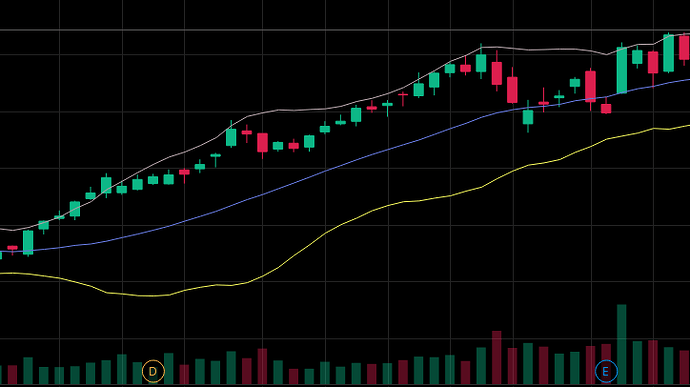

Hello y’all … I see COST ER coming up March 3. Parking EW for ER here to add to. Given current market volatility may still have opportunities with this one. Consider Ukraine, trucker freedom convoy, inflation, ex dividend, state of union, etc. Target ER is in March 1 to compare to last ER