I hesitate to call this a “trading” journal, as with work and life commitments I am not able to consistently monitor positions on day or other short-term trades.

ESSC 2.0 taught me that - I watched over $100k in unrealized gains disappear in a matter of minutes while on vacation with my wife. Not a great feeling. Still, having stayed only in 10c and shares, covered my cost basis and having set some (very loose) stop losses, I count myself as one of the lucky few who came out green overall.

My trading philosophy will be based around the following principles for the foreseeable future:

(1) Find asymmetric risk/reward plays that I can throw a decent chunk of my portfolio into for potentially big gains but capped losses. E.g., buying deep ITM far-dated calls on SPACs (pre- or post-DA) with a NAV floor, or buying 25,000 GGPI shares a couple weeks ago at $10.29.

(2) Pre-DA SPACs with massive growth potential even if the percentage chance of a unicorn DA is low. This was a strategy that worked very well pre-March 2021 and hasn’t been so great the last 10 months, but could hopefully see a resurgence.

(3) Taking smaller, riskier positions on days when I have time to consistently monitor and adjust on the fly.

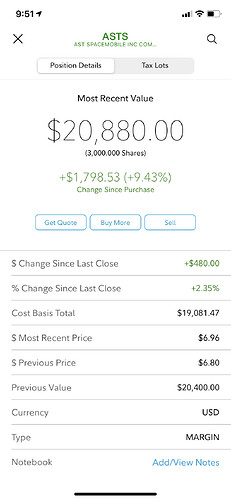

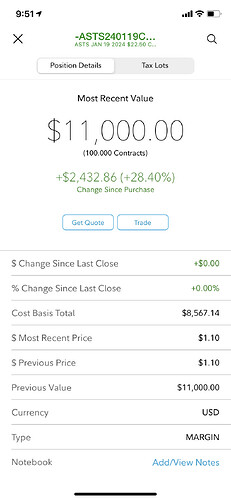

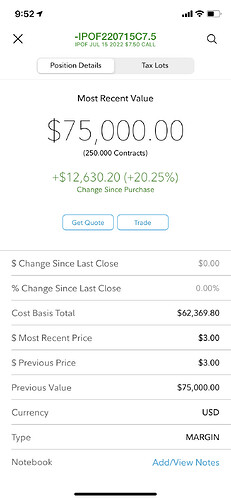

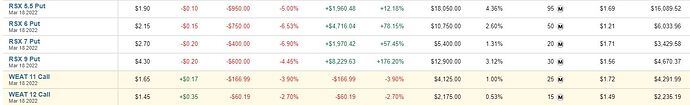

Since closing out the remainder of my large GGPI share position when my stop losses hit on Tuesday, and selling all of my IPOF 9c and half of my IPOF 7.5c on the rumor pops last week, my only remaining positions are:

Total account balance for trading account is currently $410,000. Goal is to grow that by $10,000 a month.

Planning to put together an ASTS DD compilation for the forum for anyone else interested in a 6 to 24 month hold play.

