edit: Moving my thoughts to this blog: https://torl2.blogspot.com/ Will update this forum post less often.

edit: nevermind

So… I’m really bad. Like really, really bad. If you want, you can enjoy my suffering.

I’ve decided to stop contributing to Valhalla for the time being. Instead I’ll be writing this thing. Hopefully I will learn a lot… or at least entertain…

[center]Position[/center]

I’m heavily into ESSC 10 and 12.5 calls, the main Valhalla play at this time.

I have <$100 positions in various options plays from around this forum:

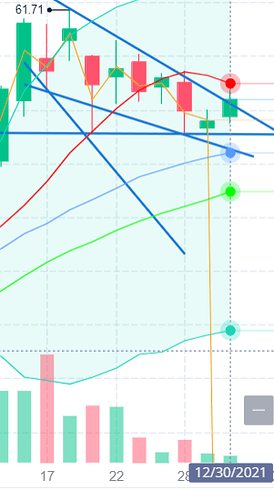

I also have one AFIB call <$100. The chart has been forming higher lows and the downward gap happened at the Q3 earnings. It seems like the downward gap was an overreaction. However, the options don’t have much liquidity. For now, this is “my” play.

edit:

I just bought CPOP and added to ASTR puts. edit: cpop was from rexxar

[center]Dear Diary…[/center]

Though I’ve been watching crypto plays, now doesn’t seem like a good time to touch them. I’m also afraid of touching SPY right now. I’ve been really interested in RIOT, but for some reason decided not to buy any bullish positions at the $21 level. I also missed out on the BTC rally (and thus RIOT rally), while playing mini golf with my family the week of Christmas.

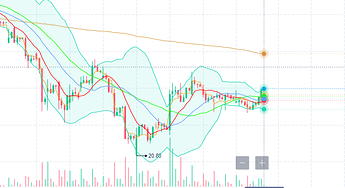

(There is also a pretty clean double bottom toward the end of this image.)

shortsqueeze, squeezeplays, and squeezetalk may be useful subreddits. I did some research on PTPI, BFRI, RELI, and others before they ran, but missed out on all of them. I thought the liquidity was too high on them and idk. Some of them were also “high” at the time I think. So I scooted away from these stocks.

If you want you can search the discord for messages from me and see for yourself how bad I am.

Instead of making money on any other plays, I got burned on AQST. You can see my thread on here if you would like. On Monday the 21st sometime after 8pm, the FDA decided to delay the decision for Libervant indefinitely. The approval date was scheduled for the 23rd.

Also, today AVCT went from +8% premarket to breaking downward at 11am. I gave up on AVCT for a minor loss. I miss out on a billion squeeze plays and end up with a minor loss on AVCT.

I think I’ll mostly be following along rather than trying to do much on my own, for now…