The purpose of creating this journal is to log my mistakes and my successes as I begin trading again. I expect losses in the beginning, but hope to recover from those as I build my knowledge and skills. This journal will only consist of my Webull portfolio with the possibility of some updates from my crypto portfolio on Kraken. I’ve created a journal previously but decided to start fresh as I brush off the cobwebs of trading in 2023.

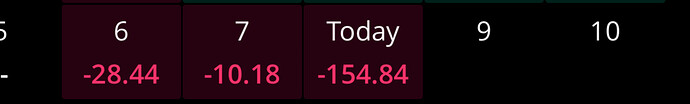

Weekly Update: 1/22-1/28

I tested out SPY way too many times as I was eager to get back into trading.

1/25

SPY

[color=#green] B: [/color] 402c 1/27 @ .50

[color=#blue] S: [/color].54

[color=#green] B: [/color] 389p 1/27 @ .74

[color=#blue] S: [/color] .35

AAPL

[color=#green] B: [/color] 144c 1/27 @ .34

[color=#blue] S: [/color] .19

T

[color=#green] B: [/color] 20.5c 1/27 @ .15

[color=#blue] S: [/color] .17

Panic sold the SPY and AAPL options during that large knife instead of holding to wait for a recovery to either minimize the loss or exit in the green.

1/26

SPY

[color=#green] B: [/color] 409c 1/27 @ .48

[color=#blue] S: [/color] .18

1/27

SPY

[color=#green] B: [/color] 410c 1/27 @ .11, .06, .04

[color=#blue] S: [/color] 3 @ .03

[color=#green] B: [/color] 402.5p 1/27 @ .11

[color=#blue] S: [/color] .05

BZFD shares only

[color=#green] B: [/color] 25 @ 2.79

[color=#blue] S: [/color] 25 @ 2.80

(Fat fingered my limit sell and hit confirm before verifying it was correct)

[color=#green] B: [/color] 10 @ 2.77

[color=#blue] S: [/color] 10 @ 2.82

[color=#green] B: [/color] 10 @ 3.429

[color=#blue] S: [/color] 10 @ 3.440

[color=#green] B: [/color] 20 @ 3.60

[color=#blue] S: [/color] 20 @ 3.75

Expected to be red this week but not too upset about the overall loss as it’s relatively small. I am proud that I minimized my loss day after day and hope to keep that trend.

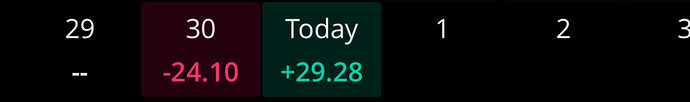

1/30/23

Got eager again and tried to use the only $50 Options BP I had. I had a stop loss set but figured I could average down, adjust my stop losses, and come out green. Lesson learned.

TSLA

[color=#green] B: [/color] 240c 2/3 @ .35

[color=#green] B: [/color] 240c 2/3 @ .19

[color=#blue] S: [/color] 2 @ .15

Tomorrows a new day!

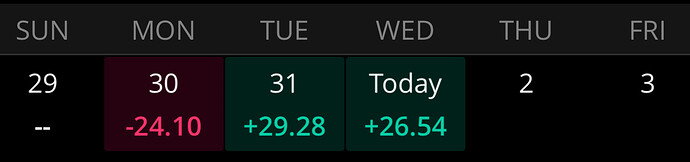

1/31/23

Decided to play earnings Tuesday before FOMC and was watching GM, UPS, and SPOT; as well as, a few other tickers called out.

CNTX

[color=#green] B: [/color] 15 @ 1.32

[color=#blue] S: [/color] 15 @ 1.30

Had this set for a tight stop loss and was stopped out after the halt.

GM

[color=#green] B: [/color] 1x 40c 2/3 @ .40

[color=#blue] S: [/color] 1x @ .41

Did a market instead of limit sadly

[color=#green] B: [/color] 1x 40c 2/3 @ .43

[color=#blue] S: [/color] 1x @ .50

CVNA

AI called out CVNA options so I decided to test it.

[color=#green] B: [/color] 1x 10c 2/3 @ .75

[color=#blue] S: [/color] 1x @ .85

UPS

My last ticker and my blunder for the day. I was watching the other tickers and saw UPS movement and added way too high thinking it would push through 185. I held to see what loss I could recover, if any.