3 Likes

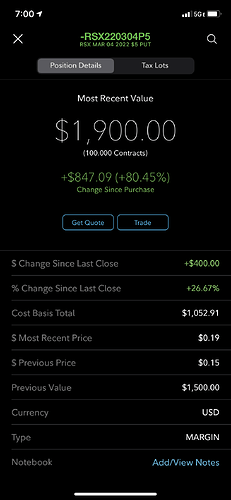

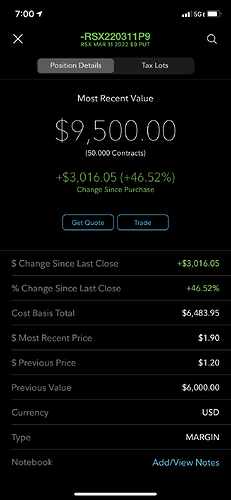

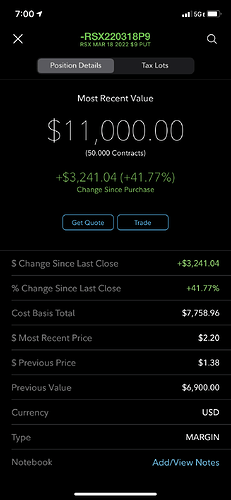

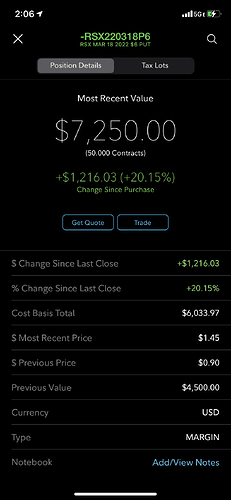

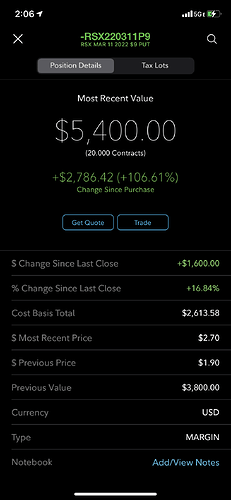

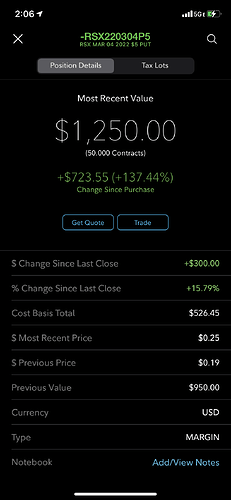

Couldn’t resist the RSX put party so I hopped in late Monday and early Tuesday. Already seeing big green and hopefully going to see more…

1 Like

Another great day. Trimmed some RSX $5 puts in the morning but also added some $7 strikes with 3/18 expiration. Also liquidated most of my crypto portfolio and will be moving over to my active investment account once the cash clears.

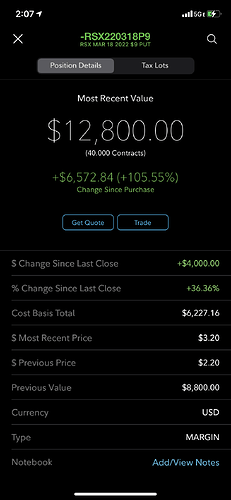

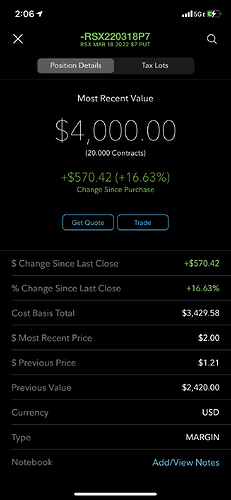

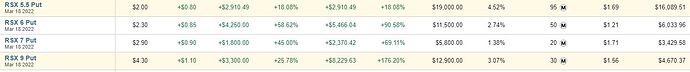

Green day on RSX yet again. Many thanks to the callouts on both taking profit and re-entering today in TF. I was able to take profit on my puts expiring 3/4 and 3/11 and reposition such that I am entirely in 3/18 puts. Managed to get some good fills on the 5.5p so I plowed most of my profits into those. This will become riskier by the day, and I am uncertain about how much I want to hold over the weekend, but I am expecting more chances to take profit on Friday.

Not much of an update other than that I added some WEAT calls when underlying was hovering around 10.80. Hopeful for next week, but whatever happens with RSX unhalting will make or break my current plays.

Not a great day, and RSX being halted continues to be a drag on the portfolio, but at least there were some good opportunities to average down massively on WEAT. Got some good fills on both 10c and 11c, and will seek to take profit (or just cut losses) on the 12c when the time feels right. Also opened a position on the April 10c on GGPI. Still staying heavy in cash in case I need to exercise the RSX puts, or other better opportunities come along (like a massive dip on GGPI commons).

Below balances are a little wonky due to misstatements of value of ASTS and PIPP calls, and RSX puts. I think total port value is around $413-414k.

Bad day for WEAT, frustrating day for RSX, but very exciting day for ASTS. It’s a company I have been excited about for a long time and I’m thrilled to see them get closer to launching with the SpaceX deal. I took profit by selling all my ASTS shares and 5 calls that were bought back in early February, but am still holding 100 LEAPs at 22.5c. Will look to reload on ASTS shares in the coming days/weeks, as I assume there will be a dip after this excitement wears off and before the ramp up toward summer launches begins.

Need to dust off the old journal, which I put aside after the RSX bomb went off. I have since recovered and gotten back to around the same level in overall portfolio balance that I had before the 3/18 RSX puts expired worthless, thanks to GME/AMC, GGPI, and a great day scalping 10c on THCA on Monday (which alone was a 10+% boost to the whole portfolio).

Today I will be looking to pick up more BEEM calls, likely 45c/50c for May, to go along with my 25c for April and May, and to restart a GGPI position with 10c (if I can get great fills) or more likely 7.5c with as long expiration as I can muster and still only pay a few cents over intrinsic.

I will also be puckering my butthole on THCA and HMHC. HMHC will either instantly add 25+% to my portfolio or be my worst loss other than BGFV/ESSC 1.0/RSX.