So I’ve been playing around with my charts and going over some of the tickers called out in the server and came across a pattern that keeps leading to a long-term (2 months+) decline in price. It’s when the EMA21 crosses over EMA9 twice within a 1-6 week period. I understand there are “Golden Crosses” and other such technical indicators but I’d welcome some feedback from our technical wizards if they have some time to tell me why this is stupid and a waste of time (seriously, please don’t spare my feelings)

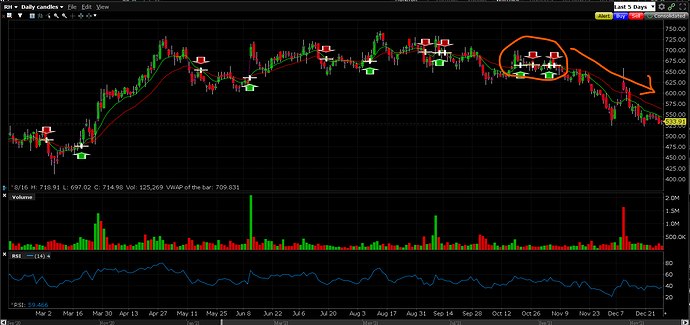

Here’s RH on the daily:

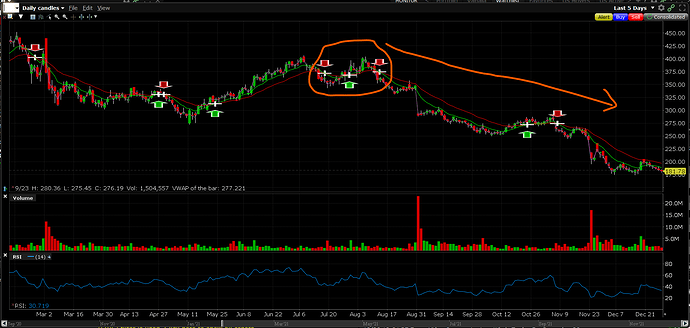

Here’s ZM on the daily:

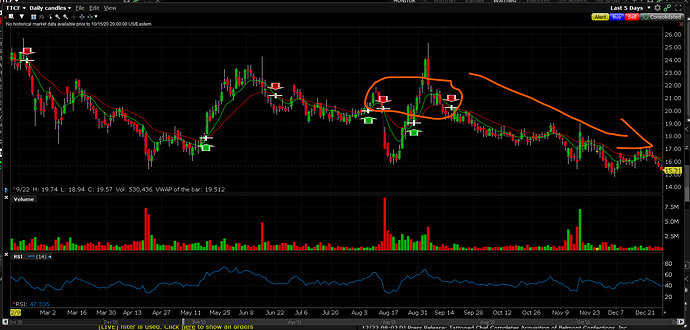

Here’s TTCF on the daily:

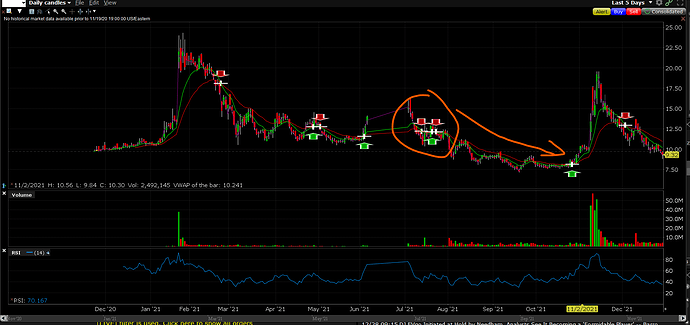

Here’s ASTR on the daily:

Here’s TLRY doing it twice on the daily:

Here’s EVGO on the daily:

Here’s DOLE on the daily:

What’s my point? Well the double crossovers happened at least a couple of weeks, sometimes months, prior to when I took a look at these stocks. And in the even that the downward trend continues into an event such as ER, it helps to re-enforce a put play.

I’m wondering if I do come across this pattern, I would start a small position with a put that is 15-20% OTM with at least 60DTE. Should the trend continue down, and no crossover occurs, I would continue to build on the position. Also, if there is an earnings play where I was confident that post-earnings it would be a put, I would like to see if this pattern fit into the continuation of the downward trend and then increase a post-earnings play. I would really like to flesh these ideas out more with more experienced traders as I don’t think we’re in for mighty bull markets in the coming months and there will be more pressure on companies to outperform market expectations leading to downward pressure on underwhelming stocks.

Also, are there any suggestions to set up a scanner to capture a crossover? I’m having trouble editing my existing in IBKR. Finviz just allows for percentage changes?