[color=#green] B: [/color] 1x 187.5c @ 1.50

[color=#blue] S: [/color] 1x @ 1.62

Kept adjusting the limit/stop as it went up and stopped out below my SL for a gain thankfully.

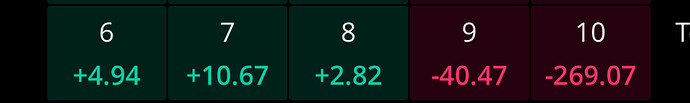

First Green Day!

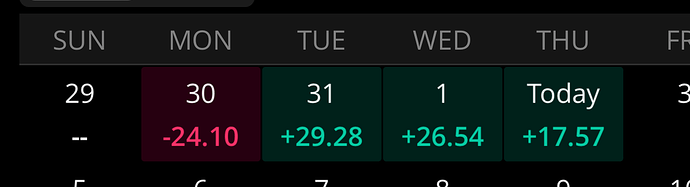

2/1/23

Another Green Day! Stuck to my convictions and did not get overzealous with the trades. Definitely had my hindsight kicking in on plenty of plays today, but there’s always next time.

MO

[color=#green] B: [/color] 2x 47c 2/3 @ .24

[color=#blue] S: [/color] 2x @ .29

AMD

[color=#green] B: [/color] 1x 82c 2/3 @ 1.47

[color=#blue] S: [/color] 1x 1.48

Had my SL tight on this one at 1.50 as it was climbing and it managed to sell below it still in the green.

SPY

[color=#green] B: [/color] 1x 410c 2/2 @ 2.29

[color=#blue] S: [/color] 1x 2.45

Jumped in on the run up. Triggered my Limit Sell before I could even blink.

2/2/23

Little disappointed with today because I didn’t stick to my plan and got greedy. Probably doesn’t help I’m fatigued from working overnights.

CVNA shares

[color=#green] B: [/color] 5x @ 16.95

[color=#blue] S: [/color] 5x @ 17.00

Was getting off work and set a LS because I was down immediately after I took the position and had no time to watch.

HSY

[color=#green] B: [/color] 1x $235c 2/3 @ .70

[color=#green] B: [/color] 1x $235c 2/3 @ .75 (made a mistake and bought when I meant to set a sell; .73avg)

[color=#blue] S: [/color] 2x @ .75

GM

[color=#green] B: [/color] 2x $40.50 2/10 @ .70

[color=#green] B: [/color] 1x $40.50 2/10 @ .60

[color=#blue] S: [/color] 3x @ .73

[color=#green] B: [/color] 1x $41 2/10 @ 1.15

[color=#blue] S: [/color] 1x @ 1.09

Definitely overtraded here thinking I could do something. I got greedy and set a high LS and watched it climb as adjusted my SL. Sadly when it dipped it triggered well below the limit.

Lesson learned: On work days either do not trade or trade for 1hr or less to avoid fatigued trading. My mistakes could have ended in a red day, but thankfully did not. Daily goal is 2-3%; ended 5.20%.

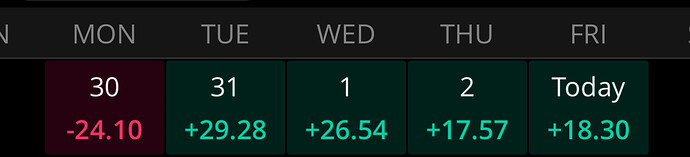

2/3/23

Ended the week green! Up [color=#green]23.78%[/color] on the week and only down [color=#blue] -7.29%%[/color] on the year.

GM

[color=#green] B: [/color] 1x 41.50c 2/10 @ 1.10

[color=#green] B: [/color] 1x 41.50c 2.10 @ .95

[color=#blue] S: [/color] 2x @ .97

X

[color=#green] B: [/color] 1x 31c 2/3 @ .50

[color=#blue] S: [/color] 1x @ .51

This is when cops decided to show up and interrogate me because I shut off the alarm late so I set a quick sell.

SPY

[color=#green] B: [/color] 1x 411p 2/6 @ .46

[color=#blue] S: [/color] 1x @ .50

[color=#green] B: [/color] 1x 411p 2/6 @ .45

[color=#blue] S: [/color] 1x @ .46

[color=#green] B: [/color] 1x 411p 2/6 @ .65

[color=#blue] S: [/color] 1x @ .89

I impressed myself this week and I’m proud.

