It’s 3am and I’m very jetlagged so I’m starting this DD i’ve wanted to post for a few weeks. I’ve noticed recently some stocks that have a risk of bankrupcy have had pretty solid movements compared to the market when we’ve had lower than expected CPI/ Dovish Powell like the recent FOMC.

It seems to be a commong thing amongst some of the most shorted stocks on the market, potentially if the market is expecting more cuts in 2024, the debt payments of these companies goes lower leading to lower chance of bankruptcy. This in turn either leads them to become undervalued, or no longer fits the models of shorts leading them to cover.

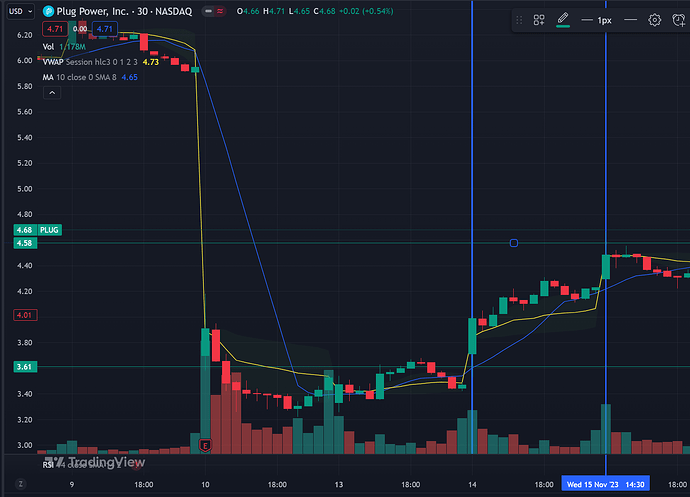

I first noticed this after PLUG had their last ER and the sentiment was that they are now at risk of going bankrupt, it then went on to run about 25% over the day or two after we had CPI come in 0.01% lower than consensus.

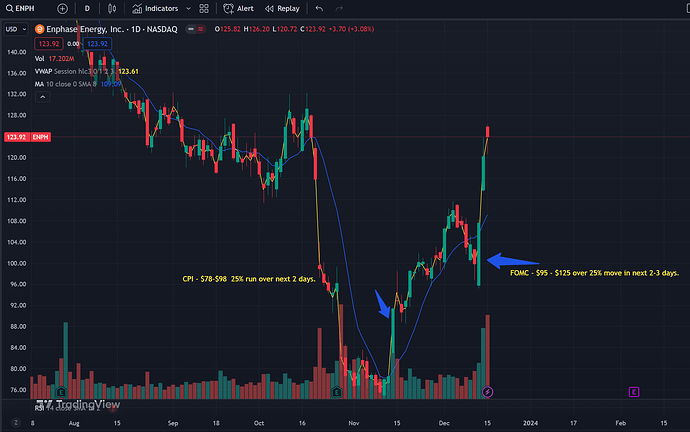

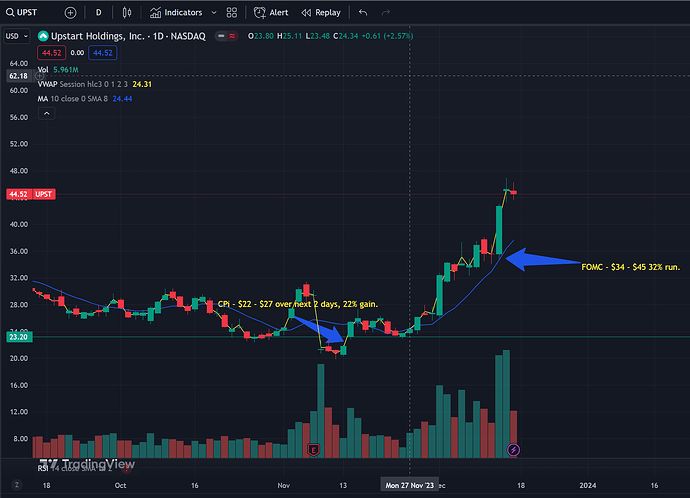

The two stocks I’ve identified seem to have the most profitability from this are ENPH and UPST. I like ENPH the most as the IV is lowest and OTM options seem to move the most. These are stocks that also are down a hell of a lot off their QE highs.

I’m going to do some more digging to see if this also applied to the downside also.

Just going to post data from the two recent big moves in projected fed funds rates we had, CPI in Nov when CPI came in 0.01% lower and the recent FOMC when powell came out Dovish.

ENPH

UPST