I would love to get some feedback on the curious case of Redfin. It’s had an interesting few days.

I have been screwing around with Etrade’s Power Etrade platform, on which one can sort options by % of OTM options on the offer ( slapping the ask). I noticed on 8/4 that Redfin had an unusual number of options come in on the 8/19 15 strike, which at the time was over 50% OTM. Redfin had earnings after hours on 8/4. Curious, I bought a couple to play along.

Earnings were not great. Missed on EPS and revenue, guidance was lukewarm at best. Analysts adjusted PTs down. It sank hard in after hours, then recouped a bit. I figured it was toast.

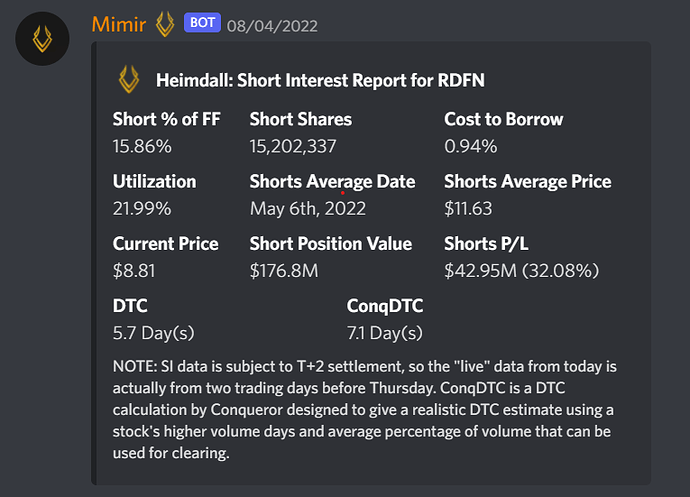

Then a curious thing happened. It rose 14% the following day (last Friday). Looking at the SI from Mimir, I figured maybe it was shorts covering.

I took another look on Saturday with updated numbers:

From Thursday to Friday, shorts lost 40 million in P/L, and the DTC, shares short, and shorts average price went down slightly.

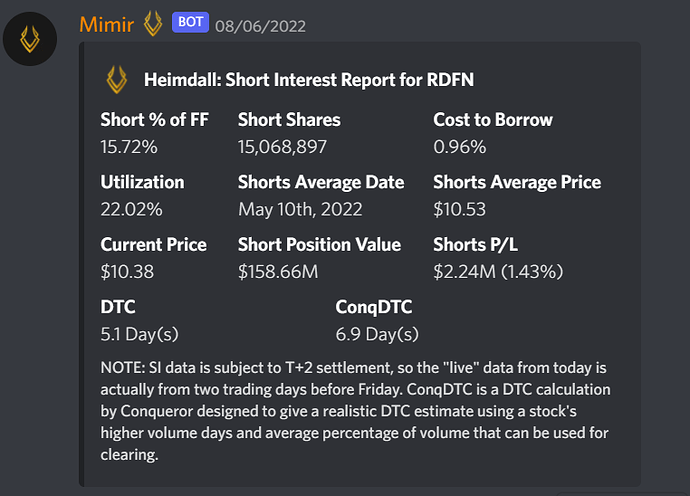

Today, RDFN went up 16% again. Now Mimir says:

In three trading days, short P/L has gone from + 32% to (19.5%), short shares have gone down by .007%, the value of those short shares has gone down 16% (covering shorts?). The ConqDTC number has gone from 7.1 to 6.6 days.

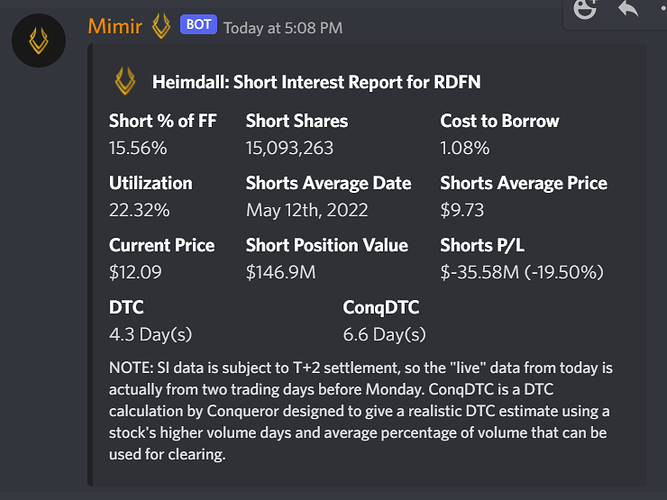

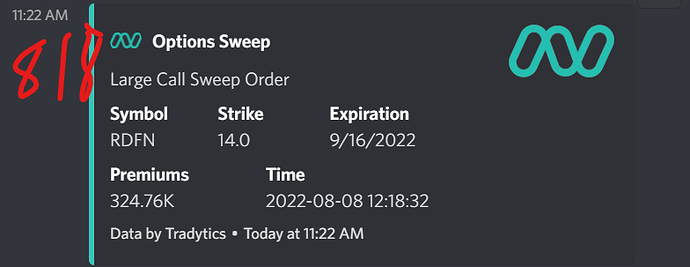

I would also submit a couple of Tradytics call outs that have happened in the interim that I was unaware of:

A big call sweep on the 9/16 14s.

A darkpool trade on 8/4 (earnings).

Maybe not all the ingredients are there for a short squeeze. Cost to borrow is low, utilization is low, shorts aren’t getting blown out yet. But it looks like something might be happening. Any thoughts?