2/6/23

Chose to play SPY today, both calls and puts. I won’t post each entry and exit because it’s just sporadic. Ended down for the day after running out of buying power. Worked on averaging down, entries, exits, and not selling at the first sign of panic. This allowed me to limit my loss for the day. Instead of losing $120 I lost $30.

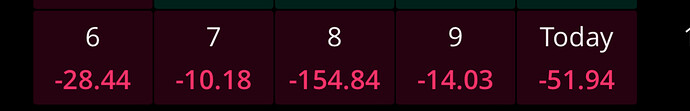

2/7/23 - 2/8/23

Missed the 2/7 update. (2/8) I lost very big today for my small portfolio. Upsetting, but unperturbed. My mistake today was not setting Stop Losses. I averaged down like I planned, but I should evaluate my entry and set a stop loss within some percentage value of my entry. My son seemed to need me today at the most inopportune times, but I’d lose money any day to help him with what he needs. Each loss is a new lesson towards some form of gain.

2/9/23

Honestly did better today regardless of the red. My other plays were pretty solid. Wasn’t expecting Pepsi to hemorrhage the way it did, but it is what it is.

GOOGL

[color=#green] B: [/color] 2x 100c 2/10 @ .32

[color=#blue] S: [/color] 2x @ .38

DIS

[color=#green] B: [/color] 1x 120c 2/10 @ .60

[color=#blue] S: [/color] 1x @ .67

SPY

[color=#green] B: [/color] 2x 407p 2/10 @ .40

[color=#blue] S: [/color] 2x .41

I didn’t like the movement at the time I grabbed this so I made a quick exit

PEP

[color=#green] B: [/color] 6x 180c 2/10 @ 0.06

[color=#blue] S: [/color] Gonna hold till expiry

Figured I entered low enough I’d be able to grab a couple bucks on each, don’t know why it really died the way it did.

2/10/23

I’m no big account and do this for the sake of transparency and holding myself accountable. Definitely bummed about an overall red week, but it’s set me up for more rules for myself. Definitely going to think about my strategies and plan of attack for next week.

Definitely had some bigger losses in the past, but I was ready to lose whatever I put in when I began trading this year. I remain optimistic.

I’ve forgotten to update things the past few weeks, but I’ve definitely noticed more success in shares plays compared to options for myself. The 13th is when my Pepsi calls expired so it hit hard for my account and the 16th I tested more options to test one more thing for myself. The red says for the week ending the 24th I took some shares up each day in a few pharma stocks and have been holding and adding since then. And so far I believe my entries and averaging down have been successful.

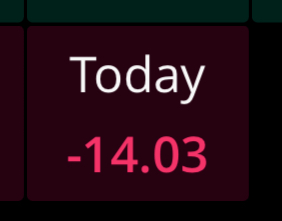

3/6/23 - 3/10/23

Honestly not too disappointed with my week and my choices here. Thursday NVIV had its failure and dropped 50%. Idk how much I’m exactly down this week because Friday isn’t showing an accurate number as deposits are still pending. I believe I was only down about $30+ today.

I’ve been mitigating my losses on options fairly well, but still no major gains so I decided in my Webull to lean heavy into Pharma because my educational background just roots for these teams to make breakthroughs in their research.

Kraken I’m down about $50 out of my $300 invested and only hold BTC, ETH, and XMR.

Robinhood I’m testing the IRA account with random dividend stocks in different sectors to see what I like. Thankfully, I’m only down 5% there. Currently I hold F, VZ, MO, EFC, and MPW.

Overall I believe I’ll be green in the end with the right amount of patience.

Liquidating all my positions across the board. My fiancé and son got into a car accident and I’m uncertain what funds are going to have to come out of pocket. So for the meantime I’ll stick to paper trading until everything is resolved.

Thankfully they’re both doing okay without any major injuries.

They were in the jeep. I’m thankful the jeep did it’s job and kept them safe. So for now we are just taking one step at a time to get things back to normal.

Hang in there homie. Glad they are doing ok. Take is slow, healthy and family (and soon to be family) are more important than many things. ![]()

Glad to hear everyone is okay. Hope it doesn’t cost too much out of pocket.